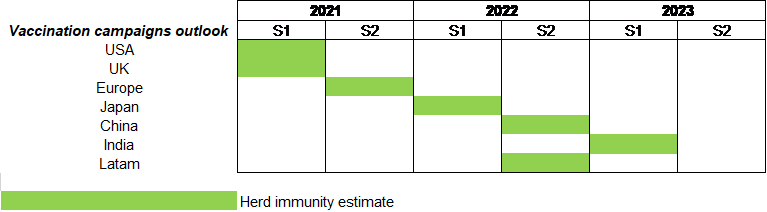

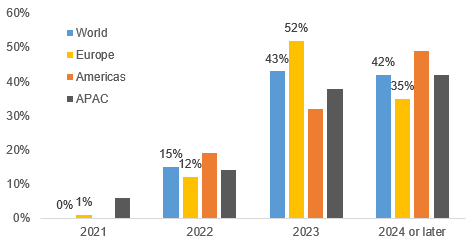

As governments race to contain new and more contagious variants of Covid-19, ‘travel passes’ or ‘vaccine passports’ won’t be enough to revive tourism: the industry could only see a recovery in 2024. To determine the pace of recovery after the Covid-19 shock, we look at 1) how long it could take countries to achieve herd immunity and 2) lessons from past economic slumps. While the US and the UK are on track to reach herd immunity by the end of H1 2021, we expect the EU to reach herd immunity in H2 2021, and Japan in H1 2022 (see Figure 1). This could prevent people from these countries visiting the US or the UK without documents certifying their health. At the same time, it is important to note that the bulk of available vaccines do not prevent vaccinated people from contaminating others, especially those who have not been vaccinated yet. This could also complicate the tourism recovery.

For China and South Africa, herd immunity should be reached in H2 2022. Next to India, South America stands out as a vaccination laggard. The delay in reaching herd immunity is driven in particular by difficulties in getting more conventional and cheaper vaccines such as the Chinese CoronaVac to Emerging Markets and to problems in vaccine delivery, especially across Brazil. South America also has to cope with its population’s reluctance to be vaccinated and with some disruptions in supply-chain management from the location where vaccines are manufactured to the ones where they are distributed.

Figure 1: Vaccination schedule by region

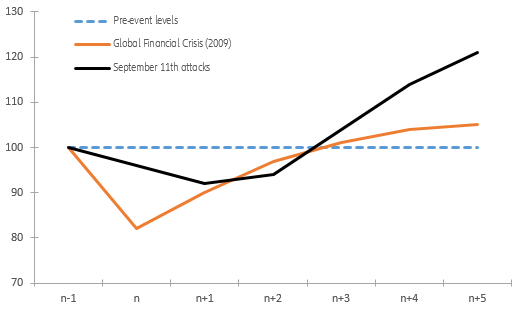

Next, we look at how long it has taken tourist travel spending to recover after past economic crises. After the two last crises (the 11 September attacks and the 2009 Global Financial Crisis) , travel spending (tourism and business) returned to its pre-crisis level two, if not three, years, after the crisis had begun (see Figure 2). In the first case, the weakness of pent-up demand determined the recovery time, given security fears. In the case of the GFC, the drag on the recovery was more to do with the sudden need to fund huge deficits and to put money back into the economic motor.

If we consider that the current economic slump started in Q1 2020, this means global tourism-related services and travel activity could go back to pre-crisis levels as of the second part of 2022. However, this pandemic has sparked an unprecedented economic crisis, with major containment measures through lockdowns and very strict travel restriction rules and curfews that still affect many people across mature and wealthy countries. As a result, the odds of a soaring rebound in the travel sector are very unlikely by next year.

Figure 2: Impact of past downturns on international tourism and traveling

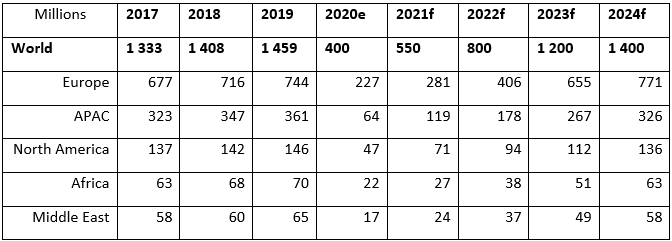

Europe could see a faster tourism recovery than the US and APAC, with 771 million expected arrivals in 2024, more than triple the all-time low hit in 2020. By regressing tourist arrival data from 1980 to 2018 on the corresponding GDP of regions of the world, we estimate the number of tourists expected until 2024 in Figure 3.

Figure 3: Tourist arrivals worldwide

The table above shows, on the left, the UNWTO estimates of international tourist arrivals from 2017 to 2019. From 2020 and onwards are our forecasts, based on the coefficients found in our regressions, presented below:

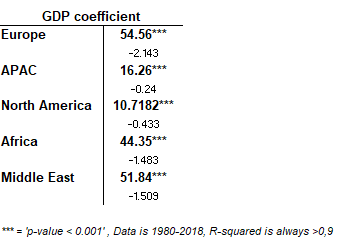

Table 1: Coefficients in the linear regression of Tourist numbers (Millions) over GDP (Billion)

In all of these five regressions, GDP coefficients and constants were always significant at the highest level. From these coefficients, we formed five linear relations linking tourist arrivals and corresponding GDP, with the coefficients stated above. Our hypothesis is that these coefficients did not change too greatly during the crisis so using GDP forecasts, we can build new values of tourism.

The results support the analysis that a return to normal tourist travel activity will not occur before another two years. A recent survey of tourism professionals by the UN’s World Tourism Organization reaffirms these results: most said they did not expect a return to pre-pandemic levels before 2023 at best. In fact, 41% of respondents said they expect the return to normal only in 2024 or later (see Figure 5).

Figure 4: When do you expect international tourism to return to pre-crisis 2019 levels in your region?

Our breakdown of the number of tourists by region shows that it is Europe that will be ahead of the curve, even though it is expected to lag behind the US and APAC in the overall economic recovery. Our calculations show that international tourist arrivals to Europe could reach 771mn as soon as 2024, more than triple the all-time low of 227mn seen in 2020.

Europe is likely to see larger tourist arrivals than the other regions because it suffered the largest drop in absolute terms in 2020, with over 500 million fewer international tourists. Besides, we expect EU countries to work together to better align on lifting travel restrictions: Europe has the most to gain in terms of a tourism revival if it can come up with a valid vaccine passport/card solution.

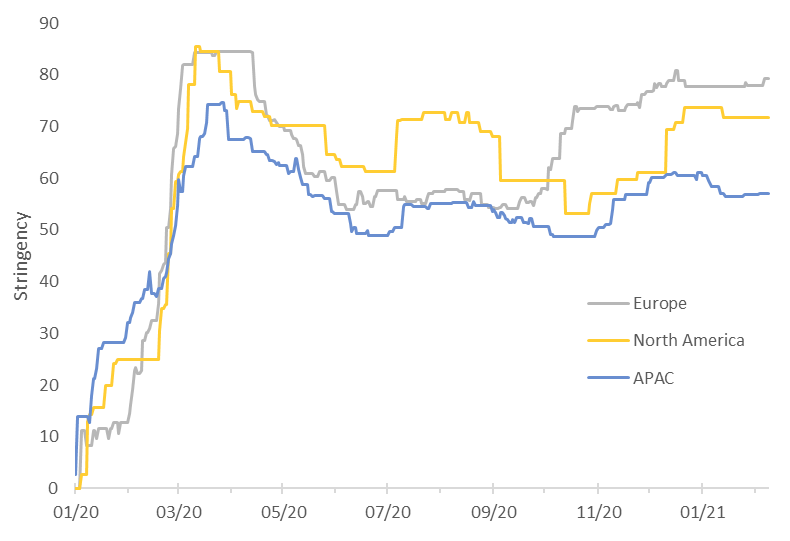

Figure 5: Stringency index by region

Figure 5 shows the current stringency level of restrictions around the world. Europe is still the most restrictive region by almost 10 points compared to North America, and 20 points compared to APAC. The current tourism levels highly depend on this index and the fact that Europe is the most stringent explains why tourism has been hit the hardest in this region. In this context, if vaccine passports were to be implemented around the same time across regions, tourism would rise the most in Europe. Indeed, the European Commission is working on the idea of health passports to ease travel restrictions by the coming summer. However, two factors will be decisive: 1) the effectiveness of Covid-19 vaccines in preventing transmission and 2) policy implementation. EU countries are likely to have an advantage as they would share the same data-based system, with uniformed and correct data inputs (just as they share economic data through the Eurostat database, for example).

However, even assuming that a vaccine passport system is workable, new difficulties could emerge. With any policy of certification, consequences might result from how the passports are used in the economy. A person without a certificate being denied the same freedom of movement as others both domestically and internationally is likely to be very tricky.

The recovery in global tourism could also suffer from protracted travel restrictions across APAC and the Americas due to the emergence of new variants for which the available vaccines appear to be less efficient, if not ineffective against new mutations – or mutations yet to come. The number of tourist arrivals in these regions is forecast to reach 326mn and 136 mn, respectively, in 2024. The breakdown by region shows that the European market share, in terms of the number of tourist arrivals, is expected to rise to 55% in 2024, compared to 51% in 2019, while North America’s remains the same (around 10%) and APAC’s reduces from 25% to 23%.

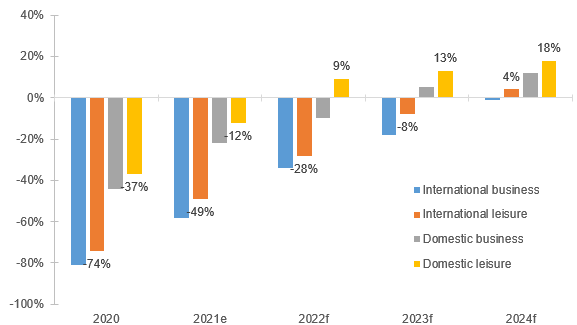

When looking at the different sub-sectors, we find that only domestic leisure could be back on track by 2022. But this won’t make up for the losses of more profitable international and business travel, which could suffer until 2023. Domestic tourists do not usually spend as much money as international ones but the international travel segment is expected to still be -8% lower than its pre-crisis level even in 2023 (see Figure 6). The rise in unemployment figures will also compound the issue, with consumers likely to curtail spending on tourism-related activities.

In short, the Covid-19 pandemic could put an end to ‘globalized’ tourism and travel for quite a long time, forcing tourism and travel-related players to transform their business models.

Figure 6: Estimated timeline of the recovery in global travel spending, by segment of travel