EXECUTIVE SUMMARY

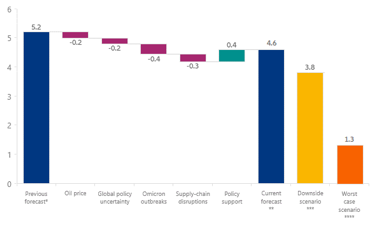

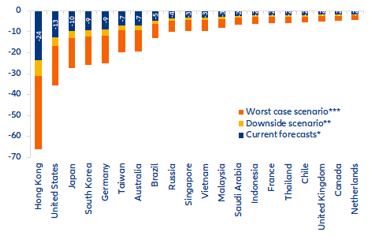

- With provinces accounting for nearly a quarter of GDP under partial or full lockdown, the cost of China’s zero-Covid policy is climbing. We expect that omicron outbreaks in Q1 and April will have cost -0.4pp of GDP growth in 2022. While the PBOC should implement one more cut in the policy rate in Q2 2022, and additional public investment of c.3% of GDP is planned for the year, policy support will not be enough to cushion the blow to domestic demand. As a result, we cut our forecast for GDP growth to +4.6% in 2022, down from +4.9% expected a month ago. In a downside scenario where the Shanghai lockdown lasts for two months, and other large cities are also affected, China’s 2022 GDP growth would slow to +3.8%. In a worst-case scenario where the Q1 2020 shock is repeated, China would grow by only +1.3% this year. On top of the domestic sanitary situation, further downside risks could arise from a worsening of US-China tensions.

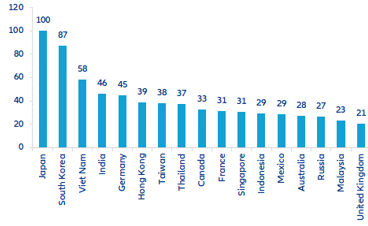

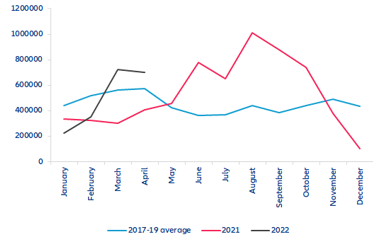

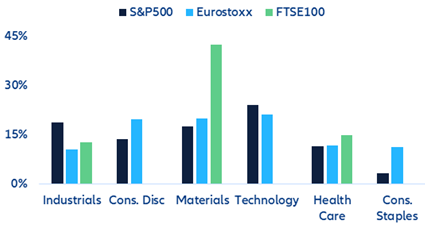

- What does this mean for the rest of the world? A contraction in global trade in volume in Q2 2022 is now highly likely, as seen during summer 2021 and as suggested by our proxy for global demand-inventories mismatch. Slower Chinese demand implies an export shortfall amounting to USD140bn for the rest of the world. On the supply side, a sudden stop in China’s industrial activity would pose risks to global output, especially in the electronics and automotive sectors. In addition, congestion in Chinese ports suggests that global shipping delays are likely to remain elevated throughout 2022, though they will remain below the highs seen in 2021. Continued supply-chain disruptions will create further inflationary pressure globally: We estimate that current domestic bottlenecks in China is likely to lead to 0.2pp rises in the y/y inflation rates in the US and Eurozone in Q3, all else equal.

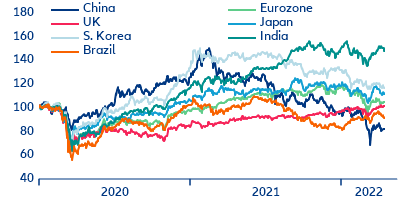

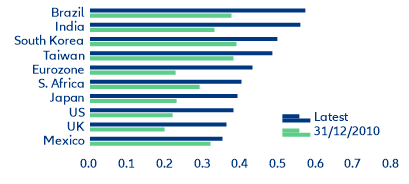

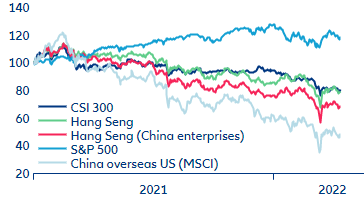

- What does this mean for markets? We expect Chinese and EM assets to remain under pressure for the rest of 2022. Stringent anti-Covid measures and the risk of further US-China tensions, which has been exacerbated after the invasion of Ukraine, will keep weighing on market sentiment. Factoring together the outlook on Chinese assets, their interlinkage with global markets and foreign companies’ dependence on Chinese demand, we believe that EM equity markets could revisit 2022 lows. However, ongoing headwinds being successfully managed could lead to a positive 2023 for emerging market risky assets as a combination of relatively cheap valuations and renewed tailwinds could positively surprise markets.

The cost of China’s zero-Covid policy is climbing and policy support will not be enough to cushion the blow.

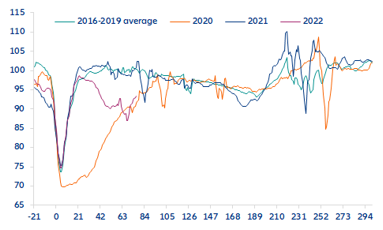

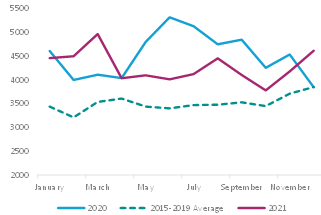

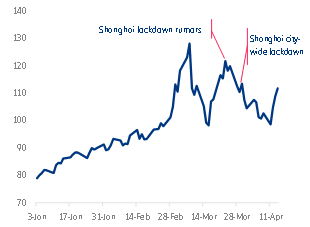

China is facing the worst outbreaks of Covid-19 since the first quarter of 2020. As authorities continue to follow a zero-Covid policy, provinces summing up to nearly 25% of national GDP have been under partial or full lockdown in March-April. This compares with 18% during the worst week of 2021 (in August) and 63% during the worst 20 days of 2020 (over January-February). The impact on mobility is visible: National mobility has dropped by -10% y/y in the first half of April – though this is roughly half the size of the shock observed in February-March 2020. High-frequency data (see Figure 1) show traffic congestion was down by -1.6% y/y on average in Q1 2022, -6.8% in March and -10% in the first half of April. Assuming a return-to-normal from May, Q2 2022 mobility would drop by -1.7% y/y, compared to the -17.7% drop seen in Q1 2020 (-21.3% in February-March 2020) and -3.7% in August 2021.

Figure 1: China traffic congestion index * (100 = Chinese New Year)