The US, Germany and Denmark once again make the top three of our 2020 Enabling Digitalization Index (based on data from end-2019). The EDI measures the ability – and agility – of countries to help digital companies thrive and traditional businesses harness the digital dividend. It scores 115 countries based on five components: regulation, knowledge, connectivity, infrastructure and size. For 2020, the US leads by far due to its best-in-class knowledge ecosystem, competitive market size and favorable regulation. In fact, its connectivity score has increased by +1.8 points after a +5.1 point increase in 2018 (see Appendix 1). Meanwhile, Germany boasts the best knowledge ecosystem and infrastructure for trade. It saw a moderate improvement in both the regulation and market size scores, but its connectivity quality has dropped relative to the rest of the world despite the continuing upwards trend in the number of secure servers. This is due to fewer mobile lines per 100 inhabitants and a slightly declining share of internet users. Denmark started 2020 as the best performer in terms of connectivity quality. Indeed, after tripling its number of secure servers in 2018, it has more than doubled it again to reach a higher number than China and Canada, and close to that of France (with a population of only 6 million).

China’s rise seems unstoppable. In the three years preceding the outbreak of Covid-19, China moved from rank 17 to rank 4. China has seen rising scores across the board: the country’s regulation score improved by +7.4 points after increasing by +15 points in 2018. The connectivity score also increased by +1.3 points. Lastly, the knowledge score rose by +12 points due to an increase in China’s innovation capability over 2019. Yet, the skills score did not follow the same pattern, highlighting that China still has leeway to boost the skills (especially digital skills) of its population. This would allow Chinese companies to appropriately tap its innovation potential.

Data also show that others in Asia made progress in the years preceding the Covid-19 crisis: Hong Kong, now at rank 7, previously 11. South Korea, at rank 12 up from rank 16. Six out of the fifteen top digital enablers were in the Asia-Pacific region at the end of 2019. France had also advanced by two spots to rank 15, and Spain had gained 4 spots to rank 20. Other remarkable progressions include Vietnam from 67 to 57 and Saudi Arabia from 53 to 41, confirming a clear willingness to transition towards a new model of growth.

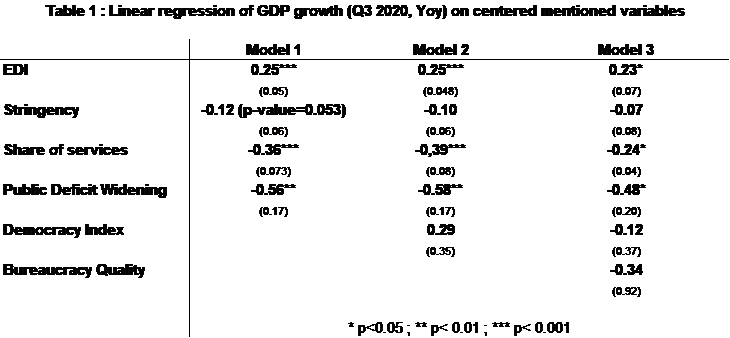

Our estimates show that an additional point in a country’s 2020 EDI score translated to +0.25pp GDP growth in Q3 2020 y/y (i.e. compared to Q3 2019), suggesting that digitization plays the role of shock absorber. The economic interpretation is that countries whose environment was more conducive to the digitalization of companies (good connectivity, market size, regulation, logistics and knowledge) were likely able to respond to the crisis by ramping up multidimensional digitalization. Those countries likely enabled digitalization in administrative bureaucratic processes (state schemes to help companies and citizens in rapidly receiving financial help or sanitary assistance (testing, tracing, isolating, distributing vaccines), on the demand side (consumption with the help of web platforms) and on the supply side in terms of companies’ ways of working (remote working, data storing and sharing etc.).

Our estimates also point to a statistically significant relationship between a country’s economic performance in 2020 and the share of services in its value added, as well as the widening of its public deficit. This confirms that service-oriented economies with prominent arts, recreation, restaurants, hotels, and other tourism-related sectors suffered relatively more, all other things equal. As for the widening of the public deficit, it appears that higher spending was associated with a higher hit to the economy. This is probably due to the severity of lockdown measures; countries that were the most aggressive in closing their economies to control the pandemic would have had to resort to offsetting actions on the fiscal side to absorb the shock. This is confirmed by the fact that that the stringency of government measures to fight the pandemic was not significantly correlated to a country’s economic performance in 2020 across all 78 countries (size of the deficit capturing the information of this variable), nor were bureaucracy quality, institutional effectiveness, power distance and the democracy index .

Table 1: Model results

China’s rise seems unstoppable. In the three years preceding the outbreak of Covid-19, China moved from rank 17 to rank 4. China has seen rising scores across the board: the country’s regulation score improved by +7.4 points after increasing by +15 points in 2018. The connectivity score also increased by +1.3 points. Lastly, the knowledge score rose by +12 points due to an increase in China’s innovation capability over 2019. Yet, the skills score did not follow the same pattern, highlighting that China still has leeway to boost the skills (especially digital skills) of its population. This would allow Chinese companies to appropriately tap its innovation potential.

Data also show that others in Asia made progress in the years preceding the Covid-19 crisis: Hong Kong, now at rank 7, previously 11. South Korea, at rank 12 up from rank 16. Six out of the fifteen top digital enablers were in the Asia-Pacific region at the end of 2019. France had also advanced by two spots to rank 15, and Spain had gained 4 spots to rank 20. Other remarkable progressions include Vietnam from 67 to 57 and Saudi Arabia from 53 to 41, confirming a clear willingness to transition towards a new model of growth.

Our estimates show that an additional point in a country’s 2020 EDI score translated to +0.25pp GDP growth in Q3 2020 y/y (i.e. compared to Q3 2019), suggesting that digitization plays the role of shock absorber. The economic interpretation is that countries whose environment was more conducive to the digitalization of companies (good connectivity, market size, regulation, logistics and knowledge) were likely able to respond to the crisis by ramping up multidimensional digitalization. Those countries likely enabled digitalization in administrative bureaucratic processes (state schemes to help companies and citizens in rapidly receiving financial help or sanitary assistance (testing, tracing, isolating, distributing vaccines), on the demand side (consumption with the help of web platforms) and on the supply side in terms of companies’ ways of working (remote working, data storing and sharing etc.).

Our estimates also point to a statistically significant relationship between a country’s economic performance in 2020 and the share of services in its value added, as well as the widening of its public deficit. This confirms that service-oriented economies with prominent arts, recreation, restaurants, hotels, and other tourism-related sectors suffered relatively more, all other things equal. As for the widening of the public deficit, it appears that higher spending was associated with a higher hit to the economy. This is probably due to the severity of lockdown measures; countries that were the most aggressive in closing their economies to control the pandemic would have had to resort to offsetting actions on the fiscal side to absorb the shock. This is confirmed by the fact that that the stringency of government measures to fight the pandemic was not significantly correlated to a country’s economic performance in 2020 across all 78 countries (size of the deficit capturing the information of this variable), nor were bureaucracy quality, institutional effectiveness, power distance and the democracy index .

Table 1: Model results