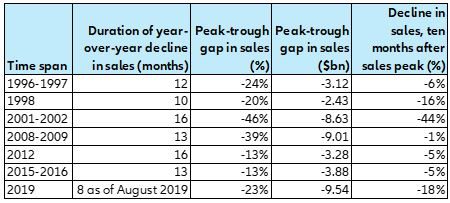

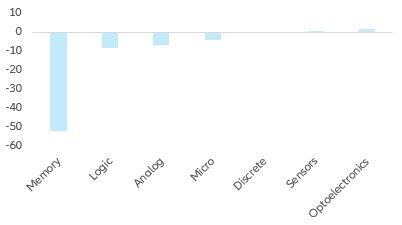

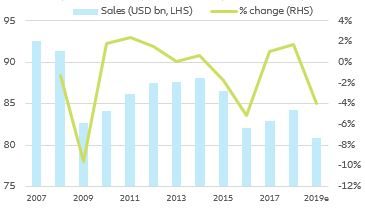

- In 2019, the semiconductor industry will post its deepest decline in annual sales (-15%) since the dot com bubble, wiping off over USD70bn in revenue. The current slump has so far been very typical of this boom-and-bust industry, which experiences brutal drops in sales lasting twelve to fifteen months every four to five years on average. Unlike past downturns, however, we believe the current slump will last well into 2020 and send annual sales down again by -3%. Depressed demand from key final markets, including smartphones and computers, and an unfavorable pricing environment will weigh on sales, which should fall below the USD400bn mark. High fixed costs, including substantial capital investment and year-long R&D programmes, mean the decline in profits and profit margins will be even more pronounced.

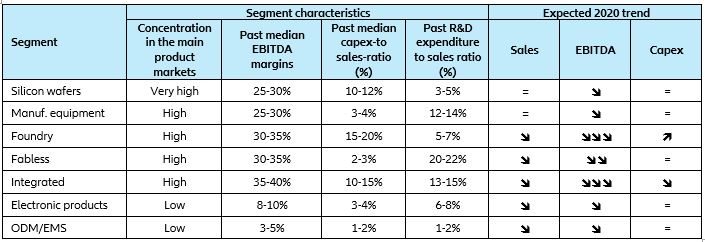

- While the semiconductor industry as a whole will maintain above average credit metrics, with low financial leverage and positive cash generation, we believe a second consecutive year of falling revenue and an uncertain business environment will exacerbate risks for five specific profiles of companies operating in the wider electronics industry:

- Second-tier chipmakers with an asset-heavy business model engaged in an unsustainable investment race.

- Chinese electronic product assembly specialists, which are losing clients as companies are shifting their sourcing strategies away from China.

- U.S. and Chinese semiconductor and electronic product companies, which are facing additional trade restrictions that hurt sales and profits.

- South Korean chipmakers, which rely heavily on key Japanese chemicals used in semiconductor manufacturing as tensions between the two countries are escalating.

- U.S. electronics retailers that are looking to preserve their market shares in a declining market and facing new tariffs on electronics goods coming in December 2019.

Semiconductors are a typical boom-and-bust industry

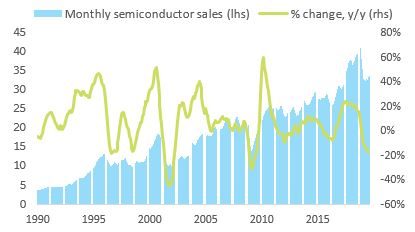

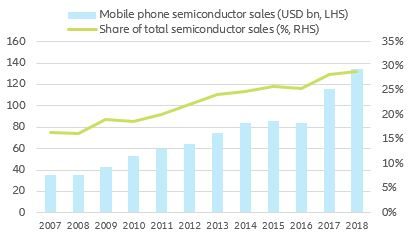

In 2019, the semiconductor industry will have its worst year since the dot com crisis, posting a -15% decline in revenue after two years of buoyant demand growth, as well as a favorable pricing environment that sent sales up +21.6% and +13.7% in 2017 and 2018, respectively. While impressive, the current slump is not unusual and reflects the industry’s inherent boom-and-bust nature.

Over the last thirty years, periods of declining sales happened every four to five years and lasted 12-15 months on average. They typically happen when demand in end-market stalls: customers cut orders to reduce their inventories before eventually resuming placing new orders. Meanwhile, semiconductor companies find themselves with excess inventories and production overcapacities, leading to fierce price competition. Inertia is another major feature of the industry: R&D cycles span over years, the average fabrication plant takes two years to build and the manufacturing of a chip takes weeks. The double impact of lower volumes and intense price competition during downturns explains the magnitude of the contractions.

Figure 1: World semiconductor sales