Executive summary

- Consumers were meant to drive the post-Covid-19 recovery in 2022, but elevated geopolitical uncertainty and sky-high inflation have derailed these expectations. Following Russia’s invasion of Ukraine, consumer surveys suggest that Eurozone households are as pessimistic – or even more – as they were during the height of the pandemic. Based on the deterioration in consumer confidence, we estimate that the resulting lost household consumption in the Eurozone tallies up to EUR70bn, or close to EUR500 per household, in 2022 alone.

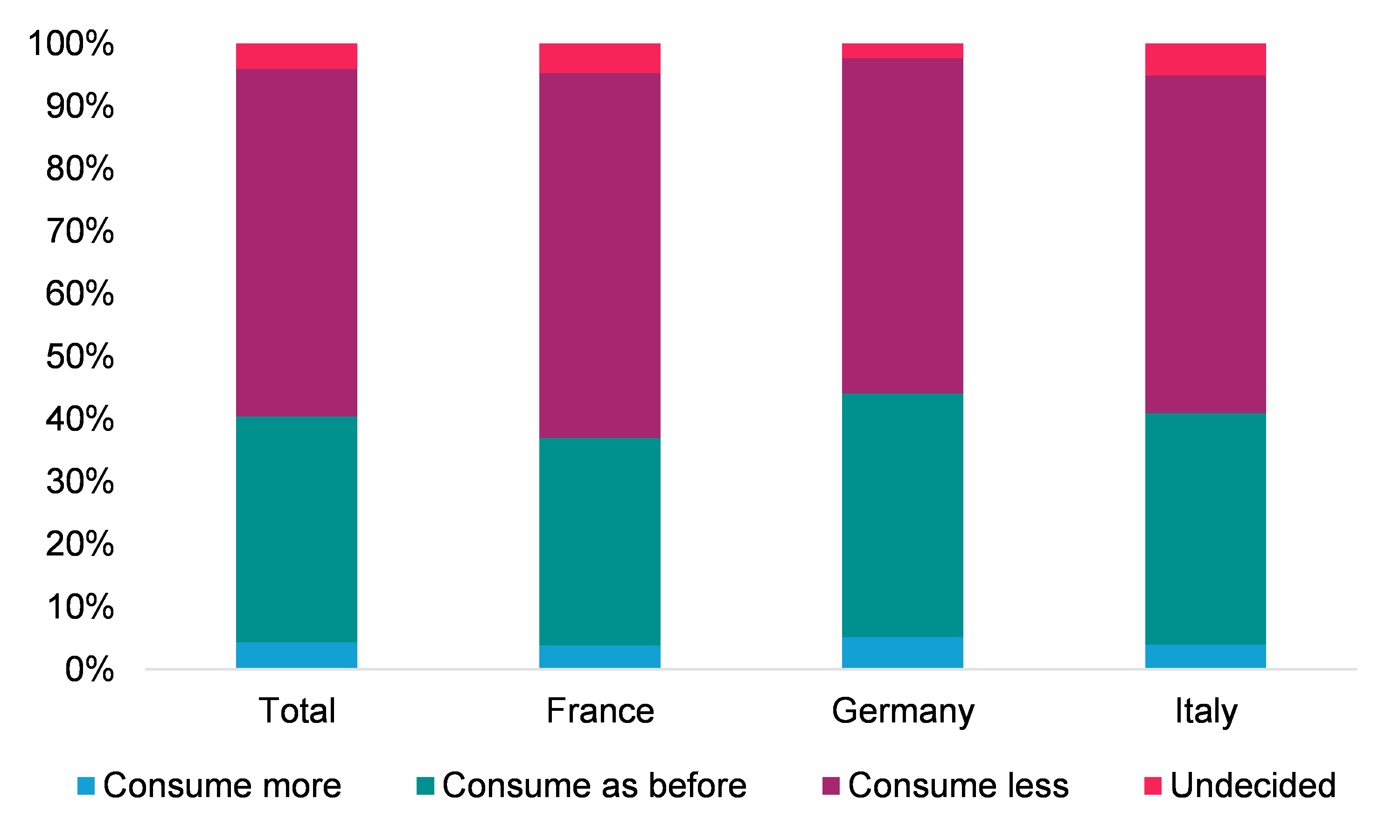

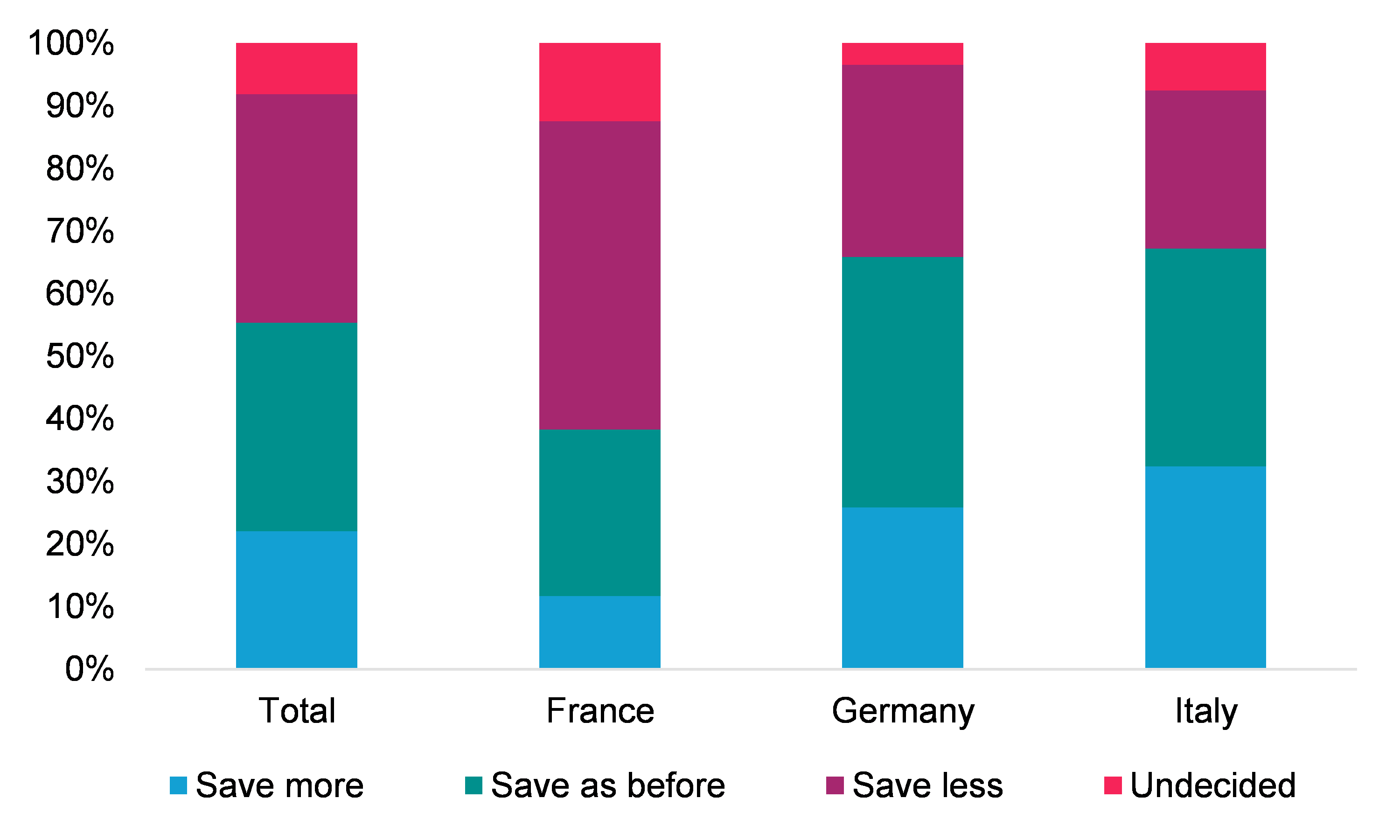

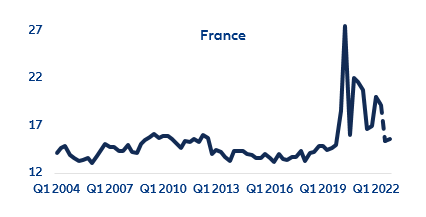

- Things will get worse before they get better: Our Allianz Pulse survey shows that a majority of consumers in Germany, France and Italy intend to cut back on their real consumption as well as their savings in the coming months. Based on a panel regression that takes into account consumer confidence, the unemployment rate, real disposable income, monetary and financial conditions as well as global demand, we estimate that gross savings rates in Germany, France and Italy will decline back to pre-Covid long-term averages by end-2022 (-4.7pp, -3.7pp and -4.8pp, respectively).

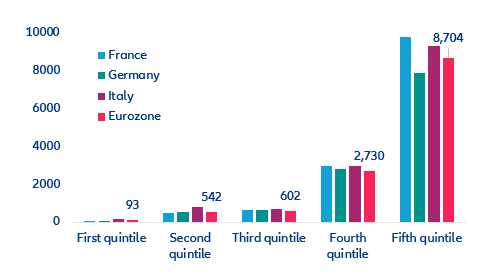

- Savings flows might return to normal, but the accumulated excess savings stock remains in place, even if it provides an unequal safety net. According to our calculations, the stock of excess savings currently tallies up to more than EUR380bn in the Eurozone. But heterogeneity is significant across income groups, with EUR93 per household for the lowest-income households against more than EUR8700 per household for the wealthiest. For comparison, the food bill for Eurozone households is expected to increase on average by EUR550 per household in 2022, while the energy bill is set to rise by more than EUR750. Hence, for almost two-thirds of households, excess savings will be insufficient to shield them from the inflation hurricane this year.

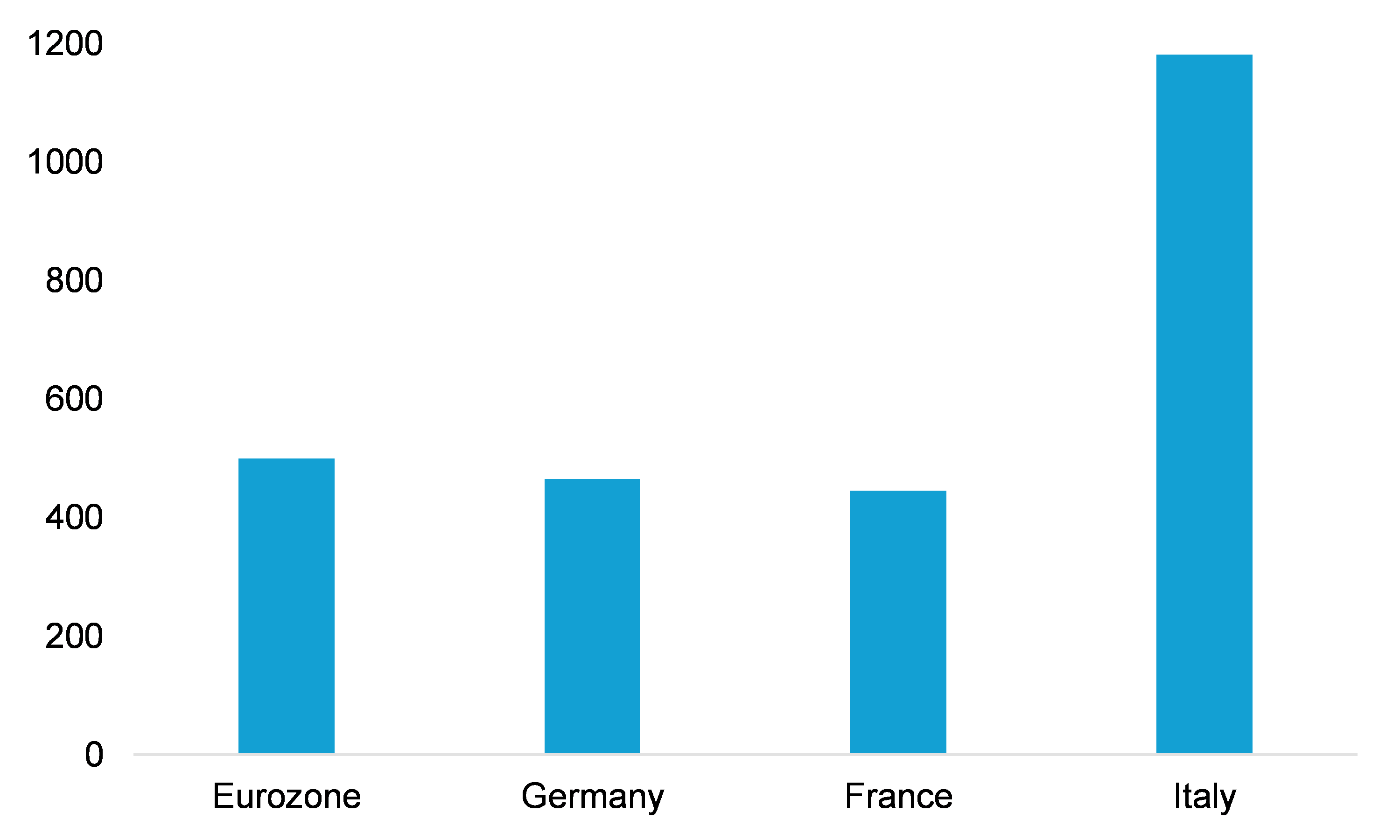

In 2022, the deterioration in consumer confidence could lead to EUR70bn in lost consumption, or close to EUR500 per household in the Eurozone.

Following Russia’s invasion of Ukraine, consumer confidence in key Eurozone countries has dropped to the lows last seen during the height of the Covid-19 crisis. Consumer confidence usually predicts trends in consumer spending with a lag of one to two quarters. Eurozone consumers already cut back their spending by 0.7% q/q in the first quarter of the year against the backdrop of fresh sanitary restrictions triggered by the omicron wave and Russia’s invasion of Ukraine. However, we believe the fall in consumer spending will continue in Q2 and Q4, with a respite only during the summer, thanks to a rebound in services consumption (mostly hospitality and travel).

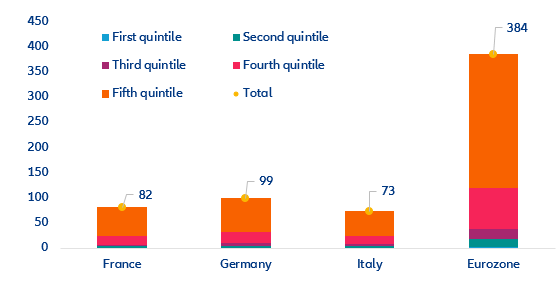

Overall, we calculate that the lost consumption explained by the deterioration of consumer confidence since the start of the war stands at EUR70bn (in real terms), or close to EUR500 per household in the Eurozone as a whole. This is what households will not spend in 2022 due to the lack of confidence - not considering the effect of any fiscal transfers. Across major Eurozone economies, the loss translates into EUR20bn for Germany (or EUR470 per household), EUR13.5bn for France (or EUR440 per household) and EUR31bn for Italy (or more than EUR1100 per household) - see Figure 1. In Italy, the loss is higher as the drop in consumer confidence since the end of 2021 has been twice as high as, for example, in France.

Figure 1: Lost consumption in 2022 due to deteriorating consumer confidence (EUR per household)

.jpeg)