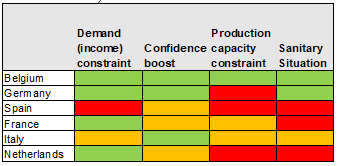

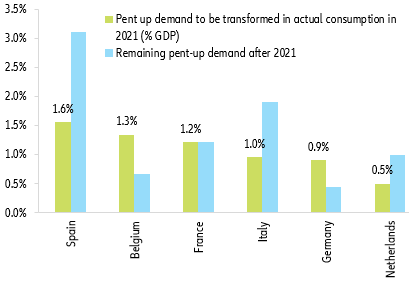

The strong rebound in European Q2 GDP growth highlights that there is significant room to grow in the sectors most exposed to Covid-19 restrictions. We expect unleashed pent-up demand to provide a boost to these sectors through 2021, especially in Spain, France and Belgium. One major driver of pent-up demand, and in turn consumption growth, will be the rebound of consumer confidence above pre-crisis levels, especially in the context of significantly high household savings. Several models show that consumer confidence can be a good predictor of consumption in the US and the Eurozone and we previously found that the recovery of consumer confidence to pre-Covid-19 levels would explain up to one third of the consumption increase in France in 2021[3]. Our extended quantitative analysis[4] also validates the predictive power of household confidence for consumption growth in Belgium, Germany, Spain and Italy.

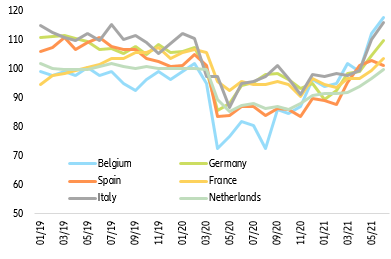

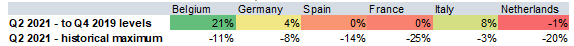

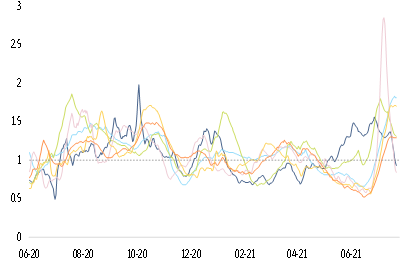

After the grand reopening in Q2 2021, consumer confidence has soared well above pre-crisis levels (+21%) in Belgium but also in Italy (+8%) and Germany (+4). In Spain and France, the indicator only returned to its pre-Covid-19 levels, signaling a more moderate boost to consumption (see Figure 1). When compared with historical maximums, confidence levels in France andthe Netherlands actually stand well below their historical peaks (25% and 20%, respectively), hinting at strong potential for further confidence boosts (see Figure 1 and 2).

In this context, the accommodation and food services sectors (2.7% of European GDP) show strong catch-up potential for summer 2021. Despite the absence of most international guests, and operating at 25-30% below 2019 activity levels in H1 2021, the accommodation sector (1.8% of final consumption spending of European households) is enjoying a significant rebound in H2 2021 with the gradual lifting of restrictions. Indeed, the summer season accounts for 30-50% of annual turnover in countries such as France, Italy and Spain. In the same way, restaurants, cafés and bars have already begun enjoying a strong recovery in activity in H2 2021, driven by buoyant consumer appetite for food services they have long been deprived of and to a lesser extent major sports events (the European Football Championship, the Tokyo Olympics in August 2021).

Figure 1 – Consumer confidence indicator

After the grand reopening in Q2 2021, consumer confidence has soared well above pre-crisis levels (+21%) in Belgium but also in Italy (+8%) and Germany (+4). In Spain and France, the indicator only returned to its pre-Covid-19 levels, signaling a more moderate boost to consumption (see Figure 1). When compared with historical maximums, confidence levels in France andthe Netherlands actually stand well below their historical peaks (25% and 20%, respectively), hinting at strong potential for further confidence boosts (see Figure 1 and 2).

In this context, the accommodation and food services sectors (2.7% of European GDP) show strong catch-up potential for summer 2021. Despite the absence of most international guests, and operating at 25-30% below 2019 activity levels in H1 2021, the accommodation sector (1.8% of final consumption spending of European households) is enjoying a significant rebound in H2 2021 with the gradual lifting of restrictions. Indeed, the summer season accounts for 30-50% of annual turnover in countries such as France, Italy and Spain. In the same way, restaurants, cafés and bars have already begun enjoying a strong recovery in activity in H2 2021, driven by buoyant consumer appetite for food services they have long been deprived of and to a lesser extent major sports events (the European Football Championship, the Tokyo Olympics in August 2021).

Figure 1 – Consumer confidence indicator