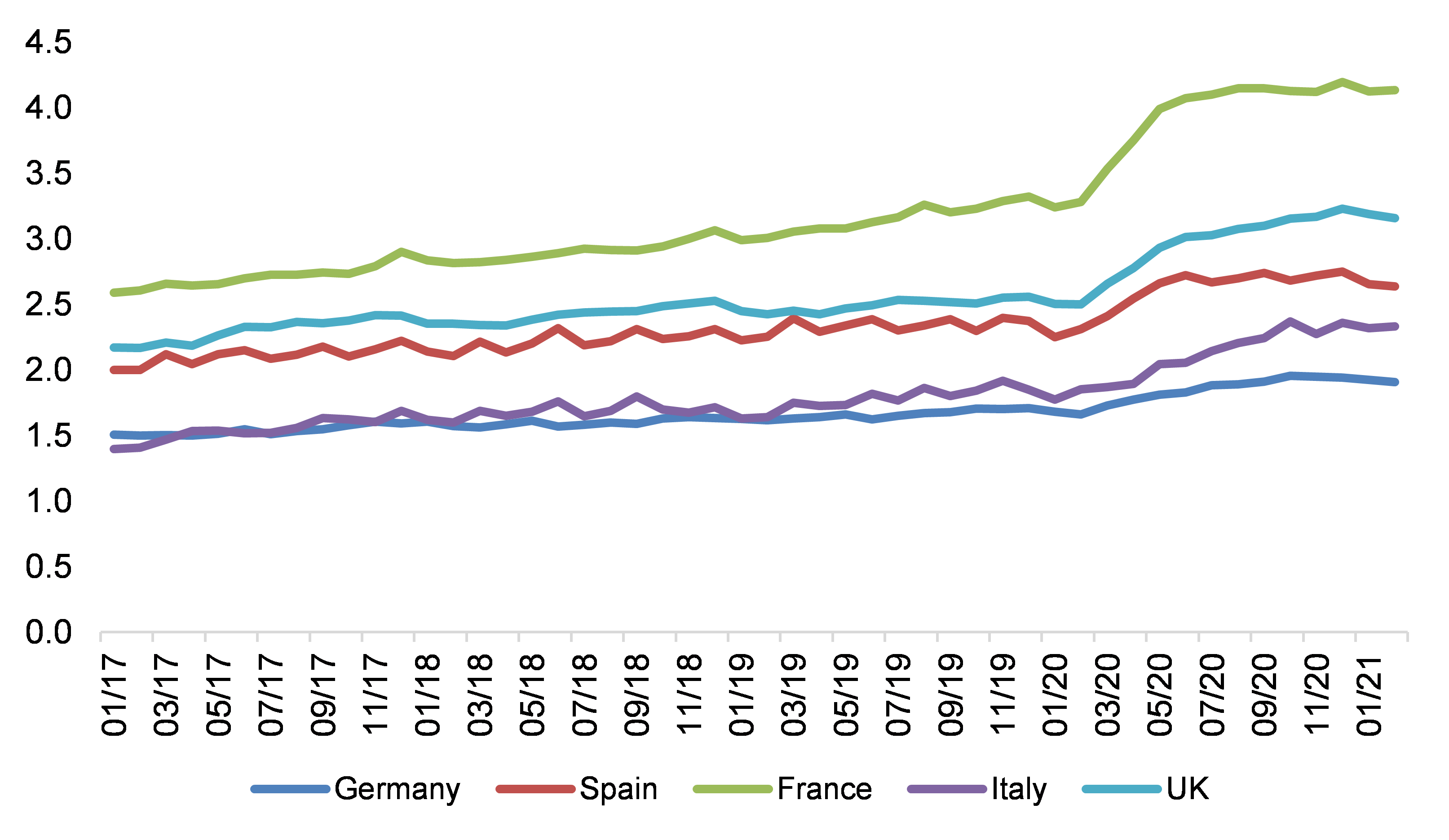

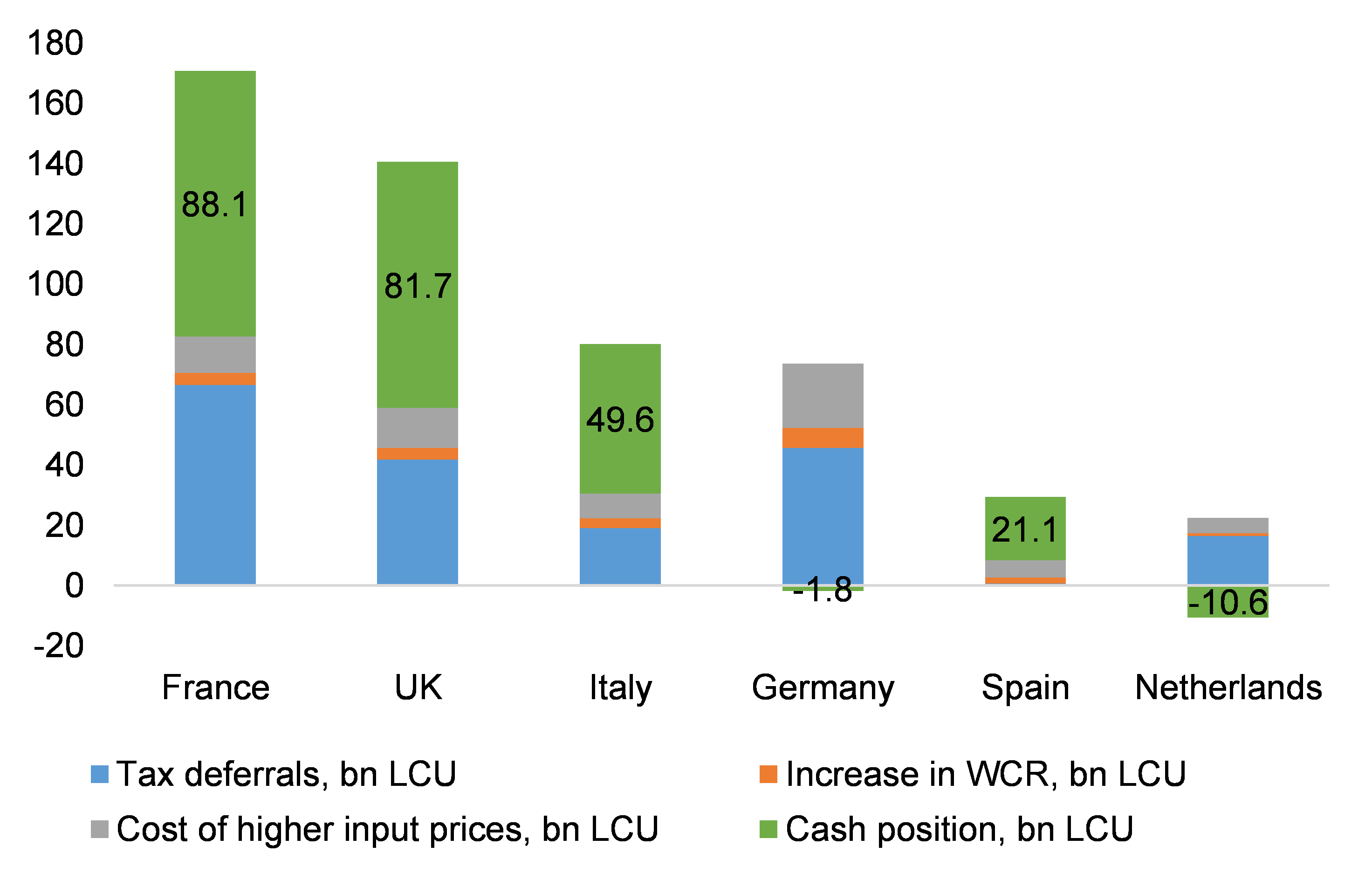

The Covid-19 crisis has pushed up cash concentration among European non-financial corporates: overall, NFCs now hold cash reserves equivalent to three months of turnover, more than half a month higher than pre-crisis averages, and it is the richest sectors and companies that have become even richer. After increasing considerably in 2020 in most European countries , non-financial corporates’ (NFC) cash has plateaued at high levels over the past few months. In France, total NFC deposits bring a cash-flow relief of more than four months of turnover, close to one month more than pre-crisis levels, while in the UK they are equivalent to close to 3.2 months, around 18 days above pre-crisis levels (see Figure 1). Given the continued light lockdowns across major European countries over the past few months, cash positions have remained quite sticky, raising upside risks for defensive and offensive investments in 2021.

Figure 1 – Total NFC deposits, months of pre-crisis turnover

Figure 1 – Total NFC deposits, months of pre-crisis turnover