On 23 March 2021, a 400-metre-long container ship ran aground in the Suez Canal in Egypt. We calculate that each day of immobilization could cost global trade USD6bn-10bn. The Suez Canal is the gateway for the movement of goods between Europe and Asia, and welcomed over 19,000 ships in 2019, or 1.25 billion tonnes of cargo. This represents around 13% of world trade so any blockage is likely to have a significant impact. In particular, this incident will likely result in shipping delays of everyday items for consumers around the world. According to Lloyd's List, every day it takes to clear the obstruction will disrupt an additional USD9bn worth of goods. Rough calculations suggest westbound traffic is worth around USD5.1bn daily while eastbound traffic is worth USD4.5bn. Yet, coping mechanisms are in place. According to our estimation, every week of closure should cost from -0.2pp to -0.4pp of annual trade growth. Note that in our trade forecasts, we assume the vessel will only block the Suez Canal for one week.

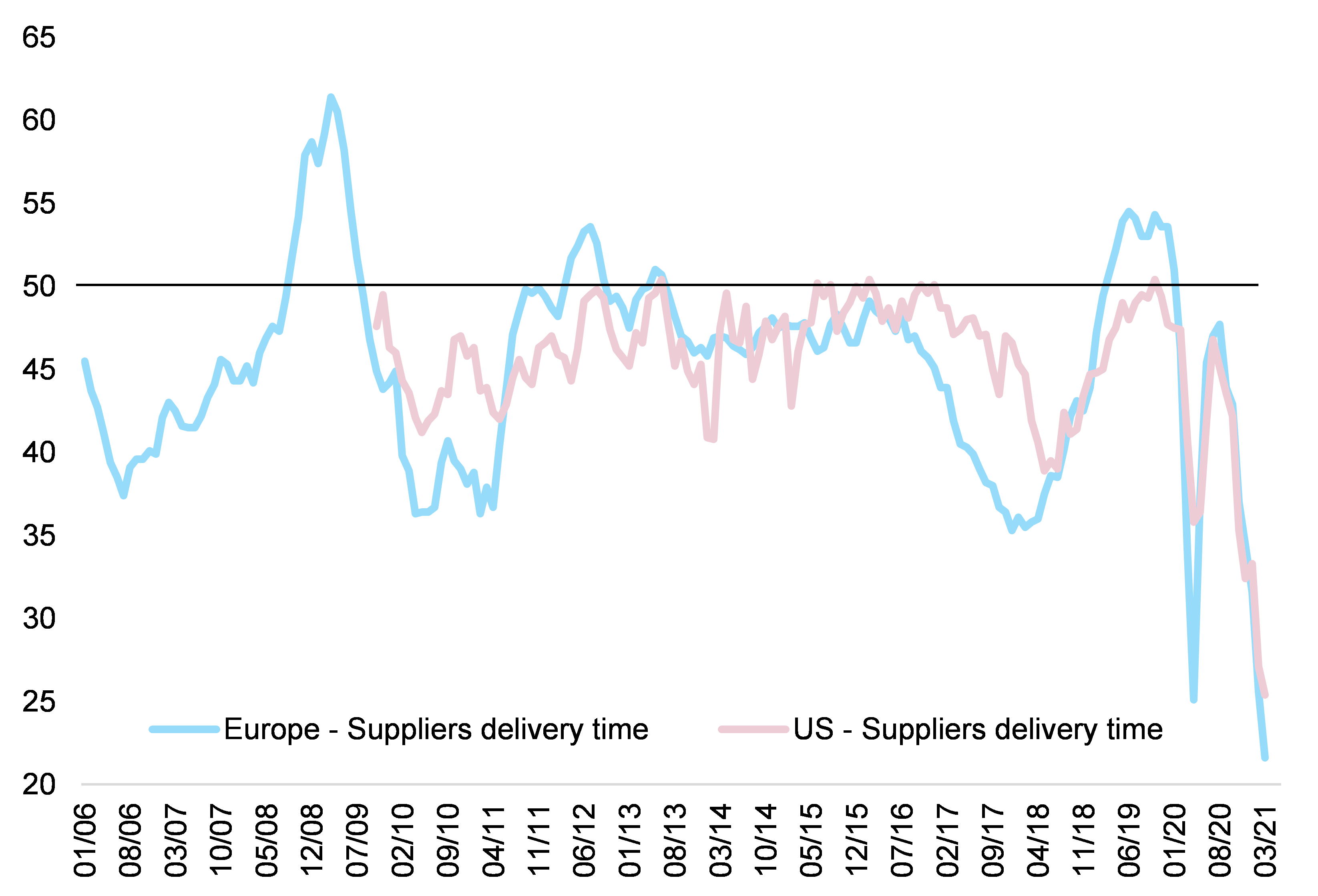

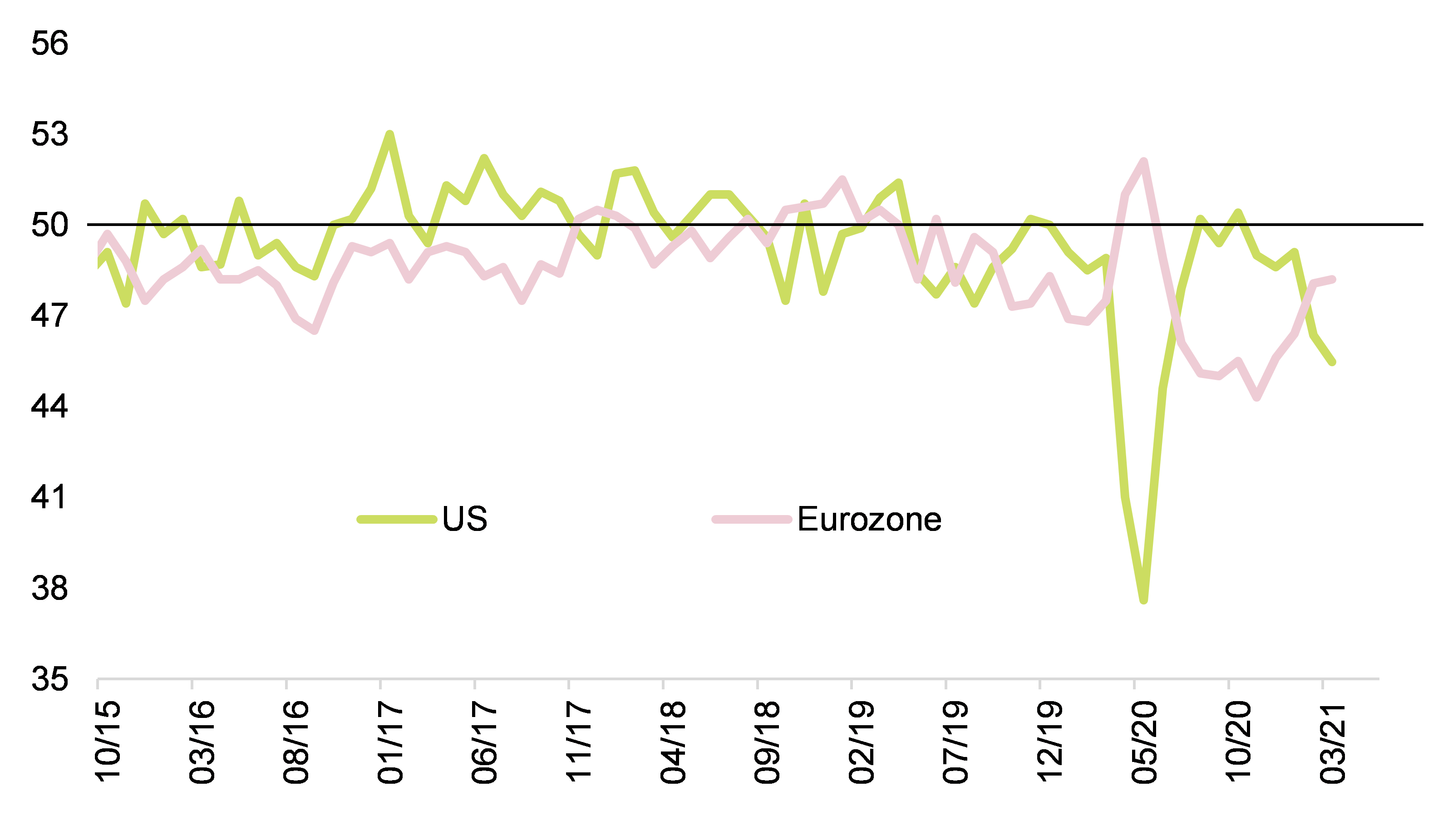

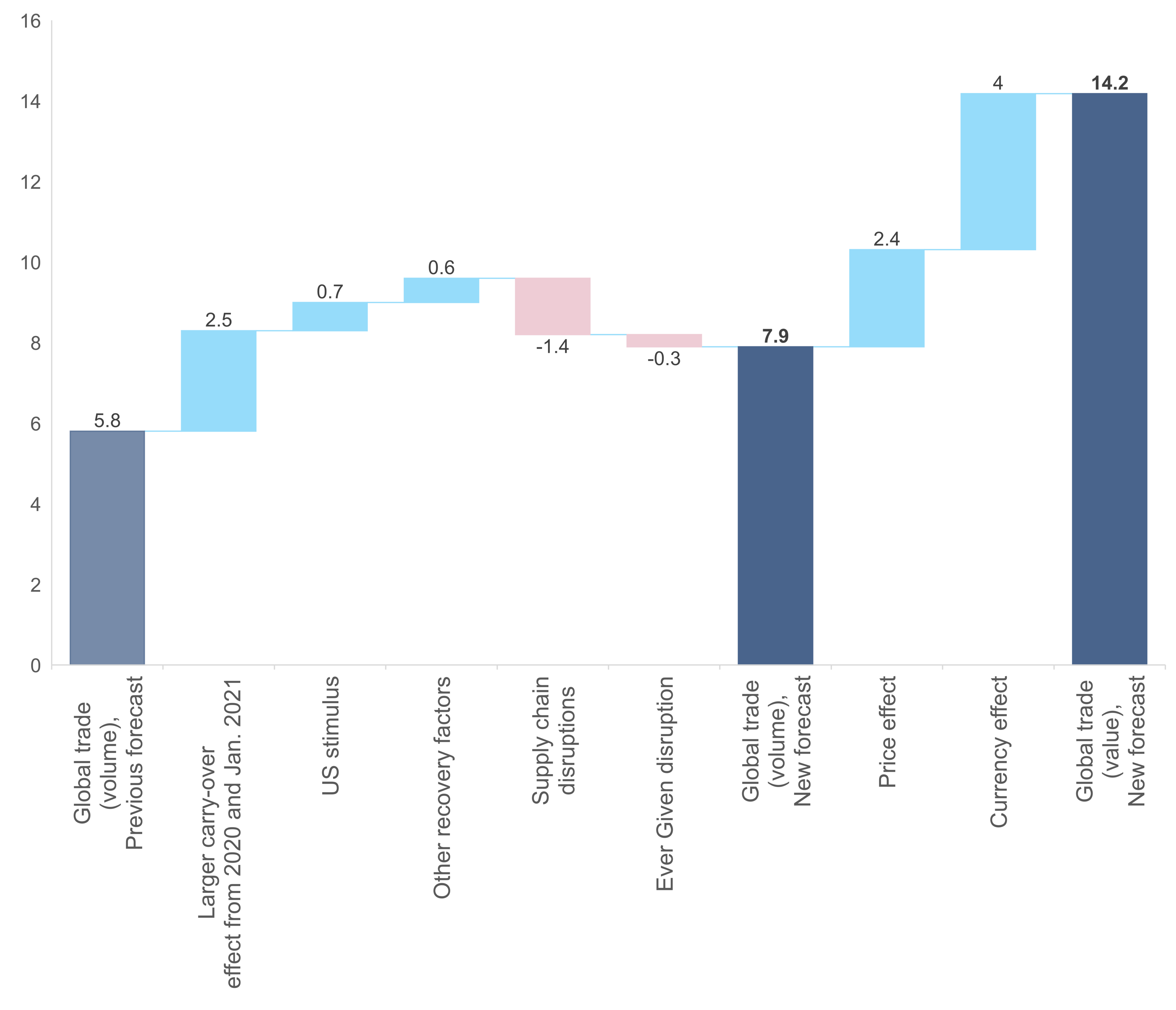

The problem is that the Suez Canal blockage is the straw that breaks global trade’s back. Supply-chain disruptions since the beginning of the year (shortages of containers, semi-conductors, etc.) could cost real trade growth -1.4pp or roughly USD230bn of direct impact, on top of the immobilization in the Suez Canal. First, suppliers’ delivery times have lengthened since the start of the year and are now longer in Europe than during the peak of the Covid-19 pandemic in 2020 (see Figure 1). The indicator slump, from peak to trough in March 2021, is equivalent to what happened in 2020 between January and April for Europe and is almost twice as bad for the US. The lengthening of suppliers’ delivery times for the US could be explained by the rapid depletion of inventories in the manufacturing sector as companies anticipate a demand boost caused by President Biden’s stimulus (see Figure 2). In Europe, this rapid deterioration of delivery times last February was chronicled in our last report: Is the Chinese ox reflating the world, one container at a time? All in all, the deterioration of suppliers’ delivery times in Europe and the US could subtract -1.4pp of growth from real global trade in 2021 and cost roughly USD230bn in value terms, all other things equal (Figure 3).

Figure 1 – Suppliers’ delivery times in the manufacturing sector (the lower the index, the longer the delivery times)