The six commandments for the ECB’s anti-fragmentation tool

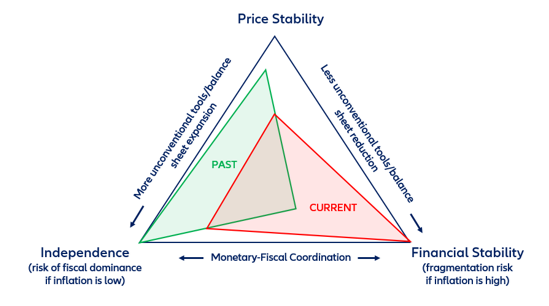

The ECB’s plan for a spread-control program can help avoid bond market stress from becoming an obstacle to policy normalization. However, current spread widening does not reflect a common shock to the Eurozone and thus limits the ECB’s capacity to control spreads without conditionality and sterilizing the liquidity of asset purchases. Thus, the planned spread-control program is unlikely to piggyback on existing anti-fragmentation tools, which were designed to either address a common shock without sterilizing new liquidity (Pandemic Emergency Purchase Program (PEPP)) or come with very strict conditionality attached (Open Market Transactions (OMT)). However, there are several lessons from past episodes of rising fragmentation risk that could inform the design of an anti-fragmentation tool:

- Thou shall engage in constructive ambiguity while maximizing existing tools! The ECB does not need to put all its cards on the table but should provide a broad idea of its firepower. At a minimum, the ECB can reinvest maturing assets held under the PEPP, which includes temporarily (i.e. up to one year) overweighting purchases of government debt issued by countries whose rising sovereign spreads risk undermining efficient monetary policy transmission. (i.e. Italy and Spain). However, even if reinvestments under PEPP are done flexibly (and sterilized), resulting in a total volume of EUR 250 billion (+EUR 120 billion by front-loading by up to one year), the ECB will struggle to (temporarily) absorb the net financing needs of the vulnerable large economies (Figure 6). The ECB also has ammunition left for additional asset purchases under the PEPP (~EUR150bn). In any case, the focus should not be on a detailed explanation, but instead on a credible communication along the lines of “and believe me it will be enough” (Draghi, July 2012). This would prevent markets from doing the math and testing the limits.

- Thou shall keep a broad definition of fragmentation risk! The ECB’s mandate is foremost to deliver price stability rather than shielding member countries from higher refinancing costs due to fiscal imbalances. While the 10y sovereign spreads of vulnerable countries relative to the 10y German Bund yield might have become a general gauge for fragmentation risk, it would be useful to broaden this narrow definition of fragmentation risk to include a wider set of indicators of stress. These could include changes in short-term rates (e.g. 2y yields as an indicator for market access conditions) as well as banking sector health, private sector lending rates, and efficient access to central bank money, with the Eurosystem’s collateral framework (safe asset supply). After all, such an approach would provide a more comprehensive view over to what extent the monetary policy transmission mechanism is impaired. Interestingly, past ECB market interventions often coincided with Italian government debt yields nearing the implicit interest burden on Italy’s outstanding public debt (Figure 7).

- Thou shall not cap yields! We think the ECB should refrain from drawing a "numerical line” in the sand along the lines of the remarks made by Bank of Italy Governor Ignazio Visco, who suggested that Italian spreads should be capped at 150bps. For one, outright yield or spread control comes close to monetary financing which is prohibited. Further, higher yields are part of the solution not the problem when it comes to attracting private investors. Should the ECB target a spread level for Italian bonds that is too low, compressing spreads risk crowding out private investors. Moreover, if the ECB announces a spread level that it deems appropriate, expect markets to test it. More generally, the ECB should neither overpromise on what it can deliver nor raise expectations it cannot fulfill alone. In any case, an anti-fragmentation tool can only serve as a temporary crutch. Beyond the immediate short-term, the burden is on national economic and fiscal policy to calm investors’ debt-sustainability concerns.

- Thou shall apply conditionality! Existing anti-fragmentation instruments are not fit for the purpose. While OMT requires a high degree of conditionality (via an ESM program), which countries are unlikely to agree to, PEPP comes without strings attached (as Covid-19 was a common shock) and thus, risks fighting fragmentation with greater fiscal dominance. The ECB could propose ex ante conditionality by committing countries to stick to their medium-term fiscal targets and/or the commitments agreed on when they applied for grant funding from the European Commission’s Recovery and Resilience Plan (RRP). Strict (ex post) conditionality is not optimal as high (political) hurdles could limit the instrument’s application/acceptance and in turn its credibility.

- Thou shall sterilize! A key design concern will be how the ECB can normalize policy while actively buying government debt. To avoid a further expansion of its balance sheet, it will have to sterilize the anti-fragmentation debt market interventions. Skewing reinvestments towards debt issued by vulnerable countries would be fully sterilized by construction and thus avoid undermining effective monetary tightening. However, it would exacerbate deviations from the capital key. Instead, supranational bonds, which represent around 10% of current public sector asset purchases, would be more suitable since (i) the capital key would not be impacted, (ii) it would provide scarce safe assets to the market, and (iii) there would be no direct impact on any individual country.

- Thou shall stay within legal limits! The ECB’s Governing Council needs to abide by legal red lines as laid out in the Treaty, such as the adherence to the capital key, as any violation could bring about further legal challenges. In particular, the informal 50% issuer limit is a major concern in that regard. For several countries, we are already close to the limit when all asset purchase programs are consolidated. Respecting the legal limits will help safeguard the ECB’s credibility. After all, it would be of little use to put forward a “no limits” spread-fighting tool that only enjoys a short shelf-life, given an unfavorable ruling by the constitutional court, be it in Luxembourg or Karlsruhe. This would risk moving from an “ECB put” to “kaput” by triggering fresh market turmoil.

An anti-fragmentation tool is no panacea.

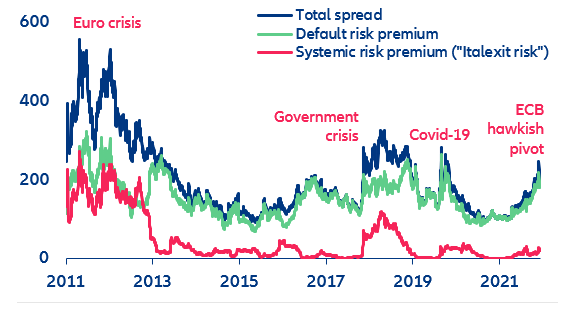

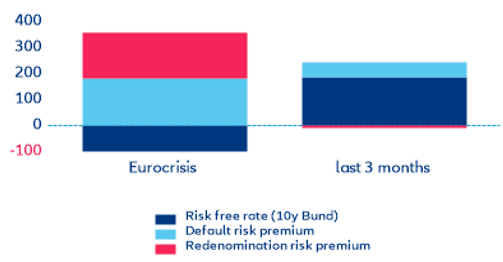

While the risk profile of the Eurozone government debt underpinning the yield curve contains a default risk premium, much like US Treasuries and UK Gilts (albeit with cross-country variation), it is also influenced by redenomination risk (i.e. the implied FX risk of a given country if it were to exit from the Eurosystem). Redenomination risk is hard to address directly. During the European debt crisis, redenomination risk was linked to a possible loss of market access. Since then, the creation of the European Stability Mechanism (ESM) and its backstop function for Eurozone member countries has significantly reduced the risk of a balance of payments crisis. The Single Resolution Board (SRB) together with the funding backstop for the European banking resolution framework has become an essential element limiting the fiscal cost of banking crises (and its feedback effect on sovereign risk). However, the sovereign-bank nexus remains considerable as banks in vulnerable countries remain highly exposed to their local government debt. However, the ECB can hardly act on redenomination risk when it is linked to domestic politics, e.g. support for Eurosceptic policies flirting with the idea of a Euro exit (Greek crisis in 2015, Italy government crisis 2018). The risk of market fragmentation will thus remain partly political.

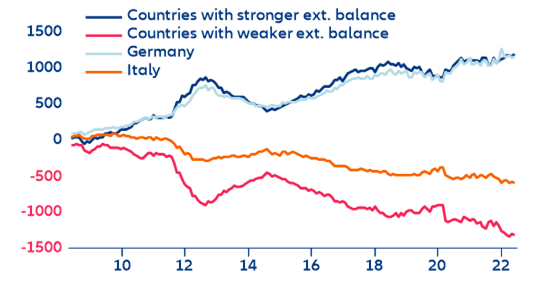

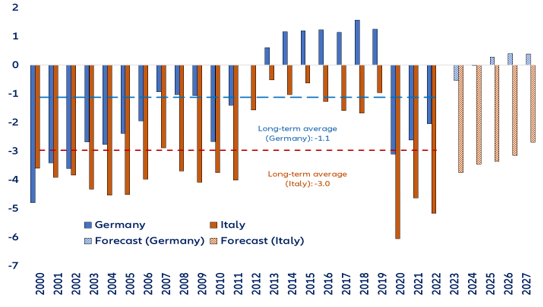

A structural solution is needed to fight the cause rather than the symptom. Ultimately, the concern about fragmentation risk is an inditement of ineffective fiscal governance in the Eurozone (which drives redenomination risk). There is widespread recognition that the EU fiscal framework needs to be reformed. The current framework involves an intricate set of constraints and is often based on non-observable criteria, both at the EU and national levels, which complicate effective monitoring and public communication, and create risks of inconsistency and overlap between different parts of the system. As a result, many of the high-debt countries failed to reduce their debt ratios in recent years while differences in the structural balance remain large (Figure 8).

Figure 8: Germany and Italy—structural balance (% of GDP)