The insolvencies of major companies are adding pressure along supply chains. They not only put at risk clients by potentially disrupting their supplying, forcing them to urgently find (costly) alternatives, they also put their own suppliers at financial risk by not paying them - and forcing them to undertake long and expensive legal procedures. The larger the company filing for bankruptcy, the higher the risk of a domino effect.

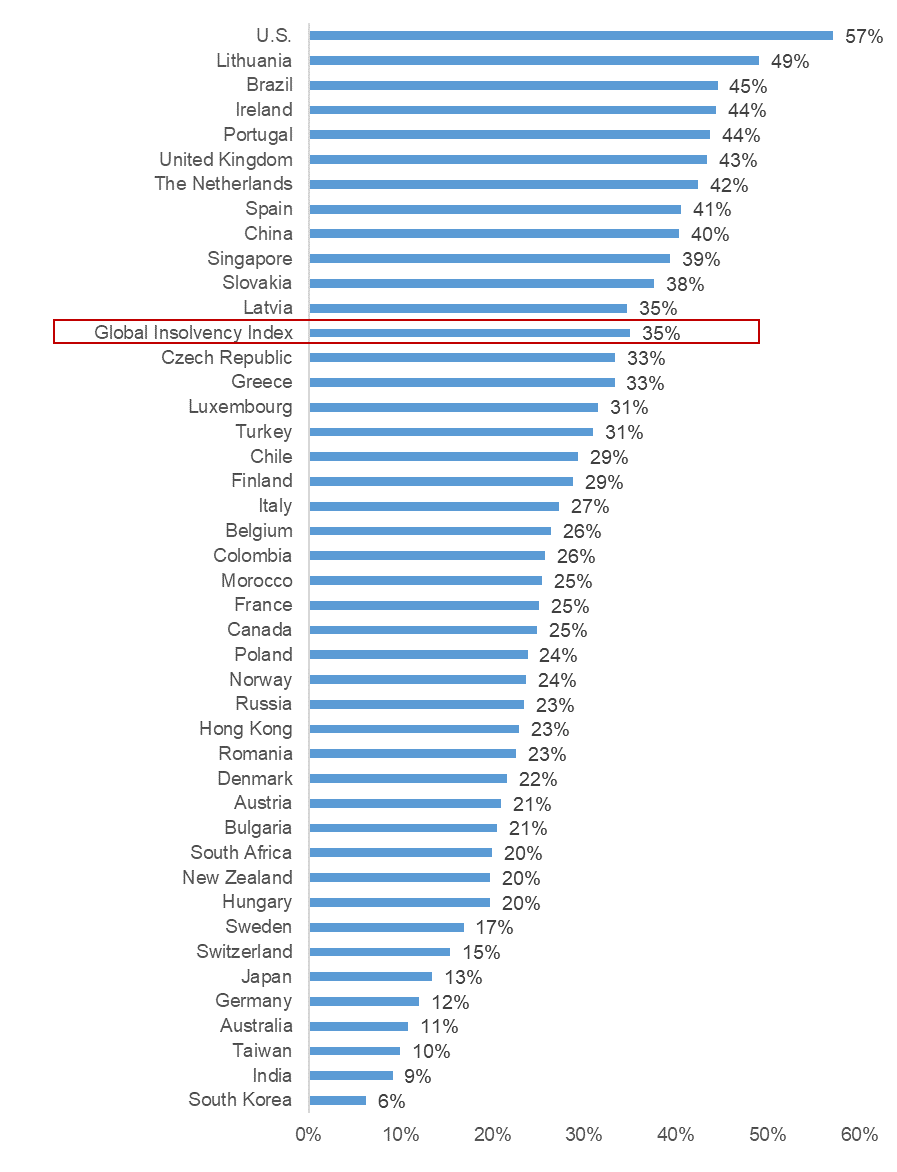

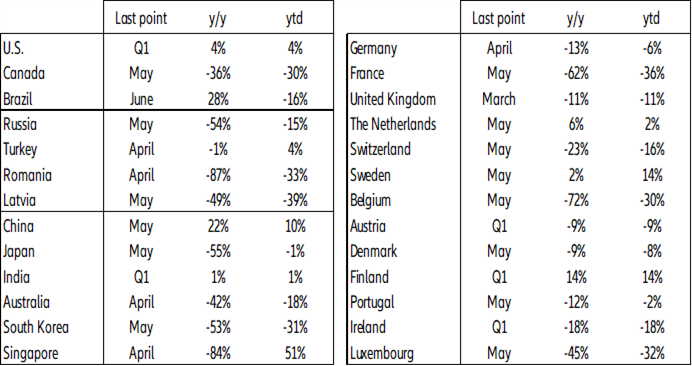

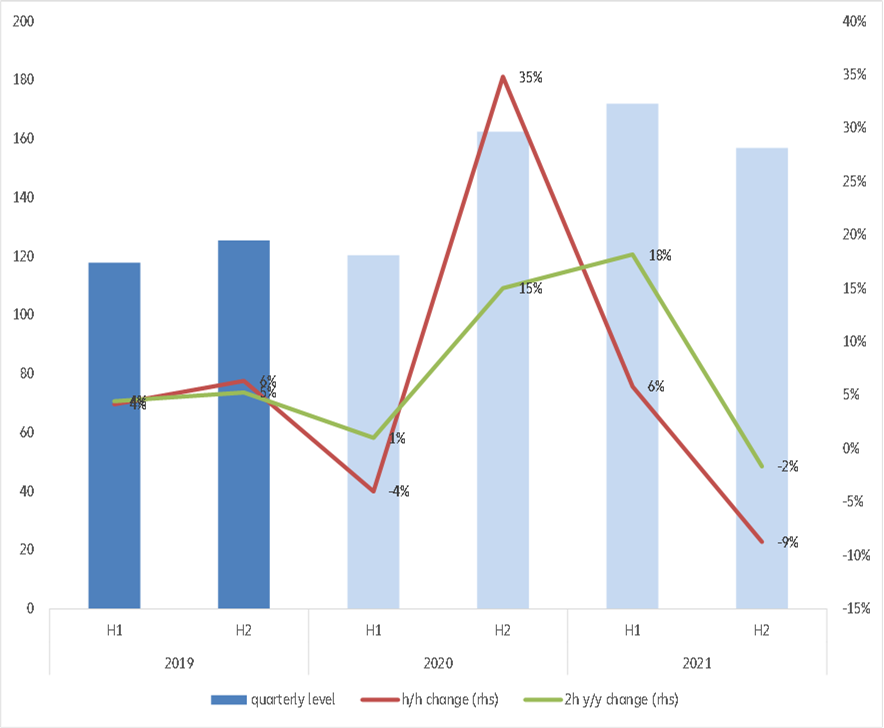

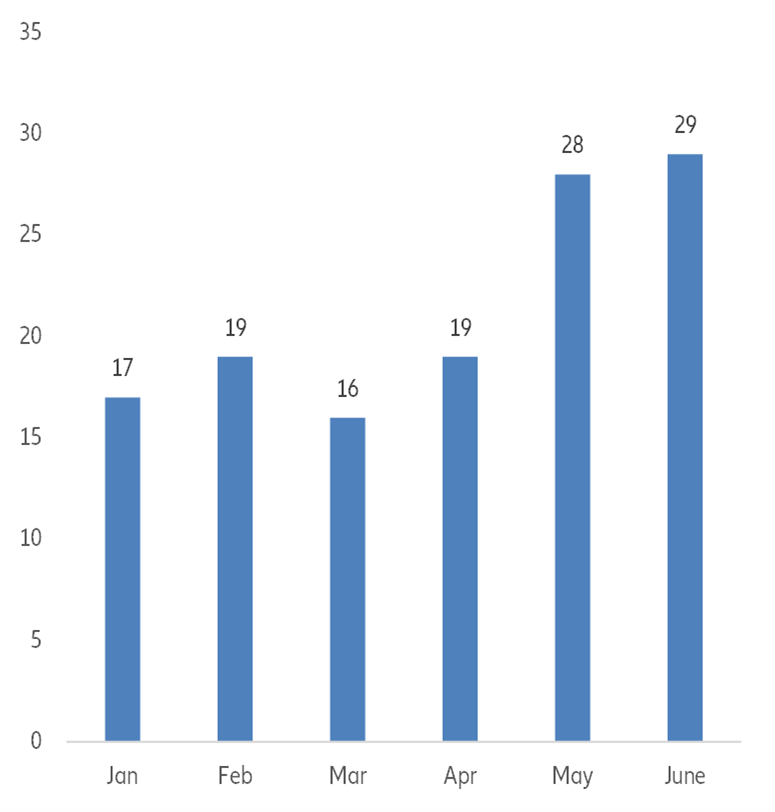

The U.S. is particularly exposed to this risk, and also a good indicator for the rest of the world of the intensity of the risk. For the first half of 2020, overall business insolvencies across all chapters are expected to post a rebound and confirm the jump in chapter 11 filings recorded by Epiq AAER (+26% y/y) to the other chapters (chapter 7, 12 and 13). However, we have already seen a significant increase in top cases. Listed companies are far from immune: Bloomberg recorded 52 bankruptcies in Q1 and 76 cases in Q2, i.e. a total of 128 companies, representing a provisional amount of USD160bn in assets (and USD150bn in liabilities). According to our proprietary data, insolvencies among companies with over USD50mn of turnover have more than doubled from H1 2019 to H1 2020 (66 cases), including several emblematic names in Q2 (Hertz, Latam Airlines, Frontier Communication, Intelsat, J.C. Penney, Neiman Marcus, McDermott Intl).

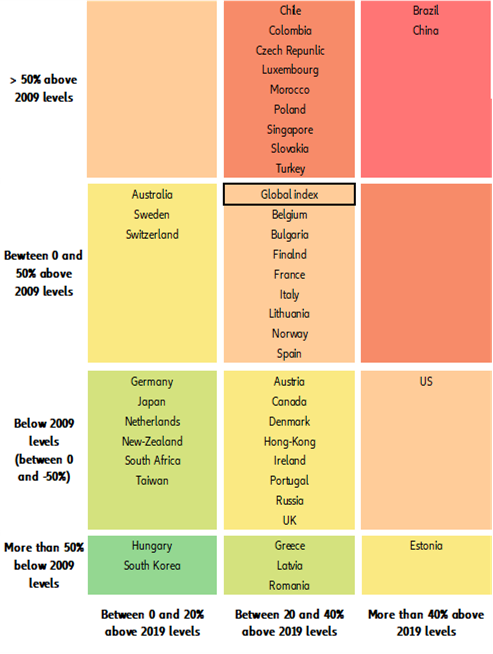

Half of the European countries also belong to this category, for one or several of the following factors: they have been less impacted by lockdowns of business courts (the Nordics in particular), they have not implemented major temporary changes in insolvency frameworks ( Sweden, Ireland) or the rise in insolvencies will occur from a low/stable level of insolvencies in 2019 ( Italy, Portugal). De facto, Italy, Spain and Portugal have all enacted temporary changes in insolvency laws, but we expect (i) not all companies to use this opportunity and (ii) a rebound right after the end of these adjustments. Italy would post a +18% rebound in 2020, from a -2% decline in 2019, and Spain a +20% surge after +6% in 2019. Both countries will see a continued rise in insolvencies in 2021 (+8% and +17%, respectively), pushing their annual number of insolvencies up to 2014-2015 levels (to 14,000 and 5,850 cases, respectively).

The remaining countries, or one out of three, should record a delayed acceleration in business insolvencies, with a stronger rise seen in 2021 than in 2020. This is in particular the case for India, due to the major effects of lockdowns on business courts activity (with the suspension of judicial functioning) and some changes in insolvency laws playing up to the end of 2020 or even untill further notice. In this context, insolvencies will decline in 2020 (-52%) before registering a massive bounce back in 2021 (+128%) to potentially more than 2,000 cases – a record since the implementation of the new insolvency law in 2018.

For France, the UK and to a lesser extent Germany, which also come under the second category, this is directly the result of adjustments in bankruptcy regimes. In the UK, the main points of the Corporate Insolvency and Governance bill applied up to end of June, but various other government schemes run to the end of December. Germany and France both decided to suspend the obligation to file for bankruptcy until 30 September and technically speaking 10 October, respectively (more precisely up to 3 months after the end of the period of sanitary urgency). Insolvencies are expected to gain traction with the end of the suspension rule in Q4 2020 and H1 2021 and the lack of recovery momentum.

In the UK, where companies already took a hit on their activity and margins prior to the crisis due to Brexit, and where the length and strictness of the lockdown have been stronger, insolvencies would rebound again by +43% by 2021 to 31,500 annual cases – less than the 2009 level. In France, we expect massive insolvencies in Q4 2020 and H1 2021, also due to the gradual easing of supportive measures: the final outcome would be a +25% increase by 2021 to a record high level (64,300 cases in 2021). Extrapolating the commercial debt at risk from additional bankruptcies, the economic cost of additional bankruptcies in 2020 could be as much as EUR4.2bn, and EUR5.7bn in 2021. In total, over 2020-21, Covid19 would mean EUR10bn liabilities to the economy or 0.4 GDP points. Germany will show more resilience, notably thanks to stronger initial conditions, a shorter and less strict lockdown and the earlier opening of the economy, on top of a larger fiscal stimulus. However, we expect insolvencies to rebound from their historical low level reached at the end of 2019, with +12% by the end of 2021.

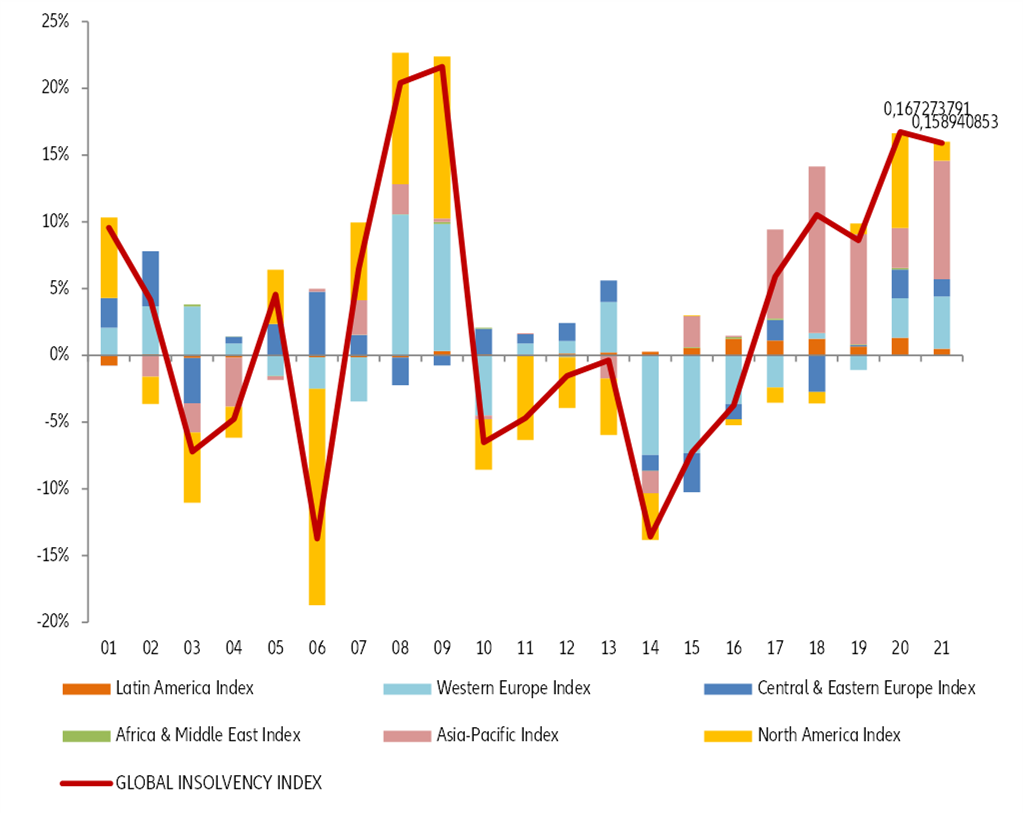

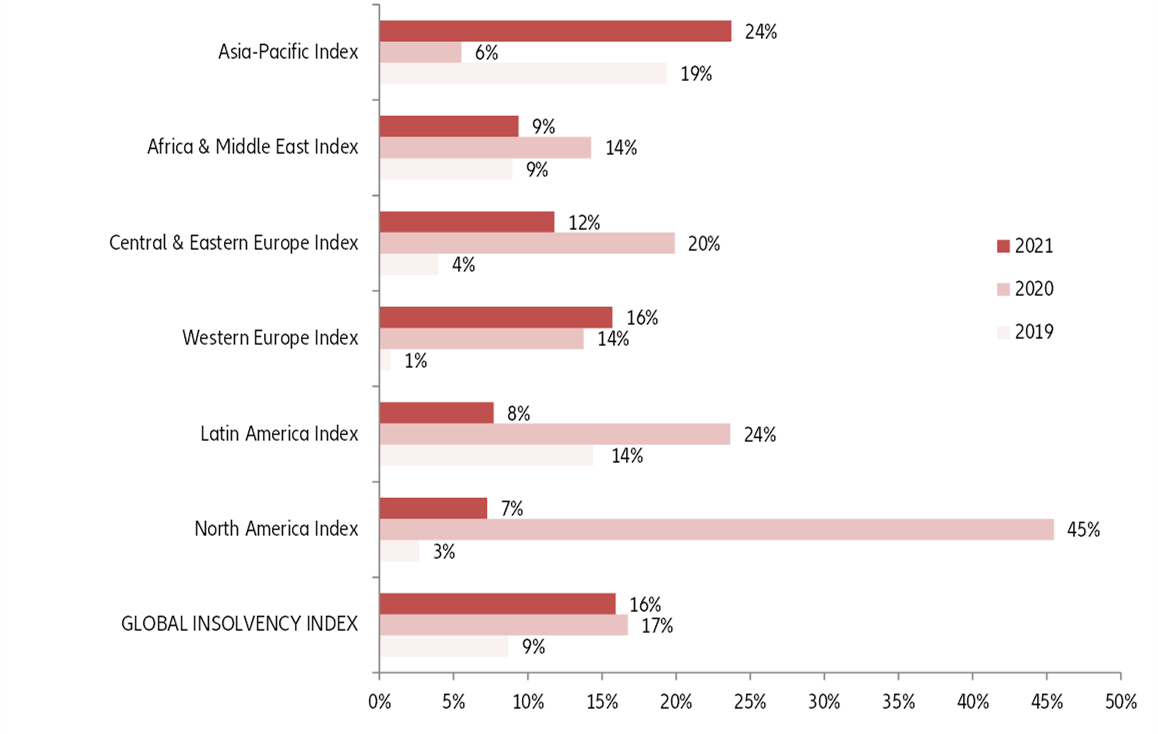

A new record level in 2021 at a global level (and for 1 out of 2 countries)

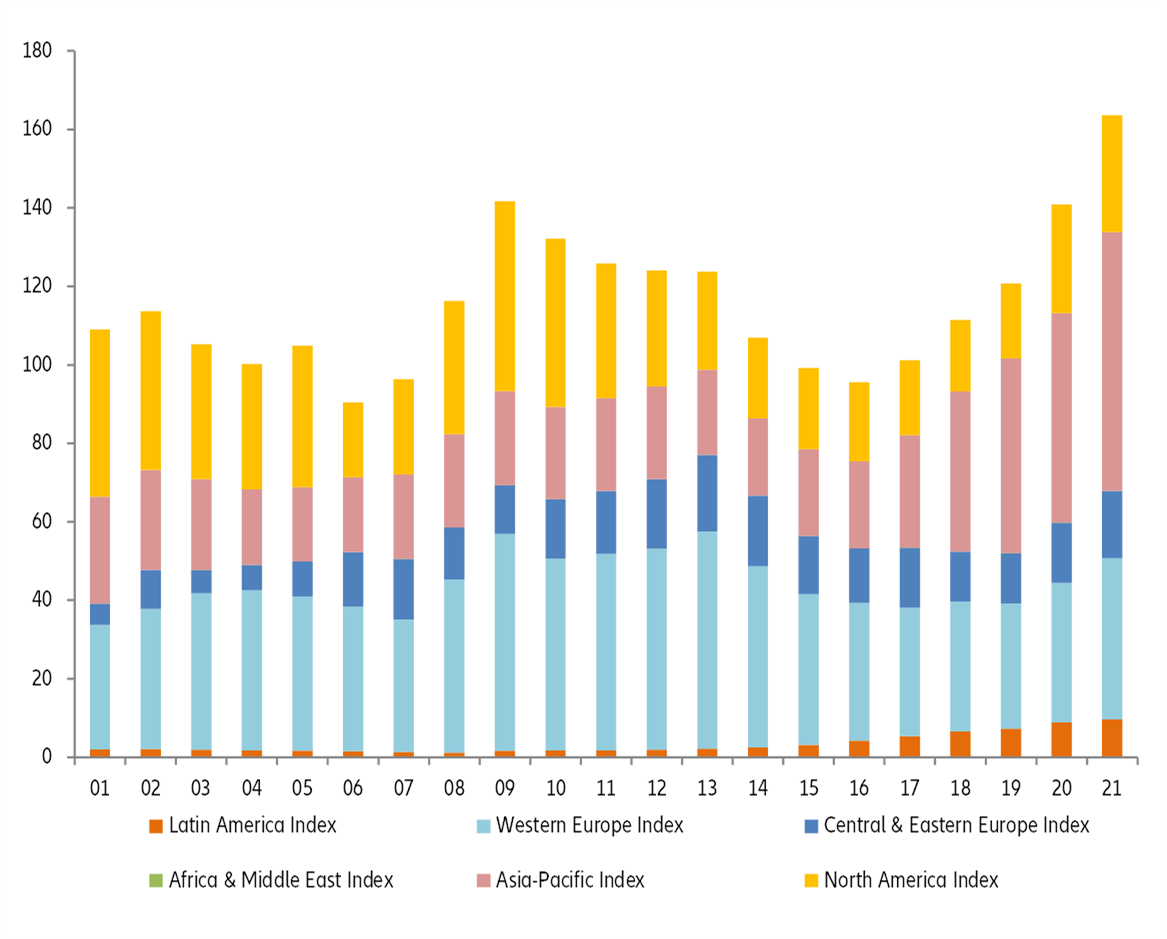

The global result is that our Global Insolvency Index will reach the level last seen in 2009 in 2020, before hitting a new record in 2021, with half of the countries registering a new high since the financial crisis. The latter are located in Europe (i.e. France, Italy, Spain, Belgium, Nordics) but also in Emerging Markets (i.e. China, Brazil, Russia, Turkey). The key exceptions would be the U.S., Japan and Germany.

However, policymakers now have to manage a delicate balance: A premature withdrawal of supportive measures could increase the rise in insolvencies by +5pp to 10pp. And if the global economic recovery takes longer than expected, the surge could be +50pp to 60pp stronger. While adding or prolonging existing support to companies could limit insolvencies in the short term, it could also prop up zombie companies, raising the risks of more insolvencies in the medium and long term.

Figure 7: Euler Hermes indices by region Global Insolvency Index and regional indices (yearly change in %)