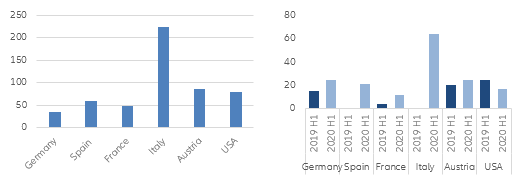

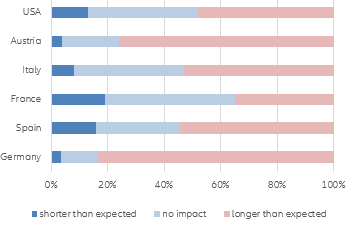

Covid-19 lockdowns changed saving behaviors: Not only did people save more, for the lack of consumption opportunities, they also saved differently, channeling more money into equities and investment funds. In all six countries we analyzed – Germany, France, Italy, Spain, Austria and the US – net acquisitions of financial assets increased significantly in the first half of 2020 (compared to H1 2019), ranging from 35% in Germany to a whopping 223% in Italy (see Figure 1). What’s more, the share of equities and investment funds increased considerably in all countries. Spanish and in particular Italian households turned from net sellers of equities and investment funds into ardent buyers. In Germany (from 15% to 24%), France (from 3% to 11%) or Austria (from 20% to 25%) as well, equities and investment funds played a bigger role in savings than before (see Figure 1). The only exception was the US, where the share of these assets in fresh savings slightly declined, although the absolute amount jumped by 25%. A possible explanation: the spike in savings was mainly caused by generous unemployment benefits – i.e. triggered by relatively poorer savers who in general lack experience with capital markets. Thus, three quarters of fresh savings ended up in bank accounts, concealing the underlying rising interest in capital market products of more seasoned and regular savers.

Figure 1 – Acquisition of financial assets in H1 2020, change over H1 2019, in % (left panel) and share of equities and investment funds in total savings, in % (right panel)

Figure 1 – Acquisition of financial assets in H1 2020, change over H1 2019, in % (left panel) and share of equities and investment funds in total savings, in % (right panel)