EXECUTIVE SUMMARY

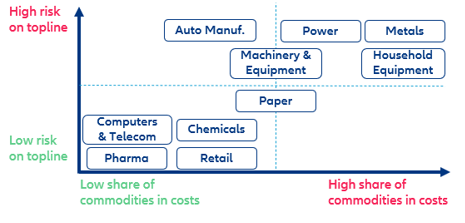

- The war in Ukraine has put pressure on European corporate margins. The conflict has sent (energy) commodity prices soaring, amplified existing supply-chain disruptions and increased uncertainty weighing on investment. So far, high cash balances and rising profitability seem to have shielded most companies from rising input prices. However, leading indicators suggest declining earnings. Eurozone consumer confidence levels imply a -2pp y/y margin erosion within the next six months. The impact is expected to vary across sectors, with power and metals most affected by a further increase in energy prices.

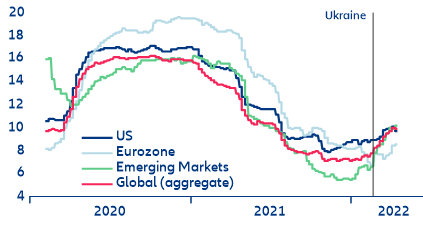

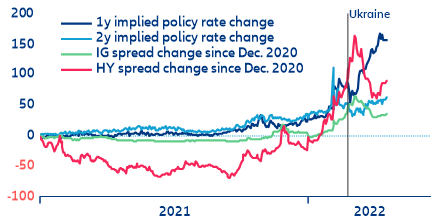

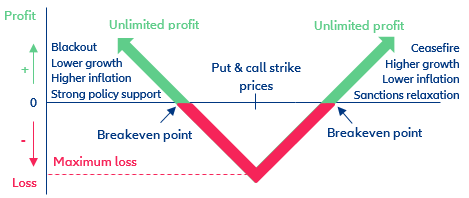

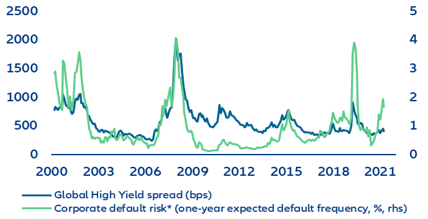

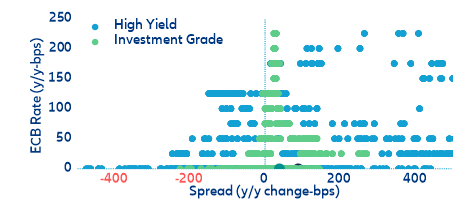

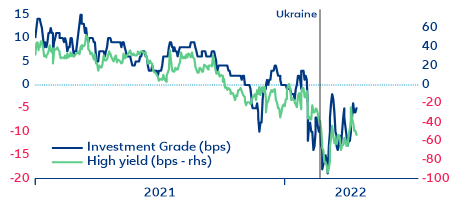

- Corporate credit spreads have de-anchored from their 2020-2021 lows due to rising -default risk amid faster-than-expected monetary tightening. After strong policy support effectively cappedinsolvency risk for almost two years, the broad-based market sell-off since the onset of war in Ukraine has amplified the progressive widening of credit spreads due to tighter financing conditions. However, credit spreads, especially within the high-yield segment, have remained range-bound due to (still) relatively healthy corporate balance sheets and a protracted phase-out of policy support. Current market positioning does not suggest a broad-basedcredit risk deterioration over the near term, with investors anticipating a quasi-straddle payout distribution from holding corporate credit risk.

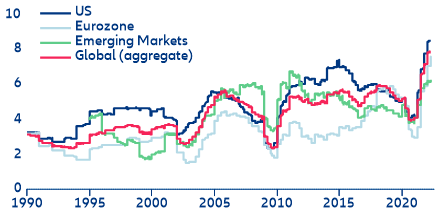

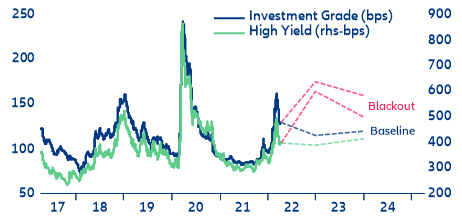

- While corporate credit risk should remain manageable, risks to the outlook are clearly tilted to the downside. We expect non-payment risk to increase further, given the economic slowdown, with Eurozone business insolvencies increasing by +12% this year from extremely low levels. An even more hawkish monetary stance (also driven by rapidly tightening financing conditions in the US) could precipitate credit constraints and raise default rates. However, strong fundamentals could keep credit spreads in check. We expect investment grade spreads to compress from current levels, finishing 2022 close to 115-120bps but to moderately widen to 120-125bps by end-2023. Moving down the rating scale, high-yield credit will probably finish the year close to 390-400bps before widening by 20bps in 2023.

The war in Ukraine has increased pressures on corporate margins.

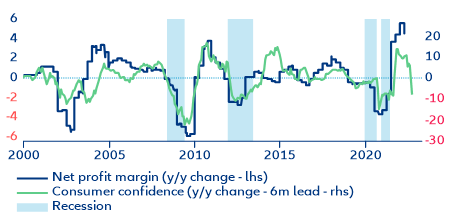

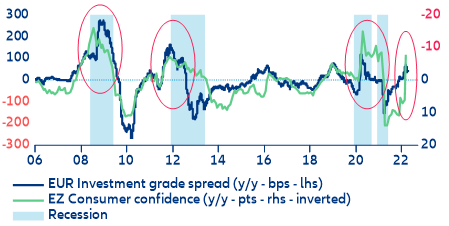

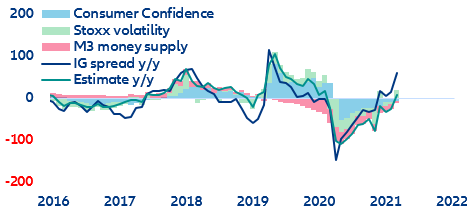

The conflict has sent (energy) commodity prices soaring, amplified existing supply-chain disruptions and increased uncertainty. So far, strong cash balances as well as rising profitability and capex, seem to have shielded most companies from high input prices. However, with the real impact on companies’ balance sheets yet to fully reveal itself, early earnings reports indicate a higher-than-expected though manageable impact (which is confirmed by deteriorating economic expectations, a leading indicator for corporate margins). Eurozone consumer confidence levels imply a -2pp year-over-year margin erosion within the next six months, implying a margin decline of 3.0-3.5pp from the current 8% peak to 4.0-4.5% (Figure 1) .

Figure 1: Europe-Corporate net profit margins vs economic confidence indicator (in y/y changes)