Executive Summary

- Tsai Ing-wen was reelected as president of Taiwan on Saturday 11 January in a landslide victory against runner-up Han Kuo-yu. Tsai’s party, the Democratic Progressive Party (DPP), also managed to keep its majority in the Legislative Yuan (albeit with a smaller margin).

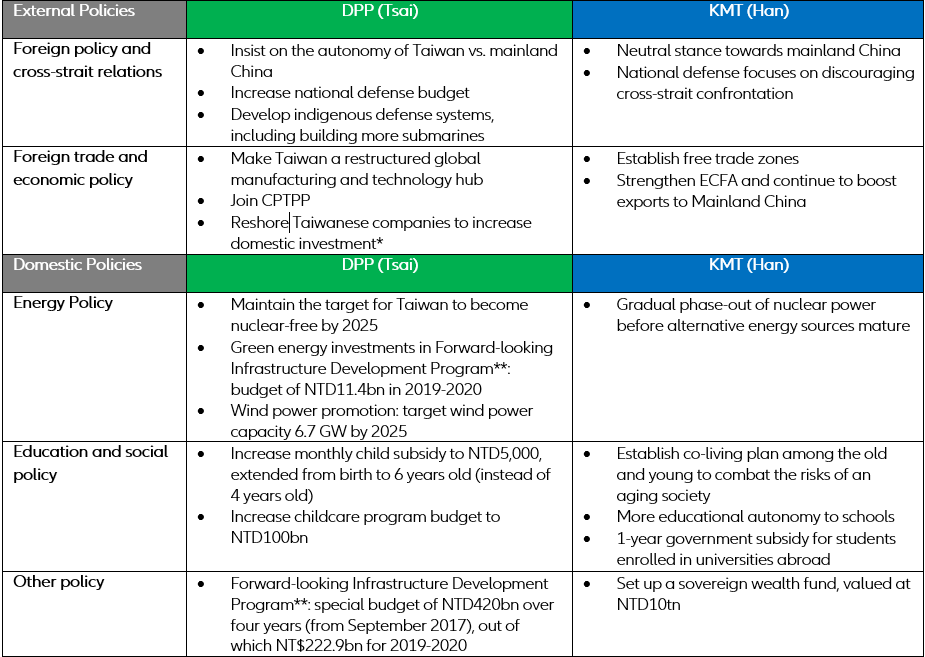

- These results should ensure policy continuity from Tsai’s first term. The biggest difference between Tsai and Han is in external policies. The reelection of Tsai means that Taiwan will keep affirming its willingness to decouple from China. We expect policy continuity, with prudent spending in energy, infrastructure and childcare, as well as more reshoring of Taiwanese businesses from abroad.

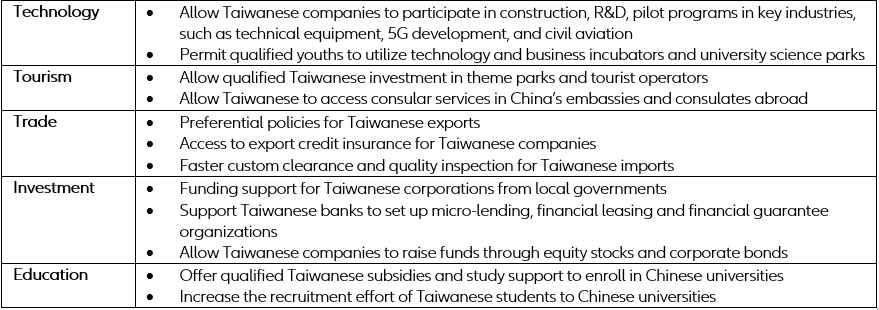

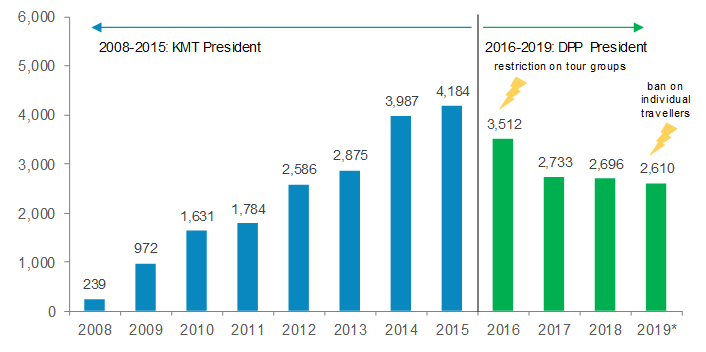

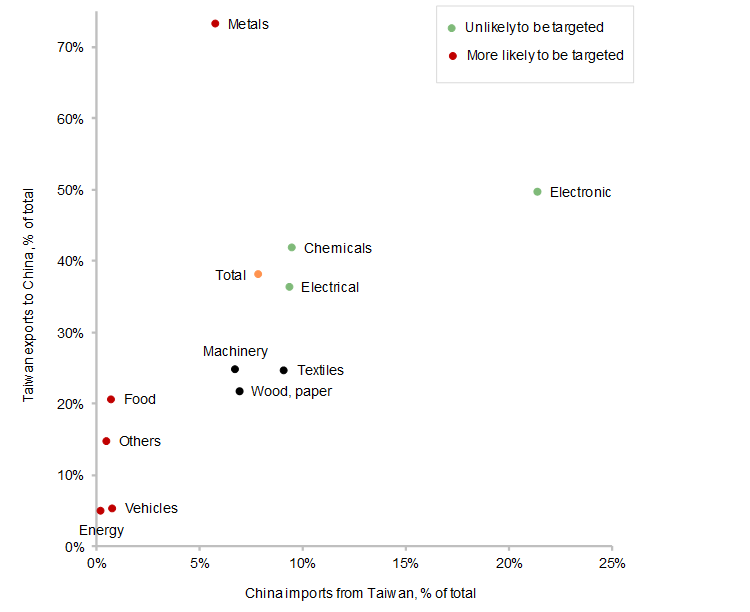

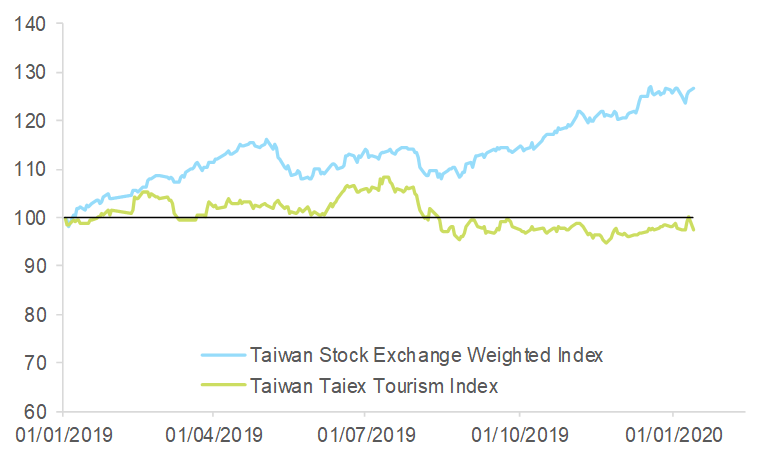

- The relationship between Taiwan and China is likely to remain choppy, with tourism being the main victim. However, a significant disruption in the relationship is unlikely in the short to medium term, in our view, given the economic dependencies. Notably, China depends on Taiwan for more than 20% of its imports in the electronic sector and 10% in the chemicals sector. From Taiwan’s perspective, sectors vulnerable to an intensification of tensions could be metals, food, vehicles and energy.

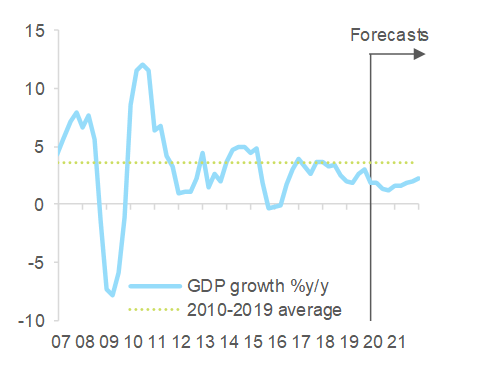

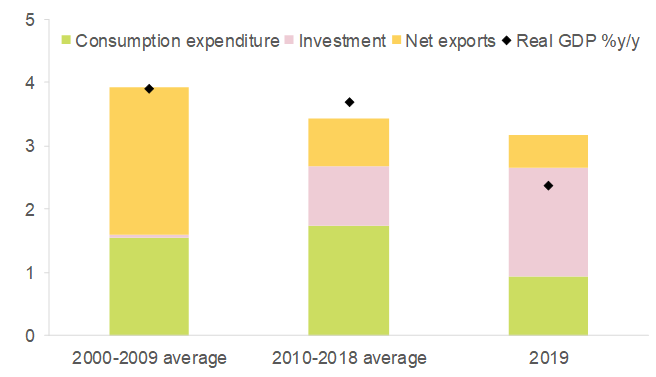

- Given that policy continuity is expected, we keep our economic outlook of a moderate rebound into 2021 unchanged. We expect Taiwan’s GDP to grow by +1.5% in 2020 and +1.9% in 2021, after +2.2% in 2019. A more benign external environment will be supportive, but the lack of a clear turnaround in the semiconductor cycle and the lack of policy easing will weigh on growth.

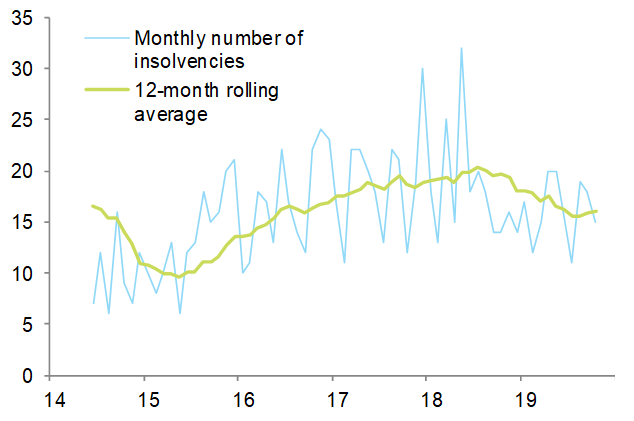

- What does this mean for companies? Companies in sectors such as tourism and retail might be exposed to additional downside risks. Conversely, a continuation of Tsai’s policies of reshoring and denuclearisation could benefit companies in the technology and green energy sectors. Overall, we are forecasting a slight increase of +2% in insolvencies in Taiwan for 2020, after two consecutive years of a declining trend.

After what has been considered one of the most dramatic campaigning periods leading to the general election on 11 January 2020, Taiwan has re-elected Tsai Ing-wen of the Democratic Progressive Party (DPP) as President for a second term. With 8.2 million votes (57.1%), Tsai received the highest vote count since Taiwan began holding direct presidential elections in 1996. The runner-up, Han Kuo-yu of the Kuomintang party (KMT), gathered 5.5 million votes (38.6%).

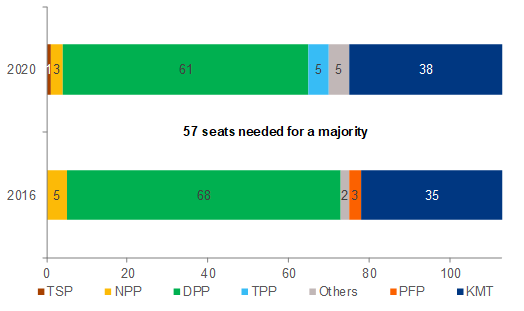

DPP also managed to once again secure its majority in the Legislative Yuan, albeit with a smaller margin, winning 61 out of 113 seats (compared with 67 seats in 2016). The election results were not too surprising, given that the latest polls before the election had predicted a relatively comfortable win for Tsai and an approximative lead of 10% for the DPP.

Indeed, the incumbent President and governing party have been supported by a relatively resilient economy, buoyant financial markets, and democratic protests in Hong Kong. The resurgence of support for Tsai could be seen as Taiwanese voters reaffiriming their willingness to decouple from mainland China.

Figure 1 – Legislative Yuan election results in 2016 and 2020