‘Impact underwriting’ can accelerate the global economy’s sustainable transformation. Due to its role as risk manager, risk carrier and major investor, the insurance industry is in a unique position to promote economic, social and environmental sustainability. But the way forward involves looking beyond focusing on already ‘sustainable’ activities. Changing for the better requires the implementation of more ‘impact’ activities that shift non-sustainable behavior and processes in a more sustainable direction. An impact-oriented alignment of just a fraction of the insurance industry’s capital flows would be a substantial catalyst for achieving the global sustainability goals.

Impact underwriting can offer a ‘double dividend’, generating revenues in a growing market besides realizing positive externalities for society. In this context, we identify 9 fields of sustainable action for the insurance sector:

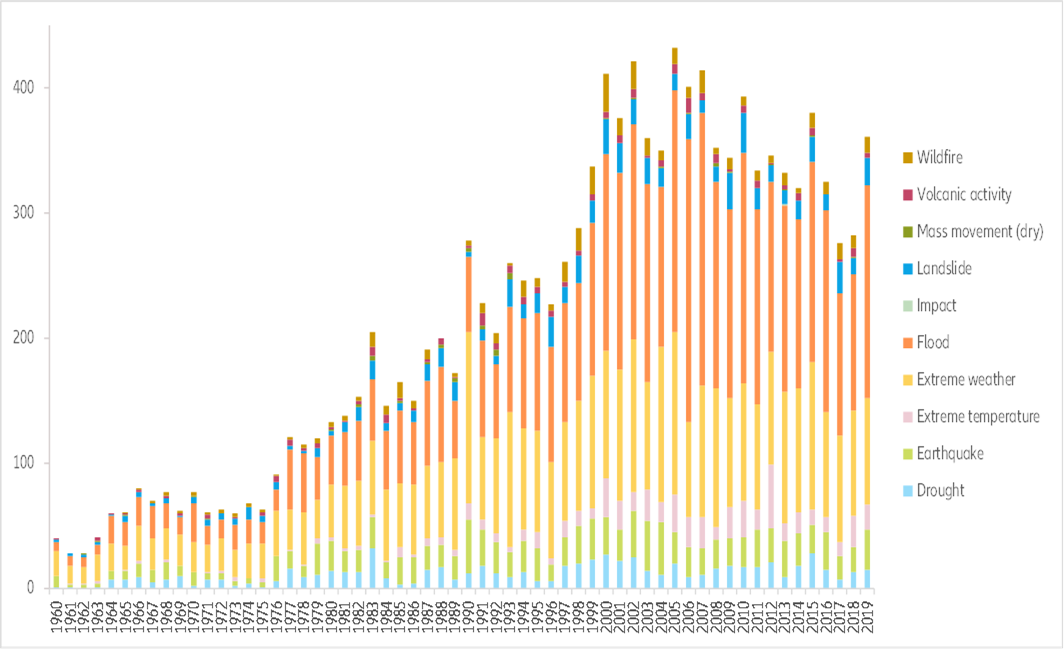

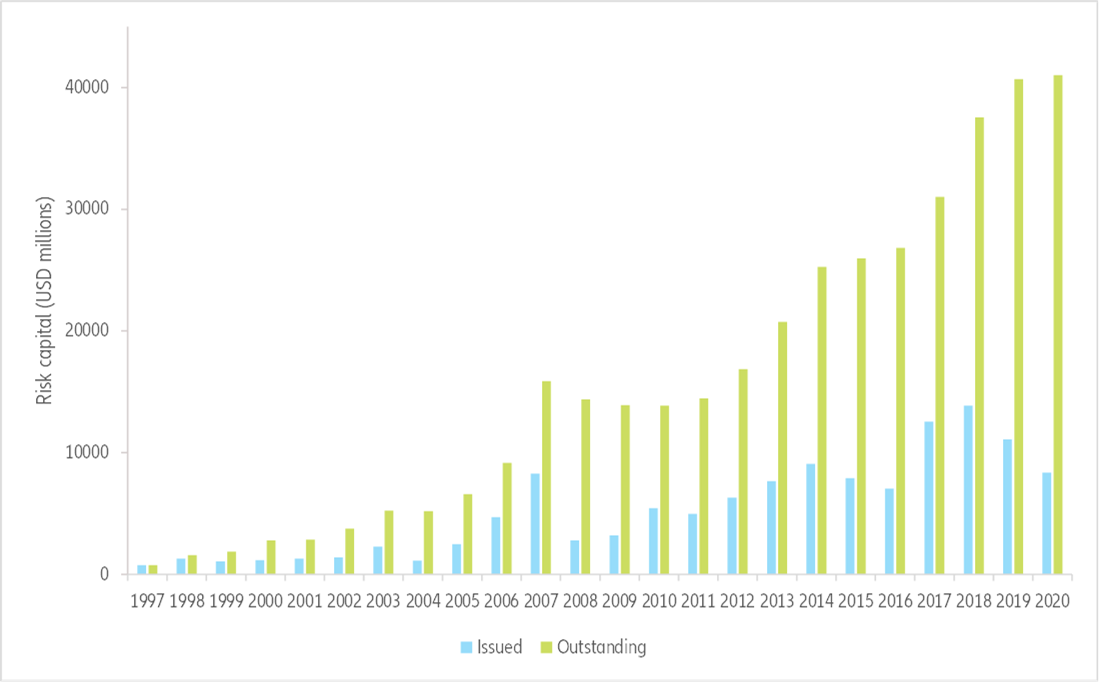

- Climate change & weather extremes: Global tropical cyclone storm intensity, for instance, is expected to increase by 5% and rain intensity by 15%. The risk associated with such disasters are increasingly covered via alternative risk transfers and impact underwriting needs to close existing insurance gaps.

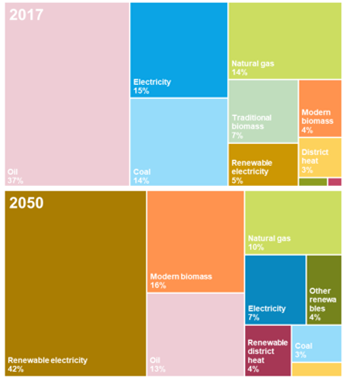

- Renewable energy investments: Global renewable energy capacities will more than triple by 2050. Accordingly, the demand for insuring renewable energy installations against physical, development or operational risks will rise. Risk consulting and risk service solutions support establishing new technologies or developing new territories and provide further opportunities for sustainable insurance solutions.

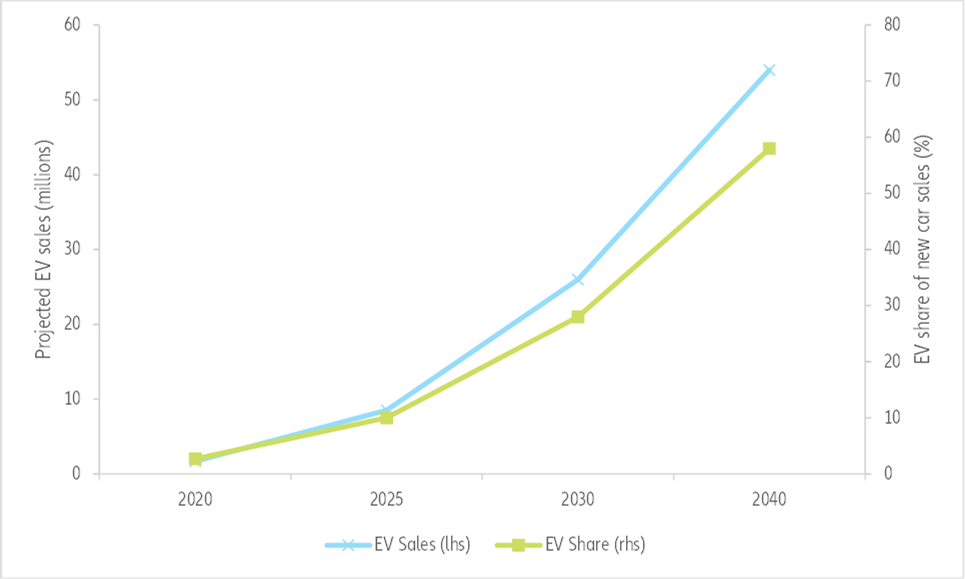

- Alternative mobility: In 2024 a tipping point will be reached when battery electric vehicles (EV) become cheaper than internal combustion engines (ICE) for passenger vehicles. EVs will dominate new car sales before 2040. Impact underwriting can support this transition by offering insurance solutions to the areas of mobility sharing as well as autonomous driving, and can seize new opportunities in the sector coupling of vehicle batteries with the energy infrastructure.

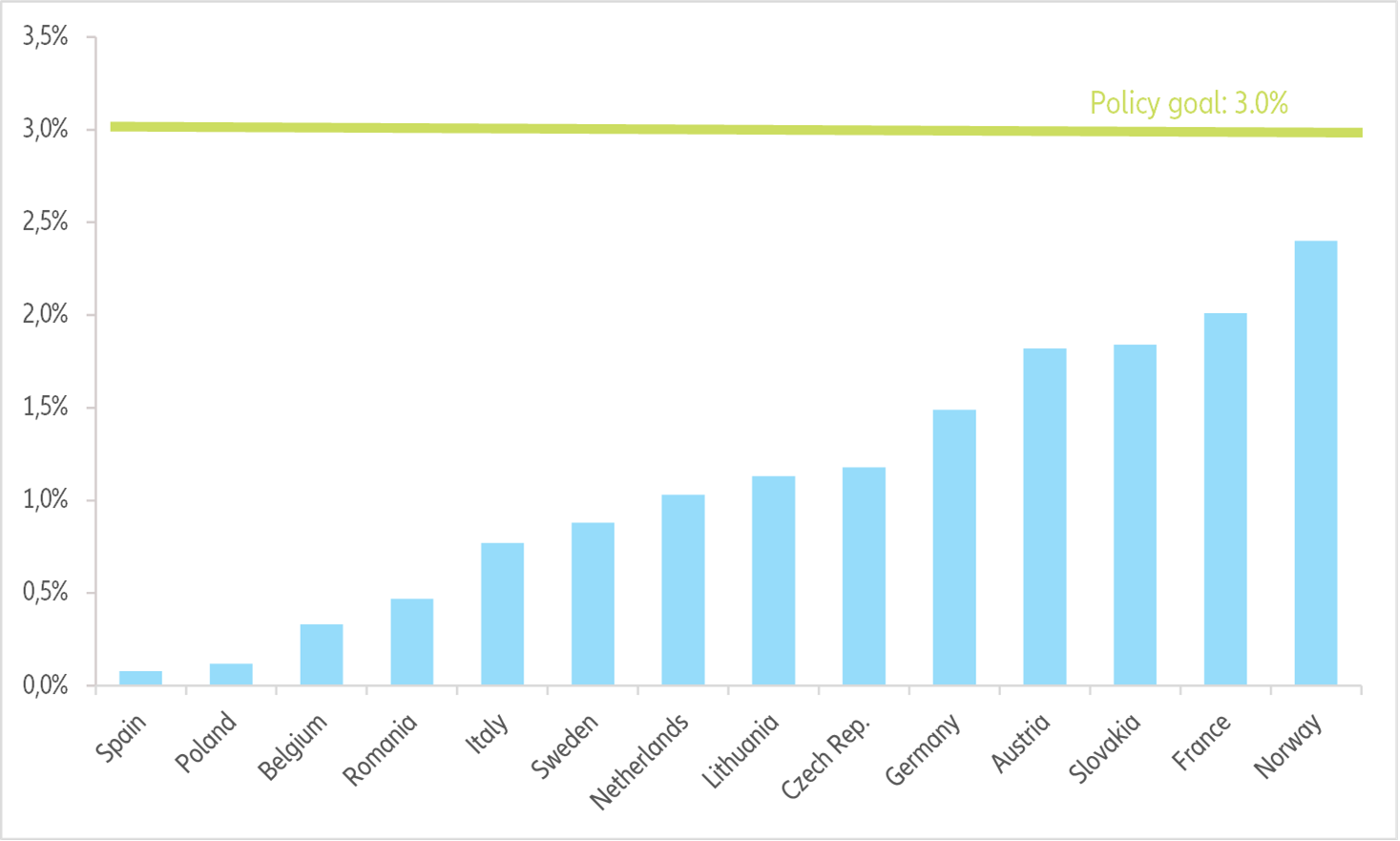

- Real estate: Non-financial barriers are a major obstacle against the demand of energy efficiency measures. Insurance can play an important role as mediator, service provider, and risk bearer and thus accelerate the implementation of efficiency gains.

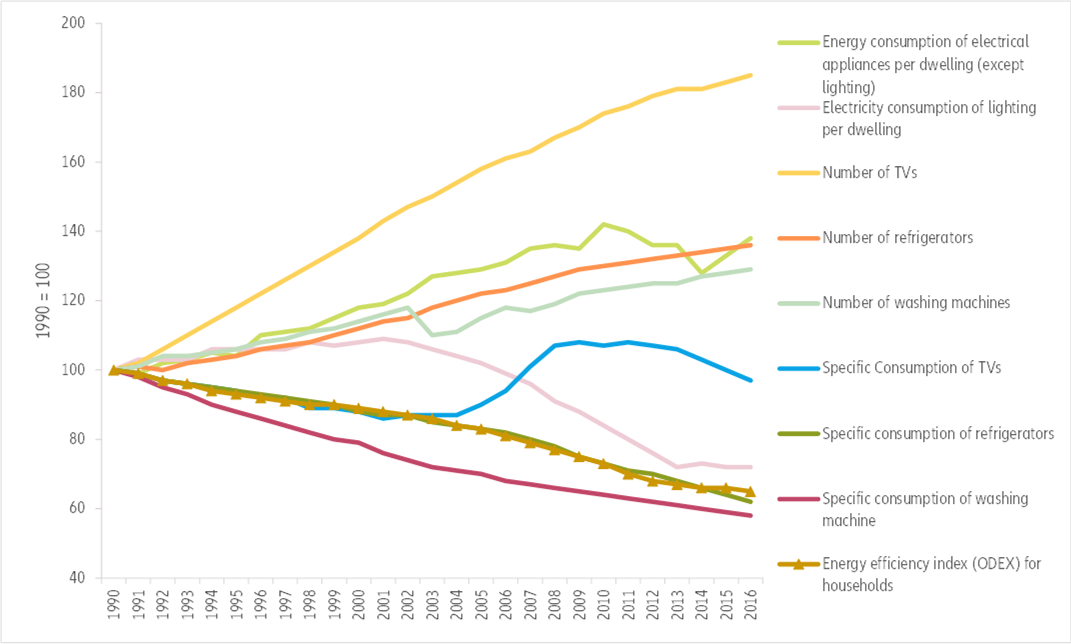

- Sustainable lifestyle: Improvements in the energy efficiency of appliances have come short of expectations due to rebound effects resulting from an increase in the usage of the appliances and a larger number of appliances per person. Impact insurance can counteract this trend by offering lower premiums for eco-friendly appliances, cars and buildings. Sustainable insurance claim regulation can allow for upgrades to eco-labelled appliances and machinery and, due to a life-cycle analysis of the emissions associated to a product, appliances might rather be repaired instead of replaced.

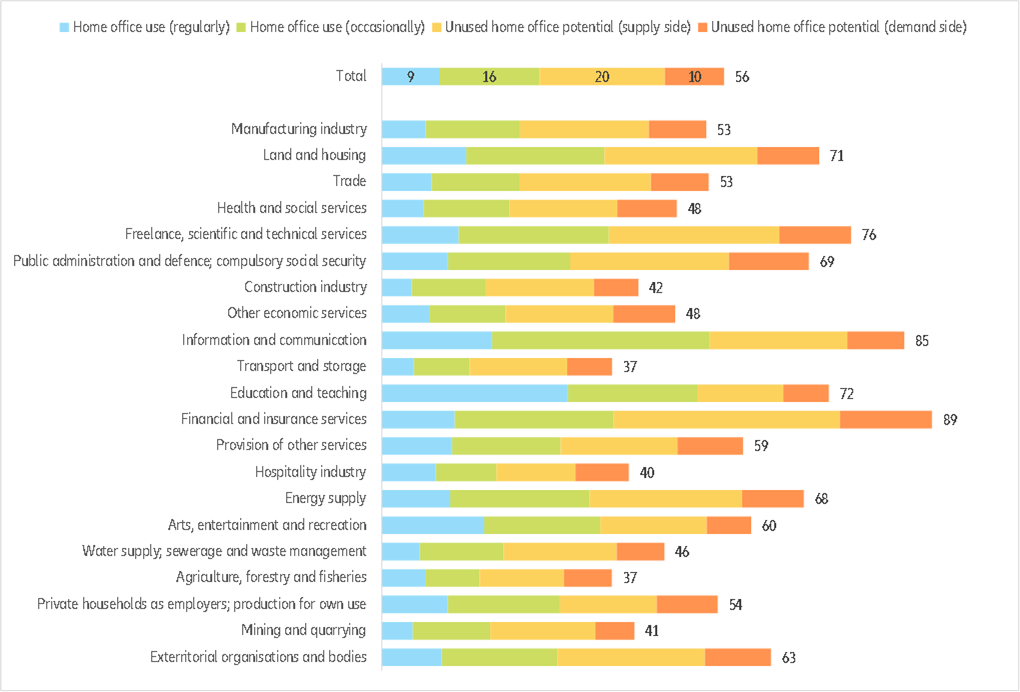

- The future of work: Home office usage could double in the foreseeable future and impact underwriting can support the transition towards ‘new work’ and the sharing economy by reducing implementation barriers resulting from risk averseness, especially coupled with the underlying digitization.

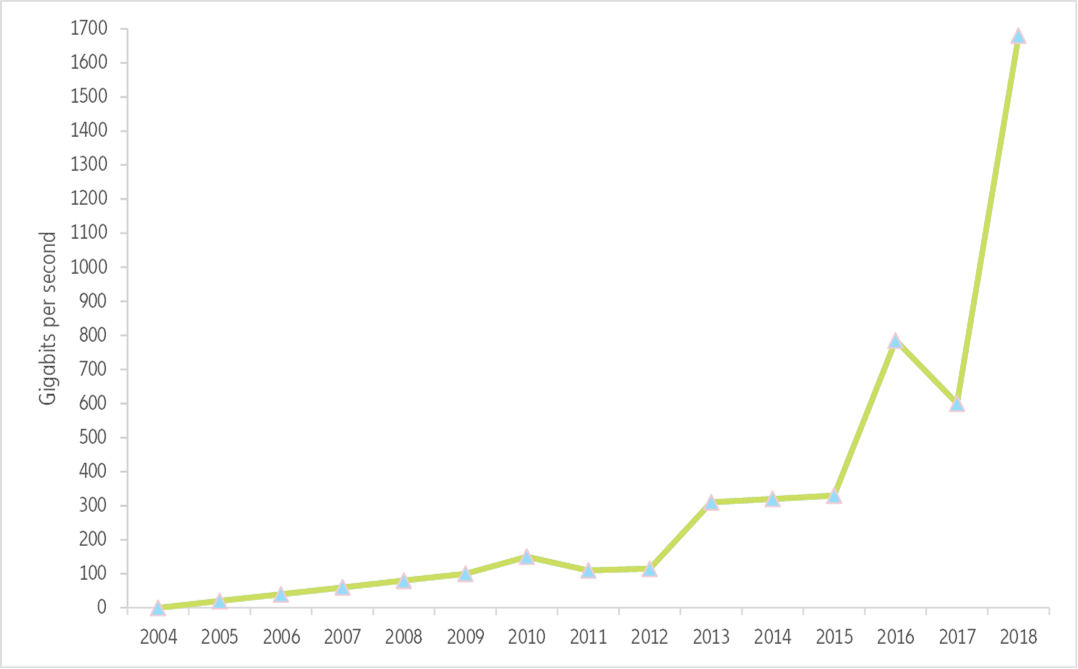

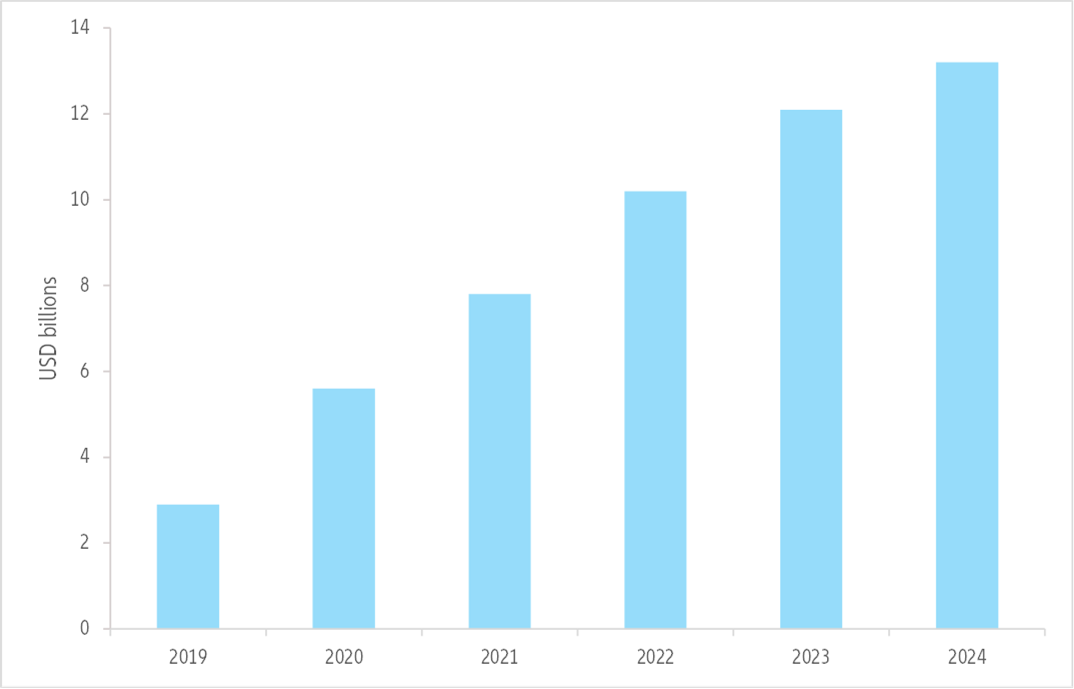

- Digitization & sector coupling: The realization of the energy transition or the sharing economy depends on the progress in digitization. Blockchain is a central enabling technology and its market size is expected to more than double within the next five years. Sector coupling leads to networked electric car batteries functioning as energy system storage, smart appliances’ energy demand being regulated according to energy supply and ‘prosumers’ sharing their self-generated electricity in communities. Impact underwriting can lower the associated risks and thus promote progress towards sustainability.

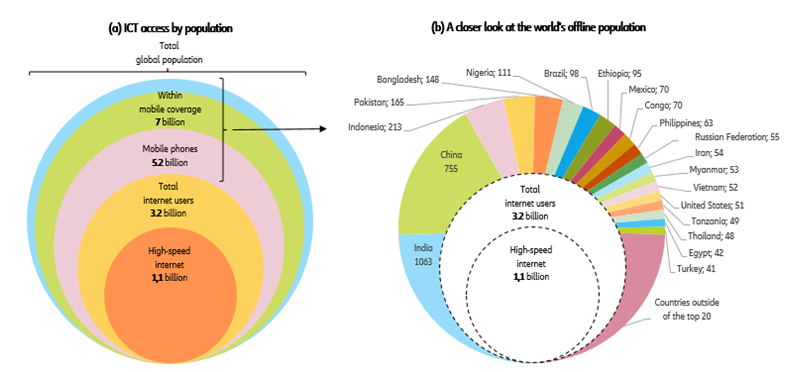

- Emerging customers and regions: Half of global population is still not connected to the internet. With increasing access to mobile phones, the insurance industry will be able to provide impact insurance solutions to new population groups that are particularly challenged. For instance, in the area of agricultural insurance, insurers could provide microinsurance and further communicate weather alerts for livestock or crops, to support the decision-making of farmers.

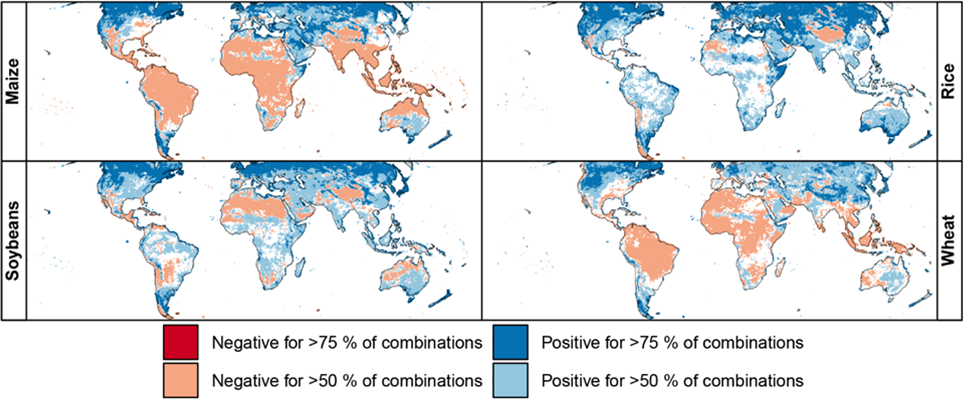

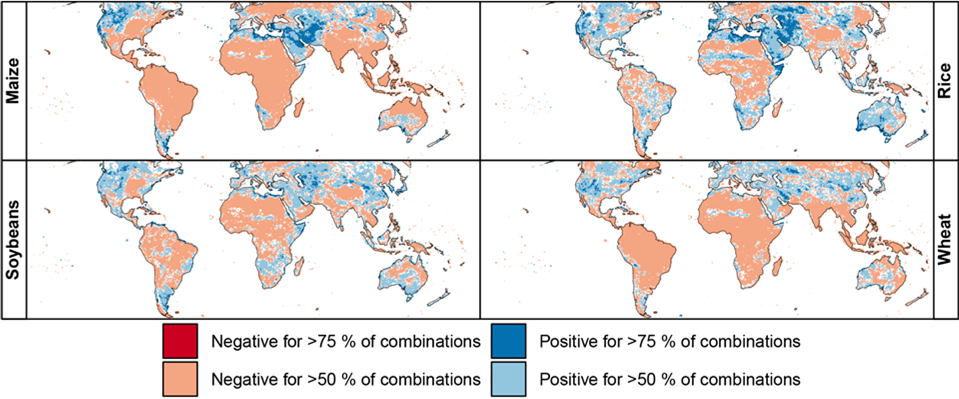

- Ecosystem: Intensifying rainfall and heat waves result in crop yields becoming more erratic, emphasizing the need for insurance and the role of impact underwriting.

‘Impact underwriting’ can accelerate the global economy’s sustainable transformation

In its role as risk manager, risk carrier and investor, the global insurance industry is in a unique position to promote economic, social and environmental sustainability. The vast capital flows and long-term horizon associated with its investment and underwriting businesses can help drive our society’s transition from narrowly focusing on short-run profits and job prospects to building a green, fair and inclusive economy. But the way forward involves looking beyond ‘sustainable’ actions and processes, which aim to preserve a preferred state, and focusing more on ‘impact’, namely actions and processes that shift non-sustainable behavior and processes in a more sustainable direction. An impact-oriented alignment of just a fraction of the insurance industry’s capital flows would be a substantial catalyst for achieving the global sustainability goals .

As Environmental, Social and Governance (ESG) methodologies and frameworks develop and start to be incorporated in risk evaluation, an increasing number of high exposures and extensive vulnerabilities have been identified in the insurance sector itself, which has the challenging position of being concerned with ESG from three different positions:

1. ESG in own operations

• Sustainable and inclusive operations beyond traditional Corporate Social Responsibility (CSR) approaches.

• Philanthropic support of environment, low-income and high-risk customers and regions.

2. ESG in asset management

• ESG factors in investments and asset management (responsible investment).

• Engagement, active ownership, good corporate citizenship (sustainable investment).

3. ESG in insurance underwriting

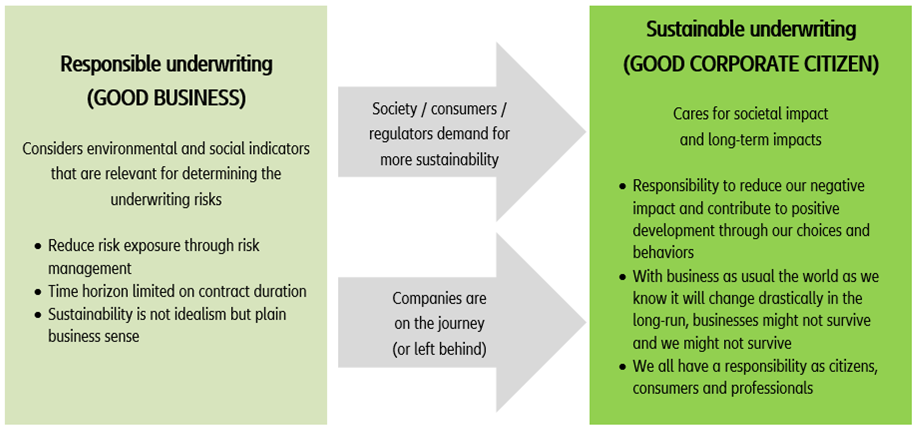

• ESG factors in underwriting (responsible underwriting).