EXECUTIVE SUMMARY

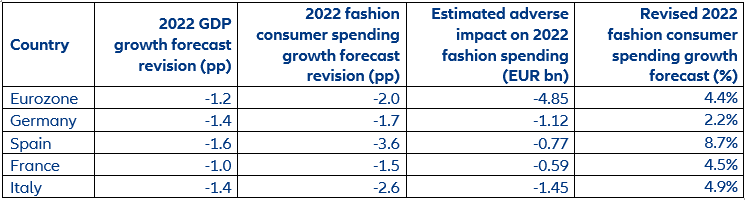

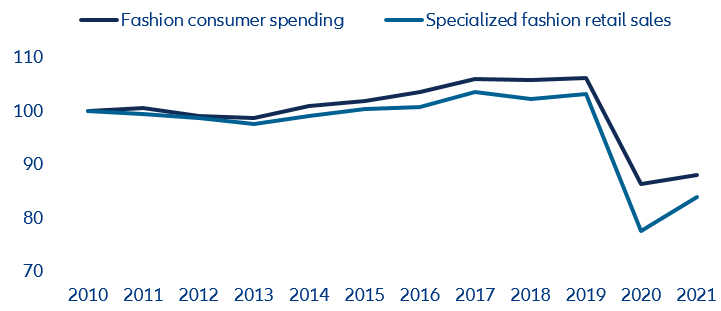

- European consumer confidence has taken a hit in the wake of the invasion of Ukraine. Amid lower economic growth, retailers could face a -EUR4.85bn hit to fashion consumer spending for 2022, with Italy (-EUR1.45bn) and Germany (-EUR1.12bn) facing the largest declines. We estimate fashion spending growth for 2022 will fall to +4.4%, down from +6.4% expected prior to the war, meaning it will remain far below pre-pandemic levels. On top of this adverse impact on sales growth, we anticipate gross margins to remain under pressure amid a context of durably high commodity prices.

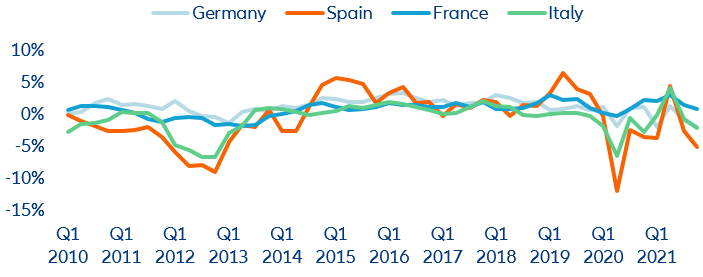

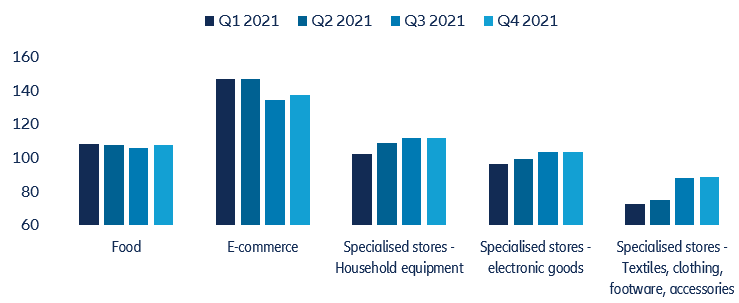

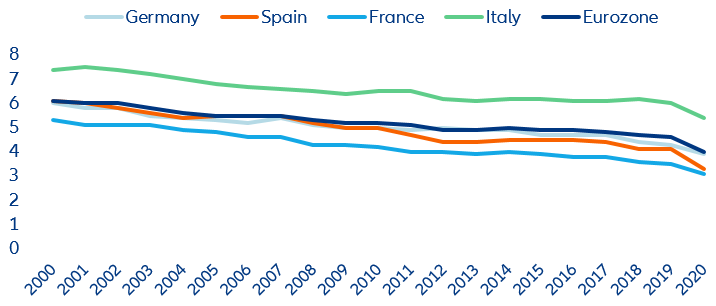

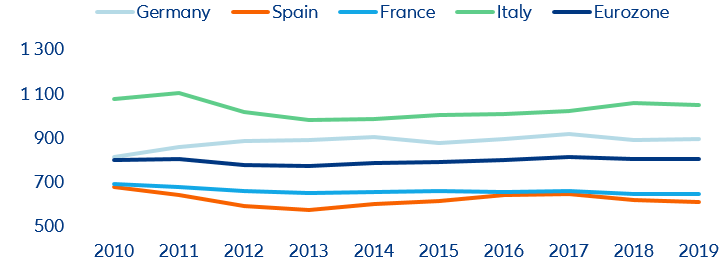

- Macroeconomic headwinds come on top of a structurally challenging market environment. Over the past 20 years, fashion spending declined from an average 6% of total household spending to 4% in 2020, while per capita spending on fashion has been receding in Italy, France and Spain. We believe the legacy of the pandemic is generally detrimental to specialized fashion retailers as consumers are increasingly opting for alternative distribution channels (online), consumption patterns (second-hand) or products (sportswear). By late 2021, monthly sales in fashion stores were still EUR1.7bn below their 2019 levels.

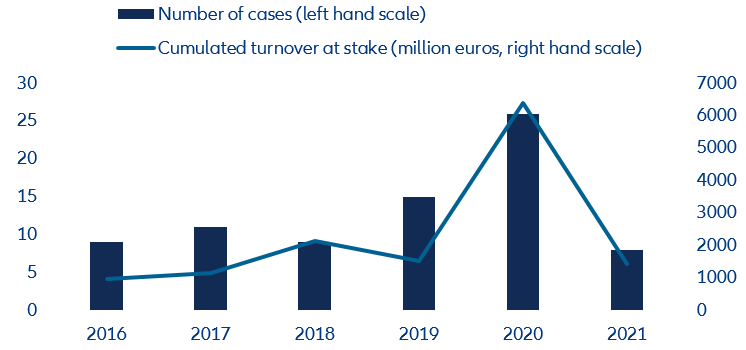

- Factoring in a modest recovery in sales, a high-cost environment and powerful structural changes at play, we anticipateinsolvency risks to remain elevated throughout 2022 and 2023. Since 2016 in Europe, there have been 78 insolvencies involving fashion retailers with an annual turnover higher than EUR10mn, for a total turnover at stake of about EUR14bn. This represents 27% of all retail insolvencies, and 31% of all retail turnover at stake over the period.

European consumer confidence has taken a hit in the wake of Russia’s invasion of Ukraine

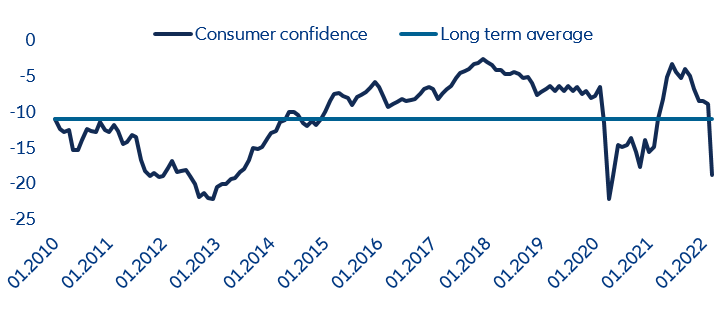

Russia’s invasion of Ukraine is casting a shadow over the recovery of some consumer businesses already hit hard by the Covid-19 pandemic. In March 2022, consumer confidence in the Eurozone fell below its long-term average for the first time since early 2021 amid worries over the war and an acceleration in commodity prices already materializing into higher fuel and food prices (Figure 1, next page).

Figure 1: Consumer confidence in the Eurozone