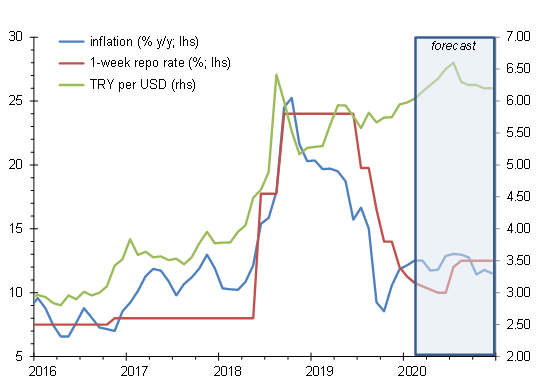

As expected, the Monetary Policy Committee (MPC) of Turkey disregarded rising inflation and once again cut its key policy one-week repo rate today, by 50bp to 10.75%. The policy rate thus remains well below the prevailing annual headline consumer price inflation rate, which rose to 12.2% y/y in January, up from a recent low of 8.6% in October 2019. The MPC justified today’s rate cut with the expectation of disinflation in the remainder of the year. However, we do not expect such a rapid disinflation and believe that the cut has raised the risk of a sharp exchange rate correction later in 2020.

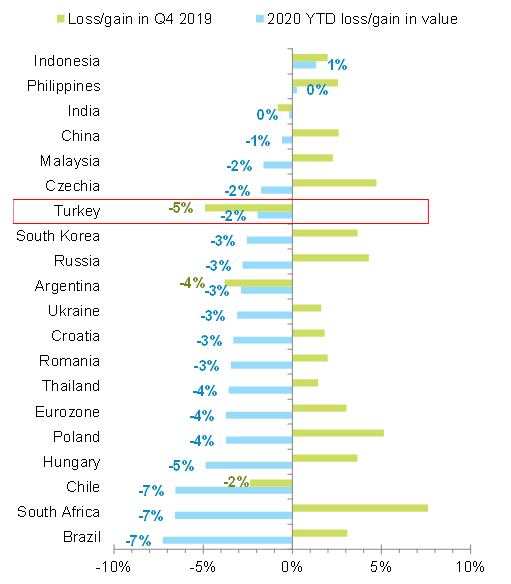

Recent intervention by the Central Bank of Turkey (CBT) to bolster the TRY add to the risk of a disorderly correction later this year. Year-to-date, the TRY has only lost -2% in value against the generally strengthening USD, in contrast to other major Emerging Market (EM) currencies. Prior to that, the Turkish currency had been the worst performer in Q4 2019 (-5%) amid the same group of peers (see Figure 1). Our analysis suggests that the CBT has strongly intervened in foreign exchange (FX) markets in 2020 to date in order to stabilize the TRY. Notably, gross FX reserves held by the CBT dropped by -USD4bn in January after they had steadily increased in the previous six months.

We expect that the recent monetary policy moves will be unavailing in the 12-month outlook and forecast a significant currency depreciation in 2020. First, keeping the TRY relatively stable will cause a loss in competitiveness (as inflation is higher than in major trading partners, as well as peer EMs) and a renewed buildup of macroeconomic inbalances. Already in December 2019, Turkey posted its largest current account shortfall since before the 2018 currency crisis. Second, FX reserves are insufficient to defend the TRY for longer. Gross FX reserves stood at USD75bn at end-January 2020, covering just about 40% of maturing external debt in the next 12 months, well below an adequate level of 100%. That ratio turns even worse when considering net FX reserves (gross FX reserves minus FX of commercial banks held at the CBT), which currently stand at only USD37bn.

Overall, we expect a depreciation of the TRY by an average -10% (to an average 6.25) vs. the USD in 2020 and the CBT to revert to monetary tightening in the second half of the year (see Figure 2).

What does this mean for companies? Many Turkish companies are heavily indebted in FX and these will continue to face a high risk of insolvency.