Executive Summary

- The official PMIs for January released today do not yet reflect the magnitude of the economic concerns around the ongoing coronavirus 2019-nCoV outbreak in China. However, we think that its impact on the Chinese economy and the rest of the world is not negligible.

- The hit to China’s GDP y/y growth could amount to c. 1pp, mostly over Q1 2020. A recovery should thereafter be possible, based on pent-up production and policy support.

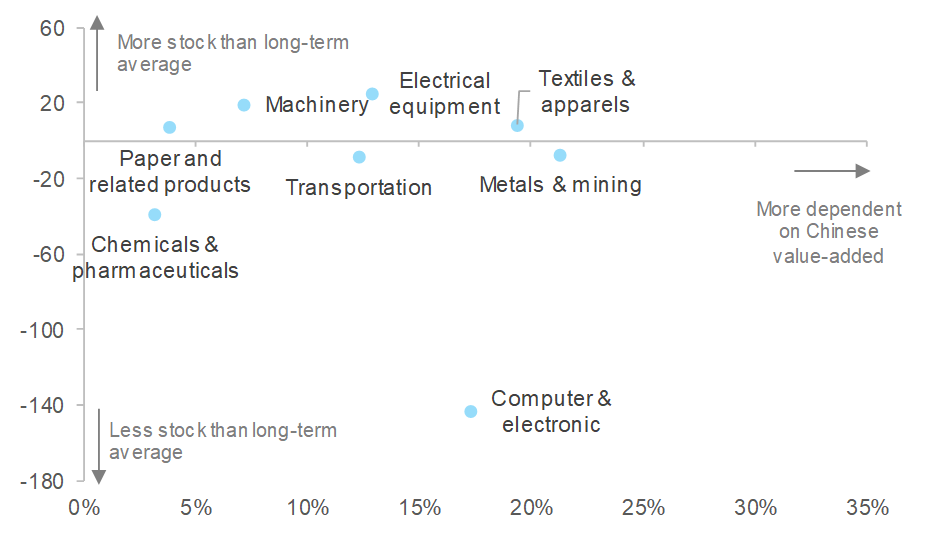

- A protracted pause in Chinese activity could be disruptive for certain supply chains such as chemicals, transport equiment, textile and electronics.

- The top five economies potentially hit by this disruption are Taiwan, South Korea, the Netherlands, Hungary and Indonesia.

The official PMIs for January released today do not yet reflect the magnitude of the economic concerns around the ongoing epidemic outbreak in China. The manufacturing PMI edged down to 50 (from 50.2 in December), while the non-manufacturing PMI rose to 54.1 (from 53.5). Such resilience is due to the cut-off of the surveys being 20 January, i.e. just when the epidemic started getting public attention. We expect the February surveys to better capture the economic impact of the epidemic. The onshore market in China will open on Monday 03 February, providing a gauge for local sentiment. We think that the impact on the Chinese economy and the rest of the world is not negligible.

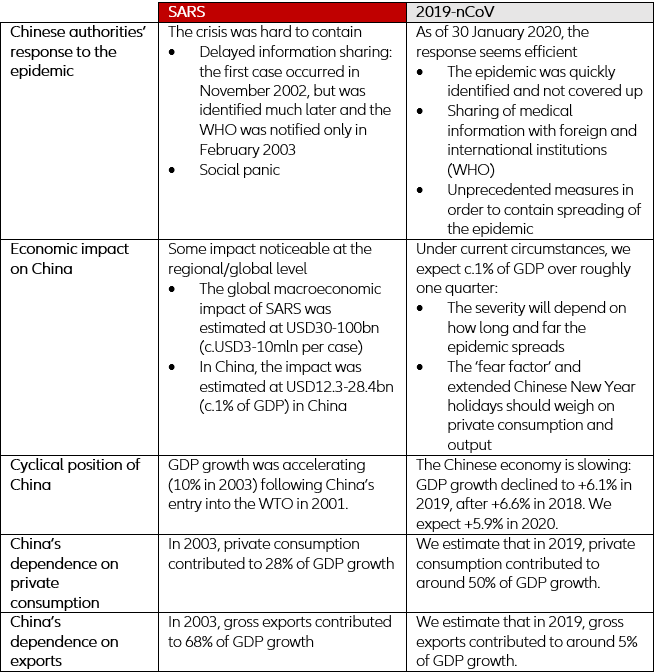

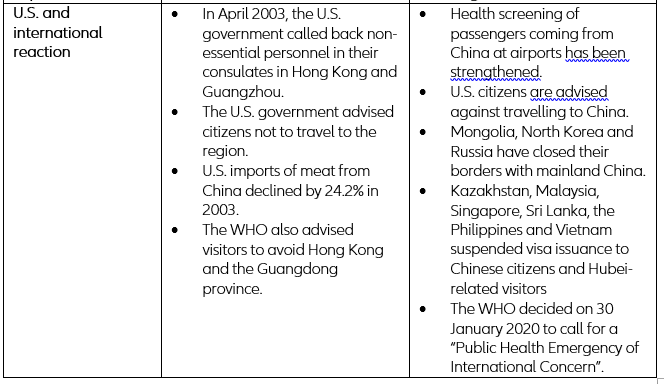

The coronavirus 2019-nCoV outbreak is a public health emergency of international concern, according to WHO. The outbreak was first reported in China in December 2019 and has been receiving intense public attention since mid-January 2020. The latest reports indicate around 9,800 confirmed cases and 210 deaths. At this stage, important containment measures taken by Chinese authorities have managed to limit the epidemic mostly at the domestic level (c.98.5% of confirmed cases are in mainland China). On 30 January, after split debates, the World Health Organisation (WHO) decided that the epidemic constituted a public health emergency of international concern.

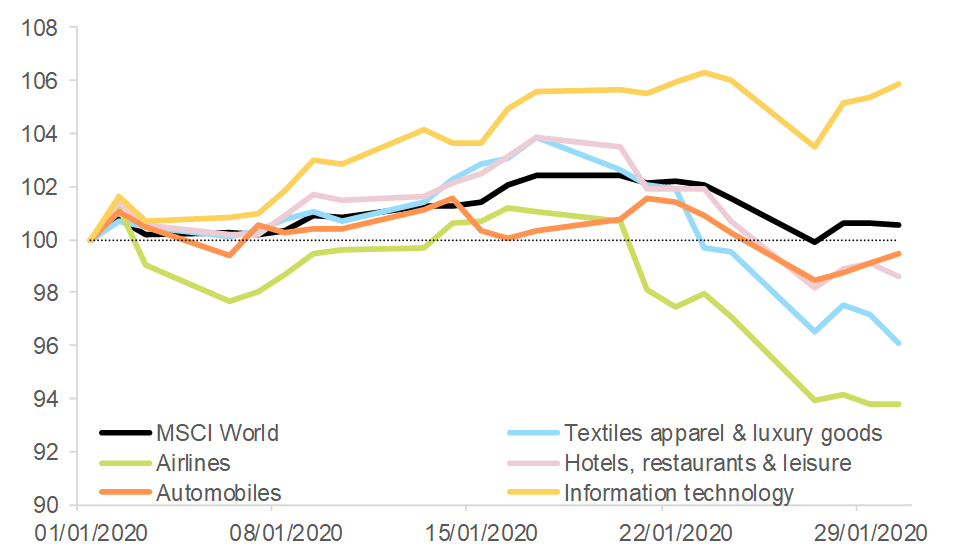

Markets have reacted strongly to the epidemic. Unlike for political risks, central banks’ accommodative stance did not suffice to calm market reactions. Equity markets have indeed corrected from stretched levels, with the MSCI World, APAC and China indices down by 1.8%, 4.7% and 8.5%, respectively, since 20 January. The industries most likely to be immediately impacted by the epidemic are bearing the brunt, with the sectoral components of the MSCI World index for airlines, textiles apparel & luxury goods and hotels, restaurants & leisure declining by 6.9%, 6.4% and 4.7%, respectively, since 20 January. Conversely, safe assets have performed well over this period: The JPY appreciated by 1.1% vs. the USD and the U.S. 10y Treasury yield was down by 25bp. The CNH depreciated by 1.7% vs. the USD, suggesting markets are starting to price in lower growth in China. This caution may only disappear when an inflection point is observed in the spread of the epidemic.