In focus – US and Eurozone growth is defying gravity ?

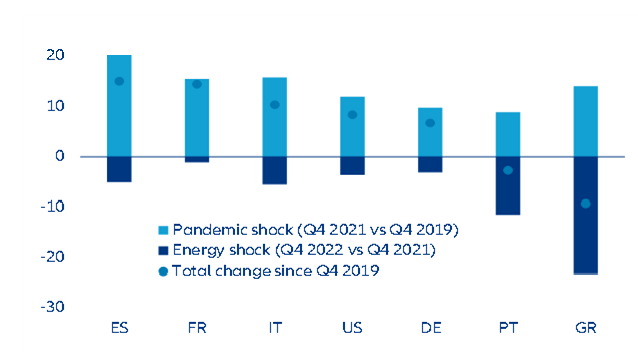

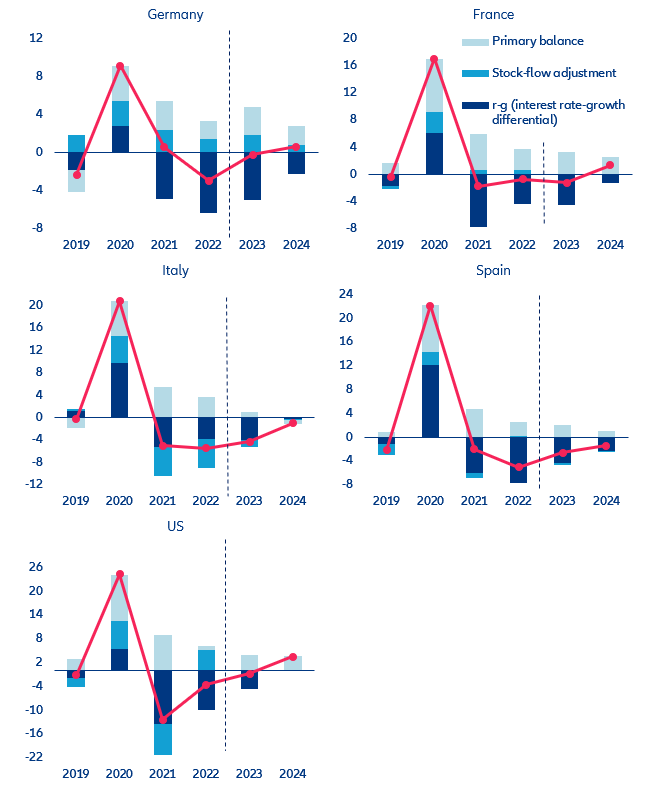

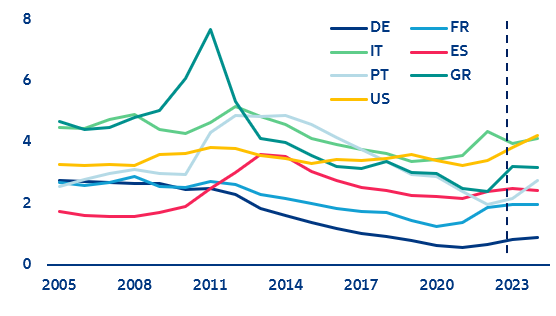

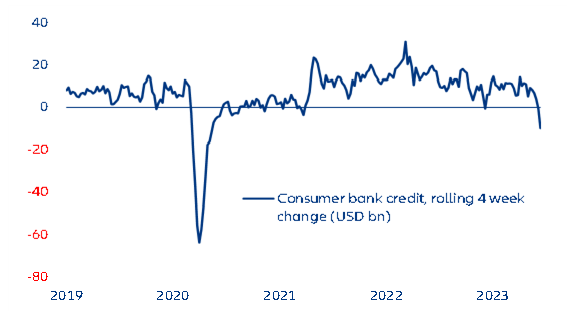

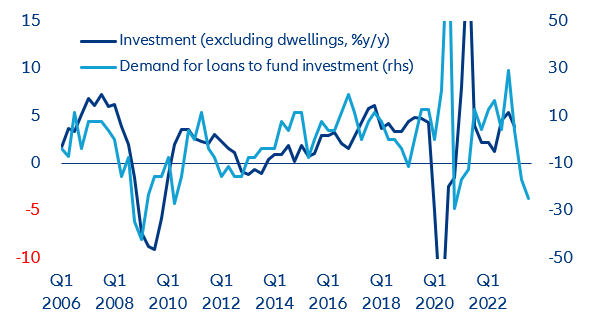

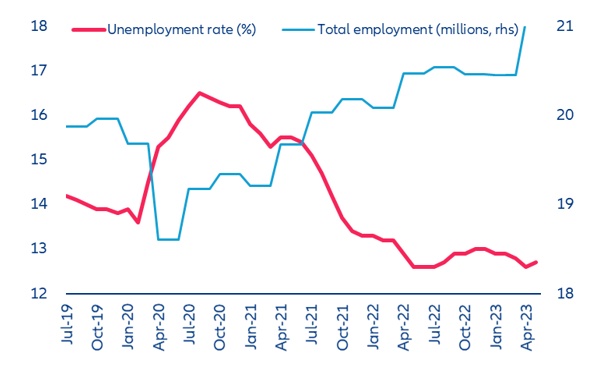

- The US economy stepped up the pace in Q2 2023, with GDP growing above-trend at +2.4% annualized, driven by soaring business investment. Q3 data continue to show positive signs, including a sharp rise in consumer sentiment and continued solid performance in the labor market. However, incentives for manufacturing plants could be offset by falling consumer credit and a softening business investment.

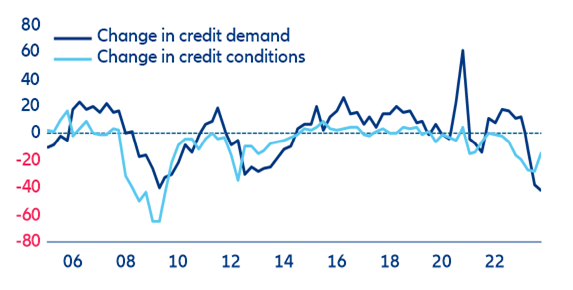

- The Eurozone's economic outlook is increasingly challenging, with indications of continued weak performance. Q2 growth is likely to have remained weak, and July's PMIs confirm a further slowdown in the second half of the year. In light of sticky core inflation, the ECB left the door open for one last hike in September to 4%, leading to tighter credit conditions and reduced investment demand. Weak external demand from major trading partners adds to the headwinds. Divergences among member countries are evident, with Germany lagging and Spain showing comparatively strong momentum, notably thanks to services and public investment.

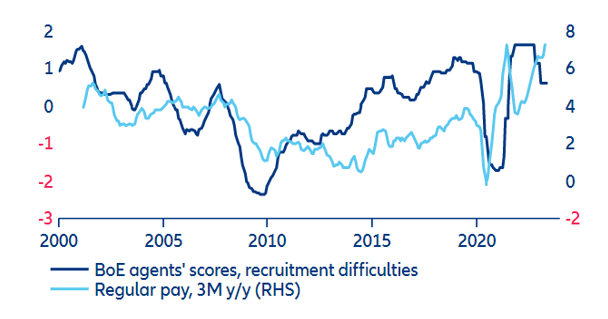

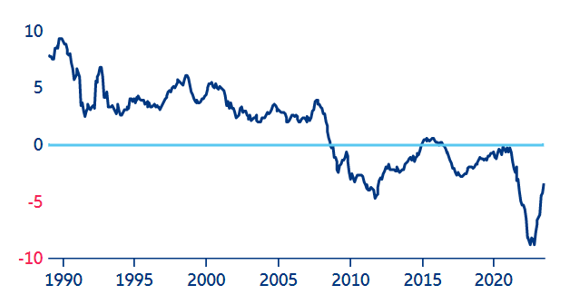

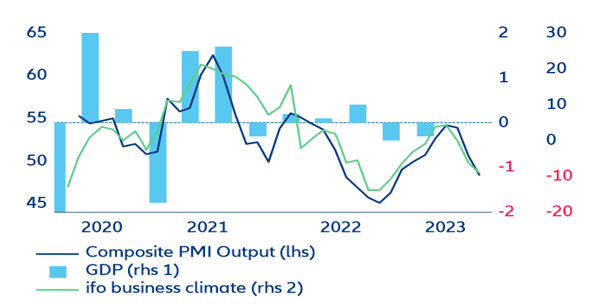

- Germany's economic outlook is still gloomy, even though further recession was avoided – with GDP stagnating in Q2. Indicators signal weaknesses across all sectors, with manufacturing and services experiencing declines. Structural issues, such as high energy costs and worker shortages, are exacerbating the situation, leading to a potential economic downturn. Capital outflows suggest waning attractiveness as an investment destination, posing further challenges for the country's economy.

- France's economy muddles through prolonged stagnation despite a surprise boost to Q3 2023 growth. Although Q2 2023 GDP growth was strong at +0.5% q/q, it was entirely driven by a boost from net trade. Exports, in particular, were buoyed up by the shipment of a large cruise ship. But falling corporate credit demand indicates a challenging outlook for business investment in H2, hinting at a marked step down of GDP growth in Q3, which we expect at -0.1% q/q.