Executive Summary

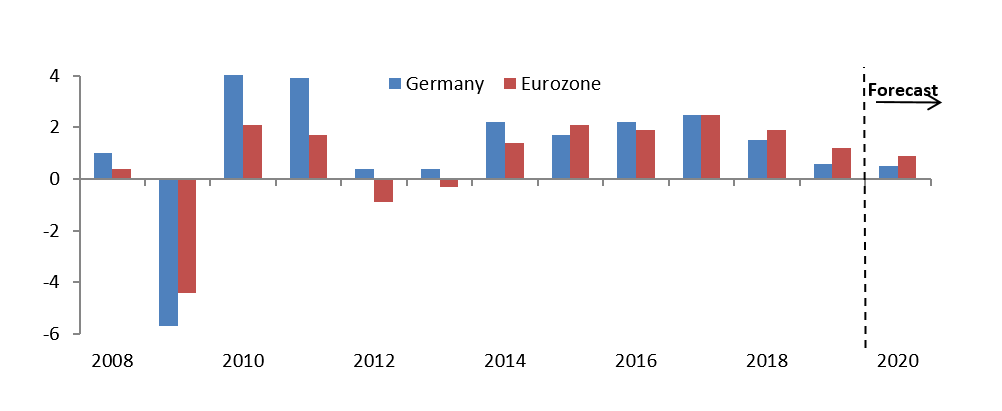

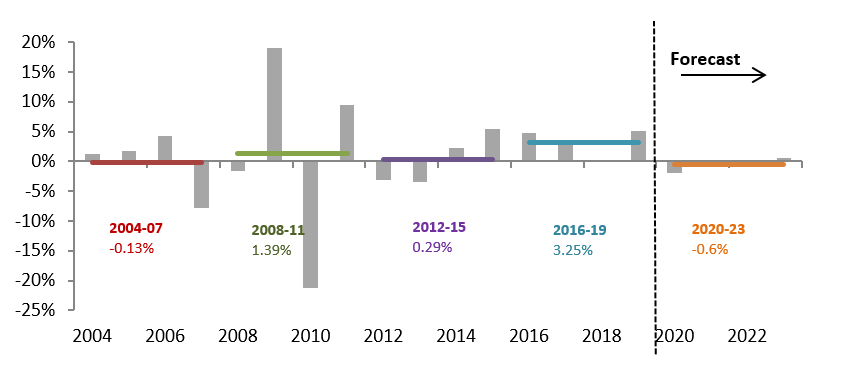

- Recession avoided in 2019, but no rebound on the cards for 2020. At +0.6%, about half the rate for the Eurozone as a whole, German GDP grew at the slowest pace since the region’s sovereign debt crisis. We do not expect 2020 to bring much relief with GDP growth likely to slow marginally to a seasonally-adjusted +0.5%. Moreover the risk that Germany’s “golden” decade of uninterrupted economic growth – the longest period of expansion since reunification – will come to an end in 2020 remains on the table for now, given the cautious outlook for global trade and the automotive industry as well as lingering elevated political uncertainty over trade and Brexit.

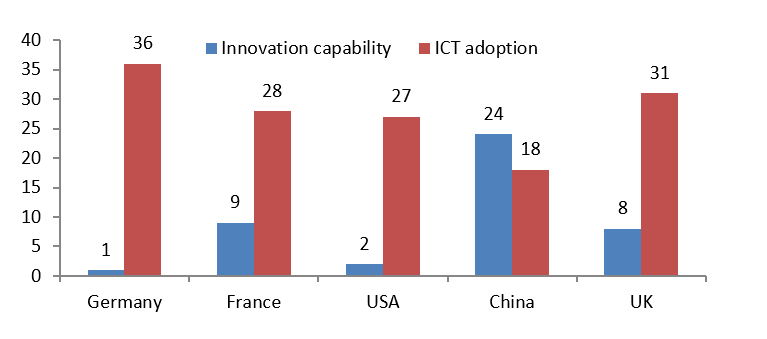

- The subdued outlook for the German economy provides a glimpse of a “stranded” future. Europe’s economic powerhouse is struggling to keep up with structural change, putting it at risk of becoming a “stranded economy” with its long-standing competitive advantage in industry and in particular the car sector becoming obsolete. While the German economy remains highly innovative, it is increasingly struggling to leverage its potential, given the lack of even a basic digital infrastructure, a growing digital skills gap and inadequate start-up funding.

- But a “lost” decade for Germany is not a done deal, yet. What is needed is a significant long-term investment plan focused on upgrading infrastructure, updating the education system, boosting research & development capabilities and creating a venture fund to co-invest in promising start-ups. But solely throwing money at the problem is not the solution. Instead the German economy’s digital catch-up initiative needs to be accompanied by a “simplification shock“ i.e. a notable reduction in red tape to allow for a better delivery of large-scale infrastructure projects, as well as to make life easier for corporates, particularly SMEs.

Recession avoided in 2019, but no rebound on the cards for 2020

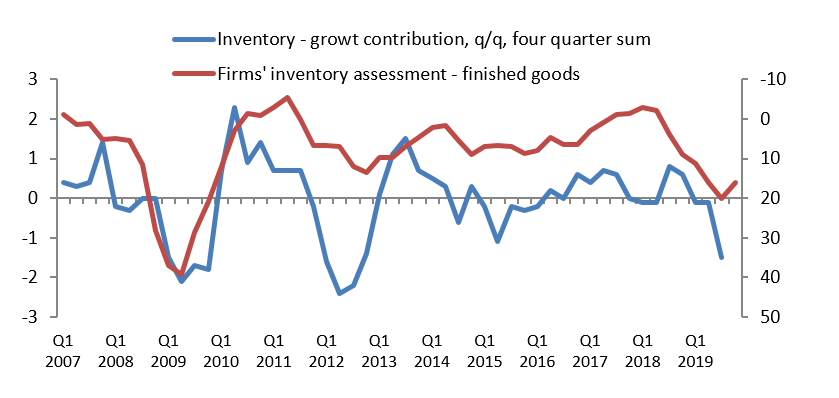

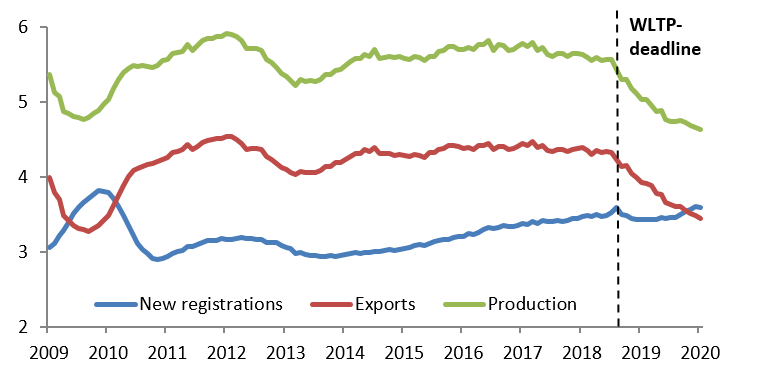

After four consecutive years of strong economic growth above the potential rate, the high-flying German economy experienced a sharp deceleration in momentum in 2018. The combination of some key characteristics of Europe’s largest economy – including its export-dependence, geographic export concentration (China, Italy and the UK account for almost 20% of exports) and large share of gross value added accounted for by industry – proved highly unfavorable in an environment of slowing global momentum and elevated political uncertainty. In addition, the dominance of the automotive sector turned from a core strength to major vulnerability, as production registered a marked setback, thanks to a homemade regulatory shock related to stricter emissions norms.

At 0.6%, about half the rate for the Eurozone as a whole, Germany recorded its weakest GDP growth rate since the region’s sovereign debt crisis in 2019.

Figure 1: Germany real GDP (%, y/y)