EXECUTIVE SUMMARY

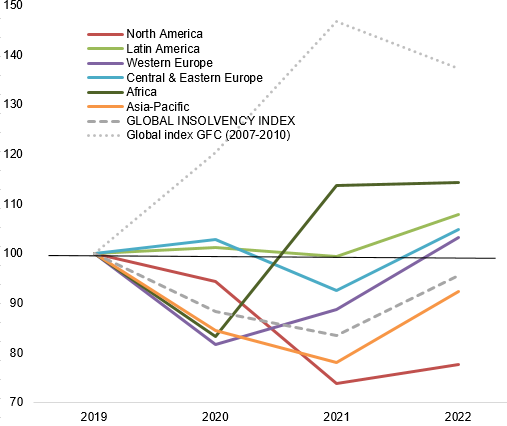

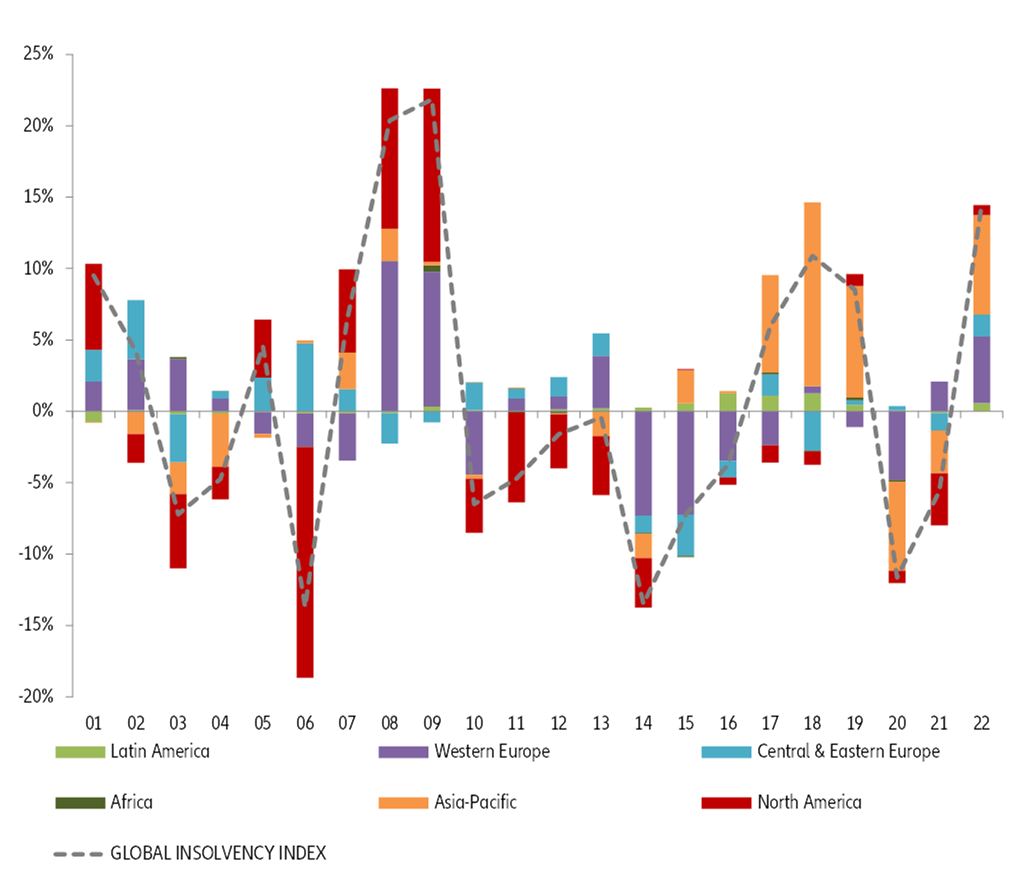

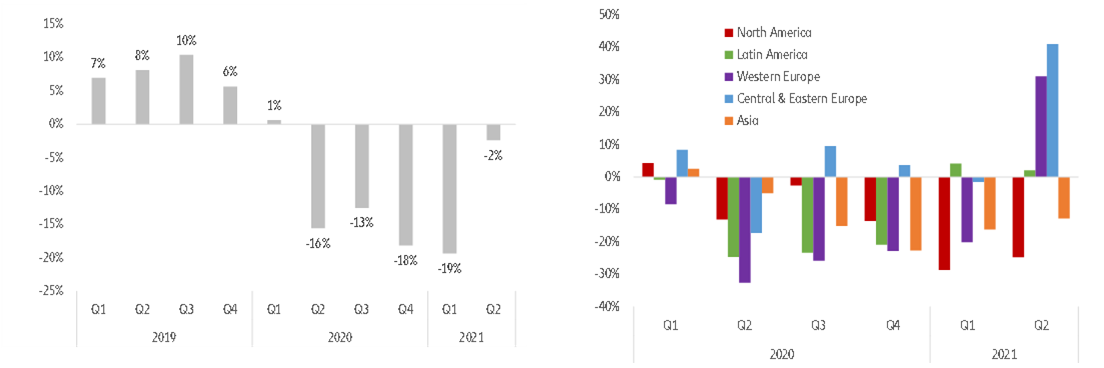

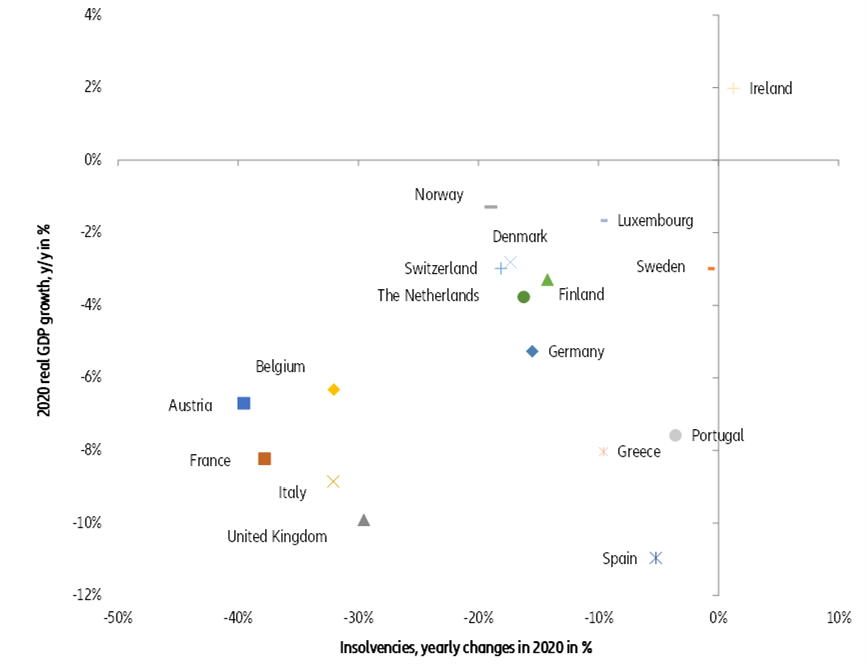

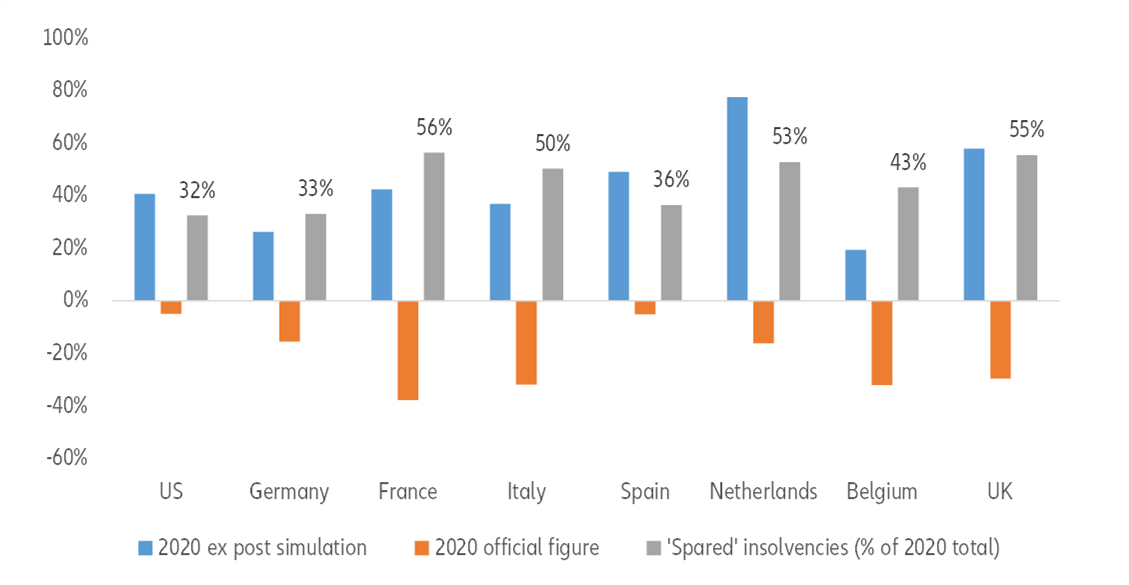

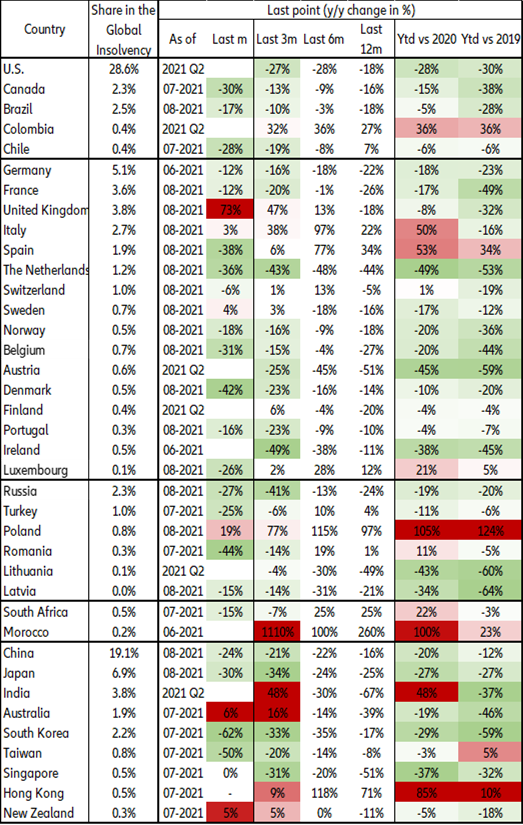

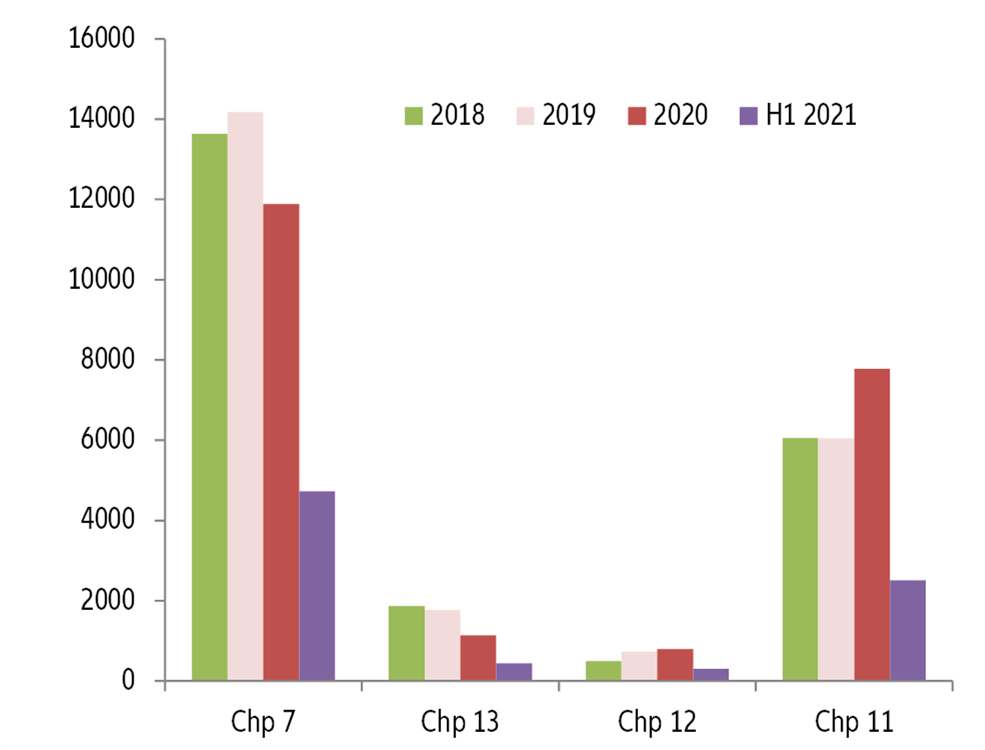

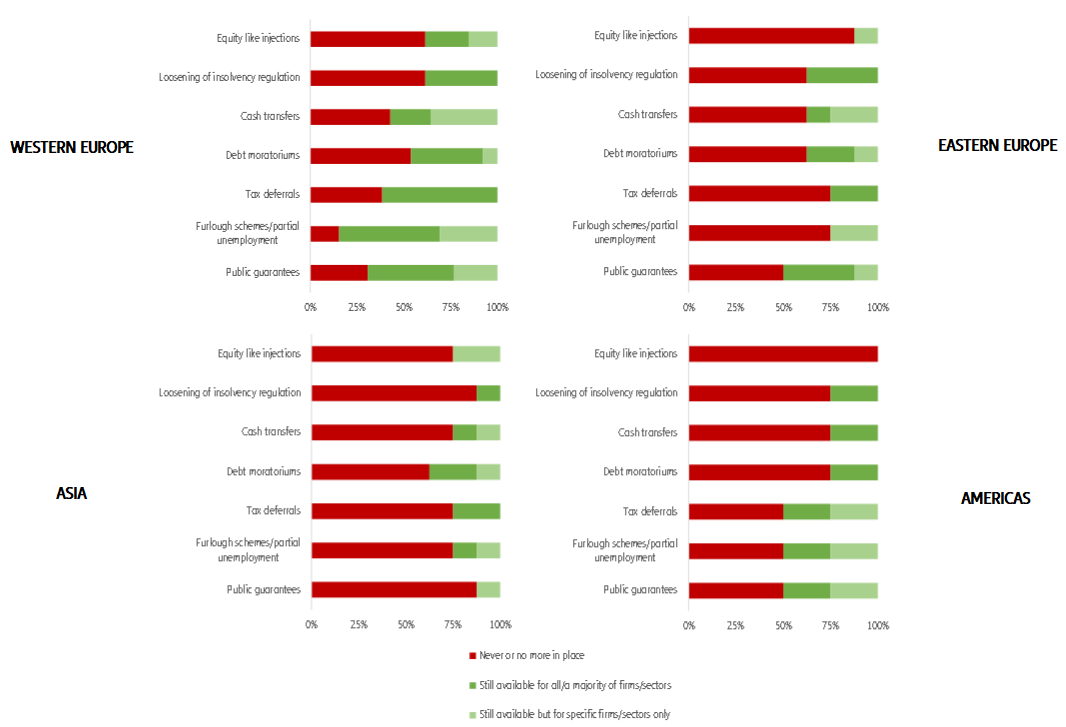

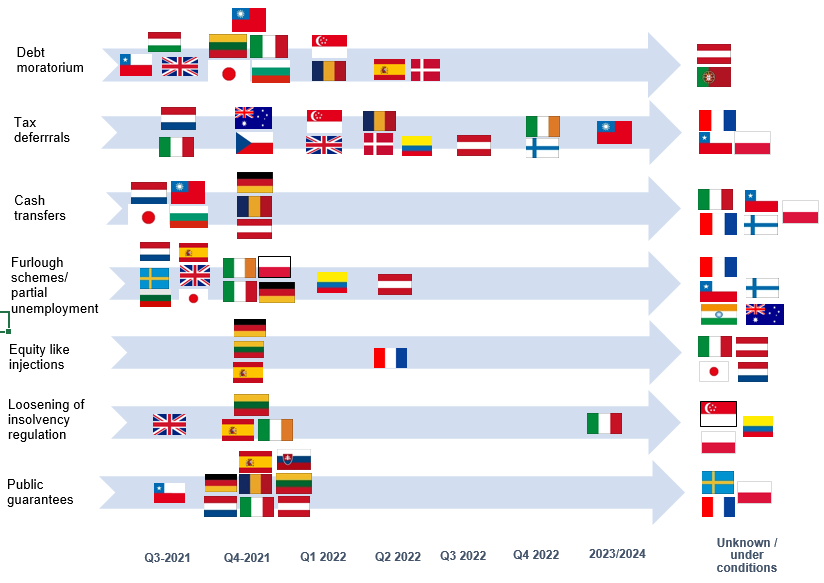

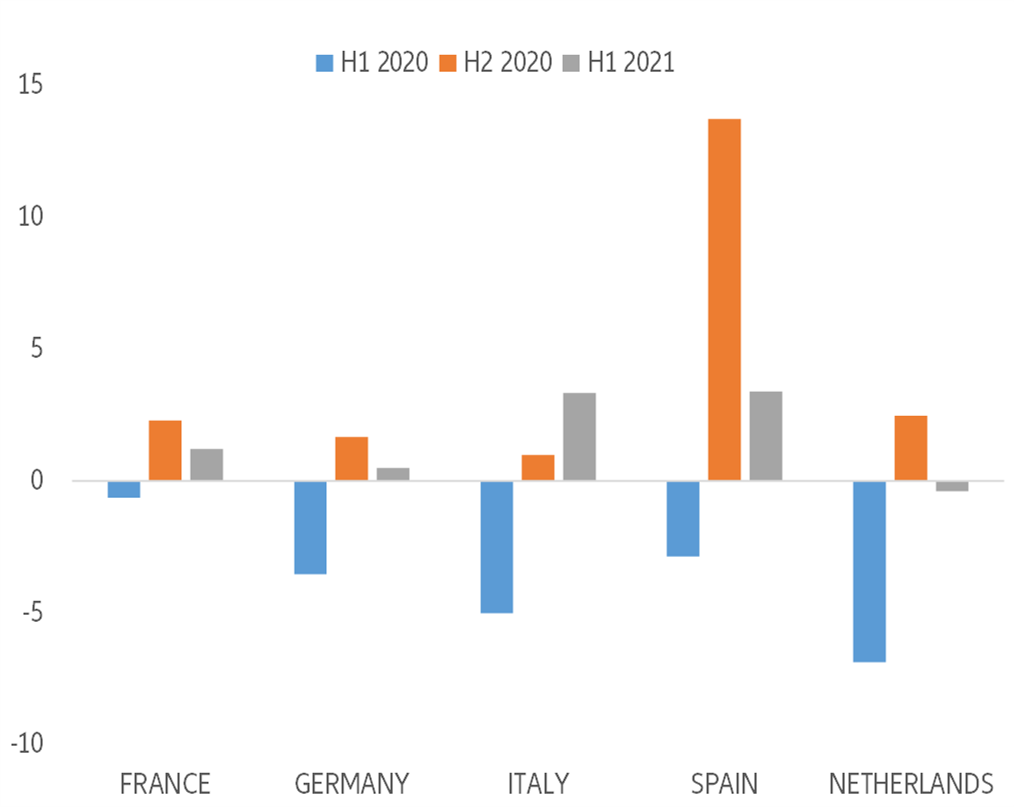

- The withdrawal of support measures for companies sets the stage for a gradual normalization of business insolvencies. Our Global Insolvency Index is likely to post a +15% y/y rebound in 2022, after two consecutive years of decline (-6% forecast in 2021 and -12% in 2020). Massive state intervention helped prevent one out of two insolvencies in Western Europe and one out of three in the US, resulting in a -12% drop overall in 2020. Looking ahead, we expect a fine-tuned and step-by-step withdrawal of support to manage the pressure on companies’ liquidity and solvability amid the generally accommodative policy stance of monetary authorities. As a result, global business insolvencies are likely to remain at a low level in most countries by the end of 2021, with the delayed normalization only gaining traction in 2022. However, even in 2022, they would remain below pre-Covid-19 levels in most countries (by -4% on average).

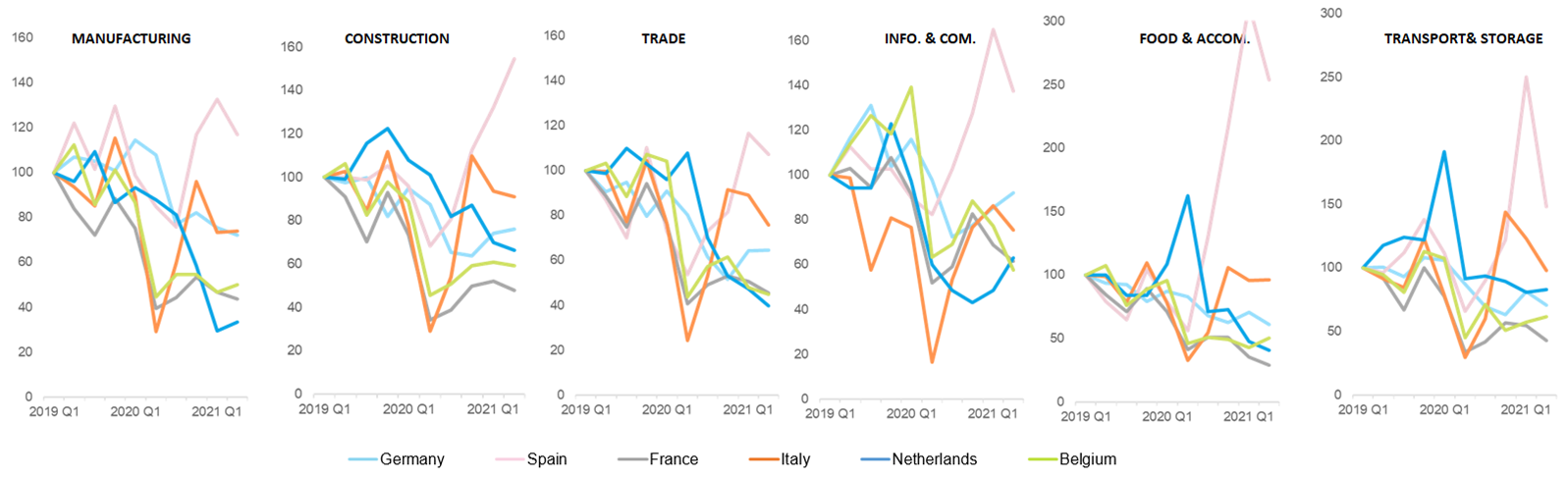

- Several European countries and Emerging Markets could see a resurgence much sooner than the US and parts of Asia. Faced with a succession of lockdowns and less generous policy support, Africa should see business insolvencies exceed pre-Covid-19 levels by 2021 itself, while Central and Eastern Europe and Latin America will follow suit in 2022. Western Europe will post mixed trends: Spain and Italy are likely to see a large recovery of insolvencies by 2022 (5,110 and 10,500 insolvencies, respectively) due to their higher shares of sectors sensitive to Covid-19 restrictions. In contrast, France (37,000), Germany (16,300), Belgium (8,150) and the Netherlands (2,400) will take longer to return to pre-crisis levels because of large support packages and/or the extension of support measures. The US is the main outlier, with a low number of insolvencies likely both in 2021 and 2022 due mainly to the combination of massive support (notably the Paycheck Protection Program in 2020 and the recovery plan in 2021-22) and the fastest economic rebound in over three decades. Asia will also record less insolvencies in 2022, compared to 2019, thanks to its faster exit from the pandemic and its economic recovery.

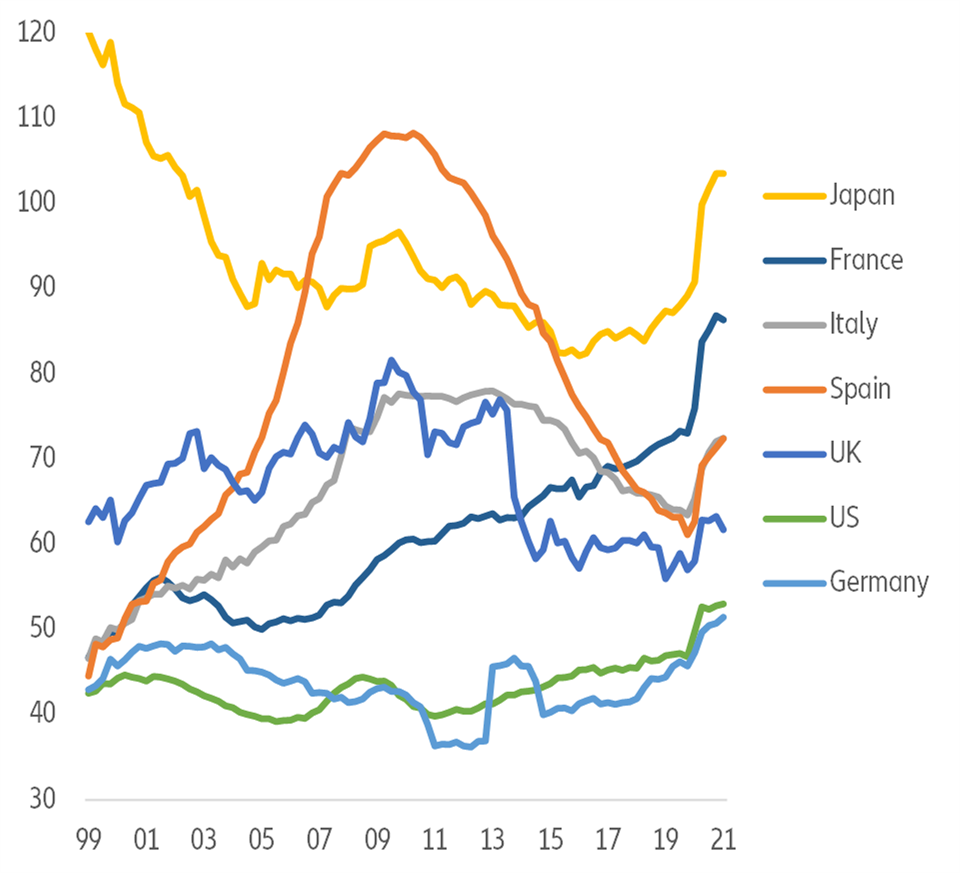

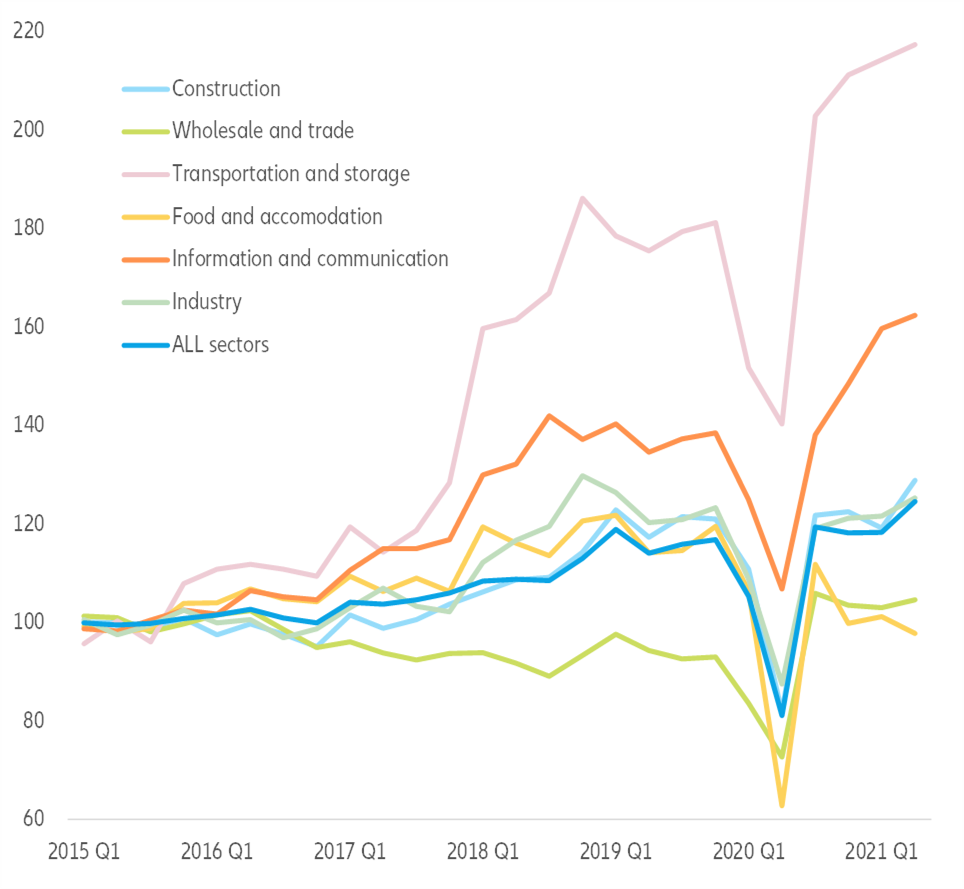

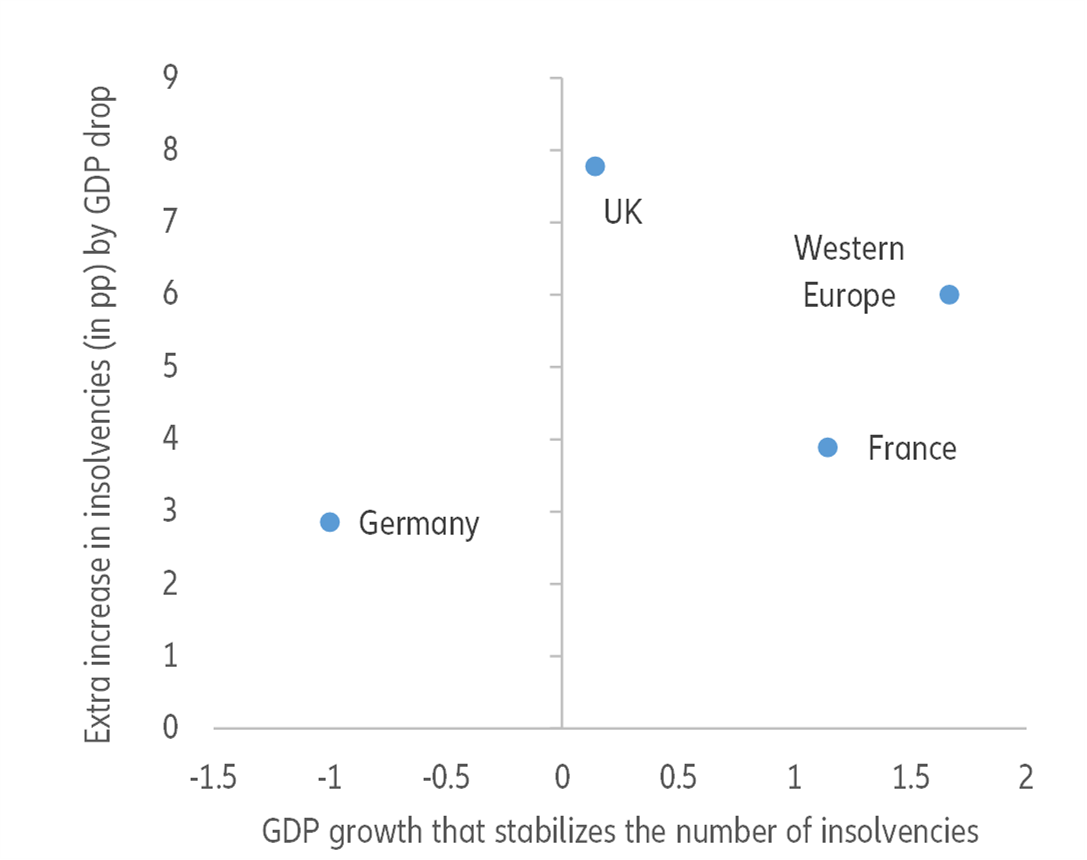

- Five factors will set the tone for the path ahead. 1) The global momentum of the economic rebound, which will be decisive for the pace of removal of state support measures, and in turn impact the pace of business insolvency normalization: most advanced economies should see GDP growth above the +1.7% required to stabilize insolvencies in 2021-2022. 2) The pace of withdrawal of state support, since it will also influence the cash-burning dynamic of companies as 3) many fragile companies will still be at high risk of default, notably the pre-Covid-19 ‘zombies’ kept afloat by emergency measures and the companies weakened by extra indebtedness from the crisis. 4) The deterioration of companies’ financials, which is adding to debt sustainability issues. And 5) the quick recovery of business creation, since the increase in the number of businesses will mechanically increase the base for potential insolvencies, particularly in sectors where creation is highly related to meeting new needs arising from the pandemic (i.e. home delivery, transportation and storage) but with uncertain viability.