EXECUTIVE SUMMARY

- The war in Ukraine underscores that scaling up investment in climate-smart infrastructure is necessary to ensure energy and food security as we transition to a lower-carbon future. Well-planned green infrastructure projects not only raise potential output growth and enhance resilience but can also help reduce the carbon footprint that comes with economic progress.

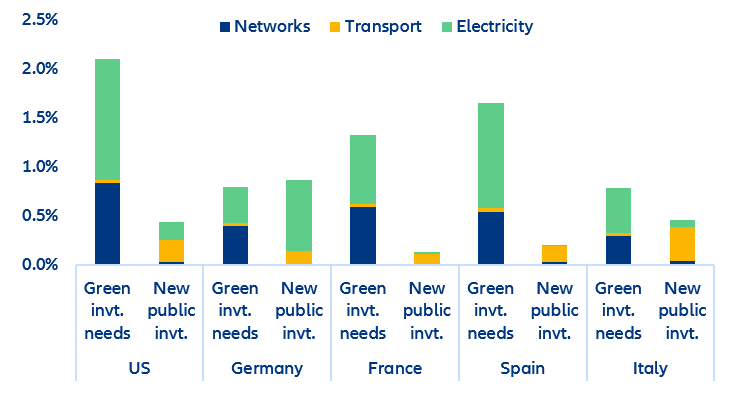

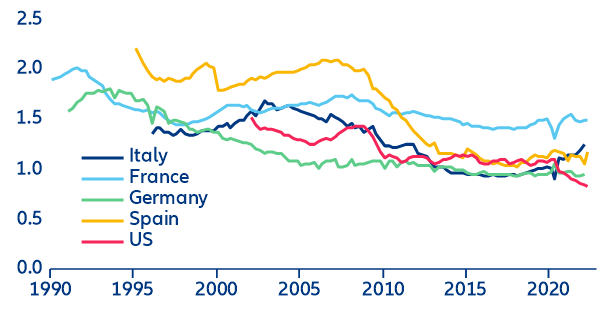

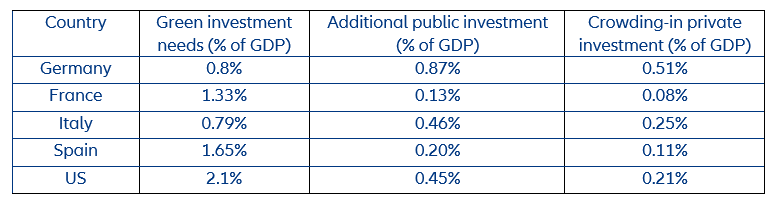

- However, current public investment plans alone will not be sufficient for strategic rebalancing toward climate-friendly infrastructure. Important investment gaps remain, especially in electricity and networks (in Europe ranging from the 1.6% and 1.3% of GDP per year in Spain and France, respectively, to 0.6% and 0.4% in Italy and Germany), where investment needs are the largest. However, public investment can be a catalyst for greater private participation, especially in green infrastructure. We estimate that a one percentage-point increase in public investment, private investment rises by 0.51pp. A green crowding-in “multiplier” is even larger.

- Greater private sector participation in the planning, construction and operation of infrastructure can help mitigate public sector constraints in funding the green transition. Life insurers and pension funds in particular will be critical to mobilizing private capital. Infrastructure investment can bring predictable yields and stable cash flows, providing a natural match to their long-term liabilities.

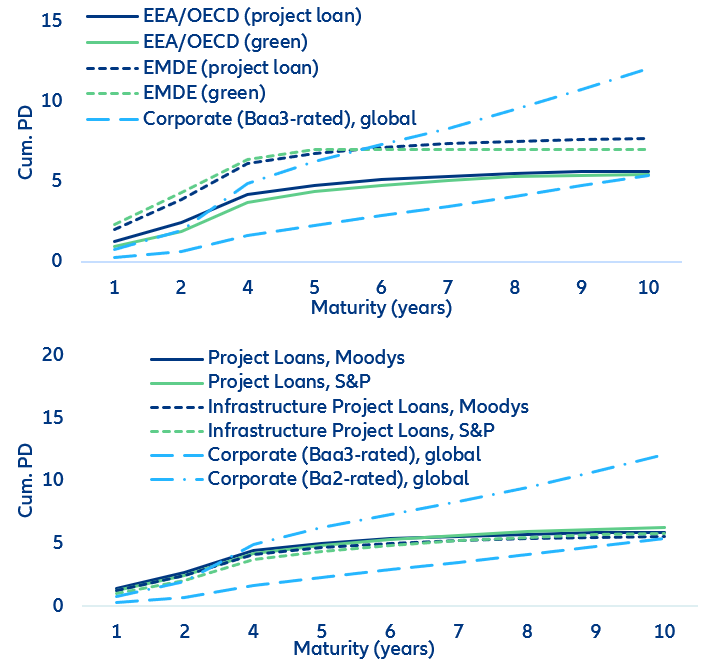

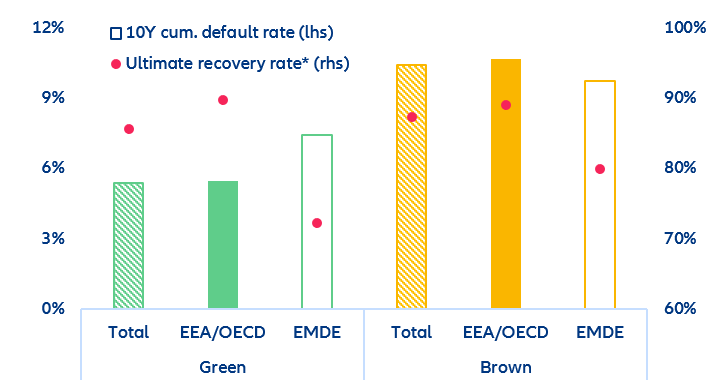

- Mobilizing long-term finance will require creating an enabling regulatory environment for green infrastructure investment. Our findings based on a comprehensive dataset of project loans suggest sufficient scope for lower capital charges to be applied to infrastructure investment, which have a more favorable risk profile than corporate debt. Especially “green projects” seem to default only half as often over a 10-year period as “brown projects”, with a greater difference in emerging markets relative to advanced economies. Capital charges that recognize the declining downgrade risk of infrastructure debt over time could potentially free up costly capital in an environment of monetary tightening; this would help mobilize resources to finance infrastructure—thus promoting the green transition.

The current energy crisis underscores the need to scale up green infrastructure investment

The Covid-19 crisis highlighted the need for better infrastructure to enhance socio-economic resilience. Now, the implications of the war in Ukraine underscore that scaling up investment in climate-smart infrastructure is essential for energy and food security as we transition to a lower-carbon future. As climate action remains critical over the next decade, it is important to direct infrastructure investment towards sustainable, inclusive and resilient economic outcomes amid rising geopolitical challenges.

Governments are increasingly recognizing infrastructure investment as the linchpin in defining effective green transition pathways. Infrastructure currently accounts for more than two-thirds of global greenhouse gas emissions on average. Thus, well-planned infrastructure projects with a greater focus on climate change and the broader sustainability agenda not only raise potential output growth and enhance resilience but can also help reduce the carbon footprint that comes with economic progress.

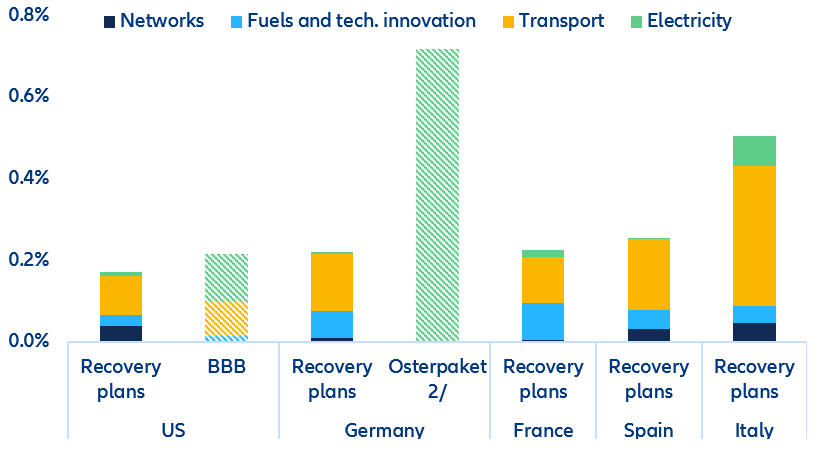

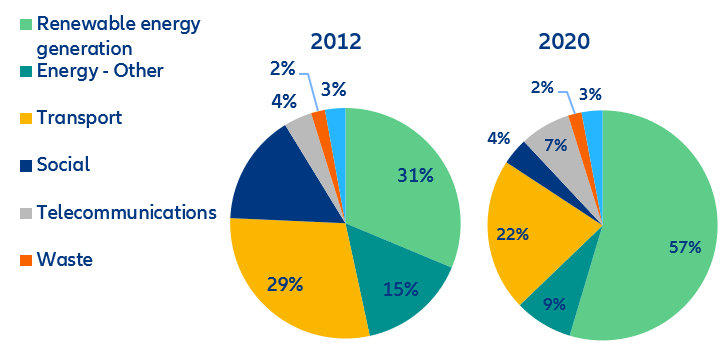

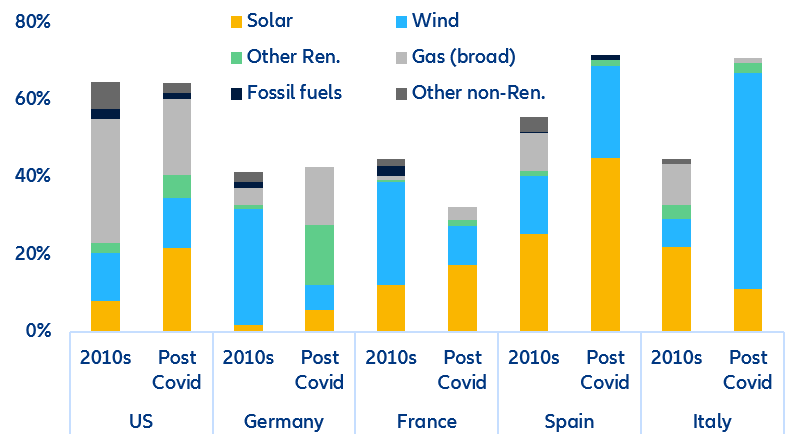

However, current public investment plans alone will not be sufficient to close the estimated green investment gap. As current plans do not cover all the sectors where green investment is needed (e.g. water, waste or buildings), we have calculated sectorial investment gaps instead of a single one. These internal calculations allow us to identify the needs of each sector to achieve different emissions targets, and to compare them with the distribution of the new plans (Figure 1). The various infrastructure stimulus plans launched during the Covid-19 crisis seem to partially address these changes. Comparing the actual investment needs by sector to current plans, we find that the latter seem to fall short in electricity and networks, where investment needs are the largest. We estimate the largest investment gap for the green transition in public infrastructure in the US at about 1.7% per year. In Europe, the largest investment gaps are in Spain and France (1.6% and 1.3% of GDP per year, respectively), with more moderate numbers in Italy (0.6%) and Germany (0.4%). Germany can only meet estimated investment needs after considering the impulse from the “Easter Package” (Osterpaket) – provided that funds are allocated efficiently, and projects are implemented effectively (Figure 2).

Figure 1: Annual green public infrastructure investment (by sector, % of GDP)