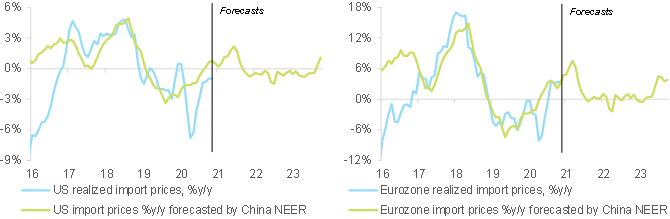

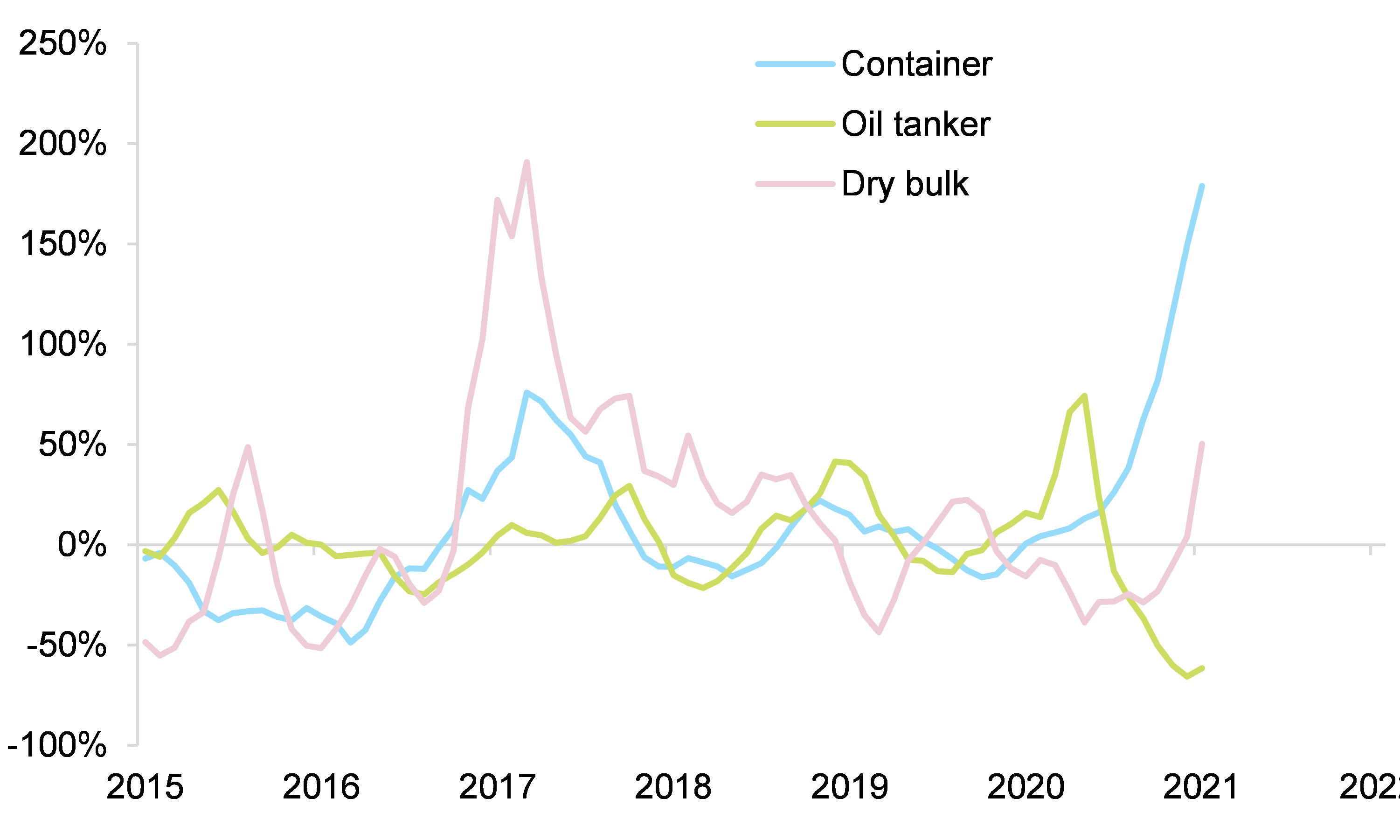

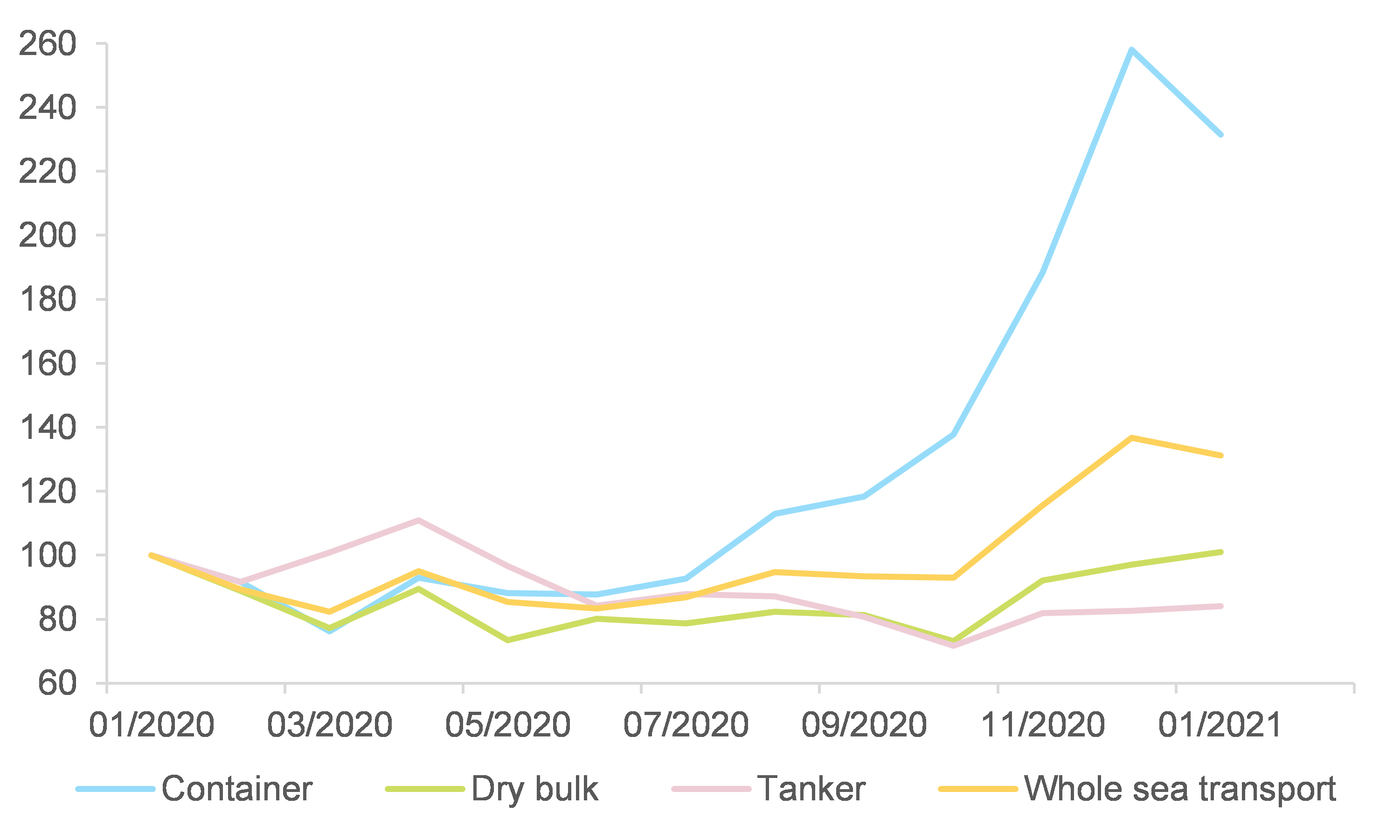

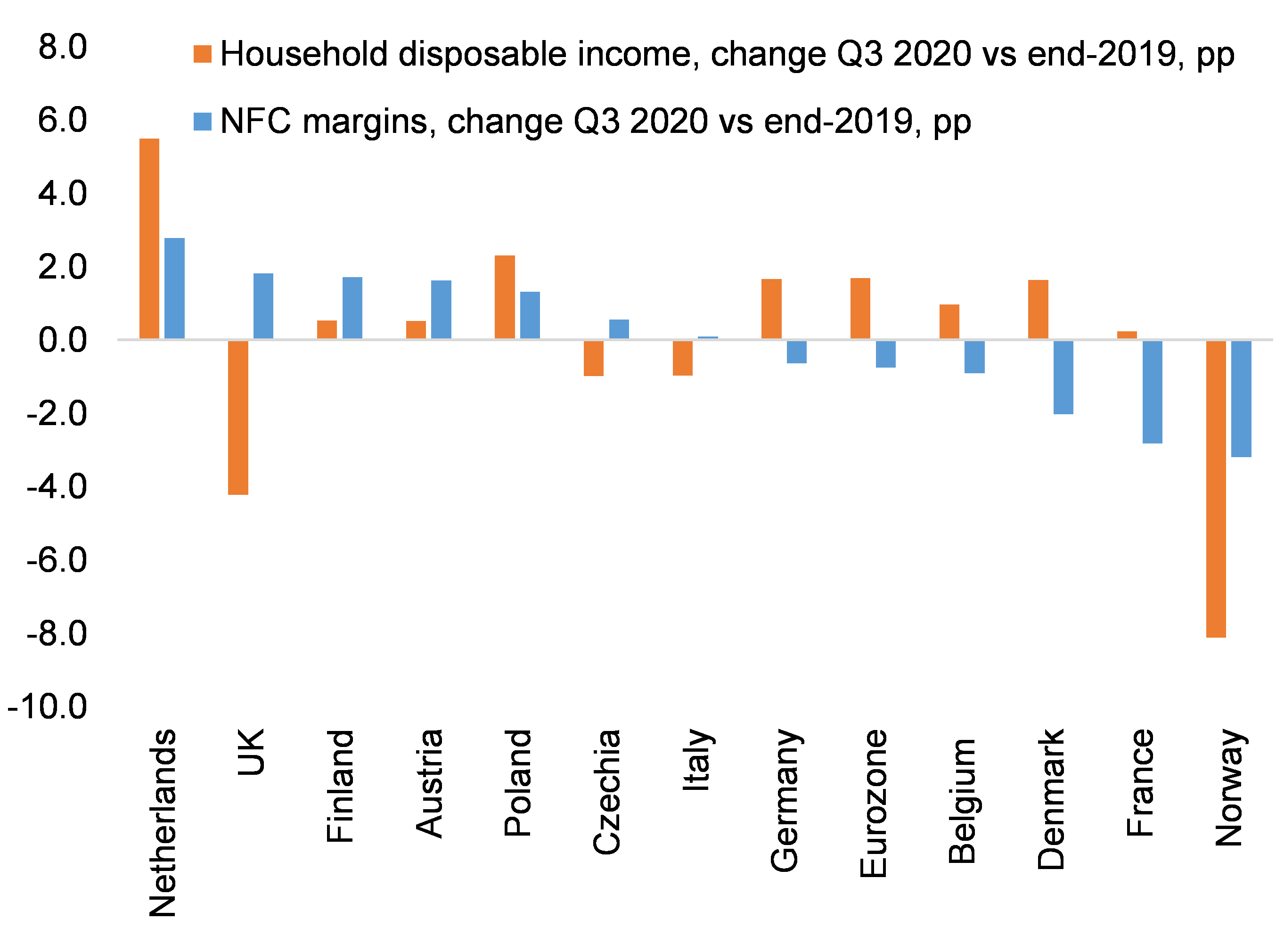

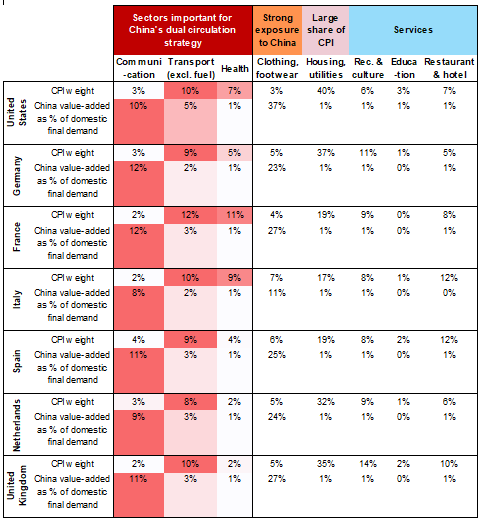

Amid surging demand for imports from China, a container shortage and a strengthening RMB are pushing up import prices for European firms: We expect a peak of +6% y/y by end-April 2021 from +3% in November 2020. For the US, the impact should be milder: +2% y/y by July from -1% in November (see Figure 1). The container shortages are the result of the differing timelines of Covid-19 lockdowns and an earlier production activity recovery in Asia. Combined with supply-chain disruptions and the oligopolistic nature of the maritime shipping sector, this has led to a sharp rise in freight rates (+150% q/q in Q4 2020, see Figure 2). This shortage is likely to continue until the summer: A survey carried out in late 2020 found that more than 90% of container shipping enterprises in China believe it will last at least three months, with 25% of them expecting it to last for six months or longer. Part of the bottleneck can also be related to inventory management and mainly to a delay in European manufacturers rebuilding stocks following the Covid-19 shock.

Meanwhile, the strong performance of the RMB in 2020 is likely to extend into 2021 as a result of 1/ a faster recovery following the Covid-19 crisis, 2/ earlier policy normalization and 3/ measures to liberalize China’s capital account that attract foreign inflows: We expect USDCNY at 6.3 at year-end, vs. 6.5 at the end of 2020. The stronger RMB comes in a context where China’s export prices are also likely to increase: The latest data, for January, show a y/y increase in China’s producer prices for the first time in 12 months. We find that producer prices tend to lead export prices by five months in China.

Figure 1 – China NEER & import prices in the US and the Eurozone

Meanwhile, the strong performance of the RMB in 2020 is likely to extend into 2021 as a result of 1/ a faster recovery following the Covid-19 crisis, 2/ earlier policy normalization and 3/ measures to liberalize China’s capital account that attract foreign inflows: We expect USDCNY at 6.3 at year-end, vs. 6.5 at the end of 2020. The stronger RMB comes in a context where China’s export prices are also likely to increase: The latest data, for January, show a y/y increase in China’s producer prices for the first time in 12 months. We find that producer prices tend to lead export prices by five months in China.

Figure 1 – China NEER & import prices in the US and the Eurozone