Executive Summary

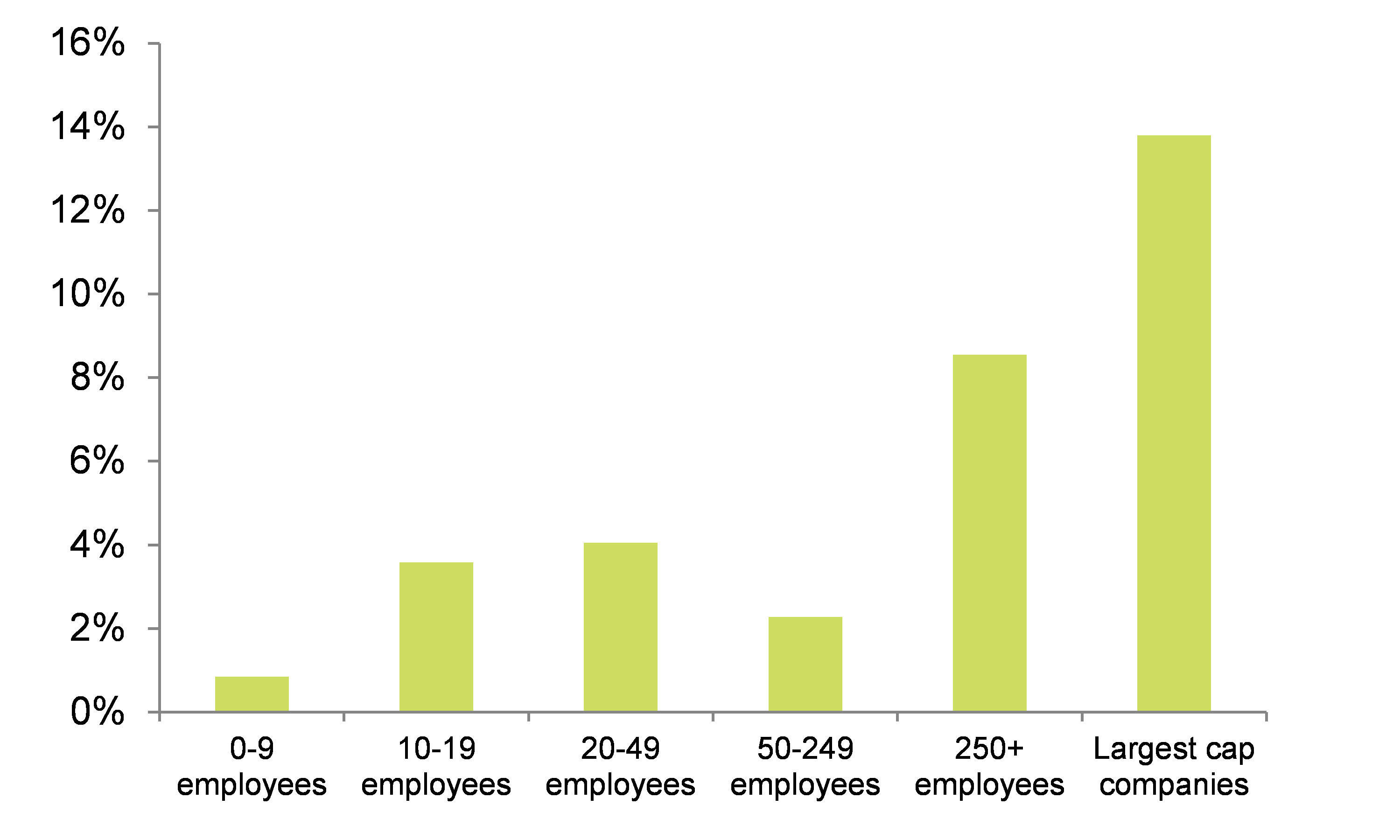

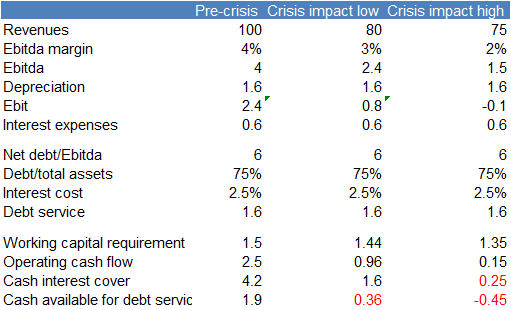

- Covid-19 is sparking a profitability shock for SMEs in the construction sector. SMEs represent the lion’s share of companies in the construction sector, with about 80% of the sector’s turnover in Europe. But unlike large diversified companies, which are resilient and well positioned to weather the Covid-19 crisis, a large number of SMEs could face severe difficulties. In 2020, we expect a 25% decline in revenues for SMEs, which could lead to a 2pp drop in Ebitda margins to 2%, against a 1pp drop to 12-13% for large companies. We further calculate that when assuming a not uncommon 6x net debt to Ebitda ratio, this could leave insufficient funds for debt service.

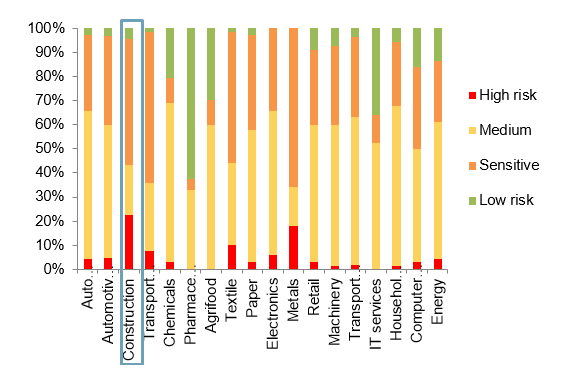

- As a result, we expect insolvencies in the construction sector across Europe to increase by 15-24% in 2020, with Spain and France representing the high end of the range and the UK at the low end. Because of its structural issues, construction already accounts for 20% of all insolvencies. Covid-19 is exacerbating the underlying vulnerabilities of SMEs, reinforcing their fragility, though large companies are not immune. We expect insolvencies to increase by +24% in Spain, +19% in France and the Netherlands and +15% in Italy and the UK.

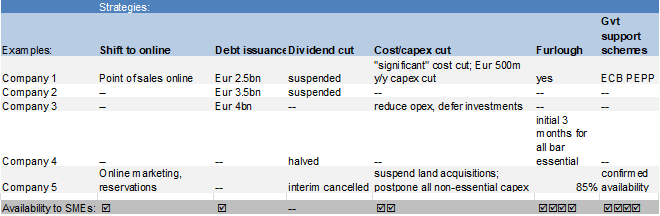

- How will construction come out of the crisis? The most common coping strategies, such as liquidity preservation through dividend cuts and large scale debt issuance as executed by a number of large companies, are not available to SMEs. The same holds for aggressive cost reduction. Rather, SMEs who are often subcontractors to large companies might be at the receiving end of cost reductions by large companies and face additional margin pressure. Self-help for SMEs is largely limited to accessing government schemes, such as furlough and loan support, which according to our estimate is largely tapped. This will create additional cash flow pressure in the future from higher cost of debt.

- In the world post-Covid-19, SMEs could be left out of opportunities. We look at the support policies in Germany, Italy, France, Spain and the UK and find that though they may lend some help, they will not fully protect SMEs in the construction sector, even where they comprise the greening of housing-related support. Policy stimulus such as public works, health infrastructure and large-scale climate change projects, and market opportunity will favour large projects and infrastructure, the domain of large companies. We expect those parts of the sector most exposed to energy and infrastructure to outperform in 2020 and 2021, which should compensate for structurally lower office and retail construction demand as far as large companies are concerned. Conversely, traditional areas of SME activity within construction may require substantial stimulus and become less profitable because of costs related to sanitary constraints, or get taken over by larger developers if demand structurally moves towards peripheral new build development. This could occur as we foresee much greater uptake of remote working, and resulting changes in housing preferences.

Covid-19 is sparking a major profitability crisis for SMEs in construction

Before Covid-19, construction was coming off a cyclical peak but still in expansionary mode, with the largest companies presenting a solid financial outlook. But as a sector dependent on physical activity, construction has seen significant business interruption from the Covid-19 pandemic, despite being classed as essential activity in many countries. We expect Covid-19 to reinforce the already opposing dynamics between large and small companies in the sector.

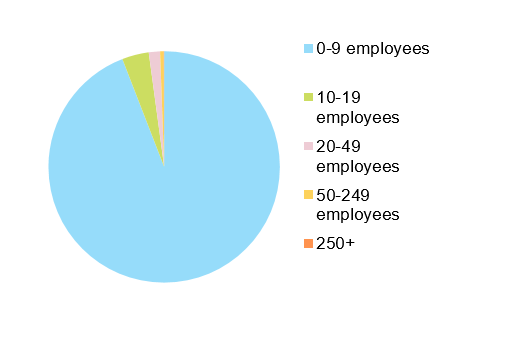

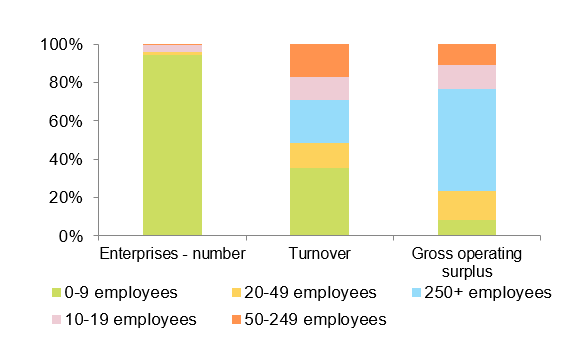

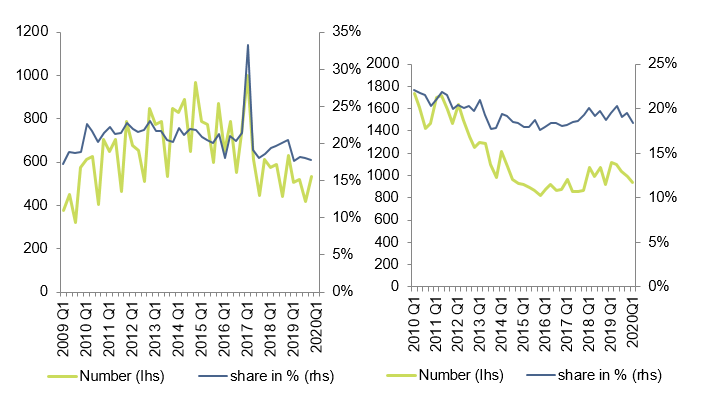

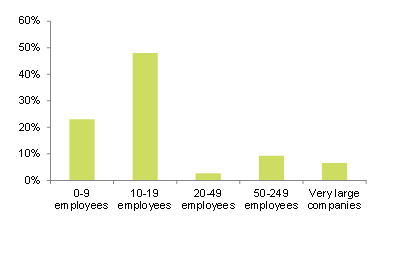

SMEs represent the lion’s share of companies in the construction sector, with about 80% of turnover in Europe. Companies with less than 250 employees make up 99% of the total, while the smallest companies, those with less than 49 employees, account for 98% (See Figure 1 and 2).

Figure 1 – Share of SMEs in the European construction sector (number of companies)