- Europe’s Next Generation EU (NGEU) – Forget me not! Europe’s Green Deal Industrial Plan will not work without an effective NGEU implementation.

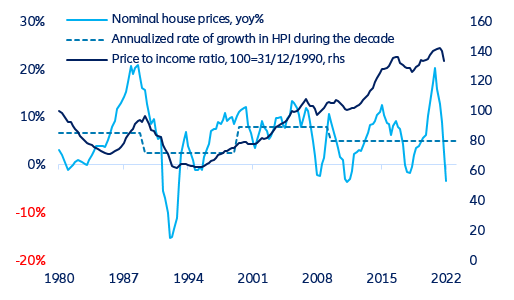

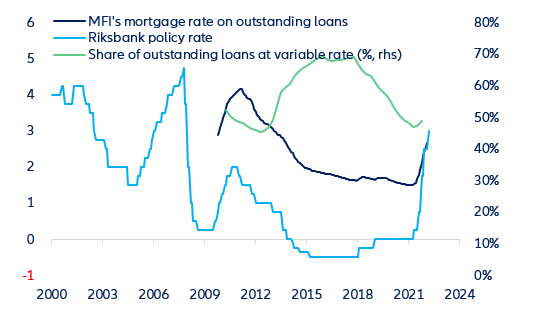

- Varning Sverige! Are we reaching the end of the hiking cycle? As the Riksbank struggles to control supply-side-driven inflation, tighter financing conditions are already creating havoc in the housing market. The monetary policy trade-off is becoming increasingly costly. Is Sweden a bellwether for the Eurozone?

- China – National People’s Congress: prudent economic target and harsher rhetoric on geopolitics. Chinese authorities have confirmed a higher GDP growth target of +5% for 2023 aimed at striking the right balance between policy support and structural reforms. However, a harsher rhetoric means no relief in sight for tense Sino-US relations.

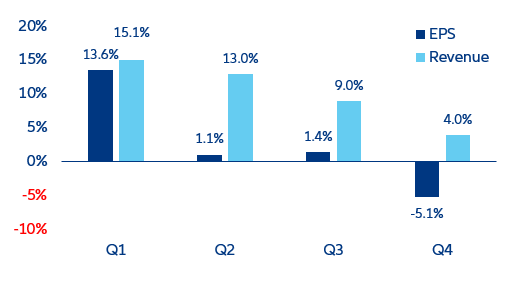

In focus – Earnings season: The end of the corporate party?

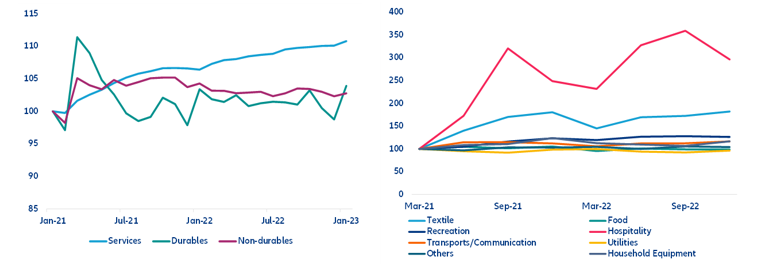

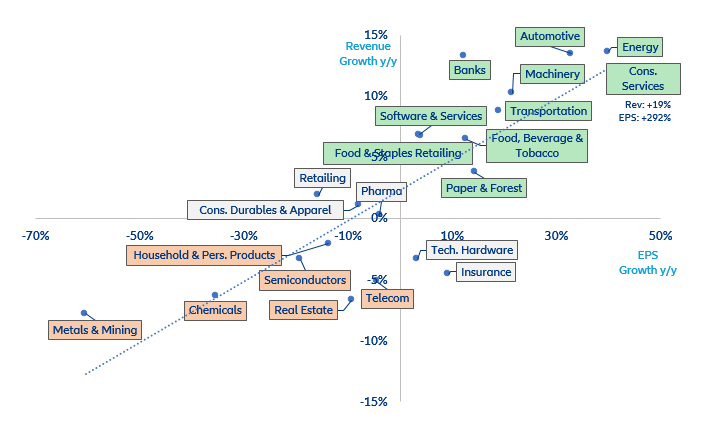

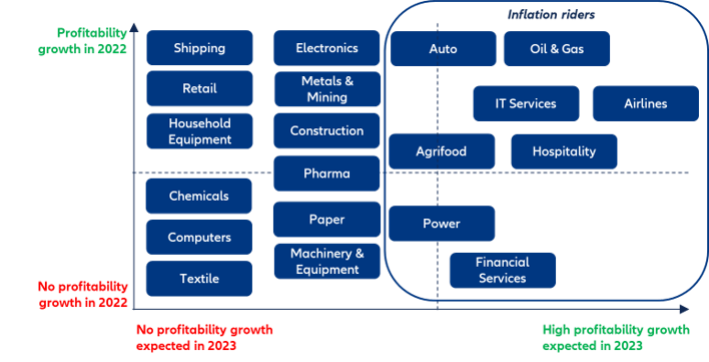

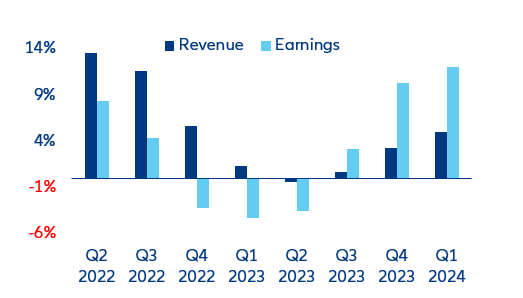

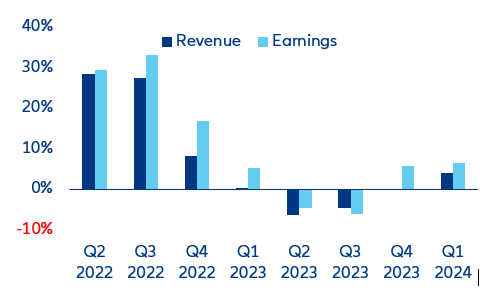

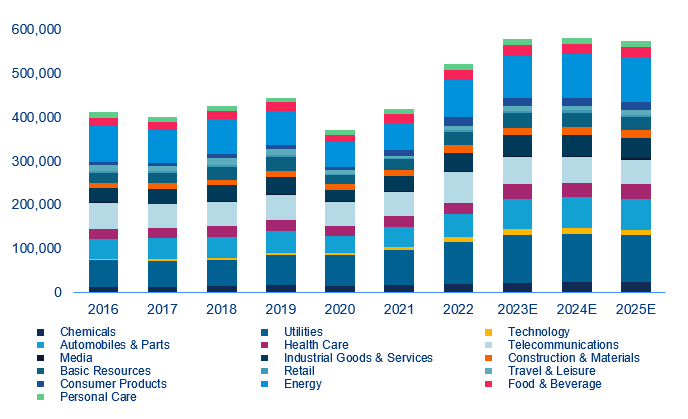

- Despite a general business deterioration in Q4, 2022 was a strong year overall for corporate earnings. Global revenues jumped by +11.7% y/y and earnings per share (EPS) by +4.3% y/y. 15 out of 23 sectors reported growth for both revenues and EPS, with oil & gas, transportation and hospitality being the biggest winners of the year.

- However, the excellent performance is set to reverse in 2023, notably for shipping and retail. The build-up of oversupply, capped pricing power, still-high input prices and waning demand will squeeze margins in some sectors. Conversely, consumer services (hotels & restaurants) and airlines should continue enjoying high booking rates as rising prices do not appear to be a deal-breaker for traveling.

- With no major revenue growth likely in the first half of 2023, protecting margins will be the top priority. Cost-cutting strategies such as restructuring and personnel rightsizing should continue in the near term, notably in the US, where profitability is declining more rapidly. However, we still expect further capital expenditures in 2023, mostly in sectors where a switch towards sustainable projects is needed the most (automotive, energy and utilities).