EXECUTIVE SUMMARY

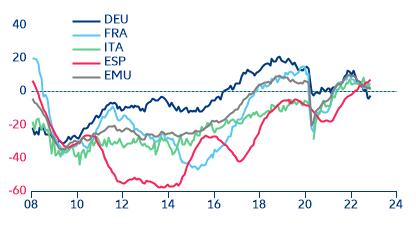

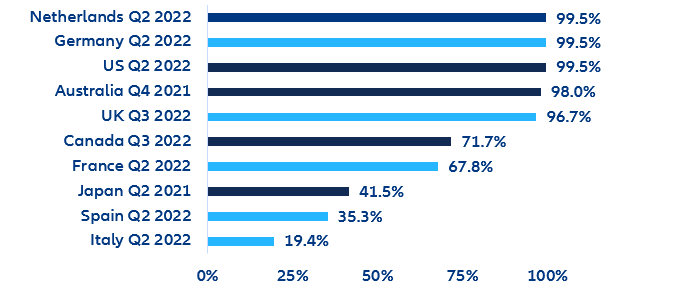

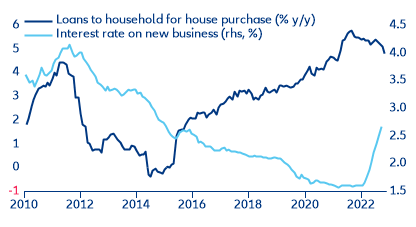

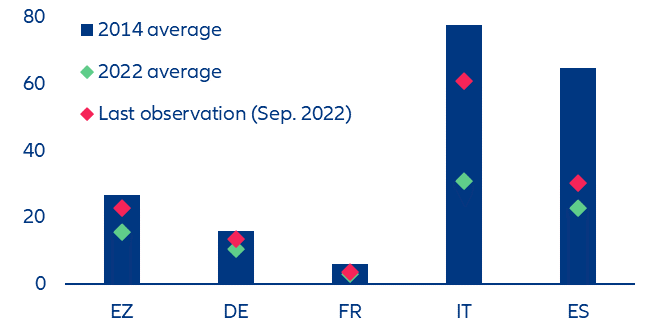

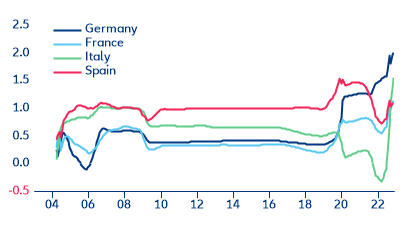

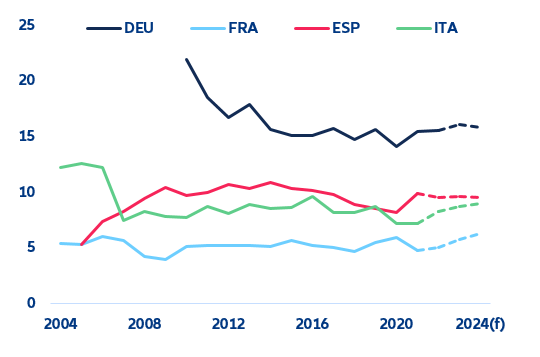

- Tightening financing conditions, slowing growth and soaring inflation are putting pressure on the European housing market. Swiftly rising mortgage rates have dramatically reduced home affordability at a time when home prices have already reached unsustainable levels in many European countries. With higher energy prices and inflation further eroding disposable income, credit demand for home purchases is bound to subside over the next quarters.

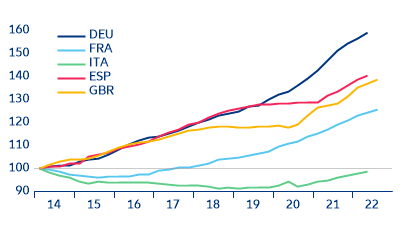

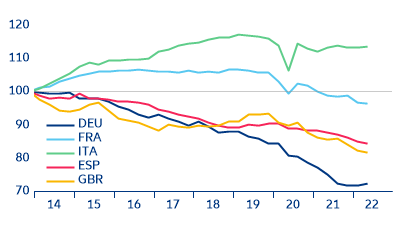

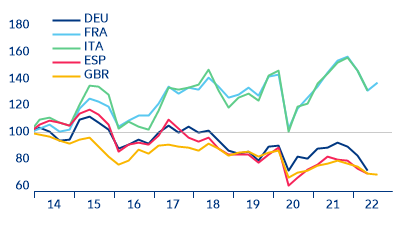

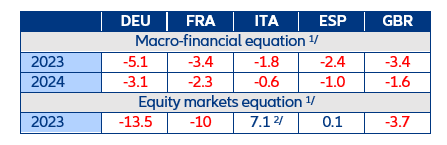

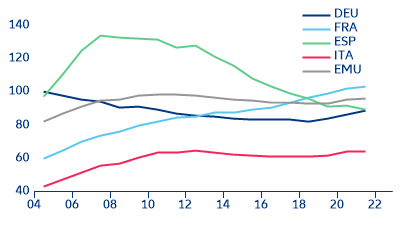

- Germany’s housing market is most at risk among the major European economies. Property prices increased by more than 50% in real terms since 2015 while home affordability has dropped by -30%. We project a price correction of -8% in real terms until end-2024, followed by around -5% in France and the UK. Price corrections in Spain and Italy, whose housing markets did not really take off after the 2000s’ bubble burst, will be less severe at around -3%.

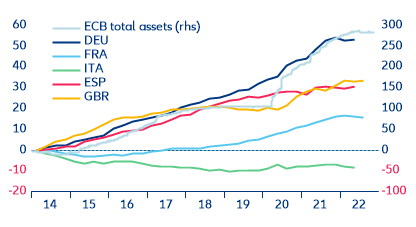

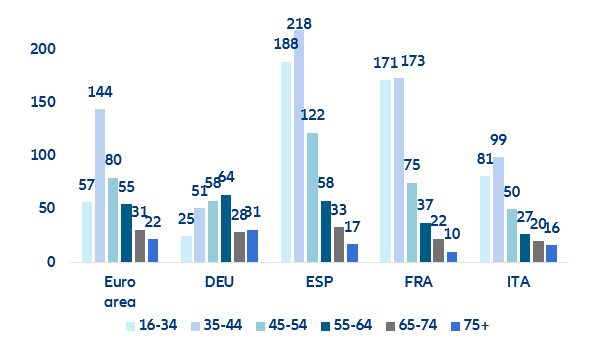

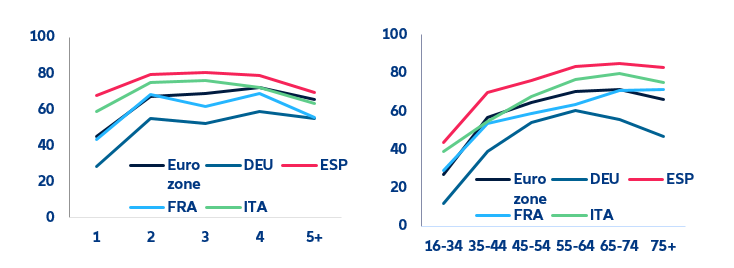

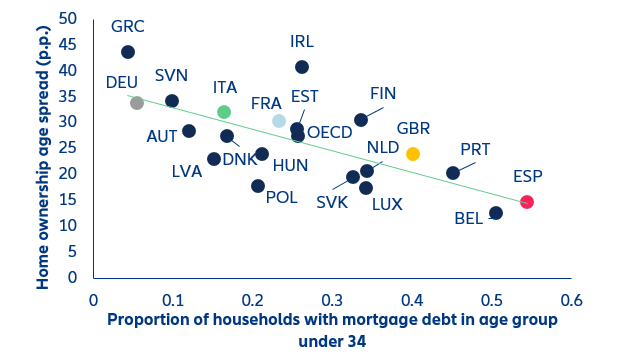

- However, the slump in house prices will not materially mitigate the growing social challenge of rapidly declining home affordability, especially for the younger generation. The massive expansion of money supply since the mid-2010s due to quantitative easing inflated prices of non-productive investment in areas that are highly collateralized, such as real estate. Thus, home affordability for younger generations and vulnerable households will become an increasingly pressing public policy issue.

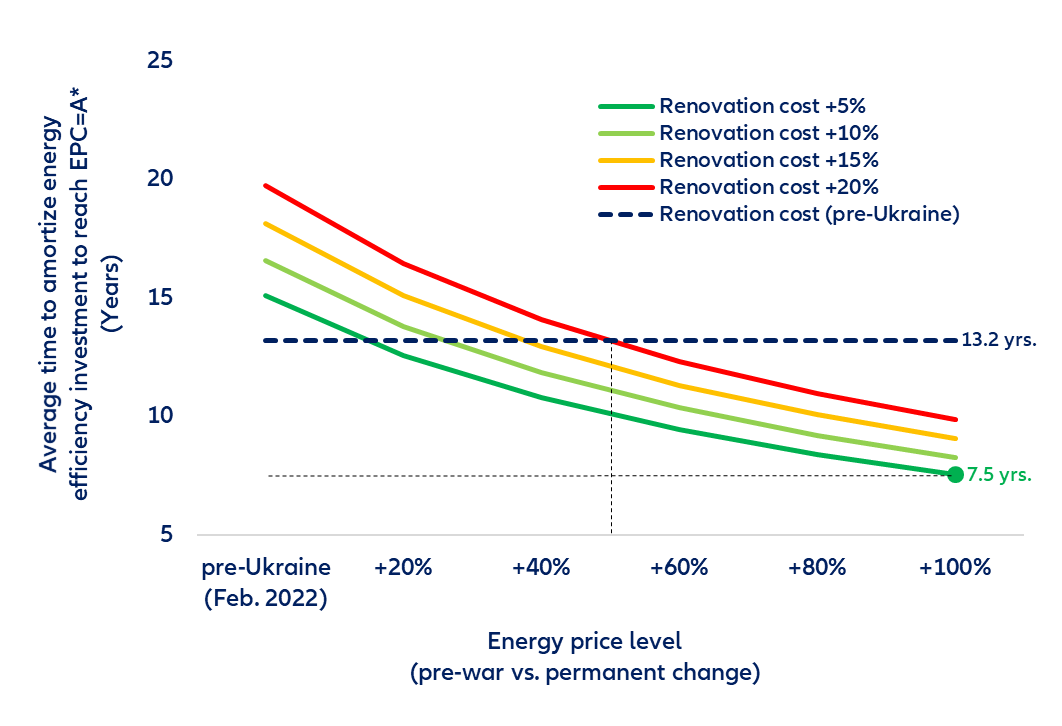

- At the same time, soaring energy prices, higher construction costs and rising interest rates could also challenge the European “renovation wave”. Unlike after the 2008 financial crisis, to address this, policy interventions need to be geared towards social and green aspects. We find that a combination of increasing the supply of housing and scaling up public support for vulnerable households could strengthen households’ incentives to invest in energy-efficiency measures, advancing one of the key goals of the EU Green Deal.

European households hit by higher mortgage interest-rate burden as the economy continues to slow.

Tightening financing conditions, slowing growth and soaring inflation are putting pressure on the European housing market. Although 2022 has been the year of price corrections across many markets, the implications of housing make it one of the most sensitive and unique sectors. For many, housing is the main form of investment, but even when not owned, real-estate-related payments (be it for rent or mortgage loans) take up a large part of monthly incomes, and housing is a basic social need.

While the overvaluation of real estate is a global concern, Europe is particularly affected by the current energy crisis and its impact on real incomes (which were declining even before Russia’s invasion of Ukraine). As Europe slides into recession, rising interest rates and higher energy costs have put purchasing a home out of reach for most households, adding to pre-crisis price pressures resulting from disrupted supply chains for construction materials. And the effects on house prices vary across the Eurozone.

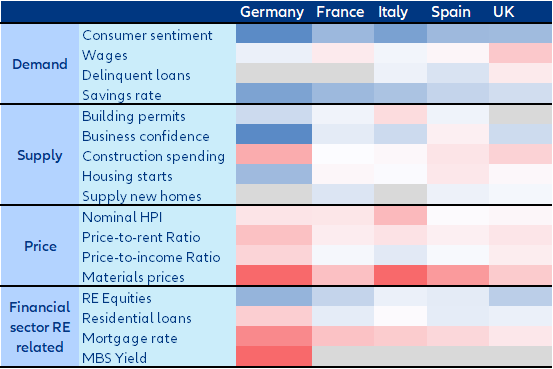

In this paper, we analyze the current developments in residential real estate in the largest European countries based on four factors: demand, supply, prices and financial conditions. We then project the scale of the potential price correction and assess the impact on home affordability, with a focus on the implications for the young generation and the green transition.

Table 1. Heatmap of the yearly changes in key variables for residential real estate. Latest available date for each indicator (z-scores)*