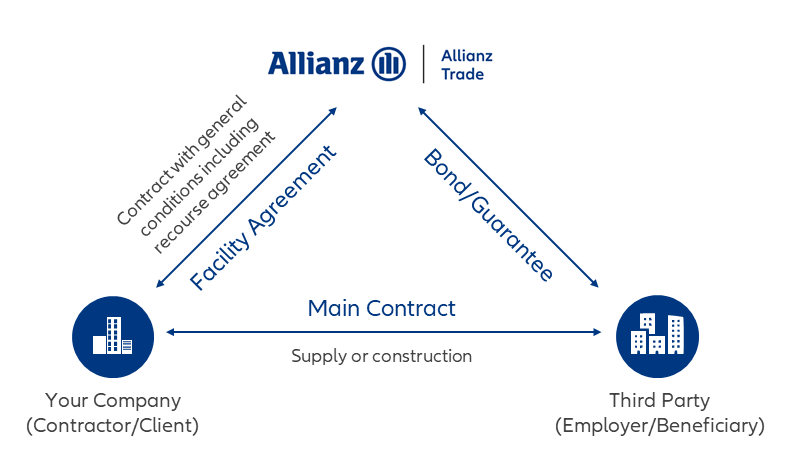

A surety bond supports and protects the contractual obligations you have entered into with a customer, supplier or partner.

It is a contractual triangle relationship between you, the surety bond company (us) and the third party requiring the bond, in which we financially guarantee to your party that you will abide by the terms established by the bond.

.png)