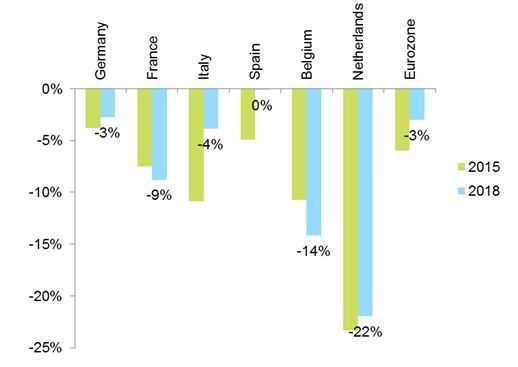

- The Small and Medium Enterprise (SME) bank loan financing gap in the Eurozone has reduced from 6% of GDP in 2015 to 3% of GDP in 2019, or EUR400bn, moving closer, but remaining higher than the 2% of GDP seen in the US, where corporate financing is much more diversified between bank credit and market financing.

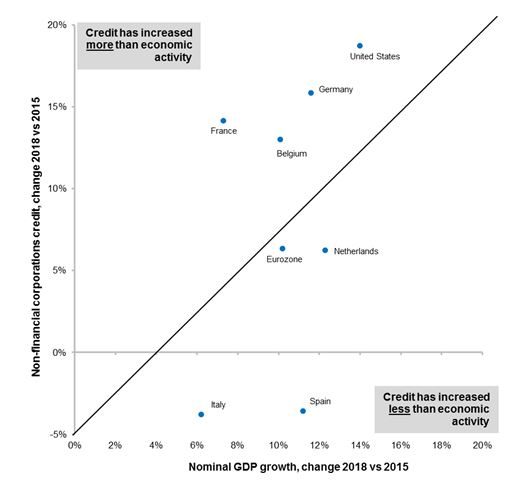

- This is the result of record low bank loan interest rates and higher loan availability thanks to ECB support which have pushed up loan supply mainly in core countries (Germany, France, Belgium and the Netherlands), but also higher non-bank financing sources.

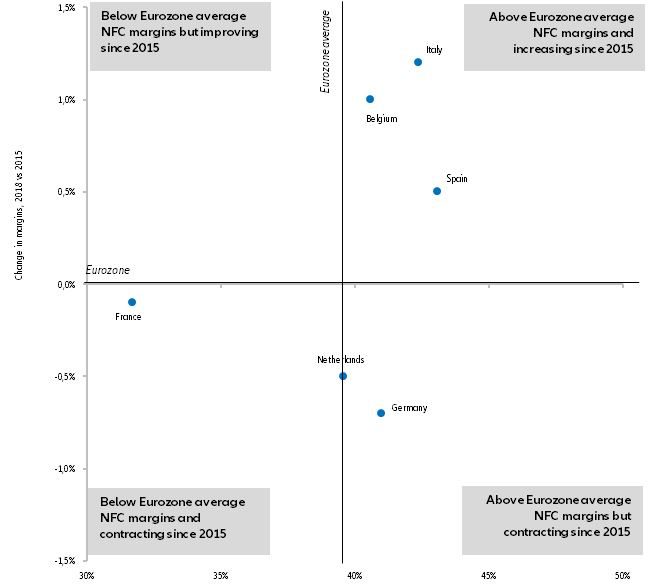

- At the same time, the decline in the financing gap is also linked to a significant downside adjustment in loan demand in Southern European countries, such as Italy and Spain. A delayed recovery in fixed capital formation and an improved self-financing capacity, notably since 2015, partly explain the trend.

- Country heterogeneity persists. The highest SME bank loan financing gaps are in the Netherlands (22% of GDP), Belgium (14%), France (9%) and Italy (4%). In the first three countries, the gap is essentially linked to the high SME debt stock but also higher economic activity, though the increase in debt has been higher than the one in activity. In Italy, the gap is mainly explained by the supply constraint.

- ·Since European SMEs depend on banks for 70% of their external financing (against around 40% in the U.S.), any gap between loan demand and supply could lead to lower investment growth if companies don’t have the means to self-finance their investments. This could be a constraint for overall economic growth.

SMEs are critical to Europe

SMEs present more than 99% of all European non-financial corporates and employ over 90 million people, accounting for almost 70% of total employment in the EU-28 non-financial sector. They also generate close to 60% of total gross value added.

However, the specific characteristics of SMEs make them more vulnerable during crises (Chowdhury 2011[1]): Because they are often not rated, their sources of financing can diminish faster than those of larger companies. Moreover, since they tend to produce highly specific products, they are less flexible in adapting to crises. In 2009, SMEs were the first to suffer from the global economic crisis because of depressed demand and financing constraints.

Since European SMEs depend on banks for 70% of their external financing (against around 40% in the US), any gaps between loan demand and supply could lead to lower investment growth, which could be a constraint on overall economic growth in the future.

In this context, we estimate the bank loan financing gap for SMEs in the Eurozone as a whole and in six main countries: Germany, France, Italy, Spain, the Netherlands and Belgium using the methodology of Mc Cahery, J., Lopez de Silanes, F., Schoenmaker, D., & Stanisic, D. (2015 “The European Capital Markets Study: Estimating the Financing Gaps of SMEs”. While the initial paper gives estimates for 2013, we look into the most recent 2018 data for the Eurozone and compare them with data from 2015, which was when the ECB began its quantitative easing program.

The ECB’s very accommodative monetary policy, which now looks set to continue until at least Q4 2020, has helped the Eurozone reduce its SME financing gap. But country heterogeneity persists.

Figure 1 - Small and medium enterprises (SMEs): share in total companies, employment and value added

1.jpeg)