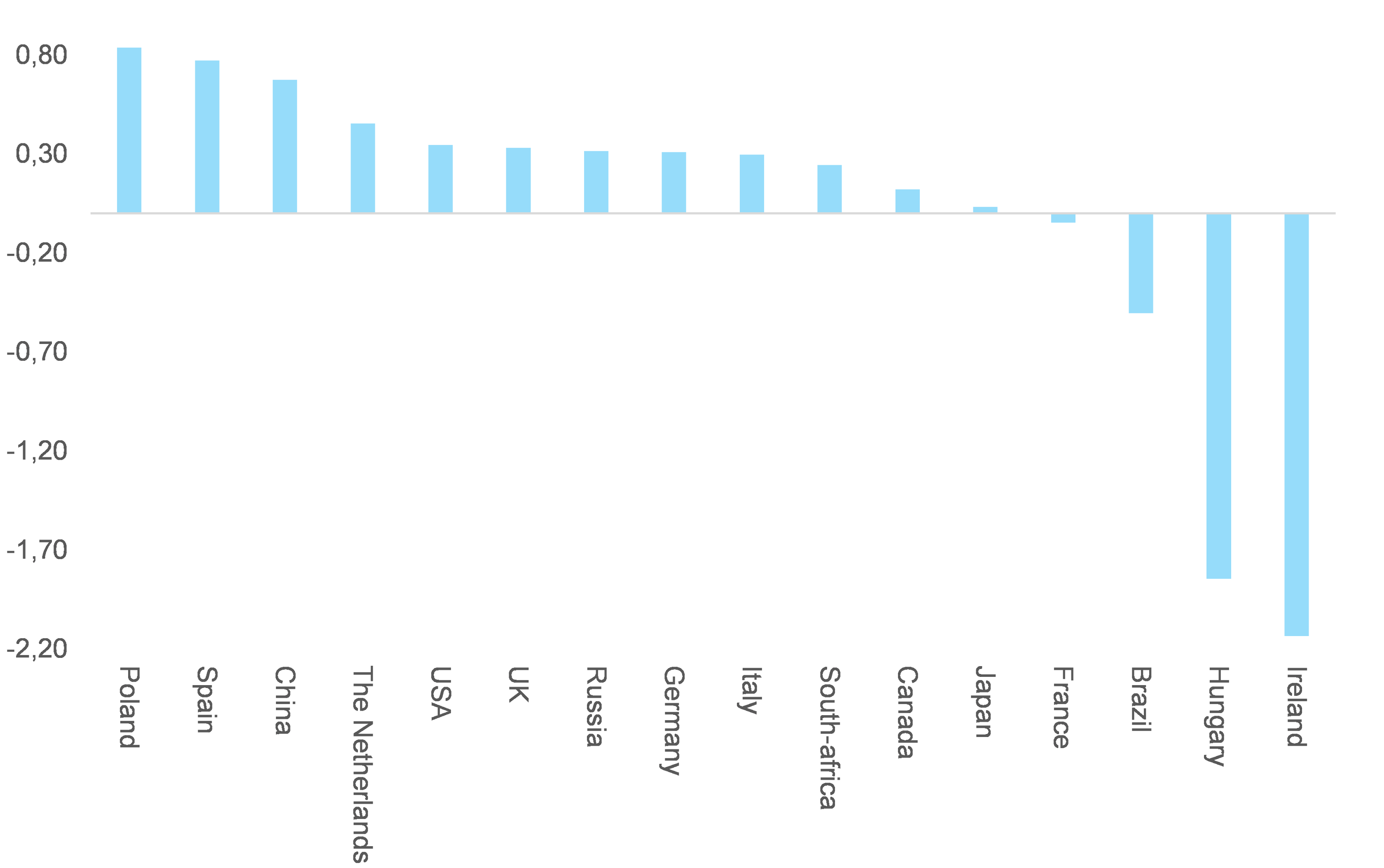

The majority of our panel with a corporate tax rate above 15% would benefit from such an agreement. However, countries with corporate tax rates below 15% would see their growth potential negatively impacted.

We find that

Poland would be the major beneficiary (+0.8pp from a 5-year potential of growth of 3.4%), followed by Spain (+0.77pp from an average potential of 0.7%) and China (+ 0.67pp from an average potential of 6.6%).

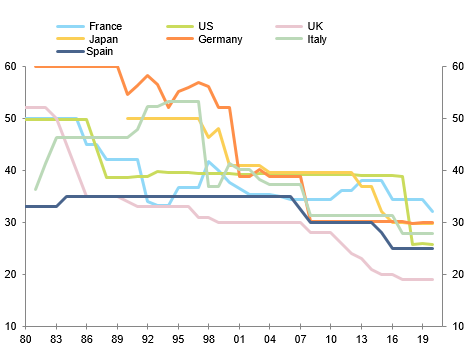

The US’s potential output would increase by 0.34pp by going from 1.80 on average between 2015-2019 to 2.1. For countries with a corporate tax rate above 25%, such as

Japan,

France and

Brazil, our analysis emphasizes that their potential growth variation gain is lower and almost negligible or even negative in Brazil’s case. For instance, France potential growth variation to set up a 15% minimum corporate tax rate would be near zero (-0.05pp from an average potential of 1.3%). In this context, it is clear why this category of countries insists on raising the proposed global minimum tax rate. In general we consider that an average speed of convergence would be required to reach the new level of growth potential eventually mirroring a new state of competitiveness or attractiveness. In

the US case for example, registering a +0.3pp positive shock on the 1.8% potential of growth would require between 2 and 3 years to be fully visible.

Countries with a corporate tax rate below 15% would largely lose from a global minimum tax rate. Ireland - whose current tax rate is 12.5% - could see its potential growth drop by -2.14pp (from a potential of growth of 5.9%). This major drop should be interpreted with cautiousness but it can give an idea of why Dublin has opposed a European tax harmonization. Likewise,

Hungary – whose current tax rate is 9% - could see its growth potential reduced by -1.85pp (from an average potential of growth of 2.9%).