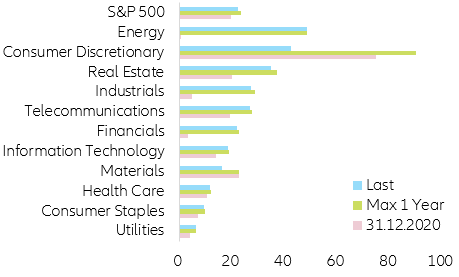

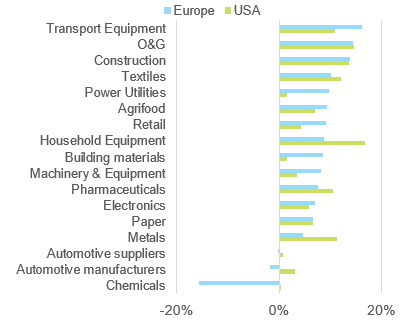

Figure 1 – Europe: shortages of material and/or equipment as a factor limiting production, % of respondents, Q3 2021 value vs 2015-2019 average (% of respondents)

Figure 1 – Europe: shortages of material and/or equipment as a factor limiting production, % of respondents, Q3 2021 value vs 2015-2019 average (% of respondents)

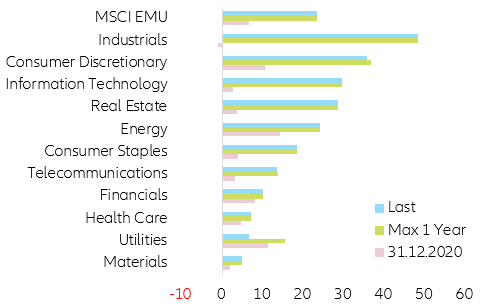

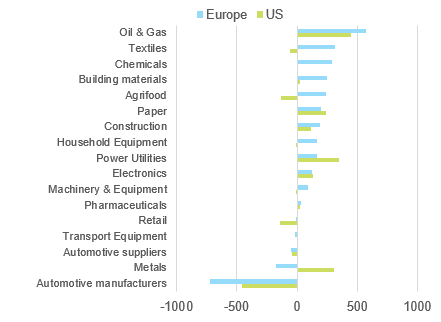

The situation on the other side of the Atlantic is similar, with the machinery and equipment, automotive, household equipment and chemical sectors reporting tensions far above the average of the entire manufacturing sector (Figure 2)

Figure 2 – US: reasons for plant production operating below full capacity, supply of materials and equipment limitations, Q2 2021 vs 2015-2019 average (% of respondents)

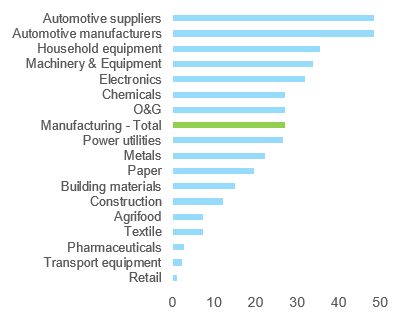

Figure 3 – Estimated H2 2021 vs realized H1 2021 sales, % change

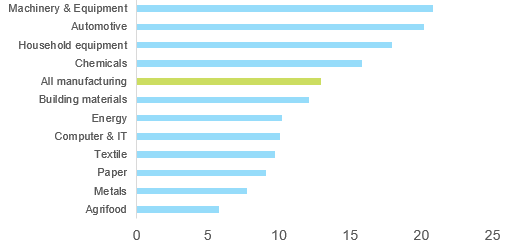

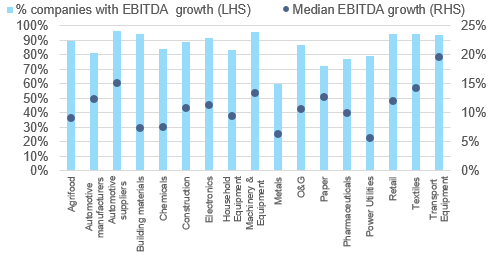

Turning to profitability, data suggest profits expressed as a percentage of turnover will start to suffer in Q4, with more than 50% of sectors in Europe posting a decrease in EBITDA margin of -2.5pp on average versus 70% of sectors in the US (-0.6pp on average). Overall in H2 2021, the most impacted sectors in terms of profitability are automotive, metals, transport equipment and retail. Conversely, higher sales driven by growing volumes and sometimes significant price increases will allow profit margins to improve further in the oil and gas, building materials and household equipment sectors (Figure 4).

Figure 4 – Change in EBITDA margins, H2 vs H1 2021, basis points

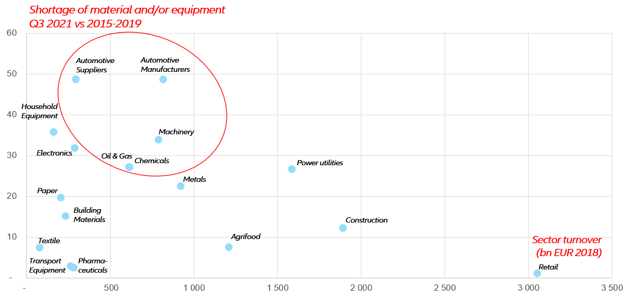

- Three of the region’s most important sectors in terms of activity, i.e. retail, construction and agrifood, report a comparatively modest increase in supply-chain tensions.

- A loose grouping comprising automotive, machinery, oil and gas and chemicals appears far more of a concern: not only do these sectors account for 30% of Europe’s manufacturing turnover (45% including the borderline metals and electronics sectors), but they also have strong linkages to other sectors, translating into elevated secondary round impact (e.g. electronic component shortages hurting automotive suppliers, in turn hurting automotive manufacturers).

Figure 5 – Shortages and sector turnover matrix (Europe)

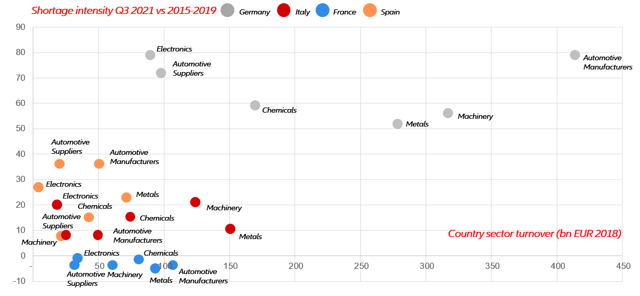

Looking at individual member countries, the data suggest that German companies are more at risk of a shortage-induced contraction in industrial activity than their Spanish, Italian and French competitors (Figure 6). While the magnitude of the gap between Germany and other countries could be accounted for by the massive floods of July 2021, this hierarchy is broadly consistent with the latest industrial production and PMI data.

Figure 6 – Shortages and sector turnover matrix, focus on key sectors

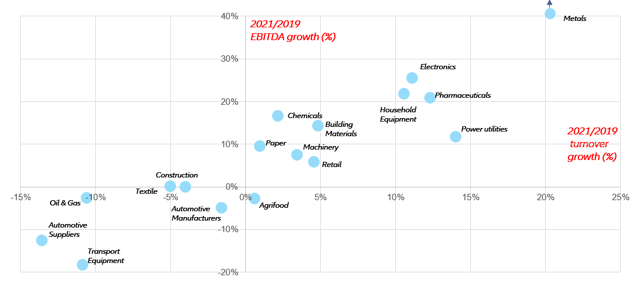

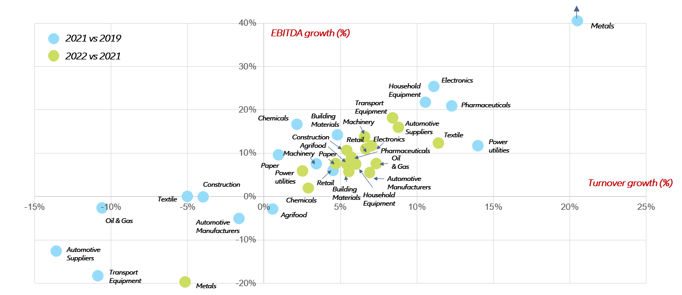

Figure 7 – Turnover and profit growth of listed European corporates by sector, weighted average, 2021 vs 2019, %

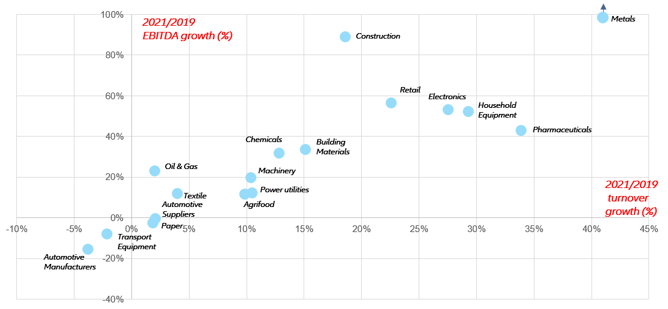

Figure 8 – Turnover and profit growth of listed US corporates by sector, weighted average, 2021 vs 2019, %

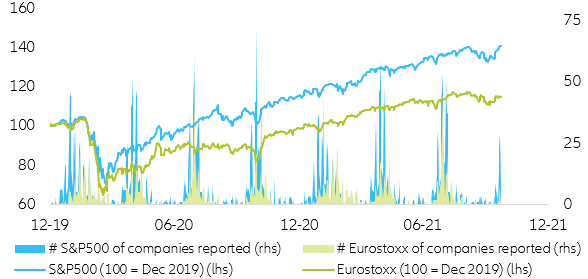

Market expectations confirm that an earnings slowdown is in the making. Markets have been volatile ahead of each earnings season since March 2020 due to high uncertainty over companies’ balance sheets. Nonetheless, and despite the combination of high valuations and an extremely uncertain environment, companies have managed to consistently beat market expectations, triggering an immediate market recovery and a continuation of the post-Covid-19 equity bull run after each reporting season (Figure 9).

Figure 9 – US & EUR equities vs earnings seasons

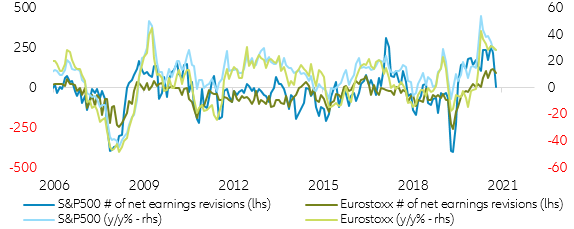

Figure 10 – Net earnings revisions and equity market performance

Three factors could tighten the squeeze in 2022 and unfold in a context where policy support measures (tax deferrals, partial unemployment schemes and direct subsidies) will be entirely phased-out in most countries: semiconductor supply, energy prices and tensions in Chinese manufacturing and transport activities. The easing of supply-chain tensions will be instrumental in shaping turnover and profit growth in 2022. Looking at the most common factors hurting supply chains across sectors, we identify three critical areas for the easing of tensions:

- Tight semiconductor supply is hurting the automotive, machinery and equipment, household equipment and a fraction of the electronics (intermediate or final goods incorporating semiconductors) sectors. Data and anecdotal evidence from dominant automotive semiconductor companies and semiconductor foundries show that semiconductor supply is increasing at a fast pace, sometimes covering up to 130% of what companies believe is “real demand”, pointing to stockpiling or double-ordering behaviour that is preventing chips from reaching their final markets. Normalization of demand in the consumer electronics industry, combined with new capacities coming online, should alleviate tensions through 2022.

- Limited gas supplies are translating into higher electricity prices and rising input costs (metals, building materials), sometimes forcing industries to cut production (chemicals). The extent to which gas prices could rise further will be heavily dependent on the severity of the upcoming winter. We anticipate prices to peak in spring 2022 before receding in the second half of 2022.

- Tensions in Chinese manufacturing and transport activites are the last factor with a broad and adverse impact on a large number of sectors, given Europe’s reliance on Chinese intermediate and final goods. In recent weeks, tensions arose from local surges in Covid-19 cases and power outages. On the latter topic, Chinese authorities have taken steps to incentivize coal and power production. As regards the saturation of port infrastructure resulting from exceptionally high exports to North America and Europe, this too should ease with the normalization of demand from sectors boosted by the pandemic.

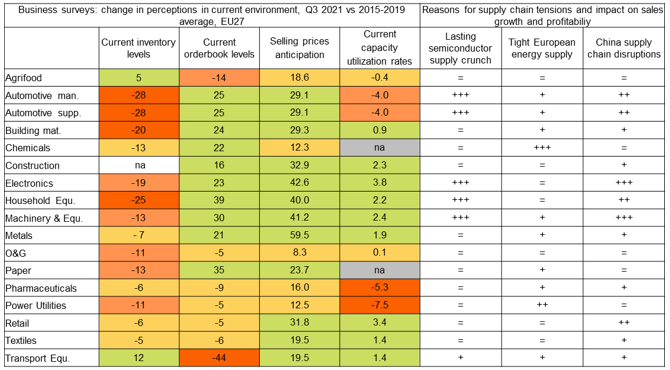

We expect Q2 2022 to be a turning point for supply-chain disruptions. In this scenario, the catch-up potential in sectors plagued by shortages could be significant, notably for those with higher pricing power (Figure 11 for selling price expectations and our report on current pricing power as measured by growth in retail prices versus input prices). Taking the automotive sector as an example, we observe in surveys that inventory levels are particularly low and capacity utilization rates depressed, but orderbooks i.e. potential volumes are high, selling price anticipations are positive and pricing power has been visible for a couple of months (Figure 11).

Figure 11 - Business sentiment survey and sources of supply-chain tensions

How to read: = neutral impact + limited impact ++ average impact +++ strong impact

Across sectors, this would translate into a +5-10% increase in turnover and profits over the whole year, reflecting two opposite trends (Figure 15):

- Sectors which outperformed during the Covid-19 crisis, including metals, pharmauceuticals, electronics and household equipment, will post softer growth after two excellent years.

- Sectors which underperformed, including the wider automotive sector and transport equipment, will bounce back from their 2020-2021 lows as supply-chain tensions ease and demand for air transport picks up gradually, respectively.

Figure 12 – Turnover and profit growth of listed European corporates by sector, weighted average, 2021 vs 2019 and 2022 vs 2021, %

Figure 13 – Profit growth distibution among European corporates (2022)

Figure 14 – Turnover and profit growth of listed American corporates by sector, weighted average, 2021 vs 2019 and 2022 vs 2021, %

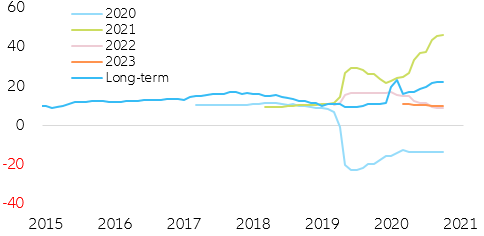

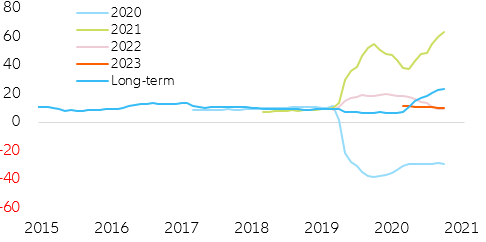

Figure 15 – US EPS growth expectations by year (in y/y%)

Figure 17 – US long-term EPS growth estimates (in y/y%)