EXECUTIVE SUMMARY

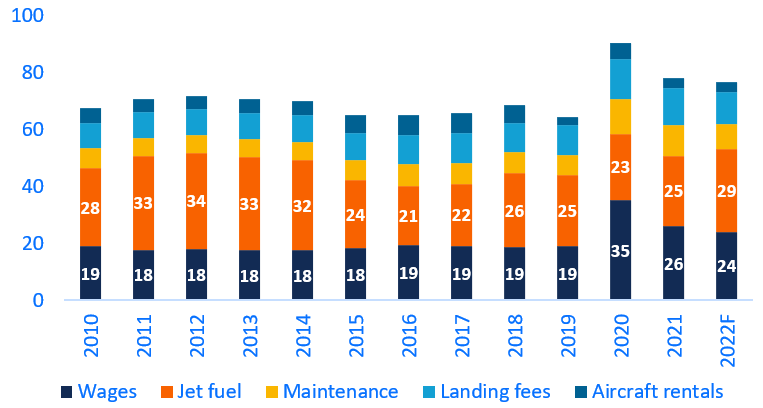

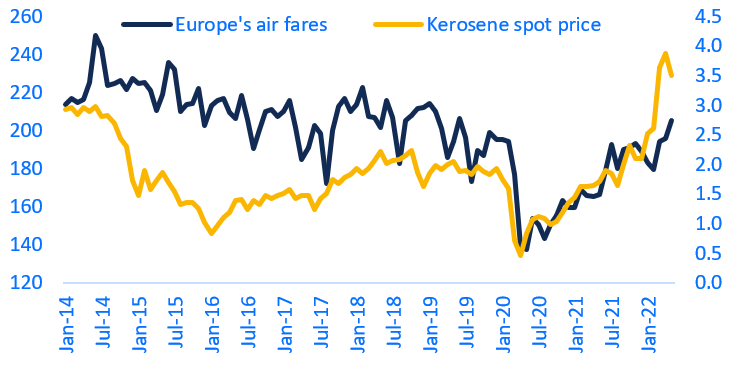

- Cancelled flights could become the new normal in Europe as airlines strive to protect margins amid surging jet fuel prices (+89% YTD). With wages accounting for 25% of revenue (vs. the global average of 19%), European airlines have little incentive to address staff shortages in the short term.

- As a result, airfares are taking off in Europe: After years of declines, we expect prices to increase by +21% in 2022. While this will boost revenue by +102% y/y in 2022, it will not be enough to prevent a third consecutive year of net losses (-USD9.7bn). European airlines won’t reach breakeven until 2023.

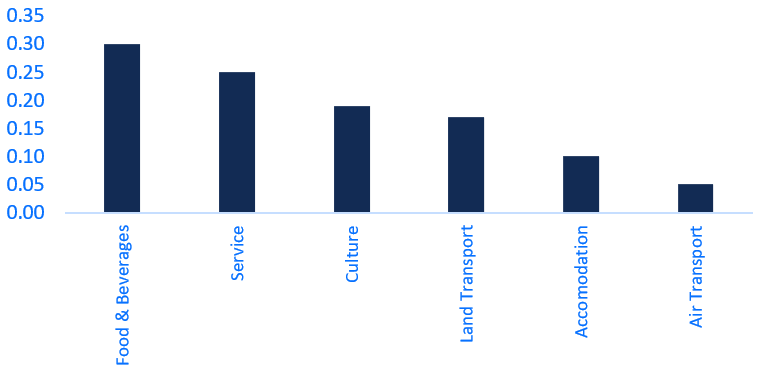

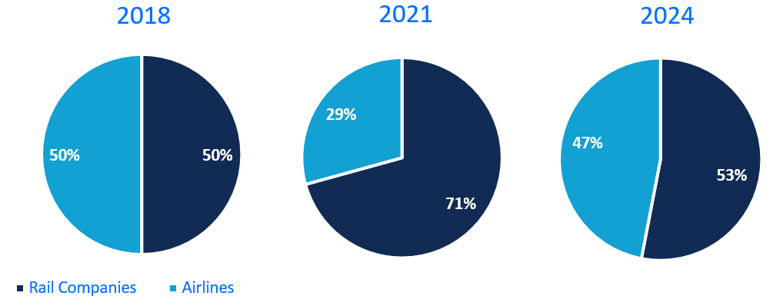

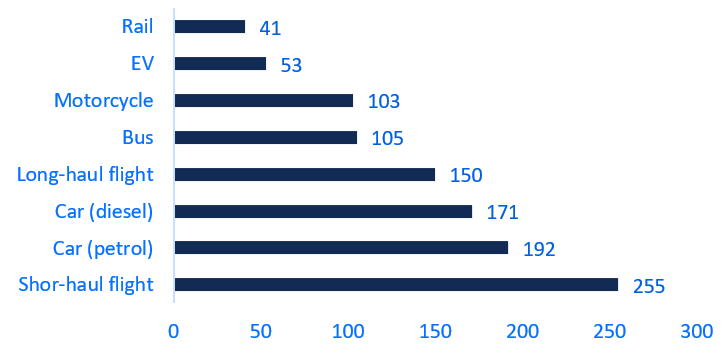

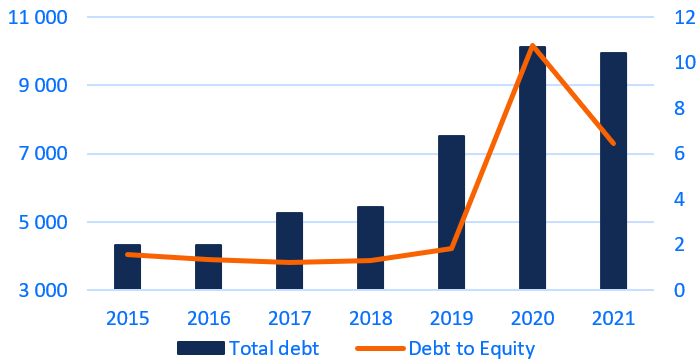

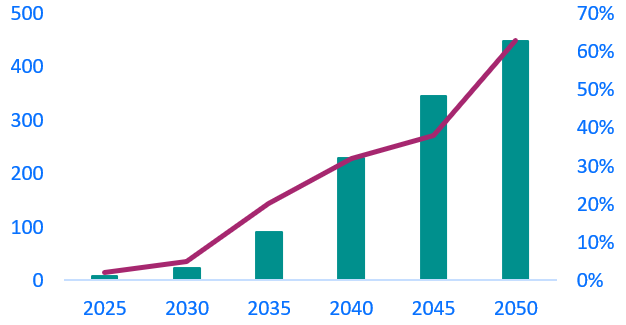

- In the long term, the green transition represents an even bigger disruption for airlines in Europe given the increasing competition from rail operators, which produce 85% less CO2 than planes and are state-owned (i.e. financially backed when investing). Renewing an old-generation fleet in a context of increasing rates and downgraded ratings will be pricey for a sector whose debt grew 1.4x in 2020. New regulations on the use of Sustainable Aviation Fuel (2.5x more expensive) will also further damage margins: the 38%/62% blend of SAF/kerosene mandatory by 2045 will increase fueling costs by +57%.

Cancelled flights could become the new normal in Europe as airlines strive to protect margins amid surging jet fuel prices.

With wages accounting for 25% of revenue (vs. the global average of 19%), European airlines have little incentive to address staff shortages in the short term. In 2020, lockdowns and border closures forced airlines around the world to take drastic cost-saving measures, including suspending dividends, reducing capex to the bare minimum, shifting to a more rational management of working capital and, the most criticized, furloughing personnel. While jet fuel has always been the biggest cost for airlines globally (around 25% of total revenues), its variable nature allowed for consumption to be reduced in proportion to the reduction in sales. In contrast, wages for staff, the second most significant cost for airlines, are fixed, equivalent to 19% of pre-pandemic revenues.

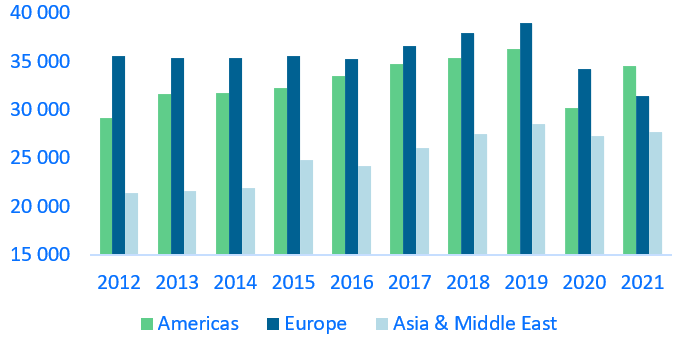

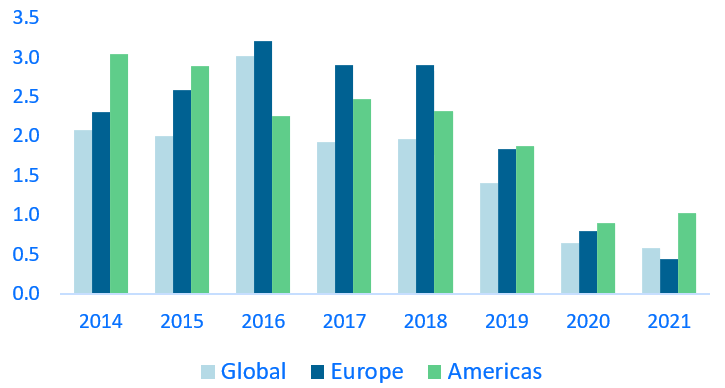

The wage bill is higher for European airlines (25% of revenues in FY2019 vs 19% for jet fuel), not only because of their larger-than-average workforce size but also because minimum salaries in Europe are relatively higher. This explains why European airlines had the lowest EBITDA margin in 2020 (-44% on average, vs -20% for the Americas and -10% for Asia & Middle East), and why they further reduced their staff by -8% y/y in 2021, even as peers in North and South America increased their staff by +14% y/y on average.

Figure 1: Airlines average number of employees by geography