Sources: National Statistics, Euler Hermes, Allianz Research

US stimulus may have kept delinquencies and spreads artificially low

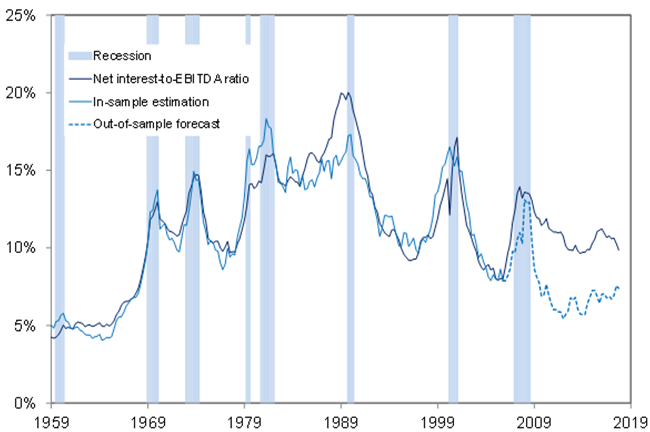

The debt vulnerability discussed above is all the more important since excessive borrowing may have been fuelled by artificially high demand. Indeed, from 2017 onwards, the large fiscal stimulus implemented by the Trump Administration (fifth largest in US history) pushed the US above potential output growth – which we estimate at 2.2%. The output gap currently stands at 5% (the highest since Q2 00), a transient situation during which corporates could have reacted to temporary high demand, by deciding to over-invest or -indebt themselves. As fiscal policy could experience a U-turn in the US, understanding the correction in the corporate sector is essential.

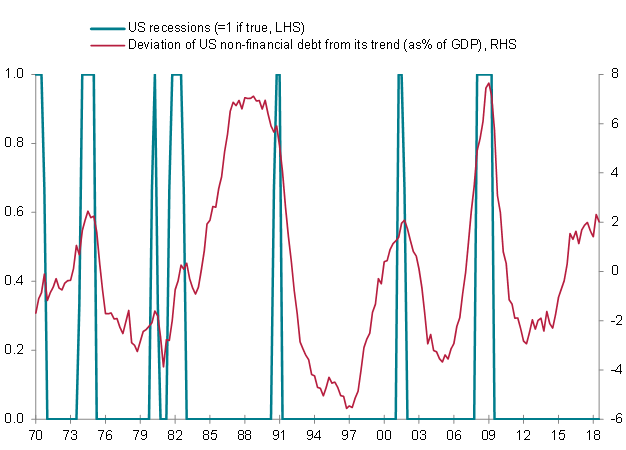

Today, the rate of corporate delinquencies – 30-day past dues of commercial and industrial loans – stands at 1% in Q3 18, which is rather low from a historical perspective. This creates some insensitivity of corporate spreads to excess debt in the corporate sector. Should the excess demand be corrected, we would observe a higher delinquency rate – and higher credit spreads for corporates. The question is by how much. To answer this question we estimated the percentage of non-performing loans among non-financial companies by regressing it against a constant, the output gap, the Fed Funds target rate and the deviation of corporate debt from its trend. According to our model, a correction of excess demand in the US economy, back to its potential output, could trigger an increase of the delinquency rate from 1% in Q3 18 to 2.32% (highest level since Q2 11).

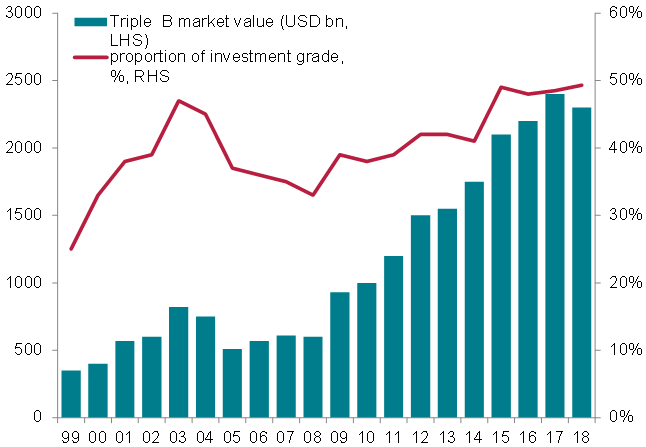

A soft landing of the US economy (our central scenario) could therefore trigger a regime switch for credit spreads, which seem rather low for the current risk level. Indeed, the average credit quality has deteriorated: the share of risky corporate bonds, rated BBB i.e. one notch above junk status, has markedly increased to reach 50% of the total investment grade credit market in Q3 18 (Figure 6).

Figure 6: US BBB credit market