EXECUTIVE SUMMARY

- The commercial real estate sector is getting squeezed by tightening financing conditions, but prime assets have remained resilient. After attracting considerable investment in the era of low interest rates, the sector is now battling a storm of cyclical headwinds: besides the weak economic momentum and the resulting increased risk of tenants’ rent defaults, higher-for-longer interest rates will also hit debt servicing and the possibility of refinancing. Also, the sharp increase in construction costs is discouraging new developments and pushing up expenses for maintaining and upgrading buildings. However, limited supply due to subdued construction during the pandemic mitigates current price pressures, with greater differentiation between prime and non-prime assets and locations. Similarly, the inflation-hedge role of real estate will attract stabilizing long-term investment and counterbalance current headwinds.

- A banking doom loop does not seem to be on the cards in Europe. Banks have built up a solid capital position and CRE debt is mostly held by larger banks that are subject to strong oversight after the ECB identified some weaknesses in its 2021/22 review (e.g. banks lacking commonly defined basic CRE risk or even an overview of loans subject to refinancing risk). In contrast, in the US, a large portion of CRE debt is held in the public markets as Commercial Mortgage-Backed Securities (CMBS), which require refinancing, and much of the private debt is held by small banks experiencing considerable pressure from their deposit base.

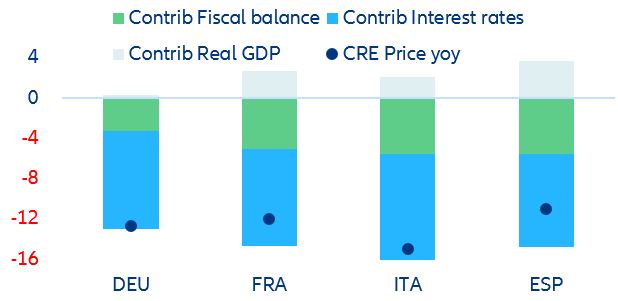

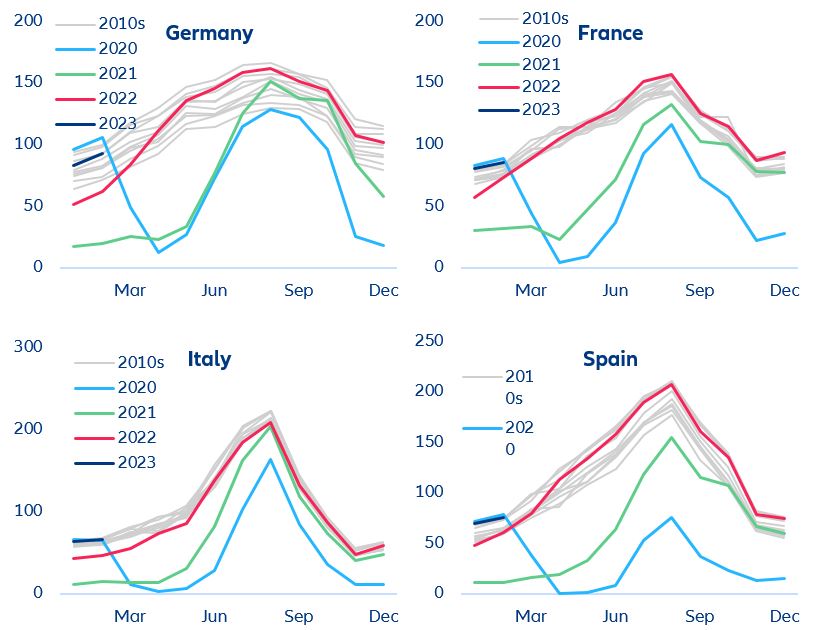

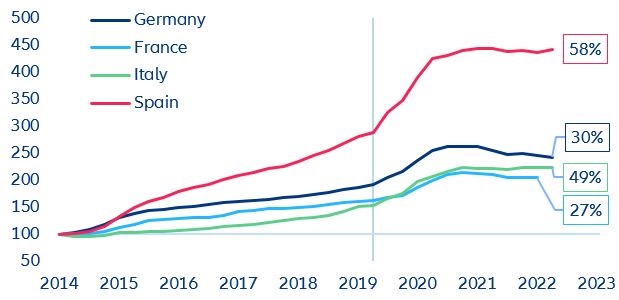

- Strategic investment decisions will depend on being selective in terms of geography, segment and asset quality, with a focus on logistics, data centers and tourism. Based on our macro-financial model, we expect CRE prices to fall between 10-15% over 2023-2024 in the major Eurozone economies, although with wide heterogeneity across countries, segments and quality. Although remote working is becoming less popular, the office segment, especially in non-prime locations, will face price corrections. However, Europe will fare better than the US as remote work is less widespread, with lower vacancies in major cities. In fact, rents for prime-grade office assets have risen within the last quarter. In addition, declining supply in the wake of the pandemic and rising interest rates have limited construction, which has helped support rental growth. Aside from the resilient office sector, the bright spots are data centers and, to a lesser extent, logistics, while the strong recovery of tourism, especially in France and Spain, has made hotels more attractive. The retail segment will remain fragile as consumers have shifted to more online purchases.

Tightening financing conditions to weigh on the commercial real estate sector

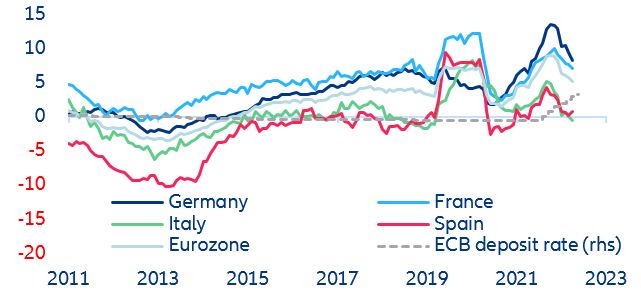

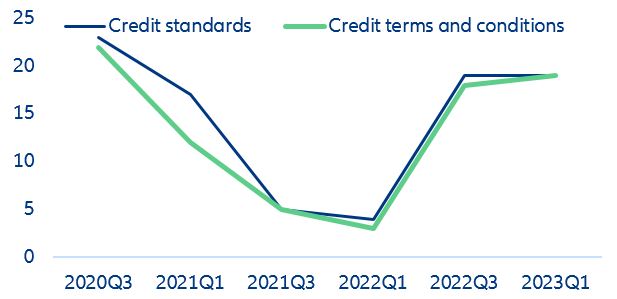

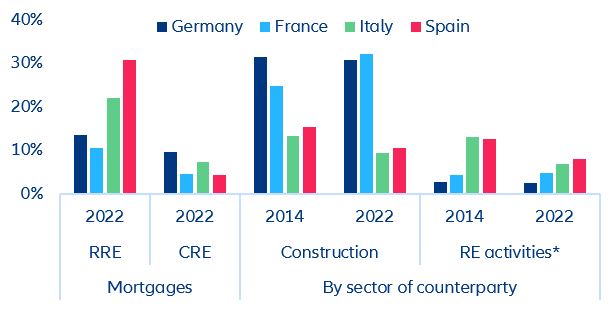

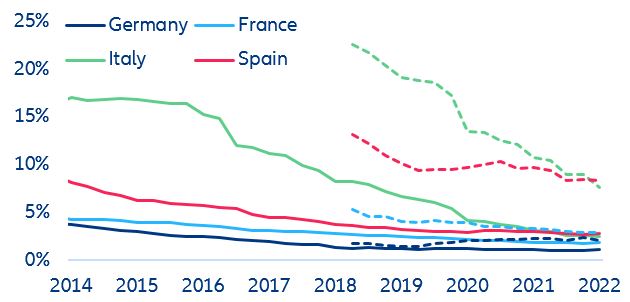

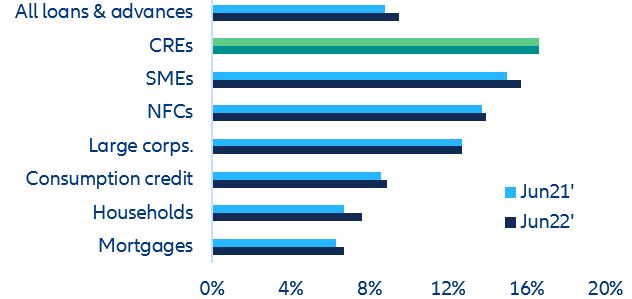

With Europe facing the prospect of stagnating growth in 2023, prolonged uncertainty and rising interest rates will weigh on the commercial real estate (CRE) sector. The sector is facing strong cyclical headwinds. Sharply rising interest rates (+375bps since July 2022) remain a major source of concern. The tightening of credit standards and banks’ overall terms and conditions – particularly pronounced in real estate – have reduced annual loan growth in recent months (Figure 1) and have amplified the negative impact on the CRE market. Also, the weak economic momentum is pushing up business insolvencies, which could lead to higher rental defaults. As we indicated in our recent Global Insolvency Report, sectors such as finance, B2B and real estate-related activities (ex-construction) – i.e., the primary users of office buildings – saw the largest rebounds in business insolvencies in 2022. And we expect insolvencies set to rise again in 2023, by +41% in France, +24% in Italy, + 22% in Germany and +18% in Spain. A sharp increase in construction costs has also discouraged investments and pushed up expenses for maintaining and upgrading buildings.