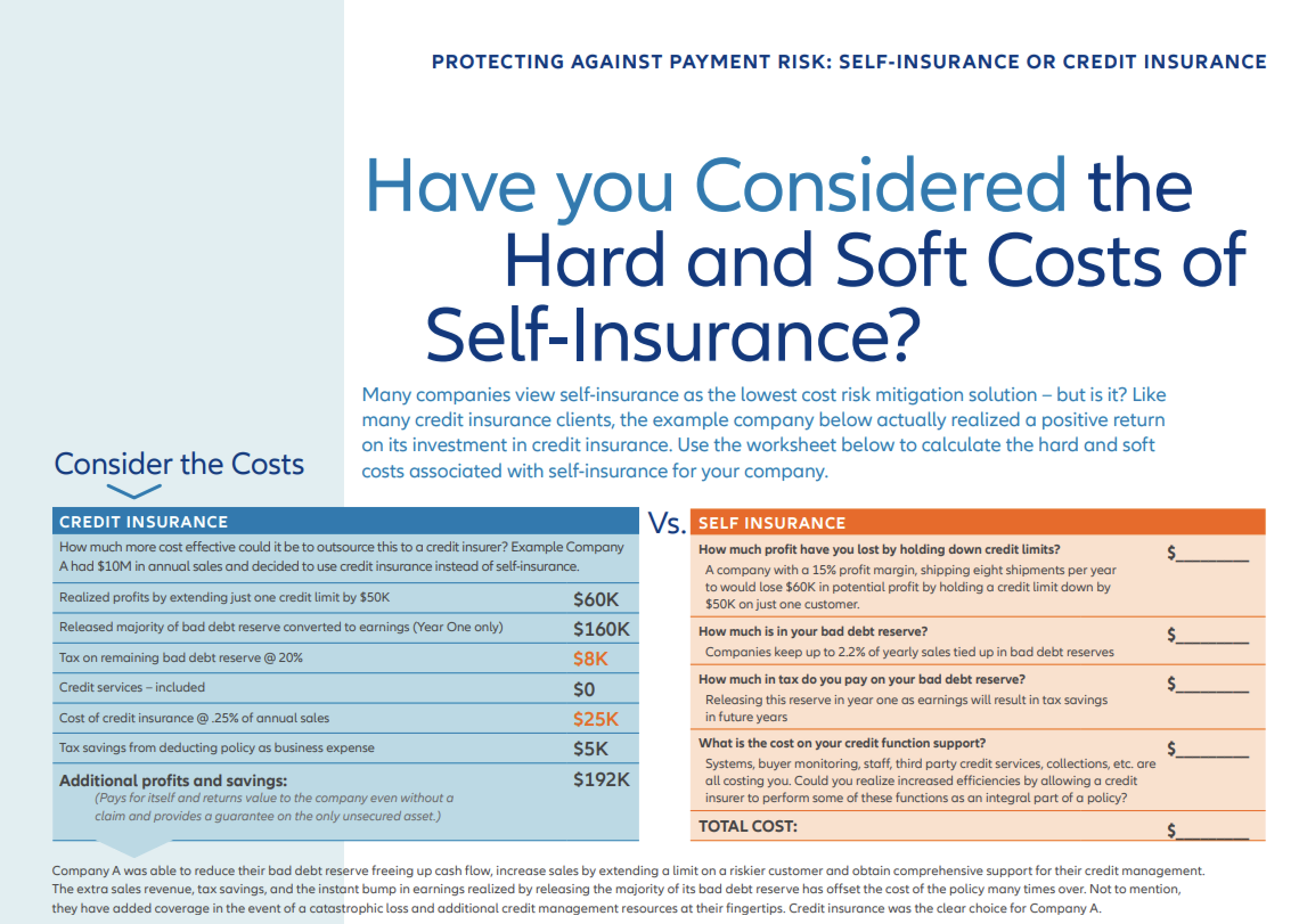

In today’s business environment, protecting against credit losses makes strategic sense. However, self insuring – that is, accepting the cost of any future losses – may not the best approach. Credit insurance is often a more compelling choice.

Here’s why. Self insurance requires companies to tie up important sources of capital in large bad-debt reserves and credit insurance does not. With credit insurance in place, companies can deploy their capital where it is needed most—as working capital that supports growth or through capital investment that spurs innovation.

This makes credit insurance is an important alternative to self insurance. It helps businesses avoid catastrophic losses and grow profitability. And it can do so at a lower cost and with less risk than self insurance.

Understanding Self Insurance

Companies often choose self insurance, assuming that it provides more control over credit management. However, this control is not always as useful as expected and often comes at a significant cost in the form of tangible losses and missed opportunities.

Self insuring through cash reserves offers little protection against catastrophic credit-related loss. And the demands of self insuring credit losses can lead to decision-making focused on protecting against loss rather than investing for growth.

Self insurance can lead companies to:

- Reduce potential revenue by imposing overly conservative credit limits.

- Spend more than necessary to maintain internal credit management resources.

- Tie up working capital in bad-debt reserves that impact capital allocation of the balance sheet.

- Expose the business to large and unexpected catastrophic losses that can imperil its future, as well as smaller losses that can its weaken cash flow.

- Use often unreliable third party data sources to manage credit decision-making.