Allianz Trade in Switzerland CAP is the right choice for you if:

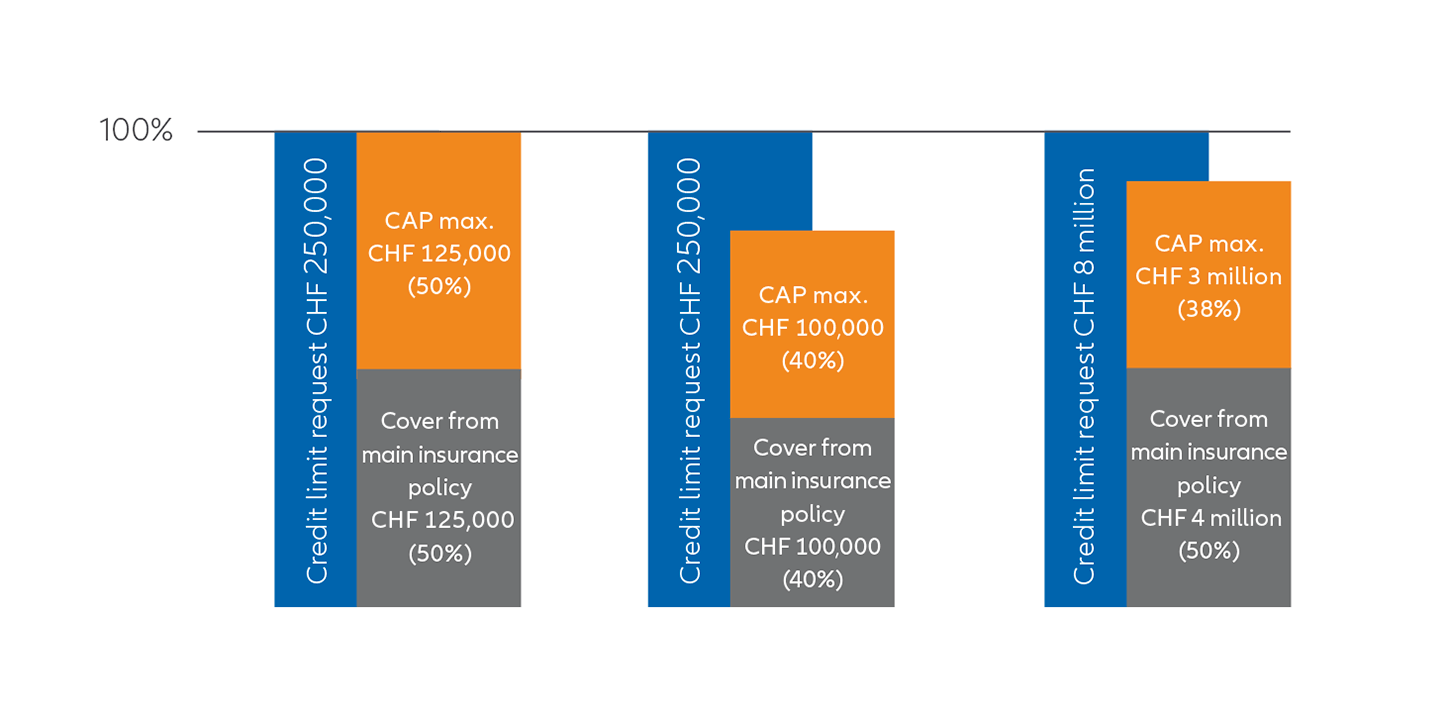

- there is already a sum insured for the transactions you wish to safeguard, but it is not high enough

- the cover should be doubled subject to certain conditions

Allianz Trade in Switzerland CAP+ is the right choice for you if:

- a credit application was rejected for a new customer under a credit insurance policy from Allianz Trade in Switzerland

- you wish to obtain cover of up to CHF 75,000

.jpeg)

1.jpeg)

1.jpeg)

.jpeg)