The introduction of the EU carbon border adjustment mechanism (CBAM) will come with a high cost for developing economies , particularly African trade partners and the Arab states of the Persian Gulf, which will face the highest ‘carbon tariffs’. For simplicity, we use the term ‘carbon tariffs’ for the cost burden imposed by an EU CBAM . In our recent report, we identified cement, iron & steel and petroleum products to be the sectors most likely to be affected, with basic chemicals, fertilizers, industrial gases, aluminum and paper being the next in line. In terms of absolute embedded CO2 emissions in exports to the EU, we found the Russian Federation is the most exposed compared to all other countries . The U.S. follows well behind in rank 2, and ranks 3 through 7 are occupied by oil-producing developing economies. China follows only in rank 8 and features a more diverse portfolio, with its top three emission exports originating from chemicals, pharmaceuticals and aluminum.

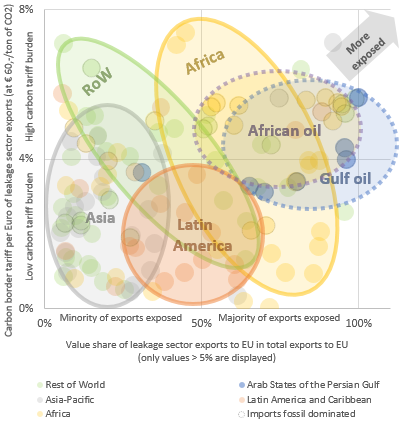

However, when it comes relative exposure, the ranking is very different. Figure 1 indicates the relative exposure to carbon tariffs by region (further details on the countries underlying the regions are displayed in Figure 4 in the Appendix). Individual countries are indicated by the smaller dots, with colors specifying the regions. Countries in the upper half face high carbon tariffs on the carbon leakage or ‘brown’ sector exports. The tariff on the export value is based on a carbon price of EUR60 per ton of embedded CO2. The 4% tariff on the export value as a cutoff for the high burden in Figure 1 is rather high. Typically, a tariff of 5% relative to value added (not relative to total export value, which is much higher) has been considered as an essential burden for identifying carbon leakage risk. As only carbon leakage sectors are relevant here, the 5% of value added cutoff is almost always fulfilled by definition.

Figure 1 – Exposure of developing and least developed countries to EU carbon border adjustments

However, when it comes relative exposure, the ranking is very different. Figure 1 indicates the relative exposure to carbon tariffs by region (further details on the countries underlying the regions are displayed in Figure 4 in the Appendix). Individual countries are indicated by the smaller dots, with colors specifying the regions. Countries in the upper half face high carbon tariffs on the carbon leakage or ‘brown’ sector exports. The tariff on the export value is based on a carbon price of EUR60 per ton of embedded CO2. The 4% tariff on the export value as a cutoff for the high burden in Figure 1 is rather high. Typically, a tariff of 5% relative to value added (not relative to total export value, which is much higher) has been considered as an essential burden for identifying carbon leakage risk. As only carbon leakage sectors are relevant here, the 5% of value added cutoff is almost always fulfilled by definition.

Figure 1 – Exposure of developing and least developed countries to EU carbon border adjustments