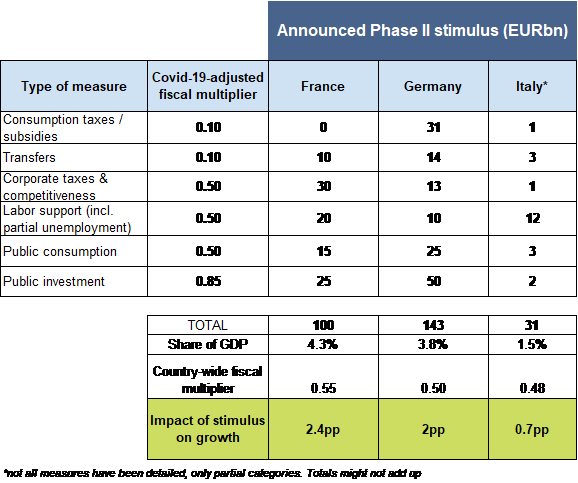

The unprecedented fiscal stimulus plans launched by European governments this summer (phase II to relaunch growth engines after phase I emergency relief programs) should help to boost economic growth by +2.4pp in France, +2pp in Germany and +0.7pp in Italy (see Figure 1) over 2021-22.

In France, the EUR100bn (4.3% of GDP) stimulus package is geared towards achieving the green transition (EUR30bn), fostering industrial competitiveness (EUR35bn) and preserving social cohesion (EUR35bn) via transfers and labor market measures. Compared to the German stimulus package (3.8% of GDP), which is essentially demand-oriented, the French stimulus aims at reviving the supply side of the economy. The French government clearly aspires to relaunch the domestic production engine –even to reshore traditional industries such as automobiles – by addressing the long-lasting structural rigidities of the economy. However, France is strongly reliant on imports (see Appendix), both for consumption and investment. Therefore, the flipside of this fiscal stimulus will be the widening of the already high trade deficit.

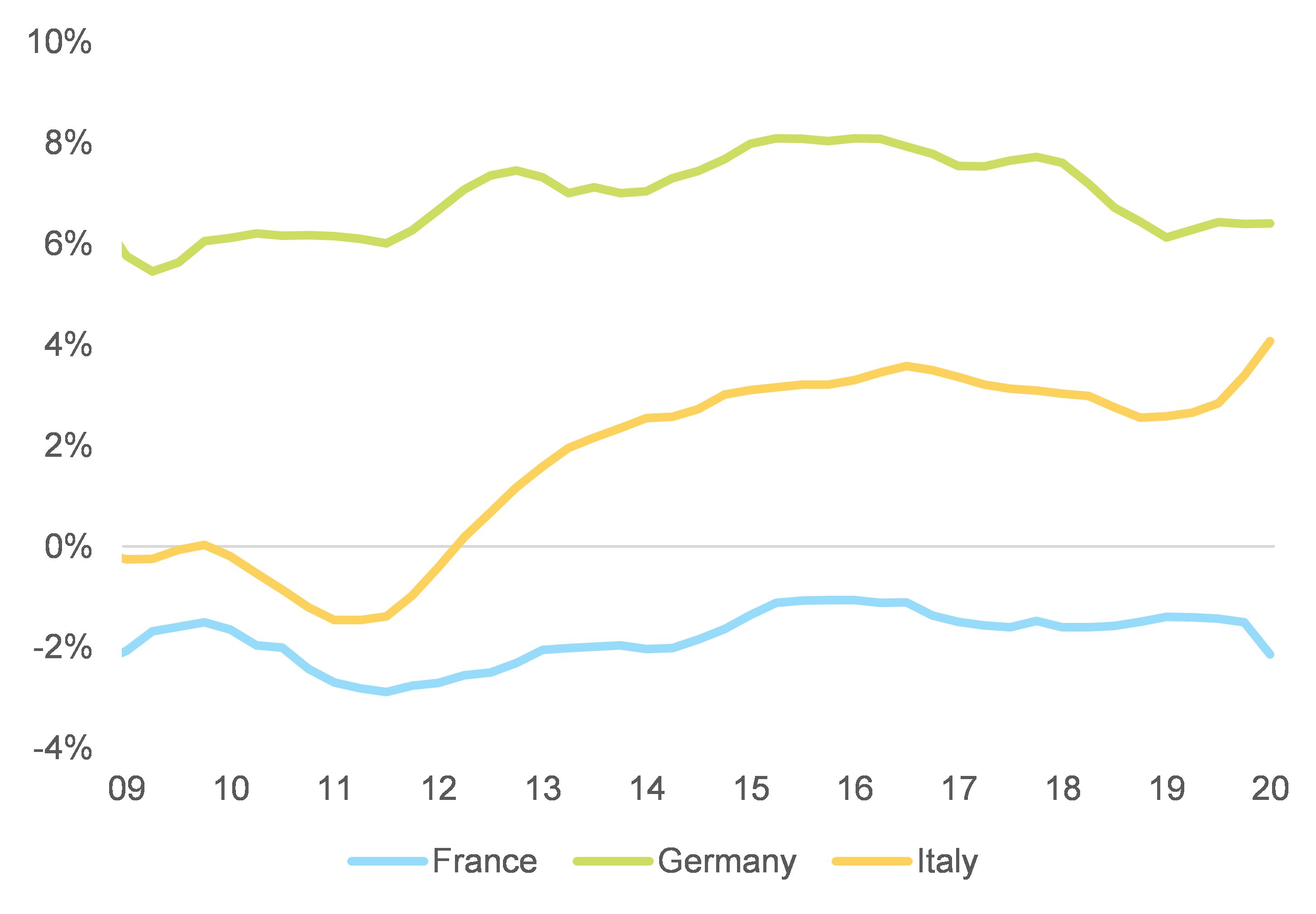

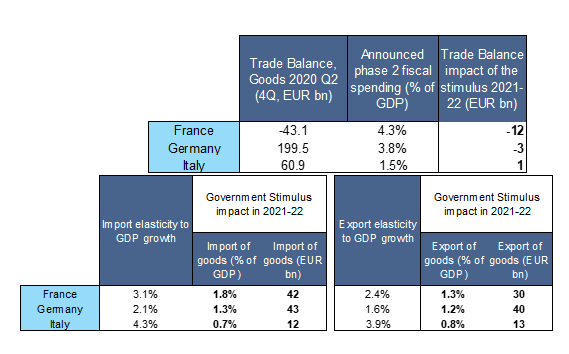

In fact, by stimulating domestic demand, government stimulus packages naturally increase demand for imports, hence benefiting trading partners: out of Europe’s major economies, we find that France could experience the largest leakage from its fiscal stimulus, causing its structural merchandise trade deficit to deteriorate by a net –EUR12bn over 2021-22. The picture is radically different in Germany where we estimate a slight decline of –EUR3bn in the trade surplus, whereas in Italy the surplus would increase by +EUR1bn.France’s fiscal deficit already stood at –2.1% of GDP (EUR43.1bn) in Q2 2020 (see Figure 2) and as half of the fiscal package is allocated to boost investment, our calculations show that in 2021-22, this would increase French imports by 1.8% of GDP (EUR42bn). Exports would only increase by 1.3% of GDP (EUR30bn). Thus, overall, this would widenFrance’s trade deficit by an additional –EUR12bn.

Figure 1: Covid-19-adjusted fiscal multipliers for 1% GDP increase