Executive Summary

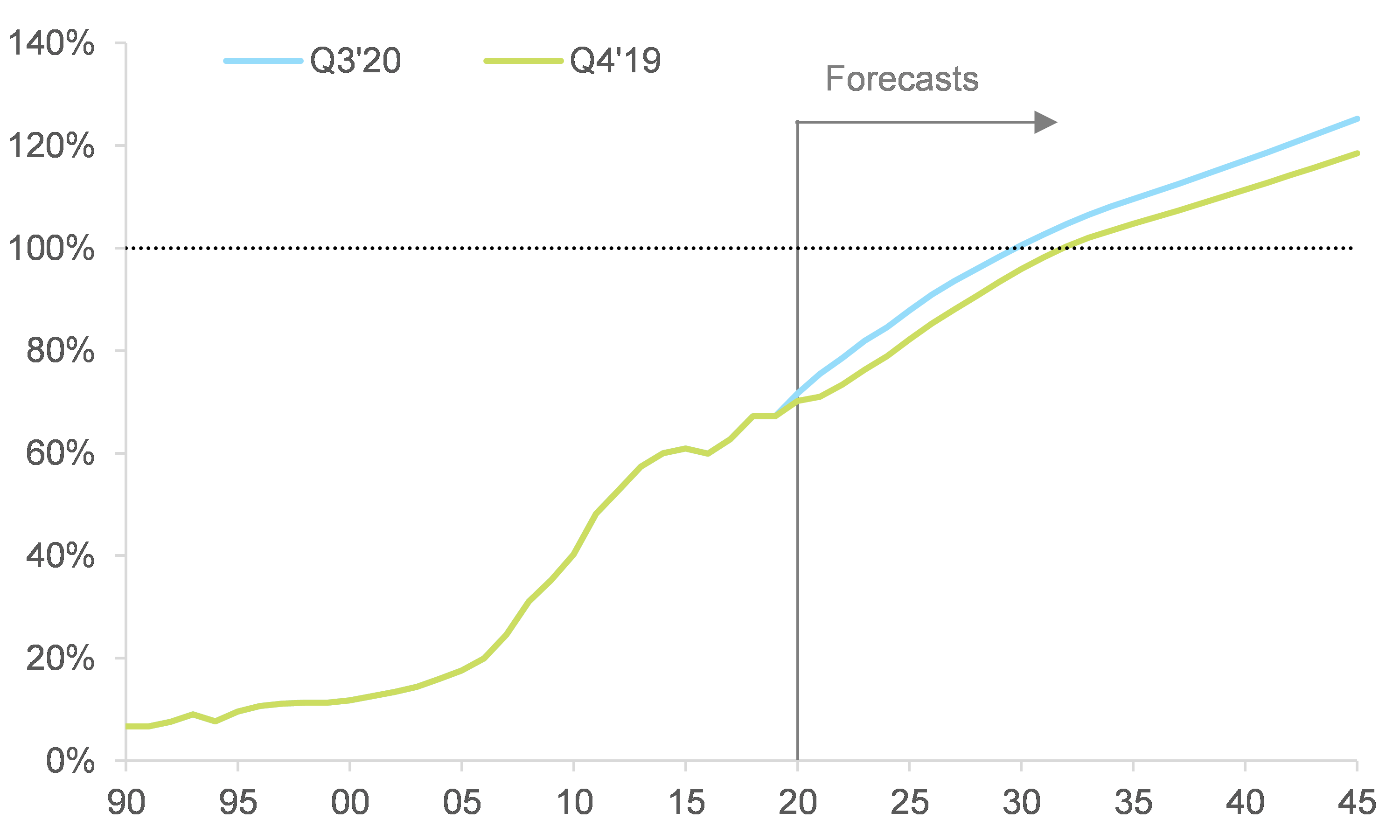

• The Covid-19 crisis could accelerate the shifting global balance towards Asia. We computed the world’s economic center of gravity (WECG) and found that it has been moving eastwards towards Asia since 2002. Looking ahead, with the Asia-Pacific region set to recover sooner from the Covid-19 crisis, the pace of this movement could be 1.4x faster than previously expected. By 2030, we forecast the WECG could be located around the confluence of China, India and Pakistan. In comparison, it was located in the Atlantic Ocean until 2007.

• China is a relative winner in the post Covid-19 world, with its GDP winning two years over developed economies (compared to the pre-crisis long-term path). China emerged from the Covid-19 shock earlier than the rest of the world and authorities are already planning for the long term. Indeed, we now expect China to catch up with US GDP in 2030 instead of 2032, as expected at the end of 2019.

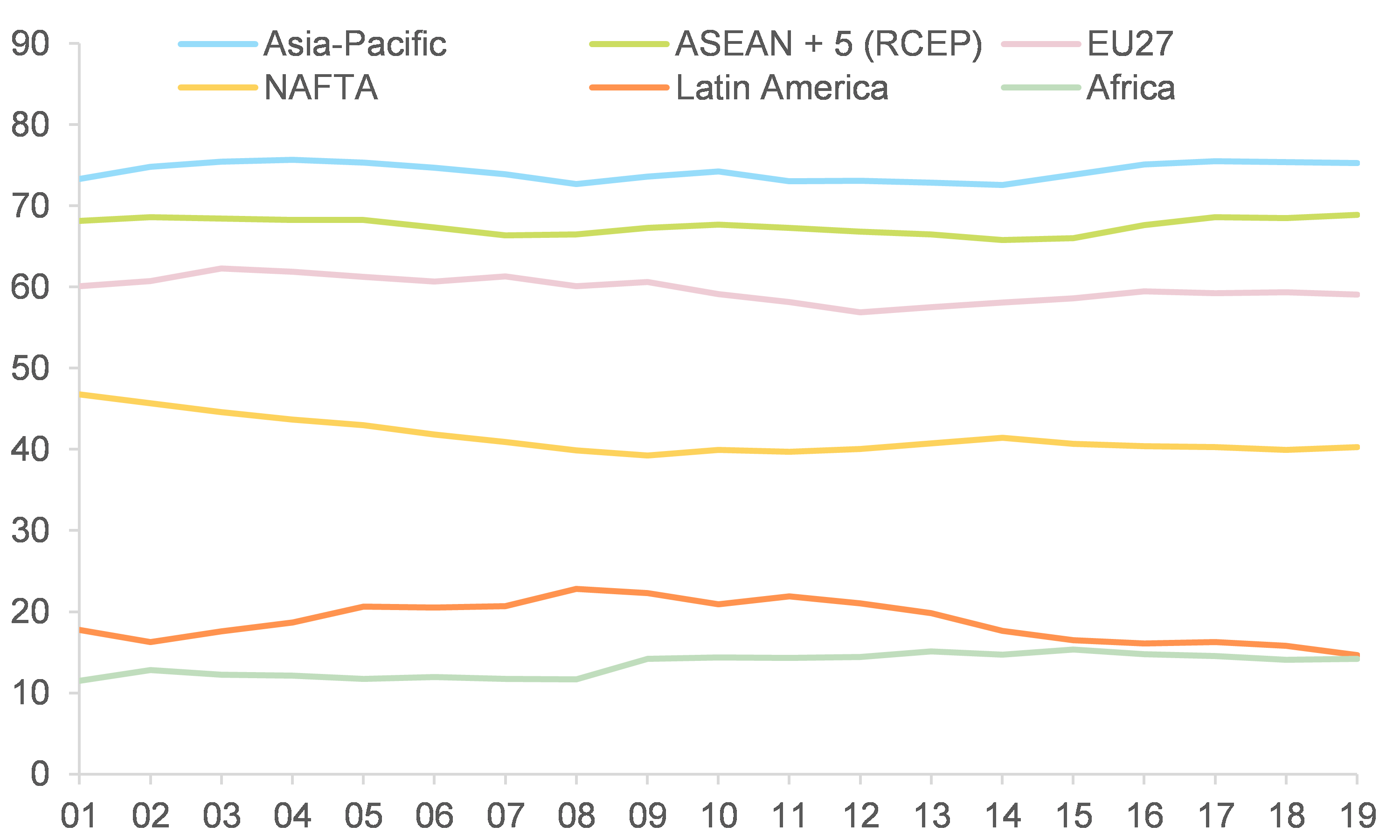

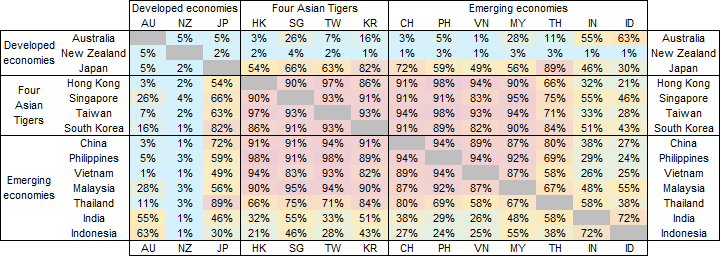

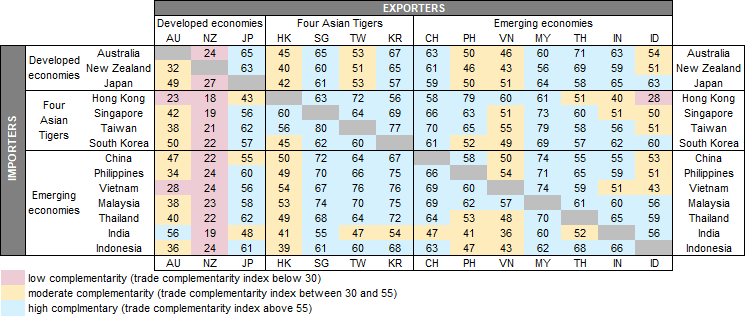

• This context, along with free trade agreements, will help strengthen Asia-Pacific trade integration. Intra-regional trade represents a large share of the region’s total trade (74% on average in the 2010s) and the relatively high complementarity between economies’ trade suggests that this situation is likely to be sustained. The recently signed Regional Comprehensive Economic Partnership sends a strong signal in favor of continued and strengthened trade integration in the region.

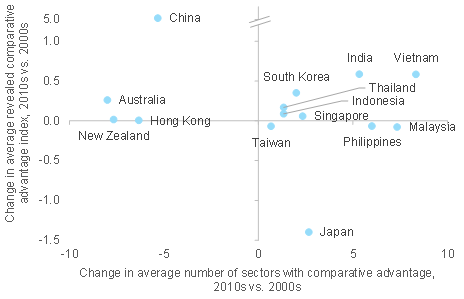

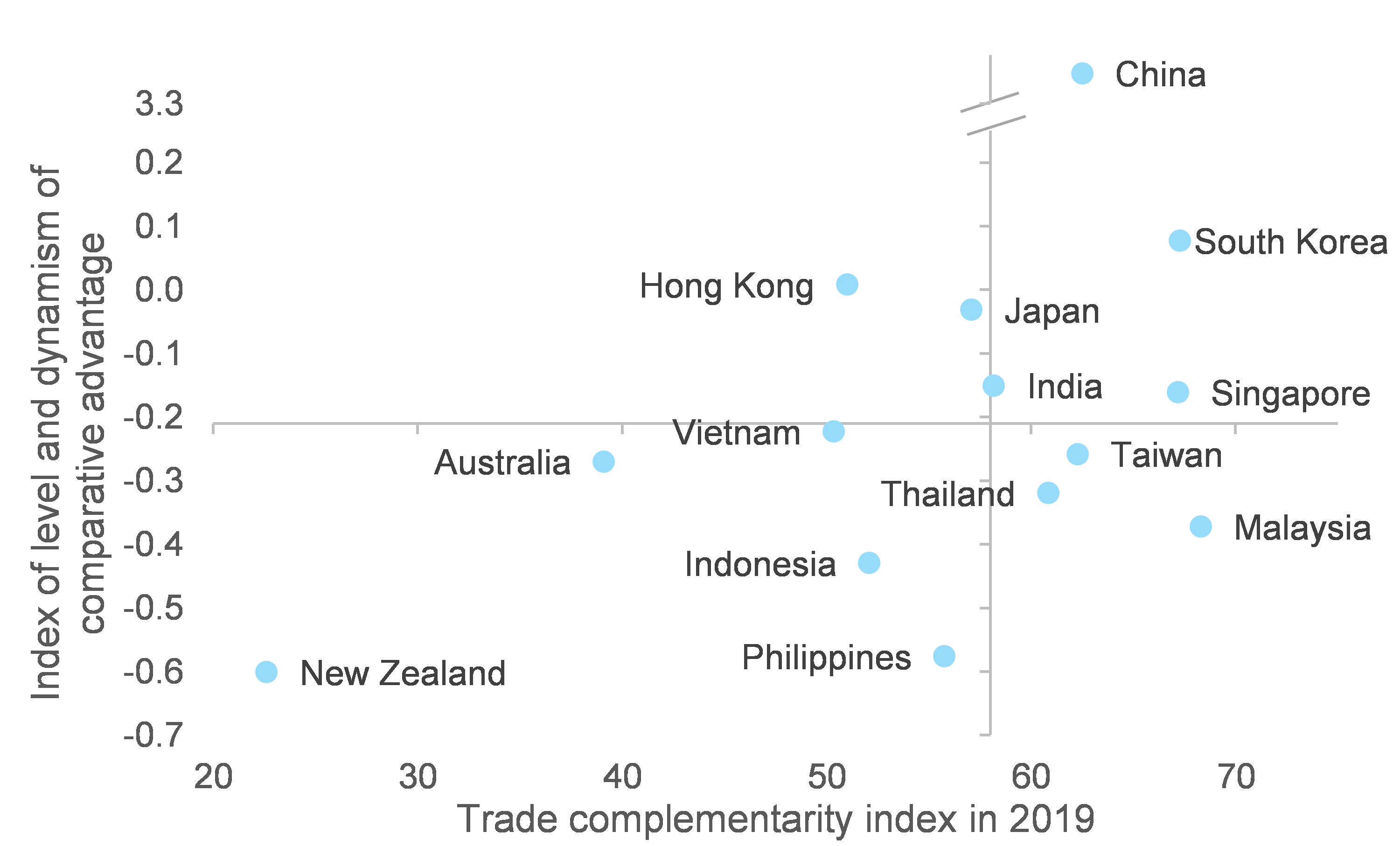

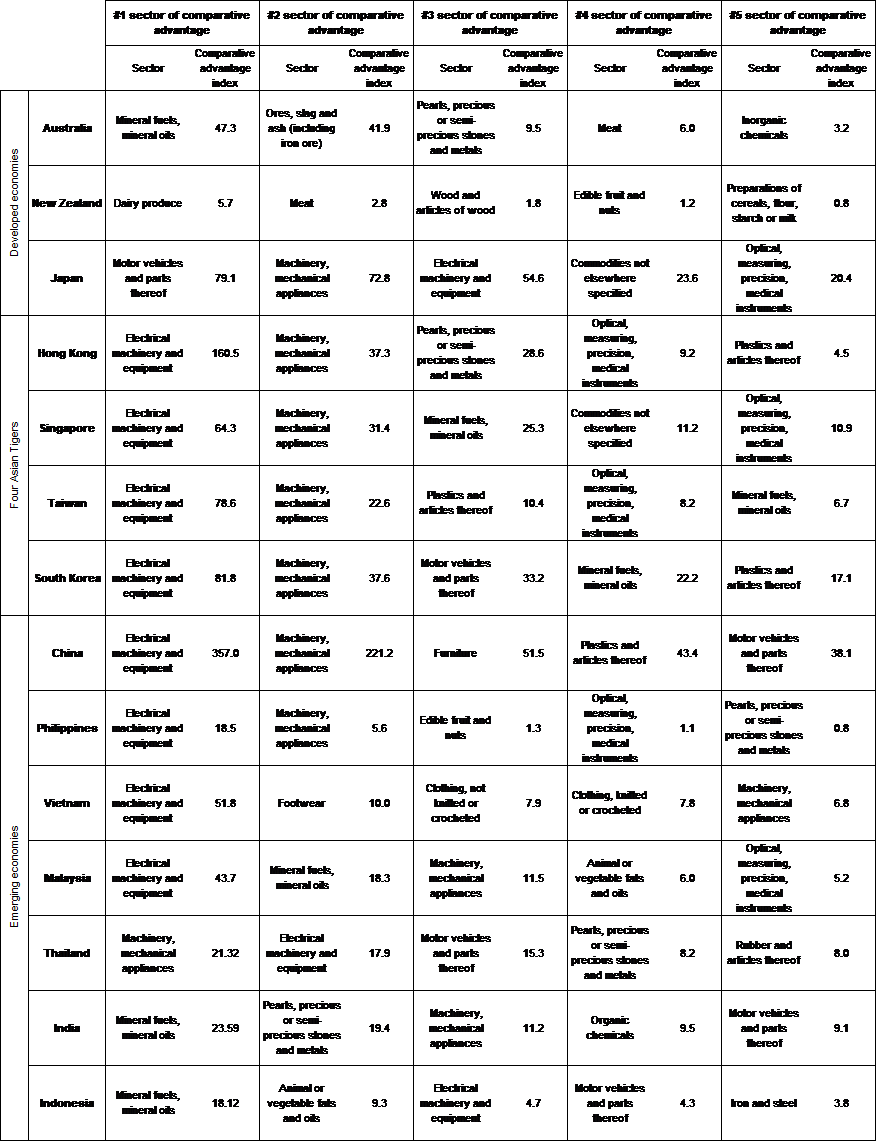

• Which countries would benefit most from further regional trade integration? China, South Korea, Singapore and Japan. Looking at export specialization and competitiveness and trade complementarity within the region, we find that exports from China, South Korea Singapore and Japan are particularly competitive and complementary with the rest of the region. China and Japan clearly exhibit higher competitiveness in the most-traded sectors globally.

• What does this mean for policymakers and companies? The challenge will be to navigate this gradually shifting balance in the global economy, and more specifically the US-China rivalry. For many economies (e.g. the EU), the aim will be to define a commercial strategy with Asia while preserving the alliance with the US. Companies should pay attention to the potentially differing competitive environments across regions as trade agreements in Asia-Pacific sometimes have less restrictive standards. From a sectoral perspective, expect further trade and investment integration in mechanical appliances and electrical equipment in Asia.