Country focus: U.S., UK, Germany, France, Italy, China

In the U.S. supply chains are caught up in the political debate

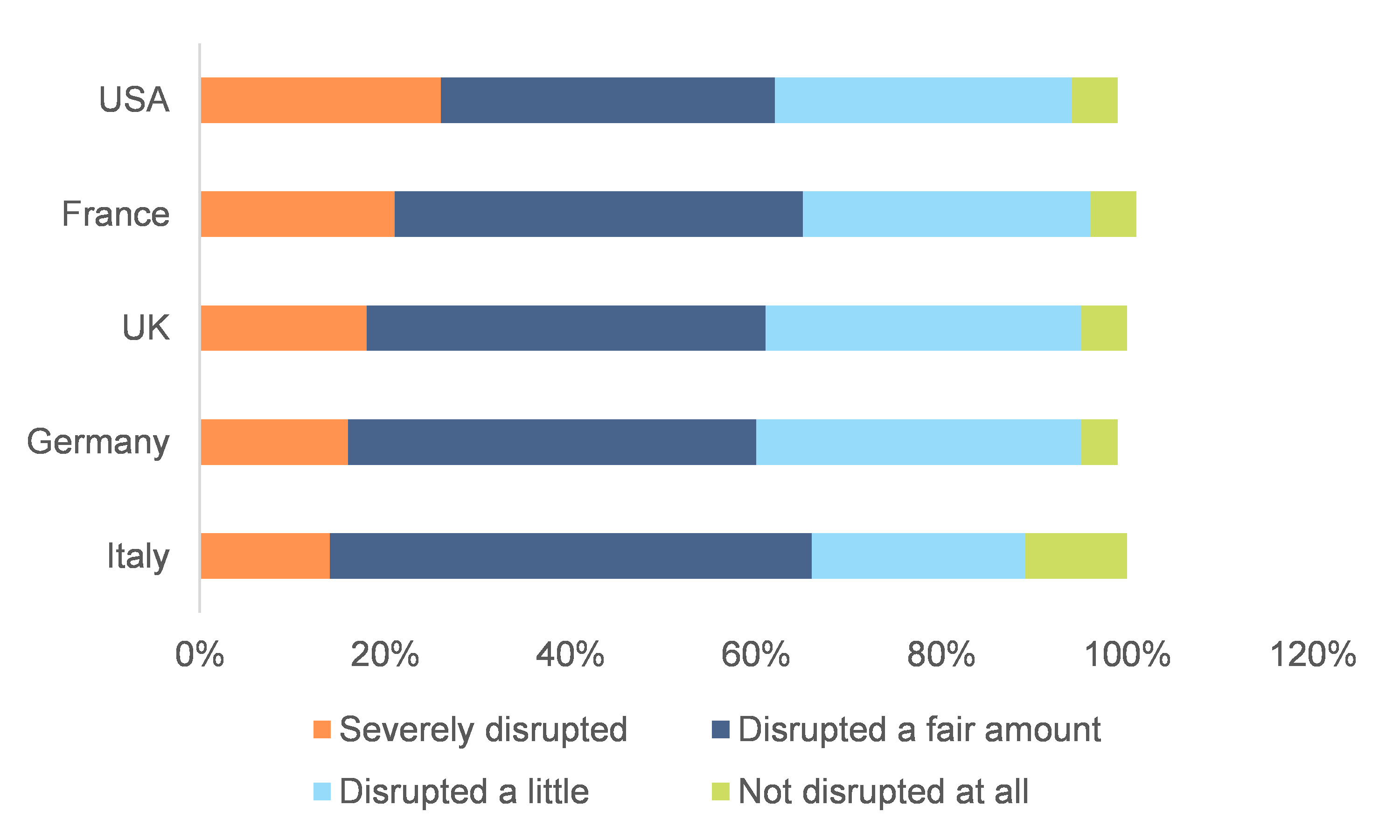

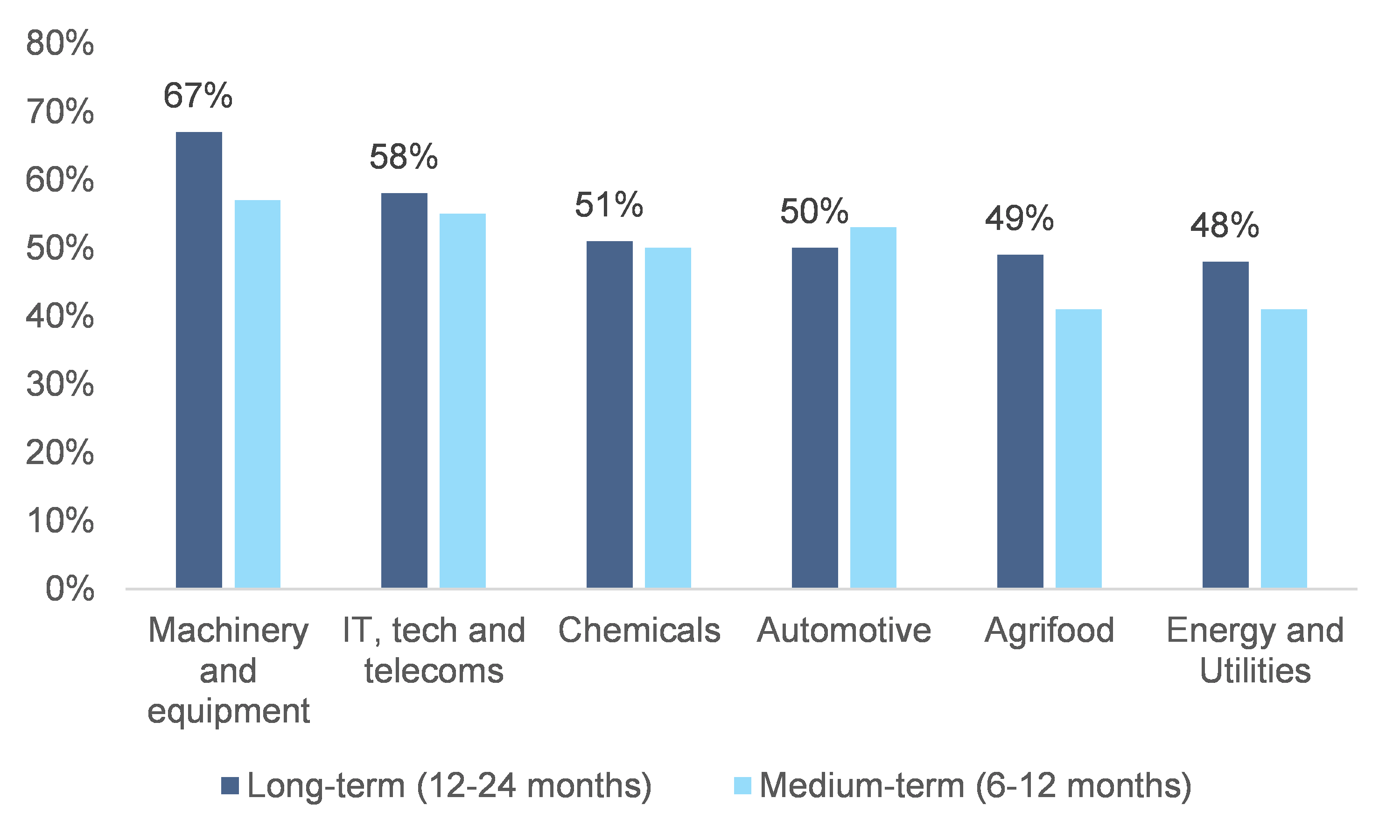

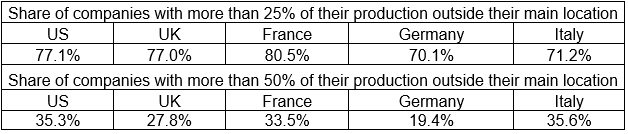

U.S. companies were particularly disrupted by the Covid-19 crisis: With on average around 44% of production and suppliers located outside the country , one company out of four reported a severe disruption (26%) in the U.S., compared to one out of five in the global sample. This could be explained by the high representation in our sample of U.S. IT and telecom companies as well as the auto industry, which are highly integrated in global supply chains and interconnected with China, Mexico, Canada and Europe, making them more sensitive to any potential disruption.

Environmental risk matters more to U.S.-based companies: While production costs and production quality problems are among the main risks perceived by U.S. companies, environmental risk/natural disaster appears more often in the U.S. based companies’ top three risks than in the other countries surveyed (28% vs around 20% on average for non-U.S. companies). Awareness of environmental issues has significantly increased over the last year in the U.S. and it was a key differentiator between the two candidates in the Presidential elections. The number of times that the keywords “U.S. climate” appeared in the media has more than doubled under Donald Trump’s presidency compared to Barack Obama’s. At the same time, adverse climate events have significantly increased in the U.S., with for instance a record high 3.2 million acres burned in 2020 because of wildfires. In this context, it seems logical to observe a higher sensitivity to environmental risk.

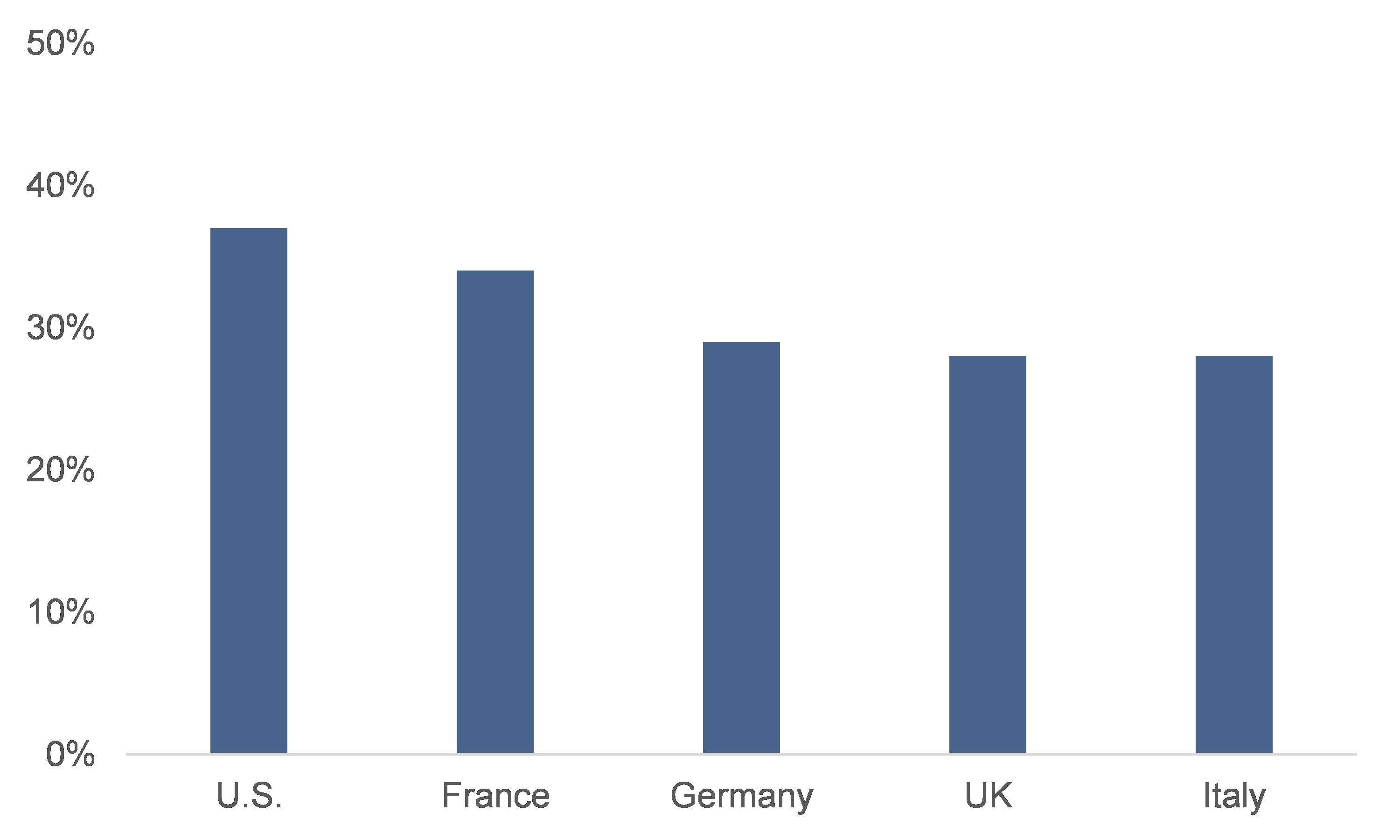

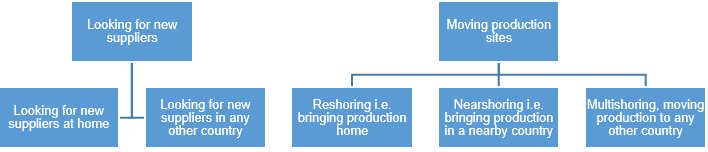

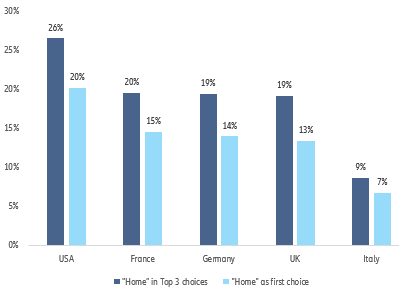

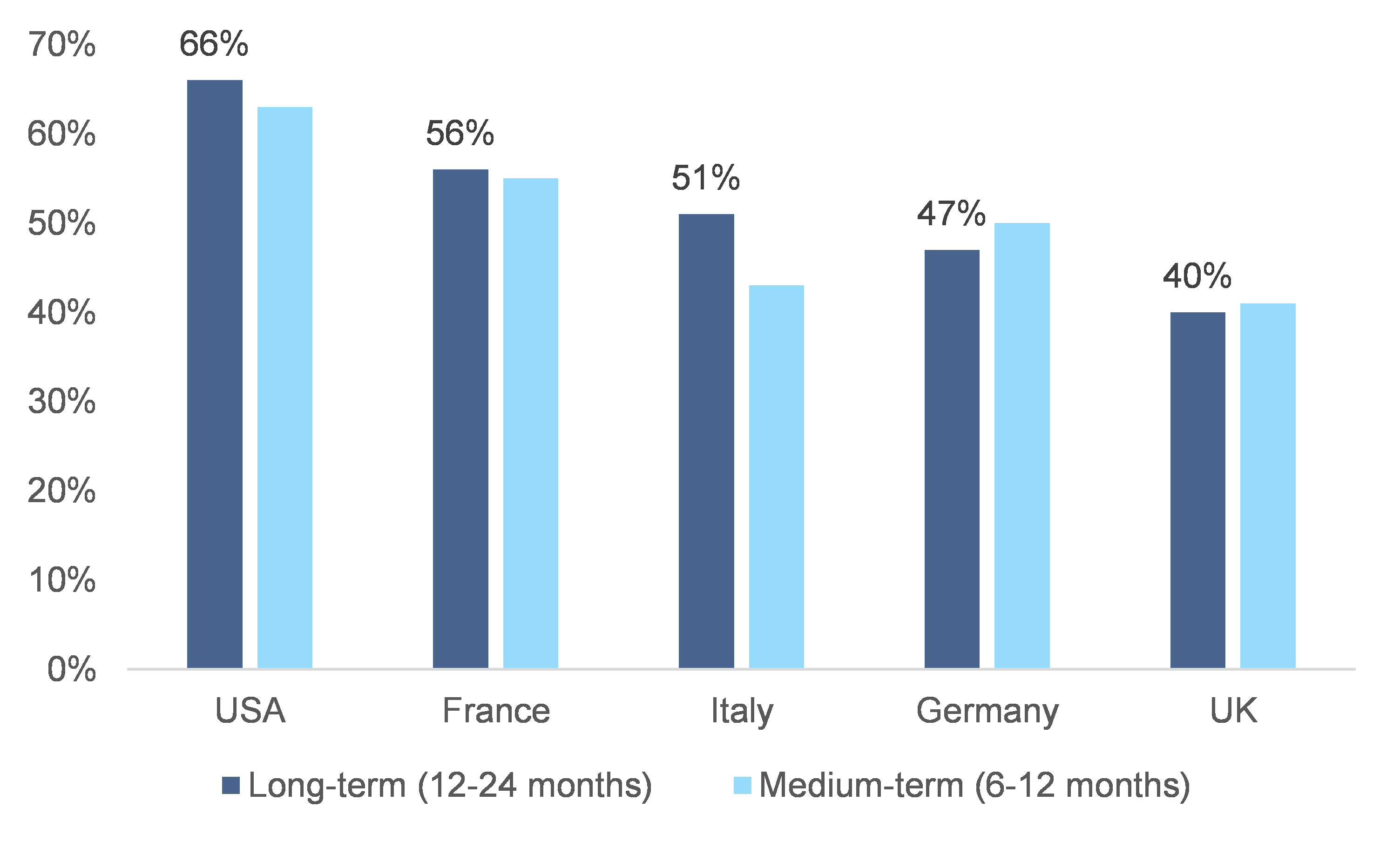

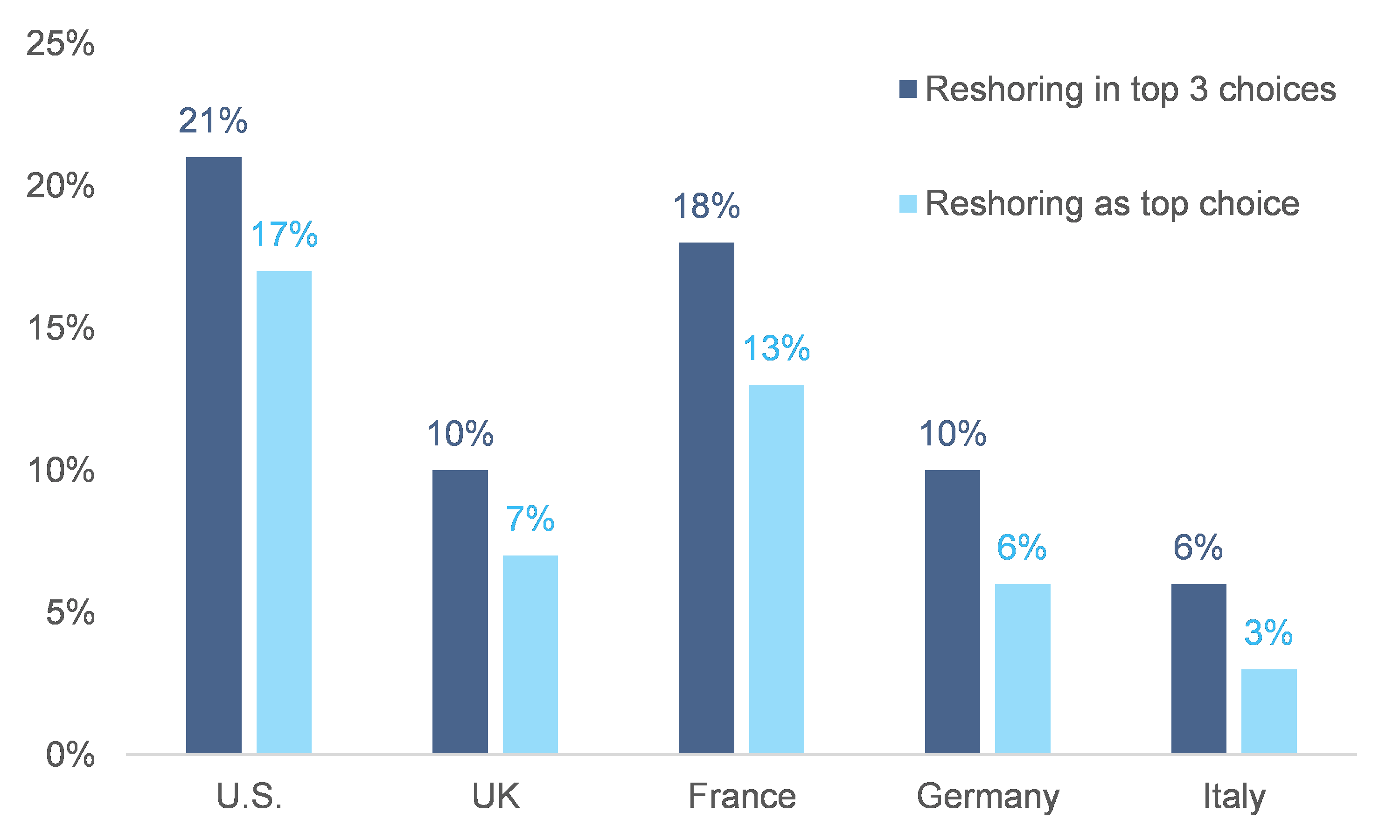

Reshoring is most popular for U.S.-based companies: First, the share of U.S. companies considering finding new suppliers and moving production sites in the medium and in the long-term is consistently and significantly higher than in all other countries in the survey. When looking at companies considering moving their production sites (54% of the sample), reshoring gathers a maximum of 32% support in t he U.S. (vs 22% on average for other countries). This means between 17% and 21% of companies in our sample of 363 U.S. companies consider reshoring. This higher determination in reshoring could be linked to U.S. trade policy as protectionist initiatives aiming at reducing dependence on other countries, in particular China, were a pivotal element of U.S. economic policy over the last four years. Given the fact that it is a bi-partisan priority to re-shore industrial activities, it is no surprise to see the reshoring trend more pronounced among U.S. business leaders. Reshoring was already an objective of Barack Obama’s administration.

Quality concerns prevalent for U.S. companies: 28% of U.S. companies that would consider moving their production sites rank finding better quality suppliers in their top three reasons for doing so. This makes the U.S. the most “quality concerned” (7pp above the other countries’ average). Highly competitive products make up the largest share of U.S. respondents (IT, tech and telecoms), which explains the big concern for quality (i.e. non-price competitiveness), just like in Germany. We have to put this in perspective with the so-called rule of origin, which was attached to the signature of the USMCA in 2018 and required North American content to represent 75% of the value-added contained in each vehicle produced by American companies. Political debates in the U.S. both under Barack Obama’s Buy American provision of the American Recovery and Reinvestment Act (2009) and the “Made in the USA” strategy of Donald Trump were constantly dominated by considerations related to the high quality of U.S. products and the unfair practices of international partners, again with a focus on China. At the same time, the U.S.’s positions at the front of the world’s technological frontier and at the top in terms of GDP per capita, imply a natural preference for higher quality when dealing with external partners

UK: Responses highlight “Global Britain”, but Brexit-related risks and policy preferences stand out

A Global Britain? No clear-cut preference for UK-based production: Companies considering moving their production in the medium to long-term appear to have no clear-cut preference for reshoring. 7-10% of all UK companies surveyed might consider reshoring in the medium or long-term, which is lower than the U.S. and France but higher than Italy. UK companies are relatively indifferent between moving production to China, France, Germany or the UK. However, UK companies would significantly prefer moving production to France than their U.S. or German counterparts, signaling the will to maintain business ties with their French continental neighbor. In a context of the exit from the EU Customs Union and Single Market, UK companies look for strengthening their local presence within the EU, having easier access to the EU market and avoiding transportation costs and tariffs. Being closer to the EU main ports would also reduce their logistical hurdles for exports outside the EU.

Brexit everywhere? From the love of the Chinese supplier to fear of delays and better inventory management to a broad support of FTAs.

- UK companies are most likely to consider Chinese suppliers: 30% of UK companies would consider switching to Chinese suppliers in the medium to long term, vs. 21% considering French suppliers and 24% considering German suppliers. In comparison, only 12% of U.S. companies would consider Chinese suppliers, 18% of Italian companies and 14% of French companies. This is in line with the post-exit strategy of the UK of lowering its global import tariff by -2.2pp to 2.8%, the second lowest tariff among G-20 countries after Australia. These new tariffs will apply to imported goods from countries with which the UK will not have a Free Trade Agreement (FTA) on 01 January 2021

- The fear of delays: When asked about the reasons for considering changing the location of their suppliers, 35% of UK companies mention reducing delays and better managing inventories among the top three risks, vs. 21% on average in other countries. Delays in terms of transportation time are expected post Brexit and estimates from Imperial College London point to the fact that two extra minutes of additional controls at the border (in addition to the current two minutes) would translate into 32km of queues, or more than triple the existing ones, leaving drivers waiting almost five hours on the route. Hence, delays in transportation and additional costs would imply that UK companies would need to manage even better their stocks to avoid future production interruptions.

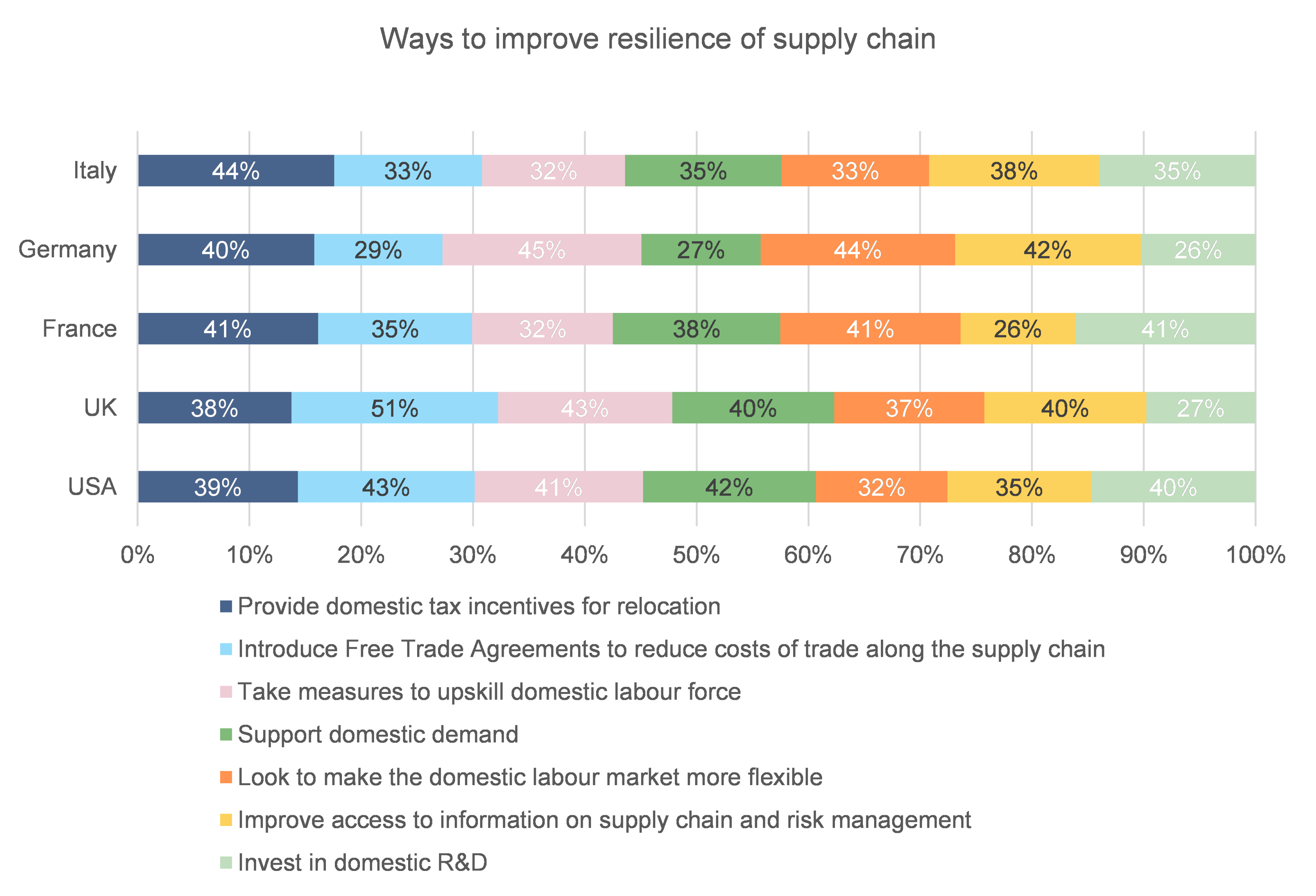

- A message to policymakers: When asked what measures could improve the resilience of UK supply chains, more than one out of two UK companies mention the introduction of Free Trade Agreements to reduce costs of trade along the supply chain, vs. 35% of respondents from other countries. This shows that companies are eager to return to international trade conditions as favorable as when the UK was in the EU.

Germany: Concentration risk is a higher concern for German companies

28% of German companies put concentration risk among their top three risks to production sites, a significantly higher share than French, U.S., UK and Italian companies. This can be explained by the current organization of German companies’ supply chains: in our sample, 76% of German companies report having less than half of their suppliers located outside the country vs. 65% on average for other countries.

Where do German companies want to find new suppliers/move production sites? When asked about reshoring, only 6-10% of German companies are considering such a move in the medium to long term. It’s interesting to note that Germany is similarly attractive to UK and Italian companies as it is to German companies. When asked about countries German companies would prefer moving their production to/or finding new suppliers in, Austria gathers more support than it does from U.S., UK, French and Italian companies. This is likely because German companies already have a third of their non-German suppliers in Austria.

Innovation matters more for German companies when choosing suppliers: 30% of German companies mentioned “the country has a reputation for being innovative and having an environment fostering innovation” in their top three reasons behind choosing supplier locations. The share is 20% on average for all other countries. This is in line with Germany’s historical competitiveness strategy, which focuses on quality and not cost.

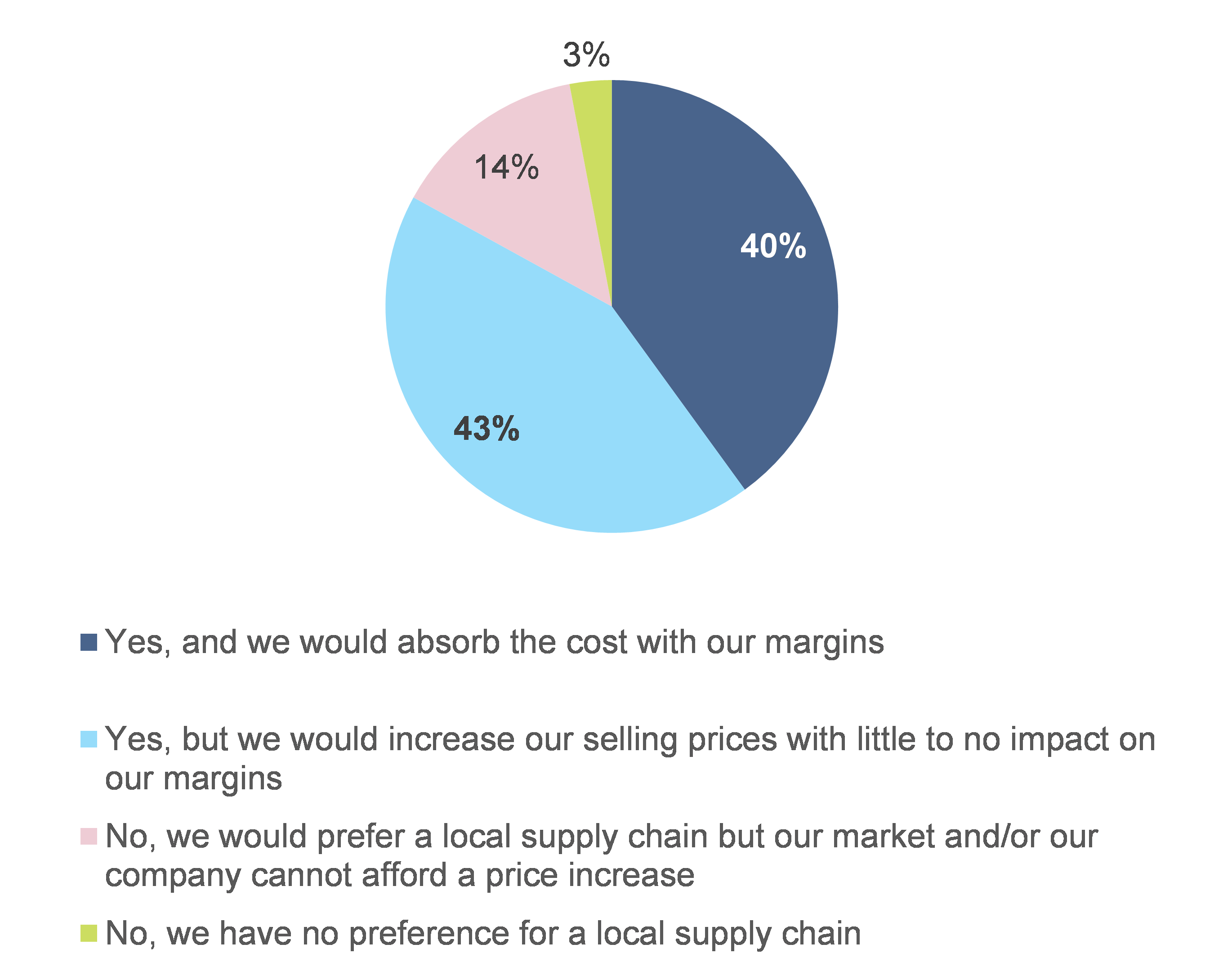

Reshoring would mean a price increase for one out of two German companies: one out of two German firms has stated that selling prices would increase if domestic production meant a higher cost (like in France but vs. 37% in the U.S.)

France: Supplier bankruptcy risk is a higher concern and companies report higher likelihood of considering reshoring

When asked about the main risks to their supply chains, 30% of French companies put supplier bankruptcy risk among their top three, vs. an average of 20% in other countries. French companies have historically had lower profit margins and higher debt ratios compared to companies in the other large Eurozone countries and the outbreak of the Covid-19 crisis has made things worse: profit margins of French companies took the largest hit, declining from a gross operating surplus of 33.3% in Q4 2019 to 27.8% in Q2 2020. At the same time, because of their tight cash positions, French companies have made extensive use of state-guaranteed loans (around EUR120bn take up). Consequently, the debt to GDP ratio of non-financial corporations has soared dramatically from 73.4% in Q4 2019 to 84.7% in Q2 2020. In comparison, debt to GDP ratios of NFCs rose to 44.1% in Germany, 68.2% in Italy and 69.1% in Spain in the same period. Such specificities could help explain why French companies worry more about supplier bankruptcy risk.

After U.S. companies, French companies report the highest likelihood of considering reshoring: Between 13% and 18% of French companies consider reshoring in the medium to long term, vs. between 3-6% in Italy and 6-10% in Germany. Out of those considering moving production, 28% mention creating jobs at home, the highest share among all countries (17% in the U.S., 15% in the UK, 10% in Germany and 16% in Italy). French companies, along with Italian companies, also appear to care more about government incentives for moving for specific sectors than U.S., UK and German companies.

When asked what policy measure would help boost the domestic resilience of supply chains, French companies that are not considering moving their production fail to converge towards a single solution: interestingly, tax incentives, investment in R&D and greater labor market flexibility appear for 41% of respondents. The French stimulus plan should help address some of these concerns as it allocates EUR35bn to the development of innovative industries and the enhancement of international competitiveness. The reduction in production taxes of EUR10bn in 2021 and 2022 is also an important step towards improving the attractiveness of France. The stimulus package also earmarks EUR150mn to industrial projects led by municipalities, EUR40mn for strengthening the resilience of the value chains in ‘strategic’ sectors and EUR40mn to support innovative industries and modernize its value chains. However, in view of the elevated unit labor costs in France, these amounts should not trigger a dramatic U-turn in companies’ production and massive reshoring.

The other attractive countries according to French companies are Belgium, China, the UK, Australia and the U.S. (to find suppliers), and Belgium, China and Germany (to move production sites). Algeria is also mentioned by 8% of French respondents, much higher than by any other country.

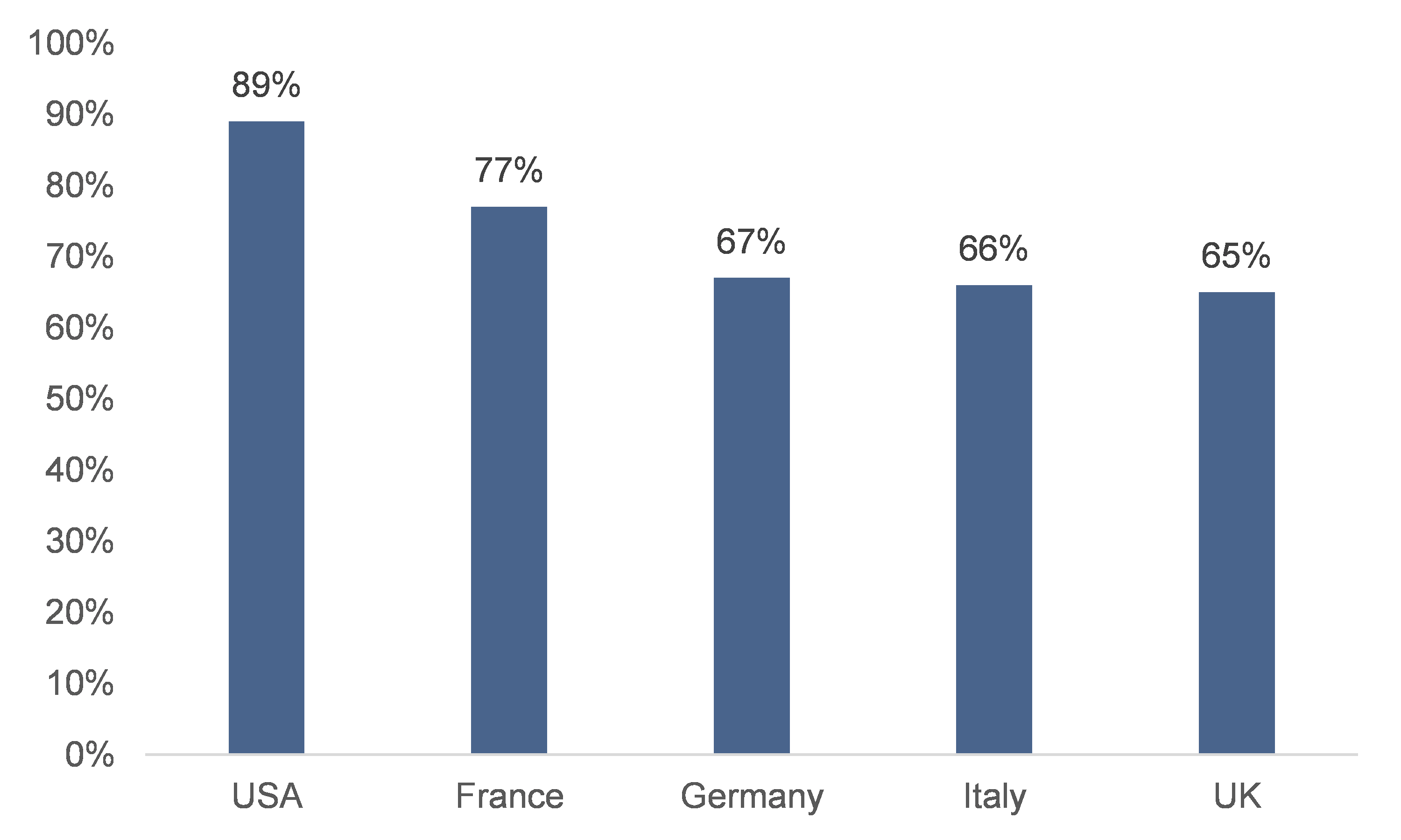

Who will pay? 77% of French companies believe customers are willing to pay more for domestically produced goods, a significantly higher share than for the UK, Germany and Italy (around 2/3) but lower than in the U.S. This result is reaffirmed by a 2018 IFOP survey, which showed that three quarters of French consumers would be willing to pay more for a "Made in France" product.

Italy: Rising production costs matter more and attractiveness is the biggest concern

Although the increase in production costs appears to be the main risk to the supply chain for most companies in our sample (33% of companies put it among their top three risks), Italian companies seem to be the most concerned about this issue, with 40% of the respondents ranking it in their top three. As Italian companies in our sample reported 57% of their production sites located domestically, this result might be related to the perception of a long-term trend of wages growing faster than productivity.

Attractiveness is the biggest Italian concern: 43% of Italian companies would consider moving their production sites in the medium term as a result of Covid-19, which is almost 10pp below the 52% on average of the other countries surveyed. In fact, over the total sample, only 3-6% of companies are considering reshoring, which is significantly lower than the 10-15% average across the sample. China seems to be a more attractive country for moving Italian production sites, followed by France. This could be related to the perception of structural weaknesses in the areas of infrastructure and education in Italy. Here, however, considerable regional differences are likely to exist. But there might also exist concerns regarding the efficiency of public administration and the political system. The fragile banking sector can also be a reason, especially for smaller companies, to avoid expanding actively in Italy. Finally, a relatively elevated corporate tax rate (standard rate of 24%, incl. trade and subnational taxes 27.9%) could also be part of the explanation. When surveyed about policy measures to make the domestic supply chain more resilient, 44% of Italian companies that are not willing to move production sites overwhelmingly support domestic tax incentives to make local production more attractive.

China: It’s not the end of the Chinese supplier

China appears in the top three for 18% of the surveyed companies considering changing suppliers. First, this suggests a preference towards a “continuation” of current supply-chain dynamics: many companies already have suppliers in China and so it remains an attractive choice. One other explanation is that companies are continuing to search for cost-effectiveness in times of great uncertainty and after an unprecedented shock; “improving margins” is cited as the most popular reason to look for a new supplier. But this also means that such companies would be vulnerable to a reflation shock from China: indeed, 33% of total companies state that the risk posing the greatest threat to supply chains is increased costs, tied with issues with quality of production. While China’s trend of rising labor costs is likely to continue in the long-term, authorities aim to improve the productivity and quality of local manufacturing bases. As part of China’s dual circulation strategy, maintaining export market shares remains one of the country’s long-term goals.

Which countries find China attractive when looking for new suppliers? Companies based in Germany, Italy and the UK mention China as their first choice significantly more than companies based in France. But the UK stands out: 30% of UK companies that are considering changing suppliers mention China in their top three, which is significantly higher than in the U.S. (12%), France (14%) and Italy (18%). When we exclude companies who selected their main country location, UK companies’ preference for China is even more apparent.

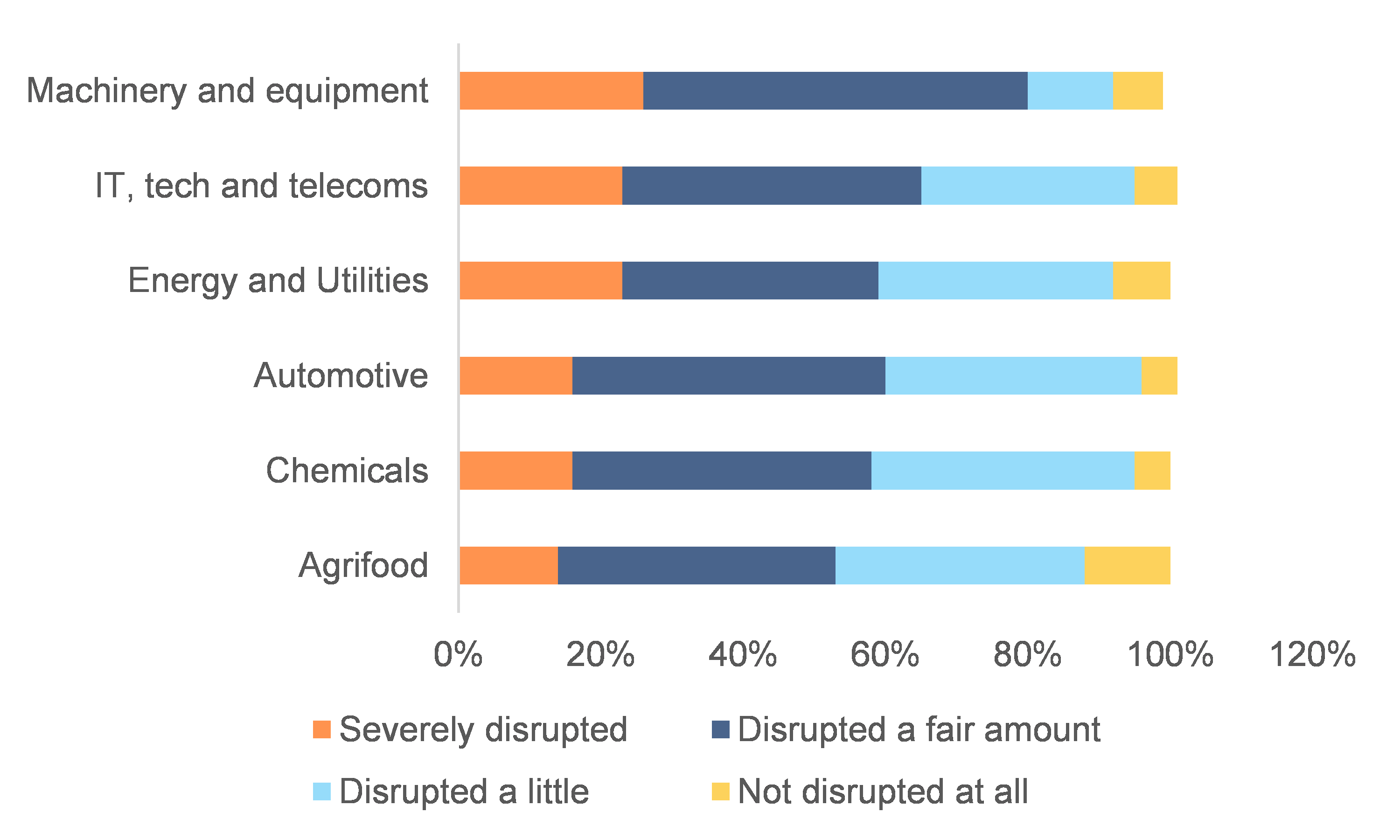

Which sectors find China attractive when looking for new suppliers? Companies in the automotive sector mention China significantly more than companies in chemicals, IT, tech and telecoms.

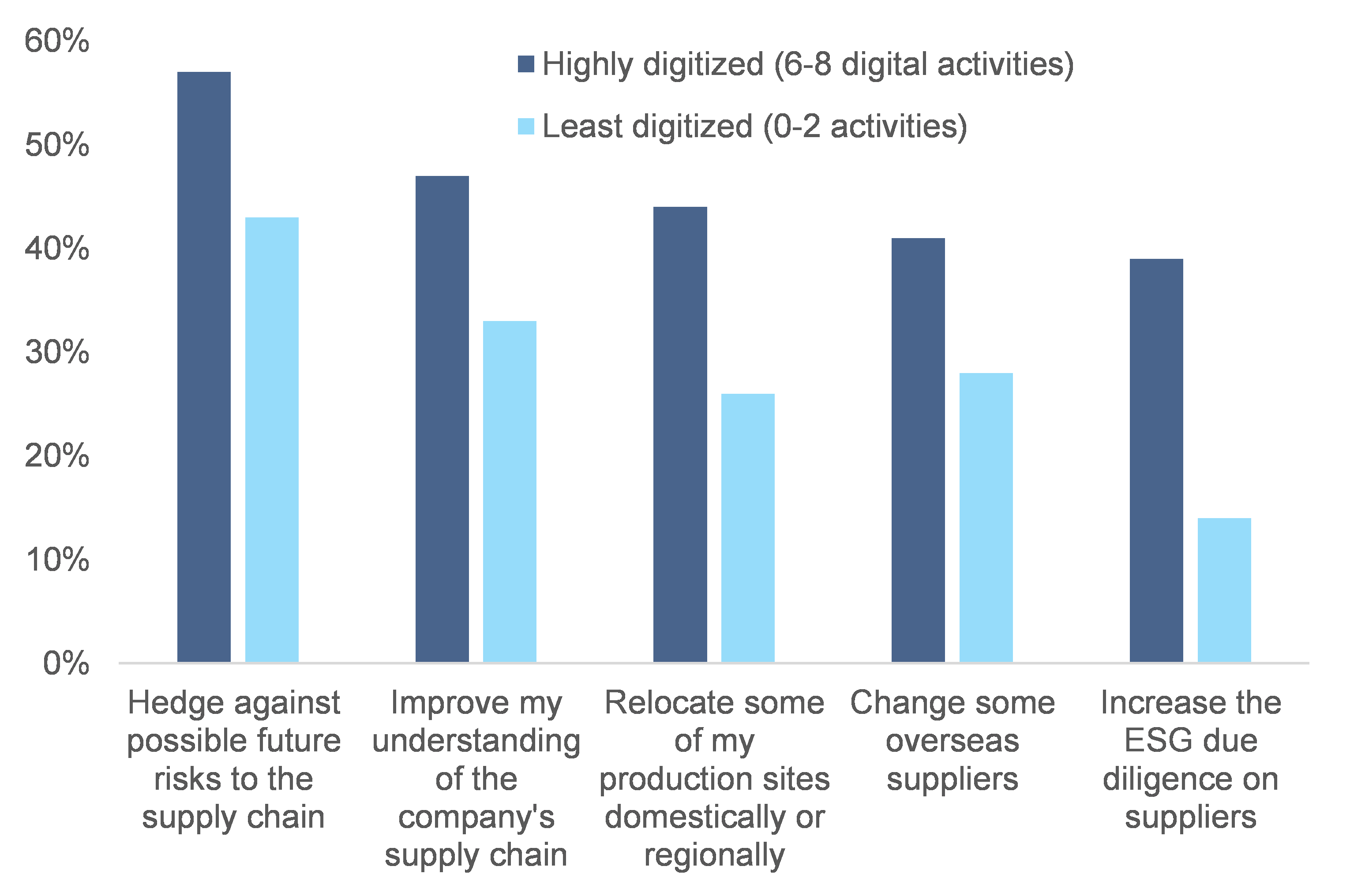

Companies that are highly digitized are significantly more likely to look for suppliers in China (as a top choice) than companies that are relatively not digitized. This could be put in the context of the fast digitalization drive that China has been experiencing in the past few years. Our proprietary Enabling Digitalization Index ranked China at the 9th position out of 115 countries in 2019, and the 3rd in the Asia-Pacific region (after Singapore and Japan).

China as a relocation destination, provided supply chains are stable: companies who saw little disruption to their supply chains or “a fair amount” of disruption are more than three times more likely to consider China as a relocation destination than those who experienced a severe or significant disruption. China remains an important offshore base for manufacturing: 21% of companies in our survey have listed China in their top three countries where production sites are based (excluding their main country of location). Global companies could continue to consider establishing production sites in China to provide for the country’s large and growing domestic demand, and as authorities continue to loosen regulatory restrictions in order to attract foreign direct investment.