Executive Summary

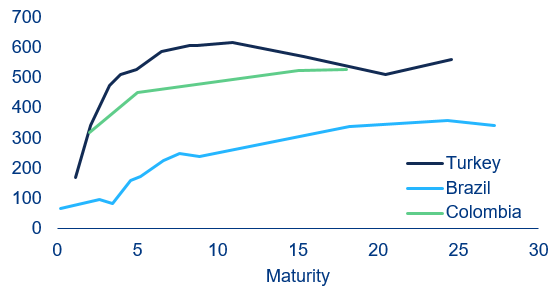

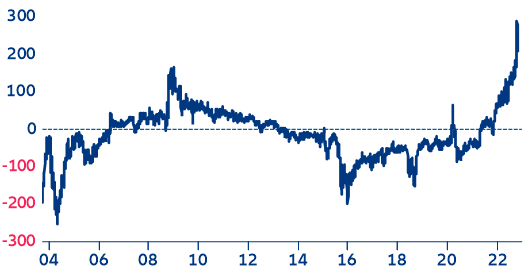

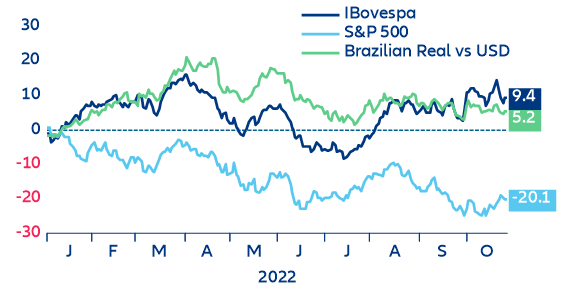

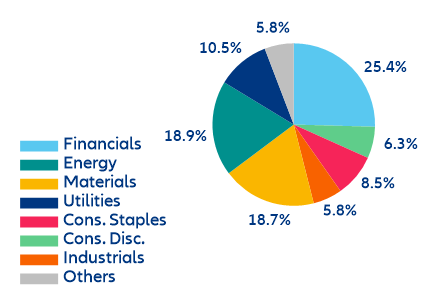

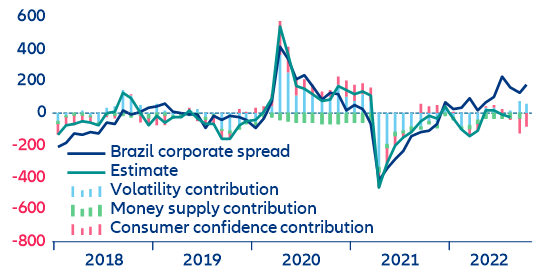

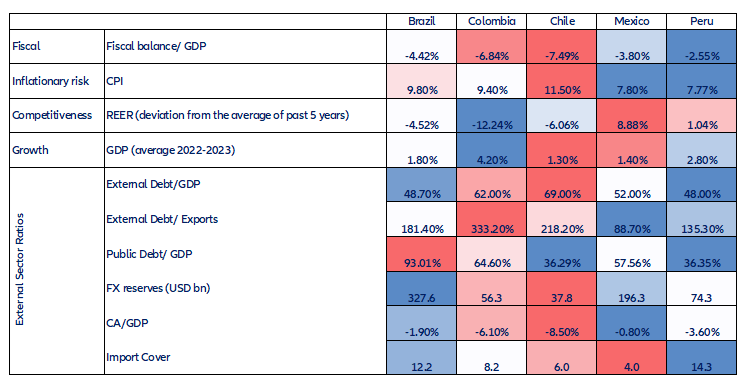

- Unlike in previous elections, there are few signs of politically driven stress on Brazilian markets. Yet, Brazilian markets are in for a reality check in 2023. The results of the first round of the Presidential elections have reduced the likelihood of extreme policies: markets are familiar with both candidates. Investors have also welcomed the commodity boom and the determination with which the Central Bank of Brazil has acted (positive real interest rates, resilient real and net portfolio inflows). In 2023, once major central banks start to pivot and markets readjust their yield expectations, Brazilian sovereign bonds should yield positive returns. In the hard-currency environment, this will come from the reduction in the risk-free rate rather than by the spreads, where we expect a slight widening (above 300bps in 2023) as oil prices adjust further and concerns of fiscal policy grow. The first rate cuts and the control of inflation should bring yields of BRL-denominated bonds slightly down, but we do not expect them to go much below 11% in 2023 for the 5Y bond. Credit should benefit from easing monetary policy but fundamentals will keep spreads wider than necessary (~400bps). For equities, short-term cyclical momentum will feed into 2023 (~0-5% yearly return) but will start losing steam by year-end due to lower structural economic growth beyond 2023.

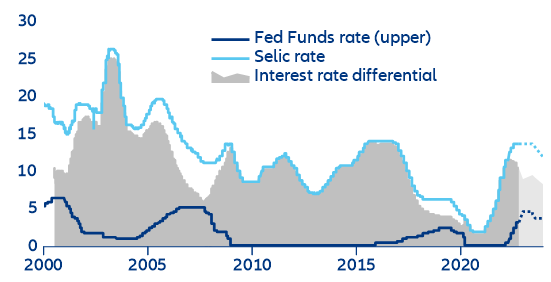

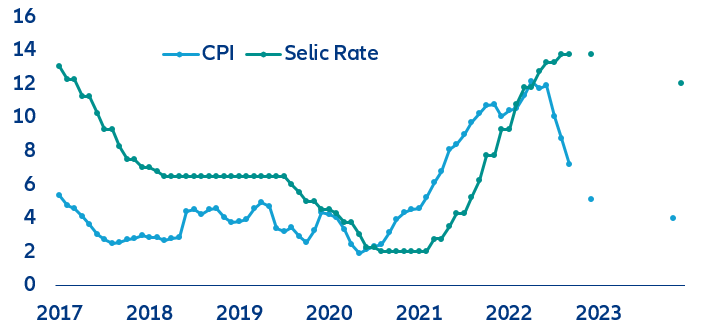

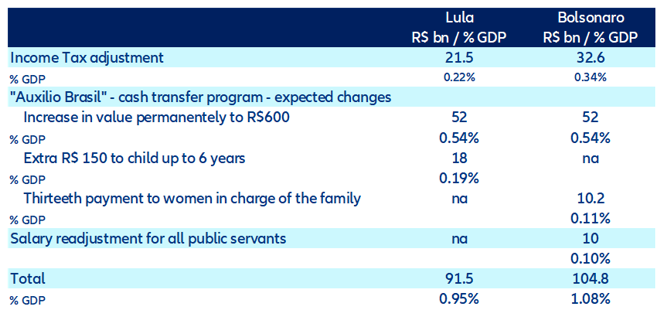

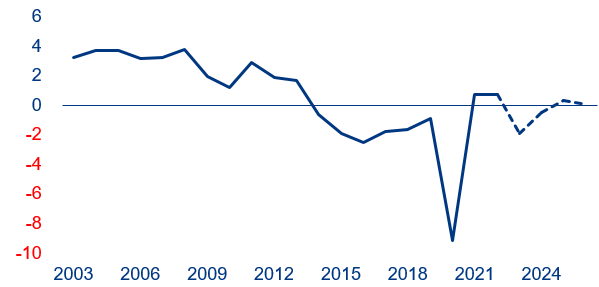

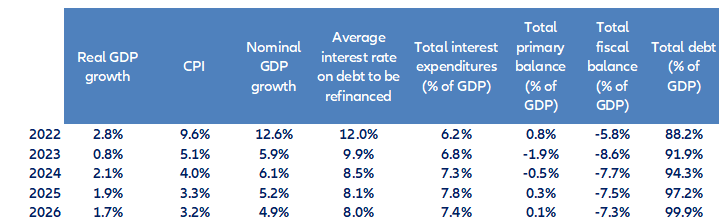

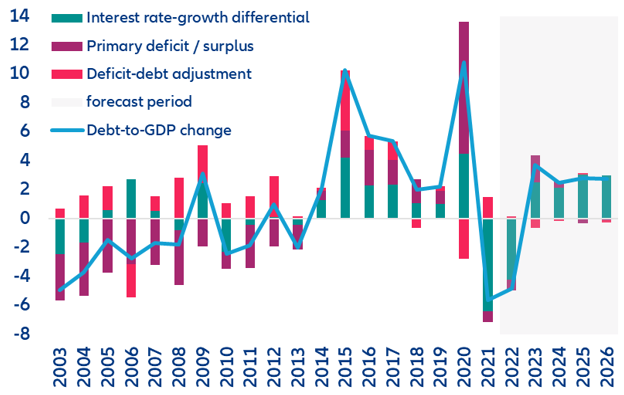

- Public debt is the true winner of this election. Investors will be watching for fiscal soundness. Beyond what comes next from the Federal Reserve and from oil prices, domestic fiscal policy will play a crucial role. We analyze the programs of both candidates Lula and Bolsonaro and find that the expansionist measures (social transfers, tax cuts, yet another revision of the spending cap) would lead to a deterioration of the primary fiscal deficit to -1.9% of GDP in 2023, the worst in 20 years (excluding the pandemic). This also means that Brazil will reach a 100% debt-to-GDP ratio by 2026. In addition, some fiscal measures may cause more inflation: We expect headline inflation at 5.1% in 2023, against the central bank’s target of 3.25%, while real GDP growth will weaken to +0.8% in 2023 and return to close to its potential in 2024 with 1.9%. We expect the BCB to hold the Selic rate at 13.75% in 2022 and to start to lower it in H2 2023, bringing interest rates to 12% by the end of the year.

What are markets telling us about the outcome of the Brazil elections?

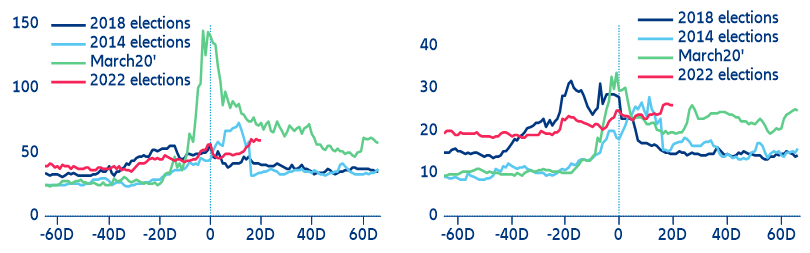

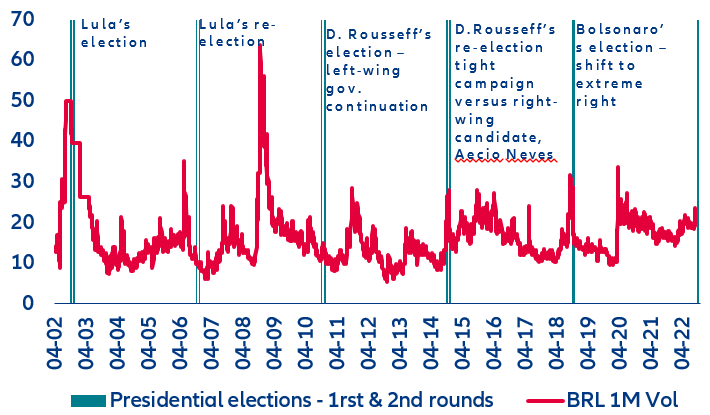

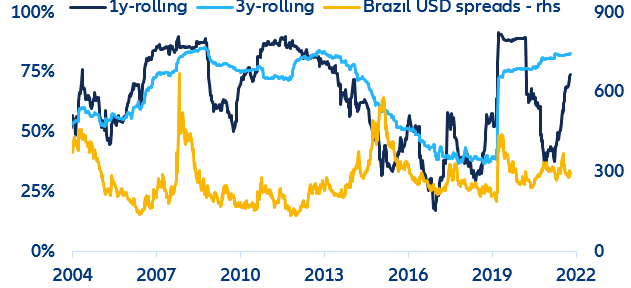

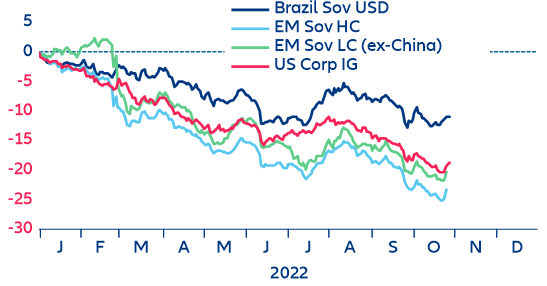

Although market volatility has been structurally higher due to the challenging macroeconomic environment, the divided 2022 Brazil elections have not created any meaningful additional stress. The current situation is neither comparable with other tense moments in Brazil’s recent financial history, such as March 2020, or to the oil price collapse of 2015-16 (lower levels than during Covid-19, but longer-lasting in time). In 2014, the turmoil came after the first-round results, and in 2018 prior to the first; both moments have already taken place in this election cycle and markets have not responded violently.

Both candidates, Luiz Inacio Lula da Silva (or more commonly known as Lula) and incumbent president Jair Bolsonaro, are well-known and although there are concerns on both sides, markets expect that neither candidate will fundamentally alter the current environment. Furthermore, the results of the Liberal Party (PL) in the Congress ensure a right-wing majority that would diminish the executive power of Lula should he – as the polls suggest – become the next President of Brazil. Judging by the reaction of Brazilian assets, the markets welcomed the first-round outcome.

Figure 1: Pre-election volatility compared to previous events (LHS: Equity volatility, RHS: BRLUSD 1M implied volatility).