Allianz Trade in Switzerland – the clear advantages we offer as an insurance partner

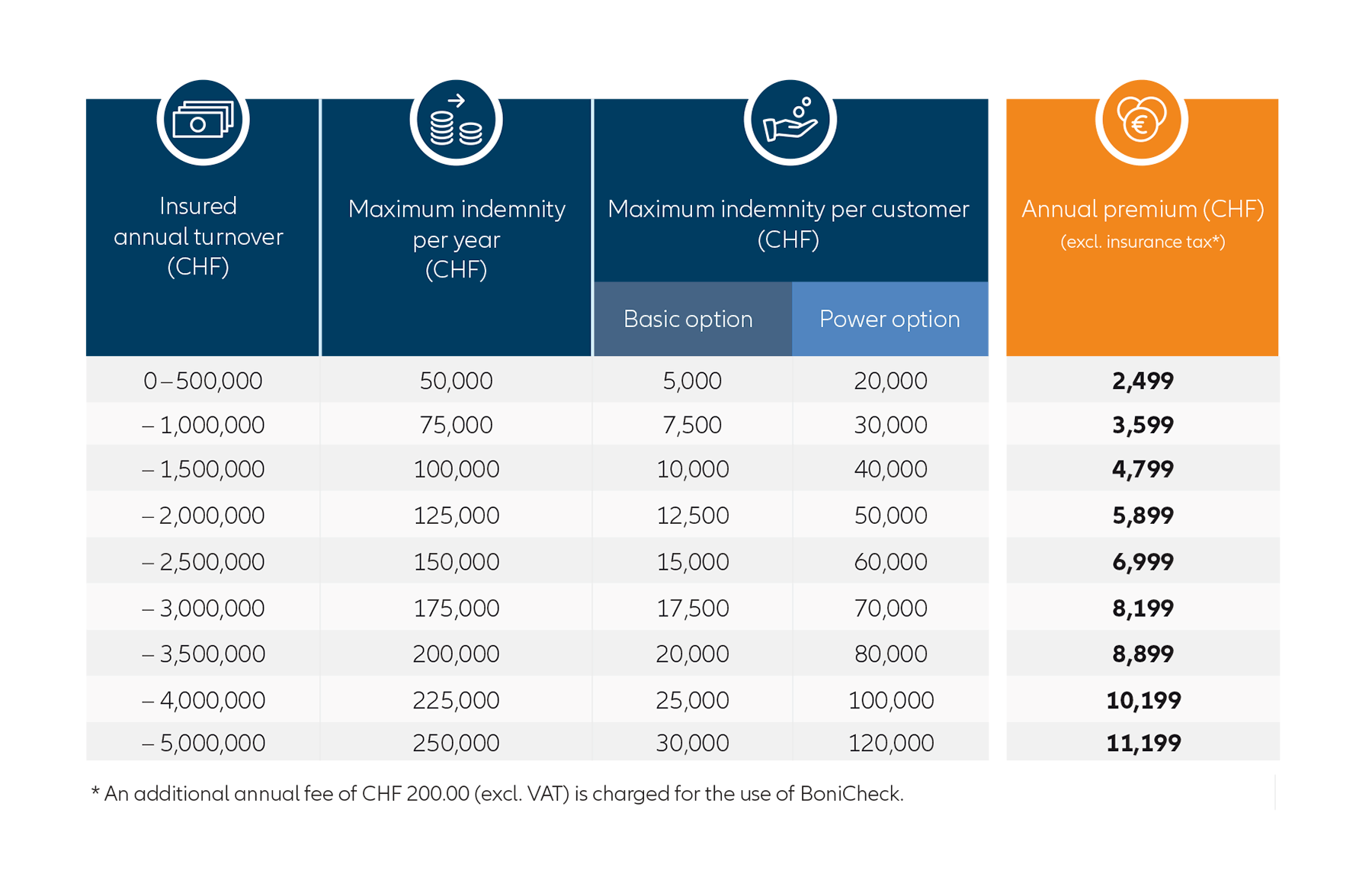

The benefits that small companies enjoy when taking out credit insurance from Allianz Trade in Switzerland speak for themselves! Thanks to flat-rate protection of 60% (Basic option), which is granted without any review, only a minimal and very manageable administration fee can be expected in case of a claim. Our premium invoice for your new insurance against losses on receivables is designed to be as simple and comprehensible as we can make it. After all, premiums and insurance conditions should be as transparent as possible and formulated in a manner that is easily understood by everyone.

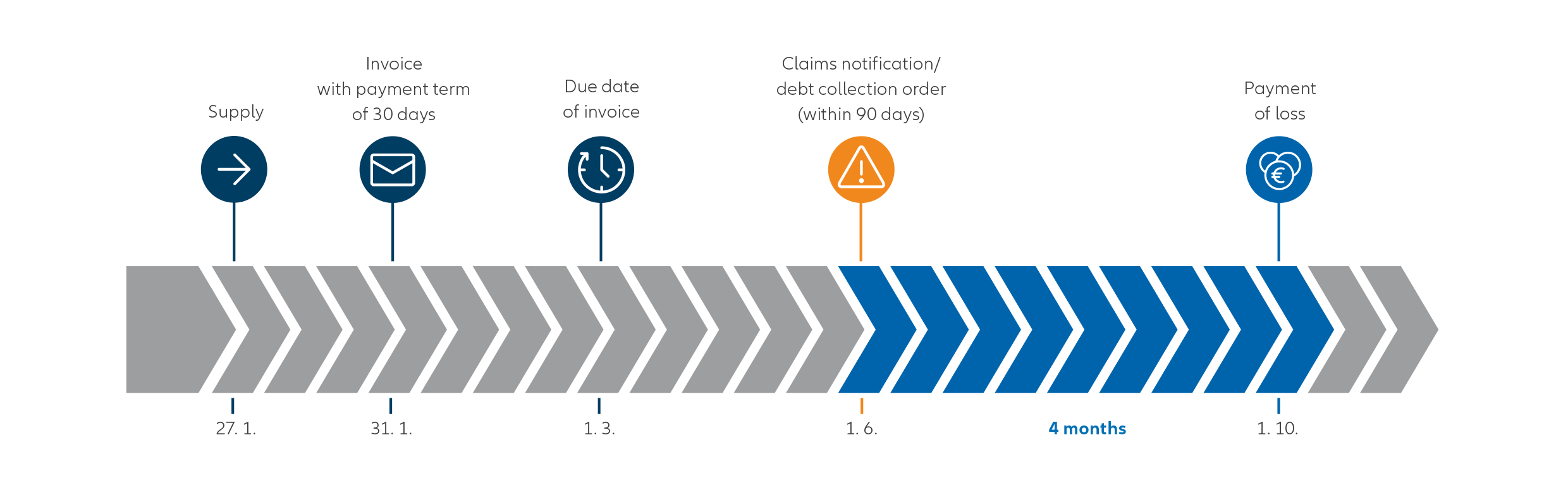

With our Simplicity insurance, you can expect to receive compensation even in the event of an extended payment in arrears. With us you do not have to be prepared for unnecessarily long waiting times. We settle and pay claims immediately after the occurrence of the insured event and after the insured loss has been ascertained. In addition, you have at your disposal a total of 100 BoniCheck credit checks per year, which we provide from as little as CHF 200 plus VAT and which you can conveniently access online. In most cases, the query enables the insurance cover to be flexibly increased to 90% (Power option). In addition, you have the option of handing over collection to us. We would be happy to advise you on the corresponding conditions.

.jpeg)

1.jpeg)

1.jpeg)

.jpeg)