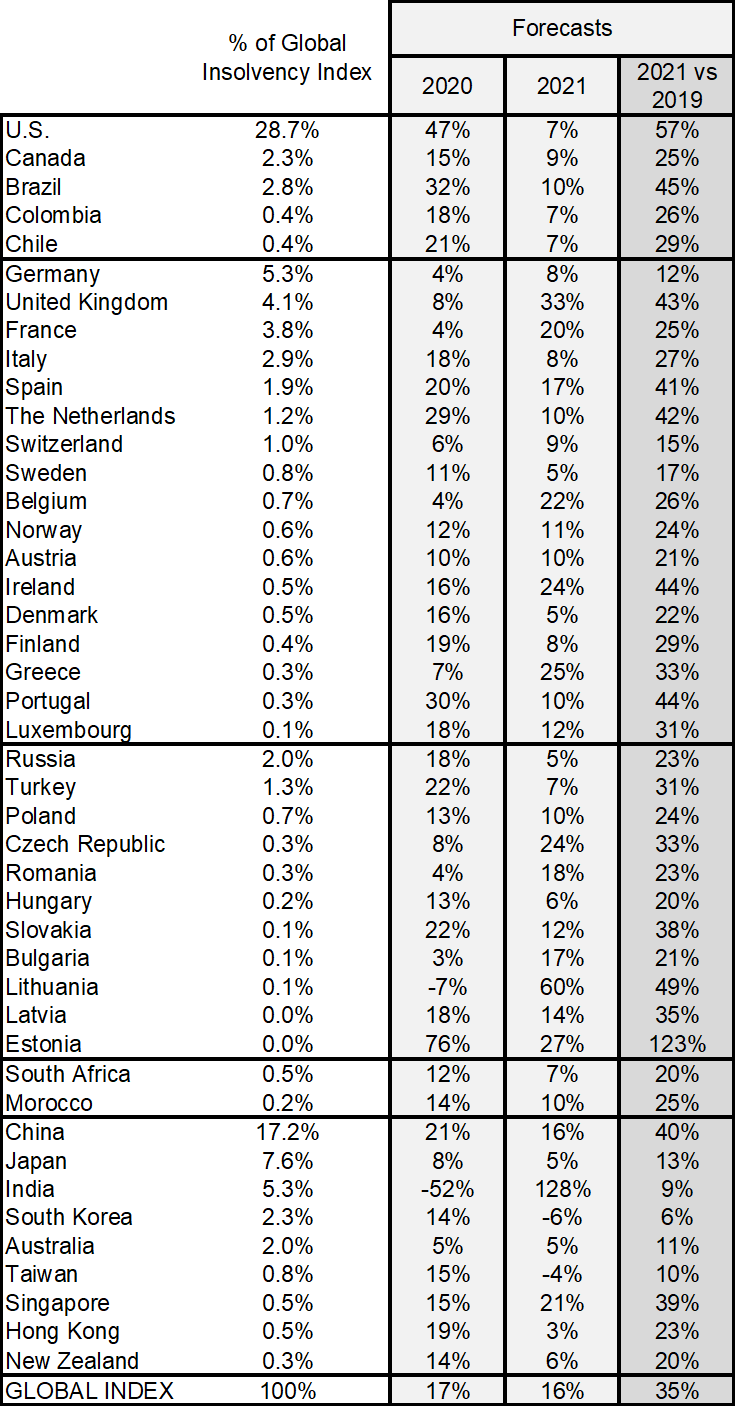

- Euler Hermes’ global insolvency index is expected to reach a record high of +35% cumulated over a two-year period (after +17% in 2020 and +16% in 2021) as the global economy faces a U-shaped recovery from the Covid-19 crisis.

- Two out of three countries will post a stronger rise in insolvencies in 2020 than in 2021 – notably the U.S., Brazil, China, Spain and Italy – while one out of three would record an acceleration in 2021 – notably India, the UK, France and to a lesser extent Germany.

Paris, 16th July 2020 – The Covid-19 crisis will trigger a major acceleration in business insolvencies due to both the suddenness and historic size of the economic shock and its expected lasting effects, according to a new study by Euler Hermes, the world’s largest trade credit insurer. These lasting effects are critical for companies that were already the most fragile before the crisis and are now among the sectors hit the hardest by measures to contain the pandemic (transportation, automotive, non-essential retail, hotels and restaurants).

At a global level, Euler Hermes’ insolvency index is expected to surge to a record high of +35% cumulated over a two-year period (after +17% in 2020 and +16% in 2021) as the global economy faces a U-shaped recovery from the Covid-19 crisis. This would represent a +16% y/y CAGR over the two-year period, similar to the intensity recorded on average amid the 2008 financial crisis.

Bulk of insolvencies to be recorded between H2 2020 and H1 2021

Unlike in 2007-2009, all regions and countries are expected to post double-digit increases in insolvencies, with the biggest surges seen in North America (+56% by the end of 2021), followed by Central and Eastern Europe (+35%) and Latin America (+33%). In Asia, Euler Hermes expects an increase of +31% by 2021, and in Western Europe +32%.

However, countries will see asymmetric trajectories over 2020 and 2021 due to uneven initial conditions, as well as differing strategies of emerging from lockdowns and different emergency policy measures, in particular regarding temporary changes in insolvency frameworks. Two out of three countries will post a stronger rise in insolvencies in 2020 than in 2021 – notably the U.S., Brazil, China, Spain and Italy – while one out of three would record an acceleration in 2021 – notably India, the UK, France and to a lesser extent Germany.

Figure 1: Euler Hermes insolvency forecasts by country, 2020-2021