UK Q1 GDP fell by -2% q/q, in line with expectations. This release confirms that each week of lockdown cuts output by around -6%. Even before implementing a Covid-19 lockdown on 23 March, the UK economy was already on a weak footing, posting no growth in Q4 2019. And at the start of the year, advanced indicators pointed to below normal investment activities and trade as Brexit uncertainty was still looming. Now, the preliminary estimate of Q1 GDP shows widespread declines in economic activity. Household consumption fell by -1.7% q/q and total investment was down by -1.0% q/q due to declining investments in housing, as well as lower government investment (business investment was flat). Government consumption contracted by -2.6% q/q mainly due to falls in education spending, while disruption within supply chains pushed inventories lower. Exports fell by -10.8% q/q while imports fell by -5.3% q/q. In March, output decreased by -5.8% with the strongest declines seen in services (-6.2%) and construction (-5.8%).

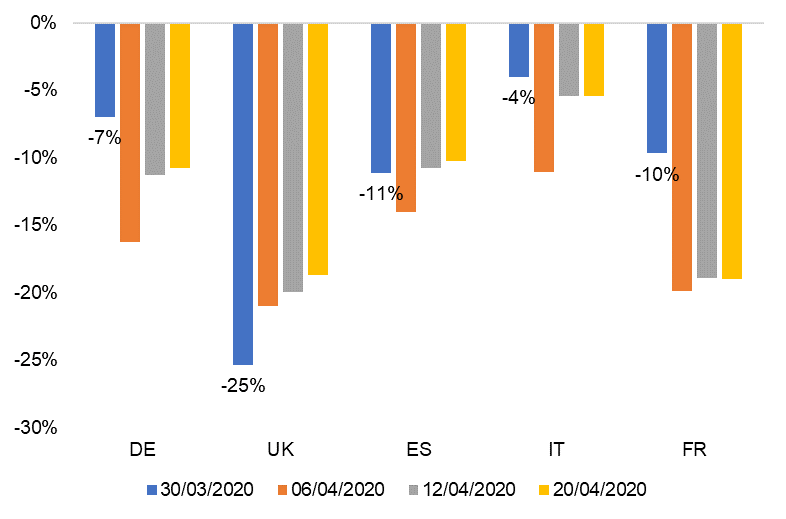

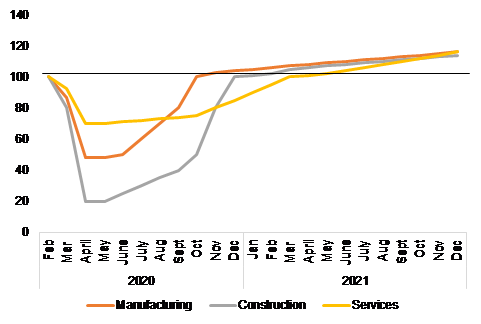

We expect Q2 GDP to fall by more than -20% q/q as the lockdown has been extended until 01 June and the activity resumption will prove slower than elsewhere in Europe. The UK is among the countries with the longest (10 weeks) and hardest lockdowns to fight the Covid-19 sanitary crisis. Activity inthe UK has fallen further than the Eurozone average: Electricity data show a -21% drop on average in both energy production and consumption since mid-March, compared to -17% in France and -11% in Germany (see Figure 1). While the final reading of the Composite PMI for April was relatively in line with the Eurozone one (13.8, compared to 13.6), the UK’s Construction PMI fell to 8.2, from 39.3 in March, much below the Eurozone level of 13.6. Although the lockdown did not forbid construction builders from continuing activity, they have taken a cautious approach and closed many sites. Builders remain pessimistic about the outlook: expectations for demand over the next 12 months matched the lowest level previously recorded in October 2008. Shortages of raw materials and safety products are likely to remain a constraint on the recovery over the coming months.The UK’s deconfinement strategy looks more cautious than elsewhere, with hospitality expected to resume activity only post 01 July and a 14-day quarantine imposed to travelers coming by air. Hence, we don’t expect the services sector to return to pre-crisis levels before mid-2021, while manufacturing and construction would at best recover to those levels at year-end should Brexit uncertainty remain contained (see Figure 2).

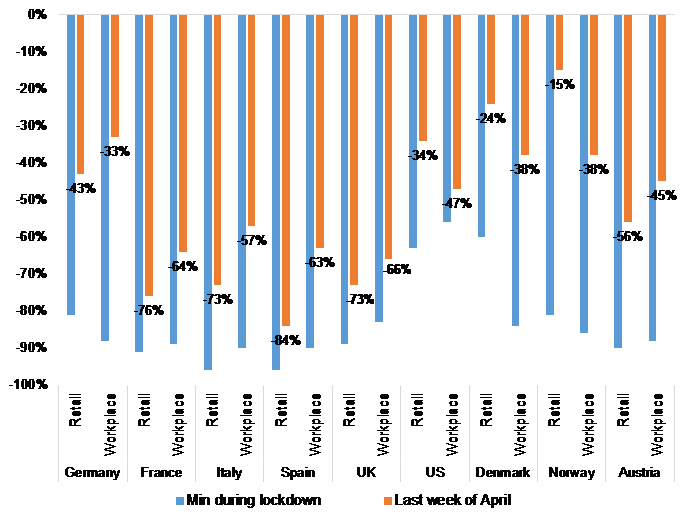

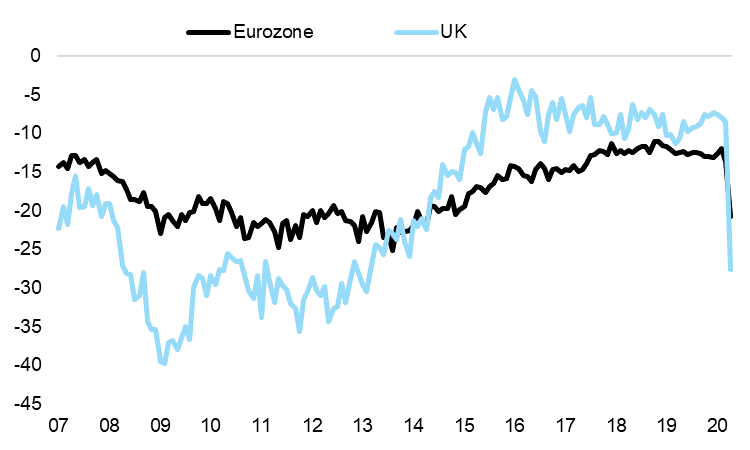

Mobility data and several surveys show a higher cautiousness for the UK consumer. We expect consumer spending to drop by -15% in 2020. Google Maps mobility data at the end of April suggest that visits for retail and workplace purposes were c.-50% below baseline values, compared with c.-80% during the midst of the lockdowns. However, in the UK, the figure was at -70% at end of April (see Figure 3), compared to -86% at the trough. Several consumer surveys suggest a very progressive return to normal. While fears of unemployment in the next 12 months are similar, even if lower, in the UK compared to the Eurozone, consumers’ intentions for major purchases in the next 12 months have dropped more than in the Eurozone as a whole (see Figure 4). Current consumer confidence is consistent with close to a 20% shortfall in new car sales relative to last year. As the Job Retention Scheme would reduce its support from end of June to end of October, we think the unemployment rate is likely to increase beyond 10% in Q3 (and 8.5% on average in 2020, from 3.8% in 2019). Until now the top five sectors to have used the scheme are food and accommodation, art and leisure, construction, manufacturing and administrative support. Hence, precautionary savings would continue until year-end in the absence of measures boosting consumer confidence. After reaching a record low level in 2019 (6%), we expect the saving rate to reach 17% of the gross disposable income in Q3 (after a peak of 31% during lockdown) and to twice higher compared to the pre-crisis level at year-end as unemployment will continue to increase. Hence, we expect consumer spending to drop by -15% in 2020.

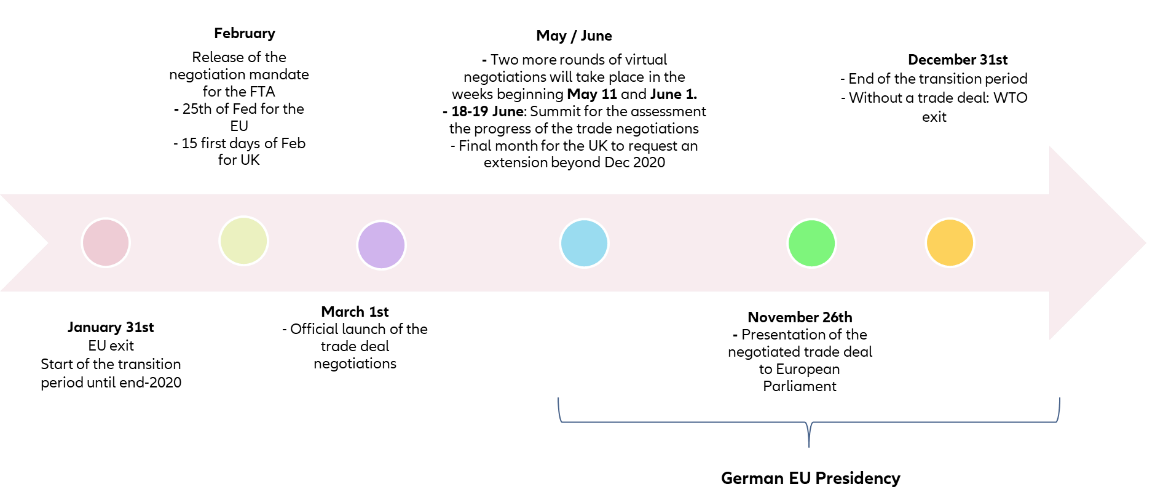

Heightened Brexit uncertainty is just around the corner and we continue to think an extension of the transition period until at least mid-2021 is likely. In our view, the risk of “no trade deal” at end-2020 stands at 20% probability, against 30% back in 2019. The Covid-19 crisis has delayed the Brexit negotiations. We were already skeptical of both parties’ ability to finalize a “new comprehensive agreement” on both goods and services by the European Summit on 18-19 June (see Figure 5), which includes a technical set-up for the double custom checks in Northern Ireland (see our report). Hence, we think that a longer transition would be needed, at least until mid-2021, as there is growing domestic evidence that the private sector in the UK is pushing for the government to avoid the double whammy of tariffs and regulatory hurdles from new FTAs amidst the fragile recovery post Covid-19. However, the extension could be requested post the end of June, the current deadline, which will increase the Brexit-related uncertainty during summer. We see increasing downside risks to our -8.2% forecast for 2020 and +8.7% for 2021

Figure 1 – Electricity production compared to mid-March (% change)