Executive summary

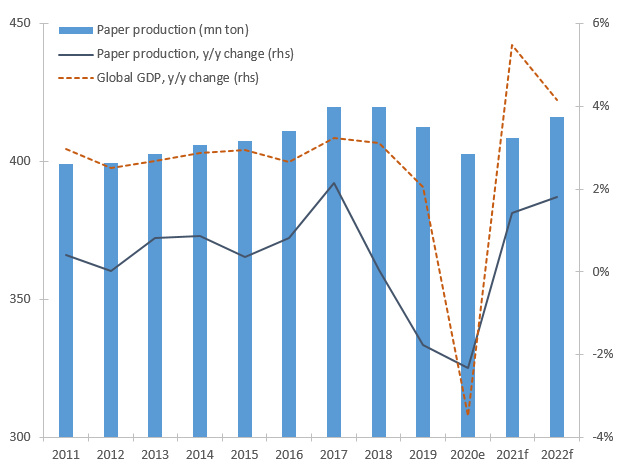

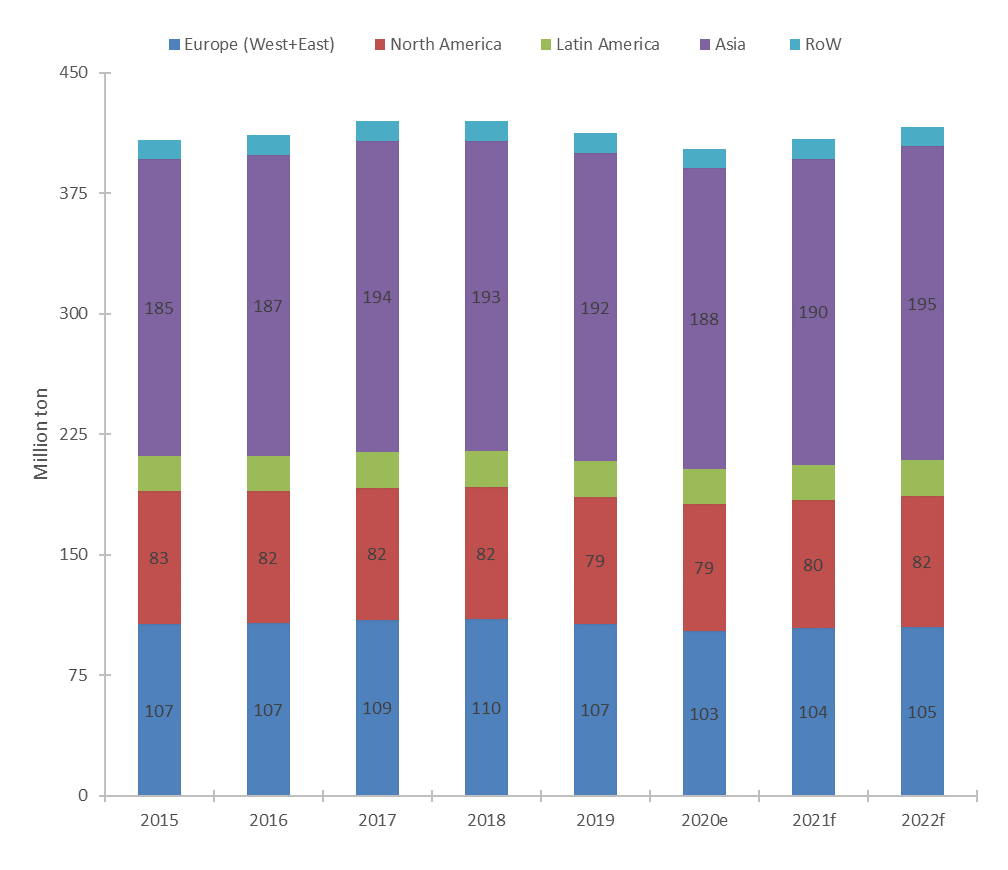

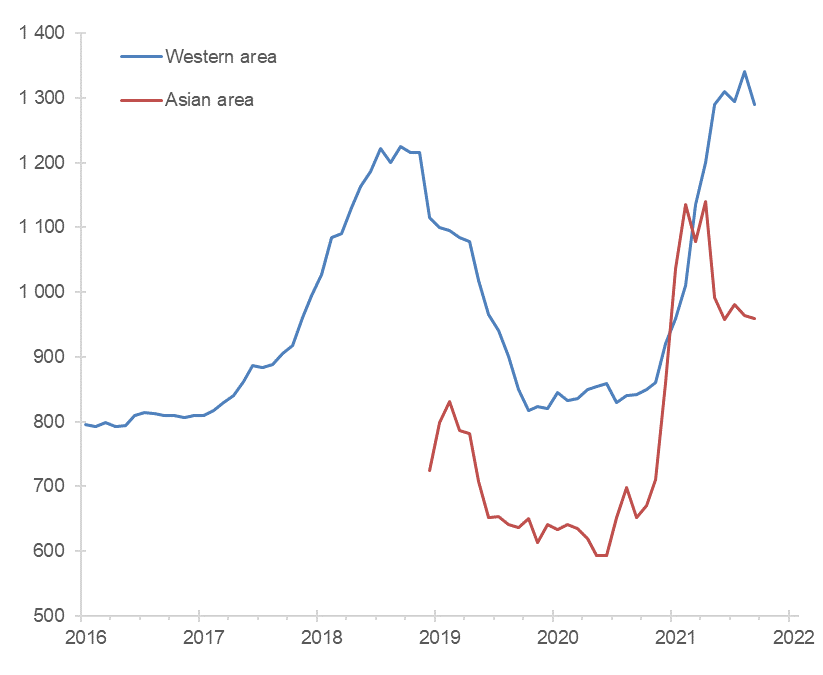

- Global paper output is expected at 416mn tons in 2022, still 4mn tons short of its 2018 level. The global paper sector withstood the slump of 2020 a little better mainly due to the increase in demand from e-commerce but has since then recovered slower than the global growth rate. The good news is that the trend should normalize on the upside next year. However, while Asia will have more than caught up on its output lag, with a change of +7mn tons of additional production of paper and board in 2022 compared to 2020, Europe is poised to lag behind as its paper and board output should gain only around 40% of volumes lost during the pandemic.

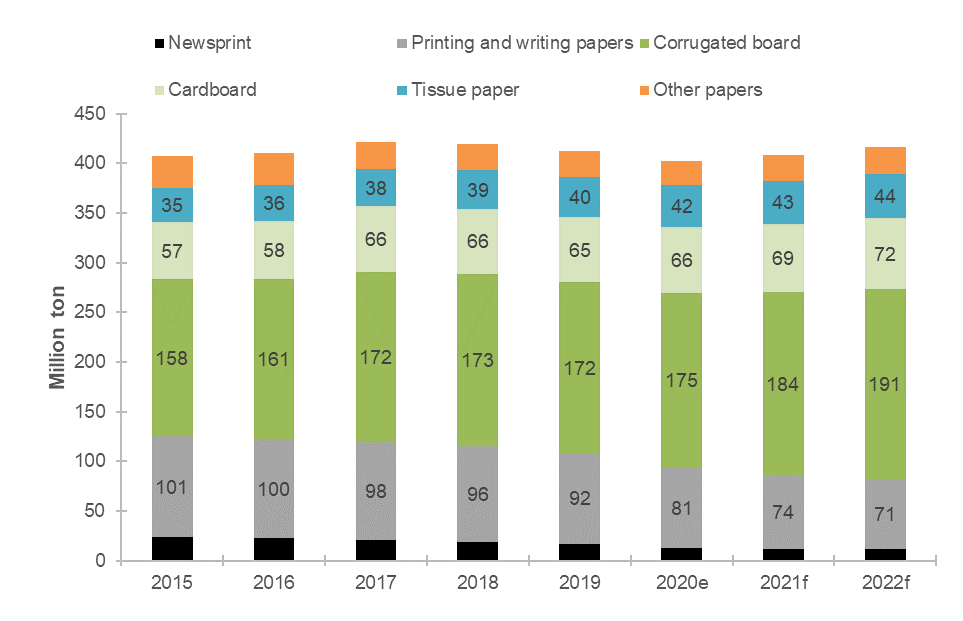

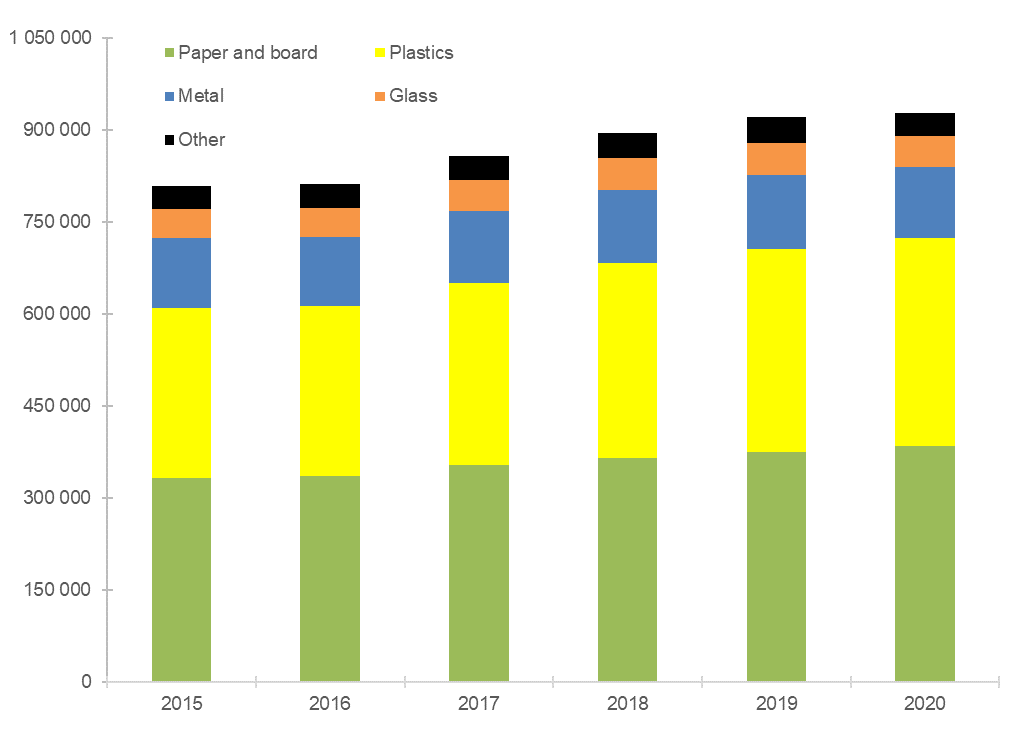

- Paperboard is the big winner. Paperboard should account for two-thirds of global paper output by end-2022 (from 50% before the Covid-19 pandemic), thanks to booming e-commerce sales. In this context, we find that China’s paperboard exports have gained market share over competitors from either Canada or Finland. In addition, the recent surge of oil prices should favor paperboard over plastics, eventually giving an edge to paperboard, which has been plateauing at 41% of global packaging sales for a decade, even as the share of plastics has surged by +5pp to 37% in the same period.

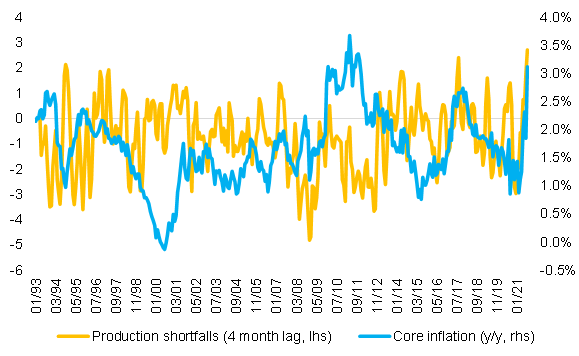

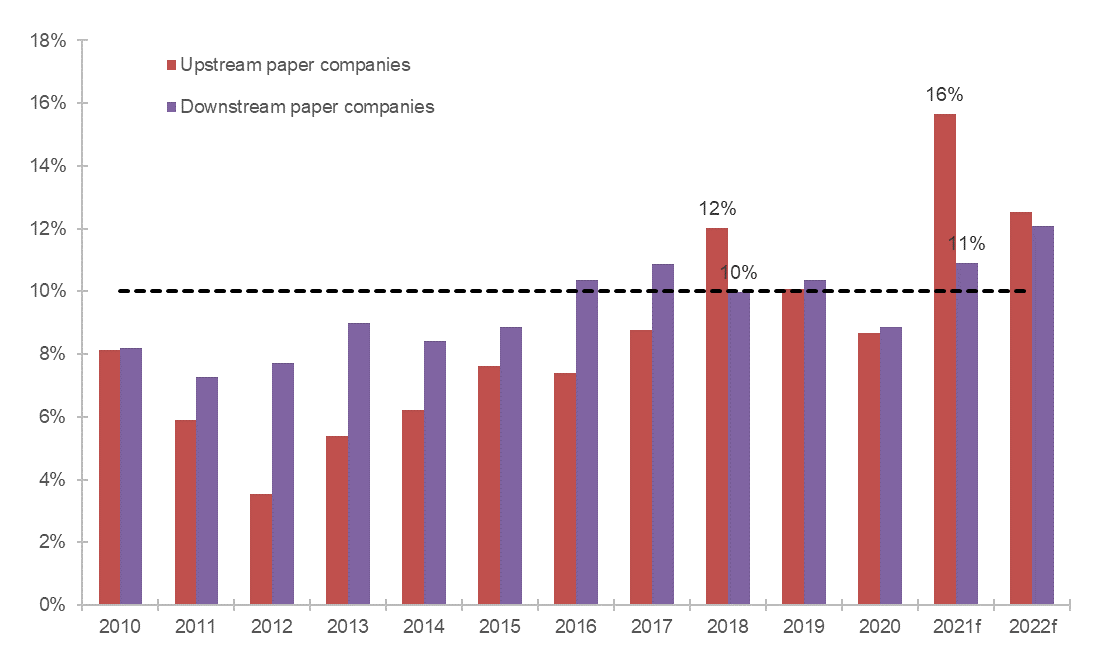

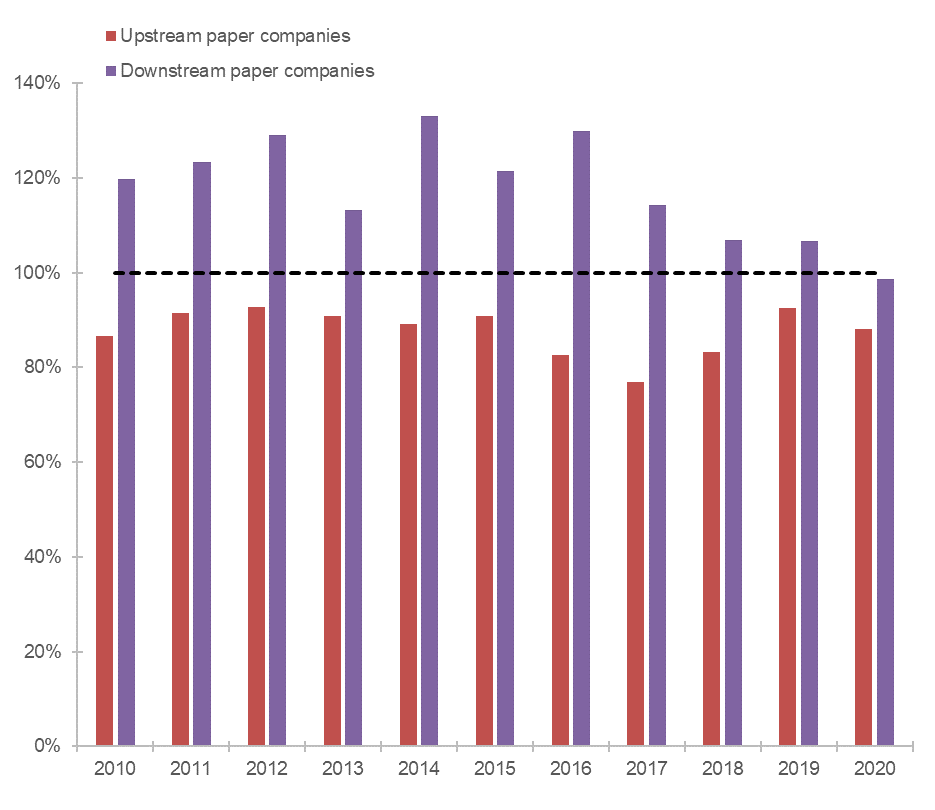

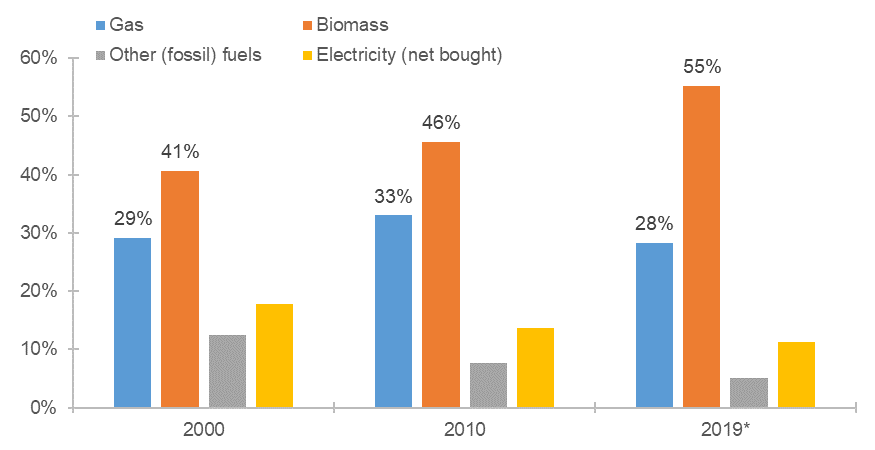

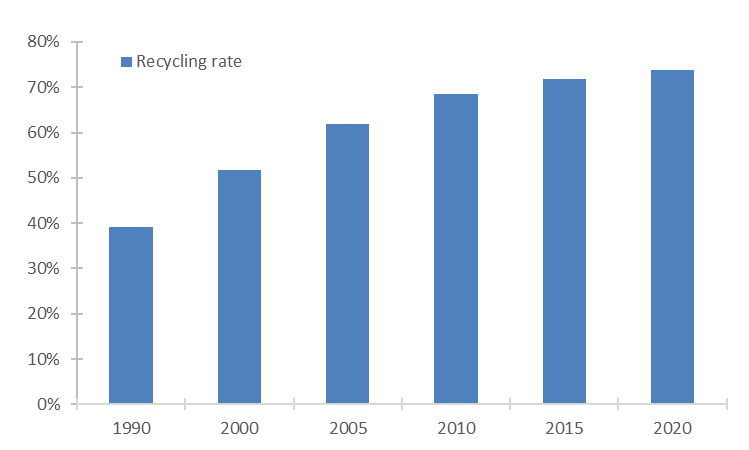

- Will rising input costs spoil the party? Though paperboard sales are expected to rise by +5% in 2021 compared to 2020, they cannot keep up with the 1.5 fold hike in (European) pulp price YTD. The downstream sector is the hardest hit: We estimate an USD7bn cutback on operating margin for downstream papermakers in 2021 (or -3pp) as they are unable to pass through the surge in input costs, though pulp and wood prices should moderate in 2022. On the bright side, the recent surge in energy prices should not hit the paper sector too heavily: Papermakers have clearly improved their energy-consumption footprint by considerably increasing their reliance on renewable biomass for 20 years (from 40% to 55%) over power and fossil fuels. Looking ahead, a large debt capacity will allow the sector to keep investing in environmental friendly plants: significant investments in water recycling systems – each of them estimated at a cost ranging from USD9mn to USD12mn - are still needed.