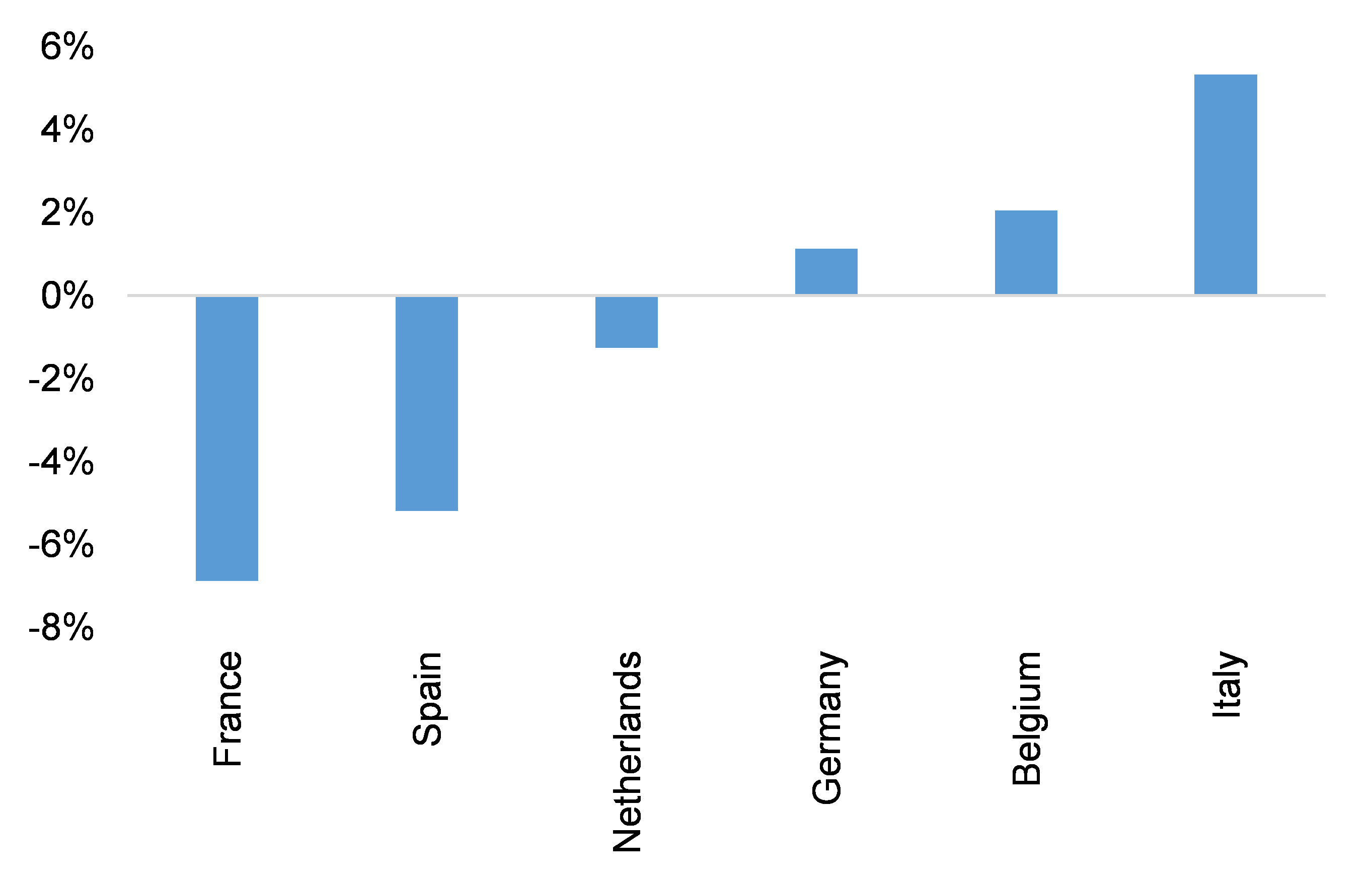

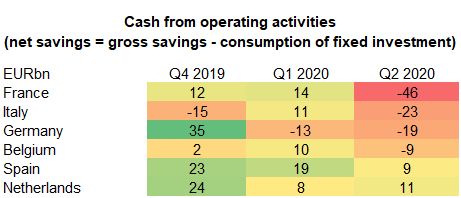

The first wave of Covid-19 lockdowns caused a stronger-than-expected profitability shock for most European non-financial corporates in H1 2020, with French and Spanish firms hit particularly hard despite generous policy support. The cumulated profit margin declined by -7pp in France, -5.2pp in Spain and -1.3pp in the Netherlands, compared to +1.1pp in Germany, +2pp in Belgium and +5pp in Italy (see Figure 1). In France, two thirds of the drop can be attributed to the production tax schedule: falling due in Q2, the production tax payments in France doubled (to EUR22bn) while remained stable in Germany (at EUR3bn). As a consequence, and excluding the higher amount of state-guaranteed loans in France (more than EUR120bn against EUR50bn in Germany), French corporates were much shorter on cash in Q2 compared to their European peers (see Figure 2).

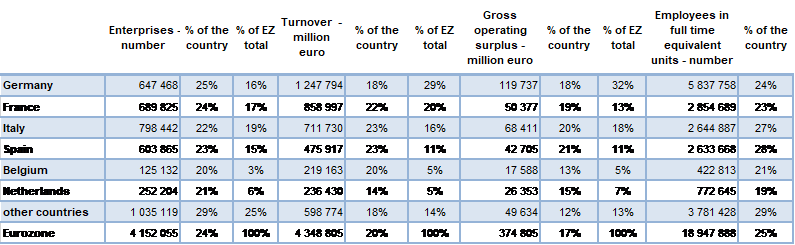

Now, with the second wave of lockdowns, we expect a heavy cost for Covid-19 sensitive sectors across the Eurozone, which could see average operating losses of -15% to -20% in 2020 compared to pre-crisis levels. In the absence of prolonged fiscal policy support or an aversion to taking on more debt, this could dry up cash buffers, putting around 24% of Eurozone companies (or more than 4.1 million) at risk of a cash-flow crisis next year. One out of four companies in Germany and France are directly exposed to the Covid-19 sanitary restrictions vs. one out of five companies in Belgium and the Netherlands. In total, the combined turnover of exposed companies exceeds EUR4,3tn and they account for more than one out of four workers, notably in Spain and Italy, or close to 19 million persons (see Figure 3).

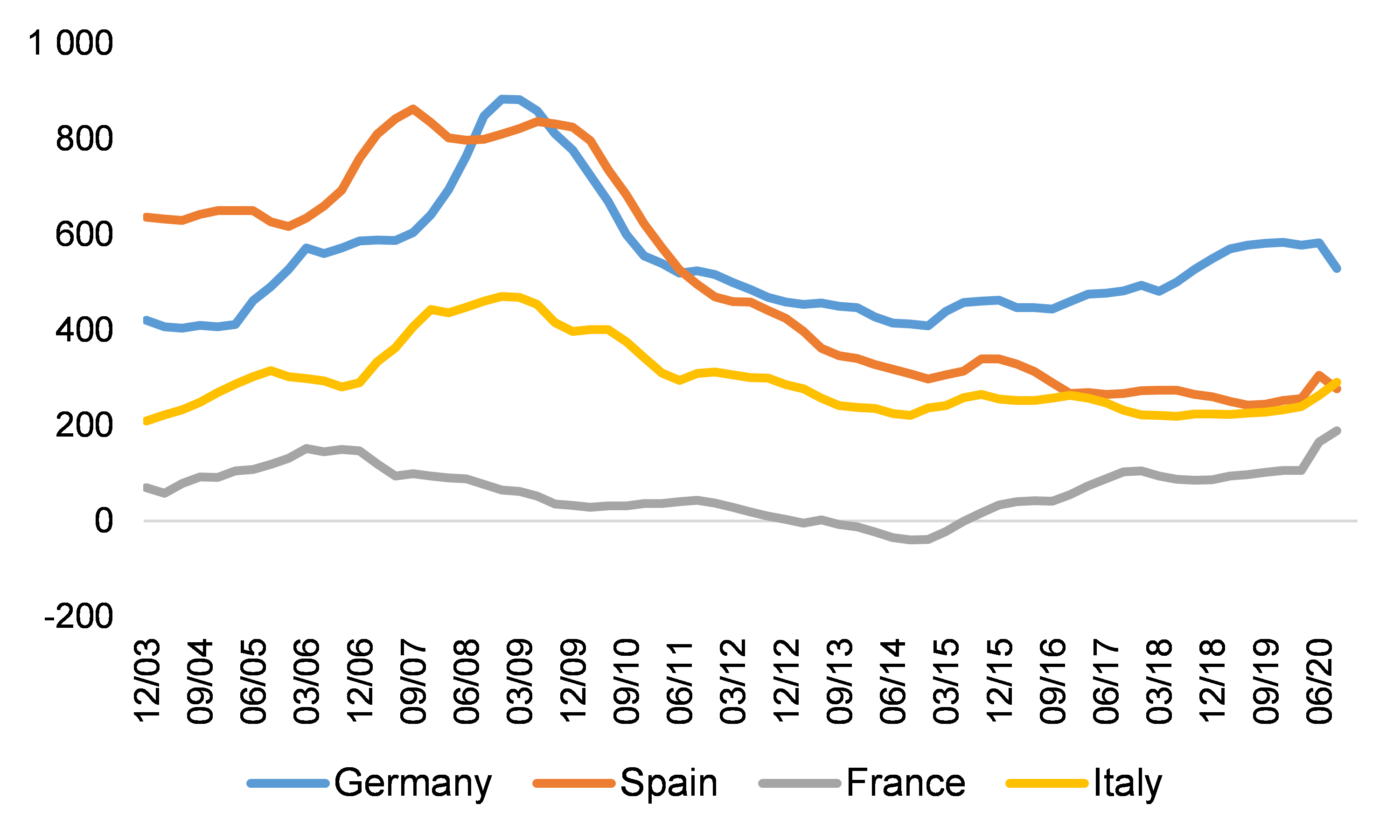

As we estimate the drop in revenues to reach up to -20% on average in the Eurozone - but the corresponding fall in operating expenses only -10% due to a certain stickness of these latter, and no recovery before late 2022, the impact on companies' cash balances will be unprecedented. And the current surge in excess corporate cash (see Figure 4), equivalent to untapped cash resources available for future investment purposes or debt repayments, sparked by state-guaranteed loans won’t be enough to compensate for loan repayments and the delayed tax repayments by mid-2021.

Moreover, we currently expect governments to take a much more cautious approach to exiting the lockdowns (no significant relaxation in sanitary restrictions before Easter) to allow time for a vaccination campaign for people at risk to reach a critical level and avoid a third wave. This means that activity in H1 2021 could prove slower to recover compared to Q3 2020.

Hence, policy measures need to address the funding gap for companies stuck between a loss of revenue and mandatory expenses such as taxes and financial debts. While state-guaranteed loan schemes have been prolonged until March-June 2021 in most of European countries, governments might also need to become the main creditor of companies by postponing tax payments even further (or even forgiving them) in order to avoid bankruptcies. In Germany, Kurzarbeit has already been extended until end-2021 for a total cost of EUR40bn. For most programs, no additional amounts will be announced as large amounts remain untapped. However, the modalities and bureaucratic hurdles should be revisited and adjusted to improve take-up. This concerns in particular the corporate bridge support and the emergency aid for micro-businesses and sole traders, for which a combined EUR75bn have been set aside but only EUR15bn used. Further fiscal relief is crucial, in our view, in order to provide viable firms with more breathing space. In particular, the government could build on already announced measures by lifting the ceiling on the amount and the time horizon applied to its tax loss carry-back regime.

In France, continued fiscal support will be vital for companies in view of the deteriorated sanitary situation and the expected cautious exit from lockdown, which will result in a milder recovery of economic growth in 2021 (+6.2%). Without this, the sluggish pace of output growth - in particular in H1 2021 - may significantly erode profit margins. However, France’s 2021 fiscal bill currently allocates only EUR2bn for employers’ social contribution relief, against EUR8.4bn in 2020. And only EUR7.5bn has been budgeted for partial unemployment subsidies in the 2021 Finance Law (before the second wave of the pandemic), compared to EUR34bn in 2020. The question on tax forgiveness might gain traction in 2021 as corporate debt reaches an excessive level and low equity ratios would not allow for covering prolonged losses. A decisive moment for French companies might come in Q2 2021 when the next production tax payments are due, combined with the quarterly installments of other payment taxes, which could further widening the profitability gap with the European peers. We estimate that the EUR20bn production tax cut will bring only +1.5pp of additional margins to French companies. Hence, fiscal policy will need to do more to avoid a wave of layoffs and insolvencies in France.

Figure 1 – Non-financial corporates’ margins (pp), H1 2020 vs pre-crisis levels

Now, with the second wave of lockdowns, we expect a heavy cost for Covid-19 sensitive sectors across the Eurozone, which could see average operating losses of -15% to -20% in 2020 compared to pre-crisis levels. In the absence of prolonged fiscal policy support or an aversion to taking on more debt, this could dry up cash buffers, putting around 24% of Eurozone companies (or more than 4.1 million) at risk of a cash-flow crisis next year. One out of four companies in Germany and France are directly exposed to the Covid-19 sanitary restrictions vs. one out of five companies in Belgium and the Netherlands. In total, the combined turnover of exposed companies exceeds EUR4,3tn and they account for more than one out of four workers, notably in Spain and Italy, or close to 19 million persons (see Figure 3).

As we estimate the drop in revenues to reach up to -20% on average in the Eurozone - but the corresponding fall in operating expenses only -10% due to a certain stickness of these latter, and no recovery before late 2022, the impact on companies' cash balances will be unprecedented. And the current surge in excess corporate cash (see Figure 4), equivalent to untapped cash resources available for future investment purposes or debt repayments, sparked by state-guaranteed loans won’t be enough to compensate for loan repayments and the delayed tax repayments by mid-2021.

Moreover, we currently expect governments to take a much more cautious approach to exiting the lockdowns (no significant relaxation in sanitary restrictions before Easter) to allow time for a vaccination campaign for people at risk to reach a critical level and avoid a third wave. This means that activity in H1 2021 could prove slower to recover compared to Q3 2020.

Hence, policy measures need to address the funding gap for companies stuck between a loss of revenue and mandatory expenses such as taxes and financial debts. While state-guaranteed loan schemes have been prolonged until March-June 2021 in most of European countries, governments might also need to become the main creditor of companies by postponing tax payments even further (or even forgiving them) in order to avoid bankruptcies. In Germany, Kurzarbeit has already been extended until end-2021 for a total cost of EUR40bn. For most programs, no additional amounts will be announced as large amounts remain untapped. However, the modalities and bureaucratic hurdles should be revisited and adjusted to improve take-up. This concerns in particular the corporate bridge support and the emergency aid for micro-businesses and sole traders, for which a combined EUR75bn have been set aside but only EUR15bn used. Further fiscal relief is crucial, in our view, in order to provide viable firms with more breathing space. In particular, the government could build on already announced measures by lifting the ceiling on the amount and the time horizon applied to its tax loss carry-back regime.

In France, continued fiscal support will be vital for companies in view of the deteriorated sanitary situation and the expected cautious exit from lockdown, which will result in a milder recovery of economic growth in 2021 (+6.2%). Without this, the sluggish pace of output growth - in particular in H1 2021 - may significantly erode profit margins. However, France’s 2021 fiscal bill currently allocates only EUR2bn for employers’ social contribution relief, against EUR8.4bn in 2020. And only EUR7.5bn has been budgeted for partial unemployment subsidies in the 2021 Finance Law (before the second wave of the pandemic), compared to EUR34bn in 2020. The question on tax forgiveness might gain traction in 2021 as corporate debt reaches an excessive level and low equity ratios would not allow for covering prolonged losses. A decisive moment for French companies might come in Q2 2021 when the next production tax payments are due, combined with the quarterly installments of other payment taxes, which could further widening the profitability gap with the European peers. We estimate that the EUR20bn production tax cut will bring only +1.5pp of additional margins to French companies. Hence, fiscal policy will need to do more to avoid a wave of layoffs and insolvencies in France.

Figure 1 – Non-financial corporates’ margins (pp), H1 2020 vs pre-crisis levels