For the 7th edition of our Export Barometer survey, we asked more than 300 French exporters about their 2020 performance, their outlook for 2021 and the main risks and threats to their activity. The results reveal that strong winds of change lie ahead. Four out of 10 French companies observed a decline in their exports in 2020, mainly driven by (i) the deceleration of global demand due to sanitary restrictions, (ii) the disruption of global value chains and (iii) Brexit. But the Covid-19 crisis also represented an opportunity for some exporters: 36% of the companies surveyed reported an increase in their exports in 2020. These companies had one thing in common: they all operated in strategic sectors, such as business services, capital goods and digital services, which managed to thrive amid the crisis.

Covid-19 has changed the export approach from ‘just in time’ to ’just in case’ in France. Overall, 81% of companies said they had changed their export approach because of the sanitary crisis, notably revising their relations with their suppliers (24%), reviewing contractual conditions offered to customers (21%) and changing modes of transportation and logistical choices (21%). Many companies also appear to have shifted from a logic of ‘just in time’, with value chains designed to produce as quickly as possible, to a logic of ‘just in case’, with the development of new supplier relationships to compensate for possible disruptions of productive activity.

Optimism is back! 8 out of 10 companies plan to increase their export turnover in 2021 and French companies are more willing to conquer new fast-growing markets. Undeterred by continued restrictions in the first quarter of 2021, 78% of companies plan to increase their export turnover this year. Firm intentions are also at a high level, with 42% of companies stating with certainty that their exports will grow in 2021. These firm intentions are particularly elevated in the capital goods (63%), agriculture, energy and construction (62%), public works (44%) and consumer goods (44%) sectors. Germany, the US and Belgium appear as the three main export destinations of French companies, followed by Spain and the UK. The European tropism remains strong, a sign that French exporters are still betting on markets that they have already mastered.

However, some exporters are also seeking growth in new destinations: 51% of said they are willing to increase their exports to new countries, against only 39% in our previous survey. The most cited new export destinations are the United Arab Emirates, Canada, Cameroon, Morocco and Senegal. This is a positive indicator concerning the proactivity and confidence of French companies, but also a sign that they have learned a crucial lesson from the Covid-19 crisis: to preserve their activities and anticipate the unforeseen, it is better to reduce dependency on a single area and diversify exports towards fast-growing/recovering new markets.

Long live “Made in France”! For the third year in a row, French companies favor exporting from France (70%) in their internationalization strategy, rather than setting up facilities abroad (30%). The main justifications for this choice are the reliance on the label “Made in France” as an indicator of image and quality (63%), the high cost of setting up abroad (54%) and the need to maintain geographical proximity to suppliers (37%). Interestingly, the reduction in the production tax (-EUR10bn per year) as part of the government’s post-Covid-19 stimulus plan is also cited by respondents (36%) as a factor backing the choice of exports from France.

To develop their export activity, French companies increasingly rely on their cash flow and excess savings. One of the major lessons of this year’s Export Barometer is that French companies are ready to draw on their cash to finance their export development: 77% of companies say that they will use their cash to finance their internationalization this year, against 48% during of the previous edition of the Export Barometer. This is followed by public aid and support mechanisms (13%) and bank loan financing (8%). The fact that companies are mostly ready to use their cash to finance their export development conveys a message of confidence. Thanks to generous public support measures in the face of the Covid-19 crisis, French companies have been able to strengthen their liquidity reserves, which now total EUR88bn . If they are ready to tap into this reserve, this is because they see export as a real source of growth that will allow them to emerge from the crisis faster and make up for the economic losses of 2020.

Payment incidents remain the main risk for exporters, while the sanitary risk outweighs political risk in 2021. The risk of non-payment is cited as the main threat to activity by French exporters (62%). This emerges as a justified fear as 38% of respondents have noticed an increase in the average payment time for exports over the past 12 months (+22 points compared to the previous edition of the Barometer) and 22% signal having suffered at least one payment incident over the same period (+7 points). Other key risks mentioned by French exporters are legal risks (59%), customs barriers (55%) and transport risks (55%). But the big change is the emergence of sanitary risk in the top ranking (45%), which exceeds political risk (41%). The Covid-19 crisis seems to have profoundly changed the way French exporters approach their environment. They are now more concerned about being affected by a health crisis, such as a pandemic, than by a political event, such as a popular uprising or an embargo.

Looking ahead, we expect French exports to rebound significantly in 2021 (+7.9% in volume), buoyed by the global economic recovery. After a drop of -16.6% in volume in 2020, French exports are set to rise by +7.9% in 2021 and +6.6% in 2022, thanks to the cyclical recovery of demand from countries exiting the Covid-19 crisis. But the recovery won’t be a walk in the park. Supply-chain disruptions (including extended supplier delivery times, shortages of containers and some inputs like semiconductors or building materials) and rising input prices are expected to take a toll on French exports throughout the year, although to a lesser extent than their German or American peers. We estimate that these disruptions will cost global trade in volume around -1.7 points of growth this year.

Export gains in France could reach EUR59bn in 2021 but exporters will need wait until 2023 for a return to pre-crisis levels. Additional demand for goods and services addressed to France is expected to grow by EUR59bn in 2021 and EUR47bn in 2022 (after a drop of EUR125bn in 2020). The rebound of French exports will be supported by the cyclical upturn in world demand and the tailwind from ambitious US stimulus plans under the Biden administration, which are expected to boost French exports by +1.2pp in 2021-2022. Yet, as the slight decline of exports in Q1 2021 (-1.5% q/q in volumes) illustrates, the recovery will be a slow process: We expect French exporters to make up for the losses of the Covid-19 crisis in 2023.

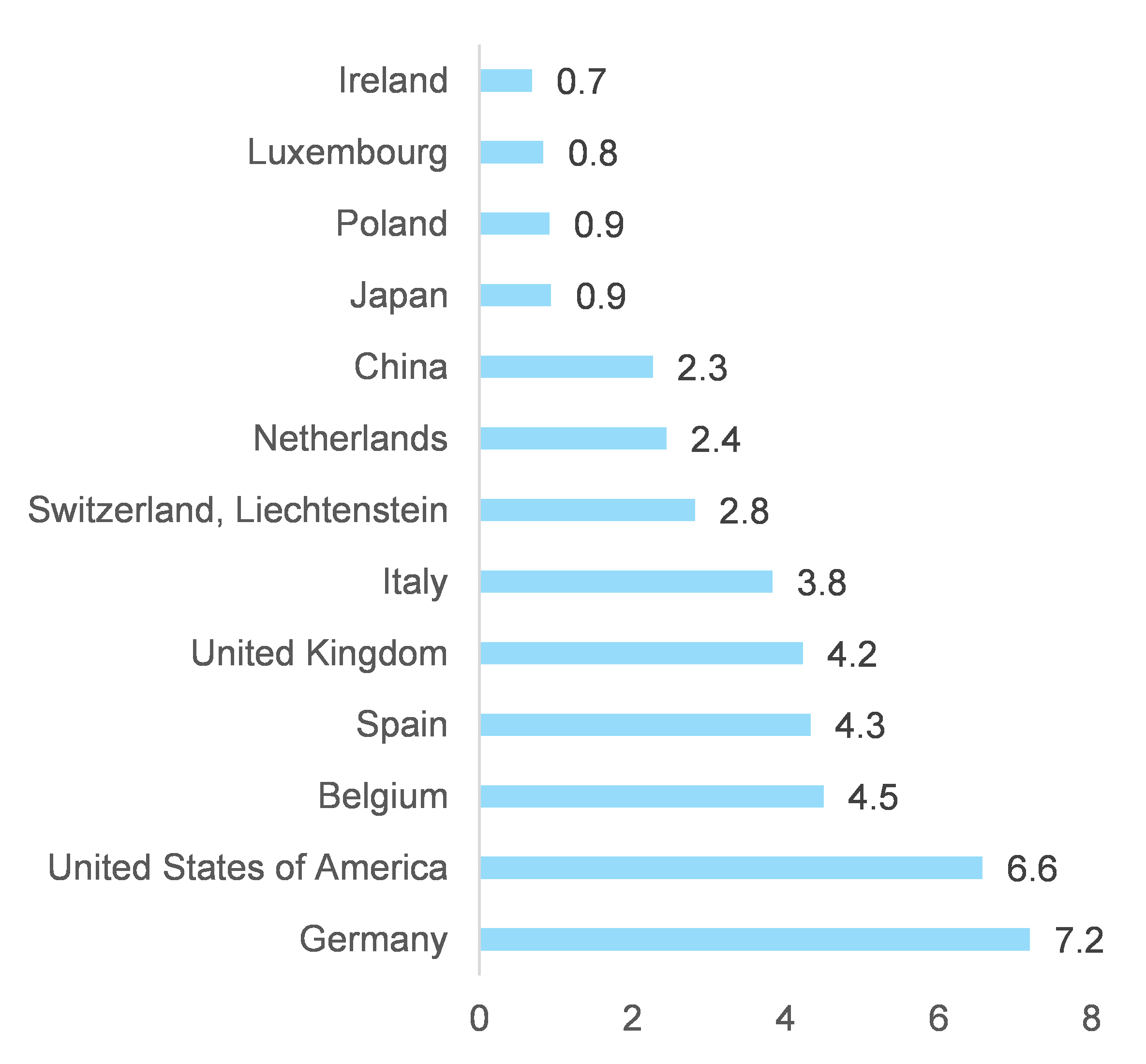

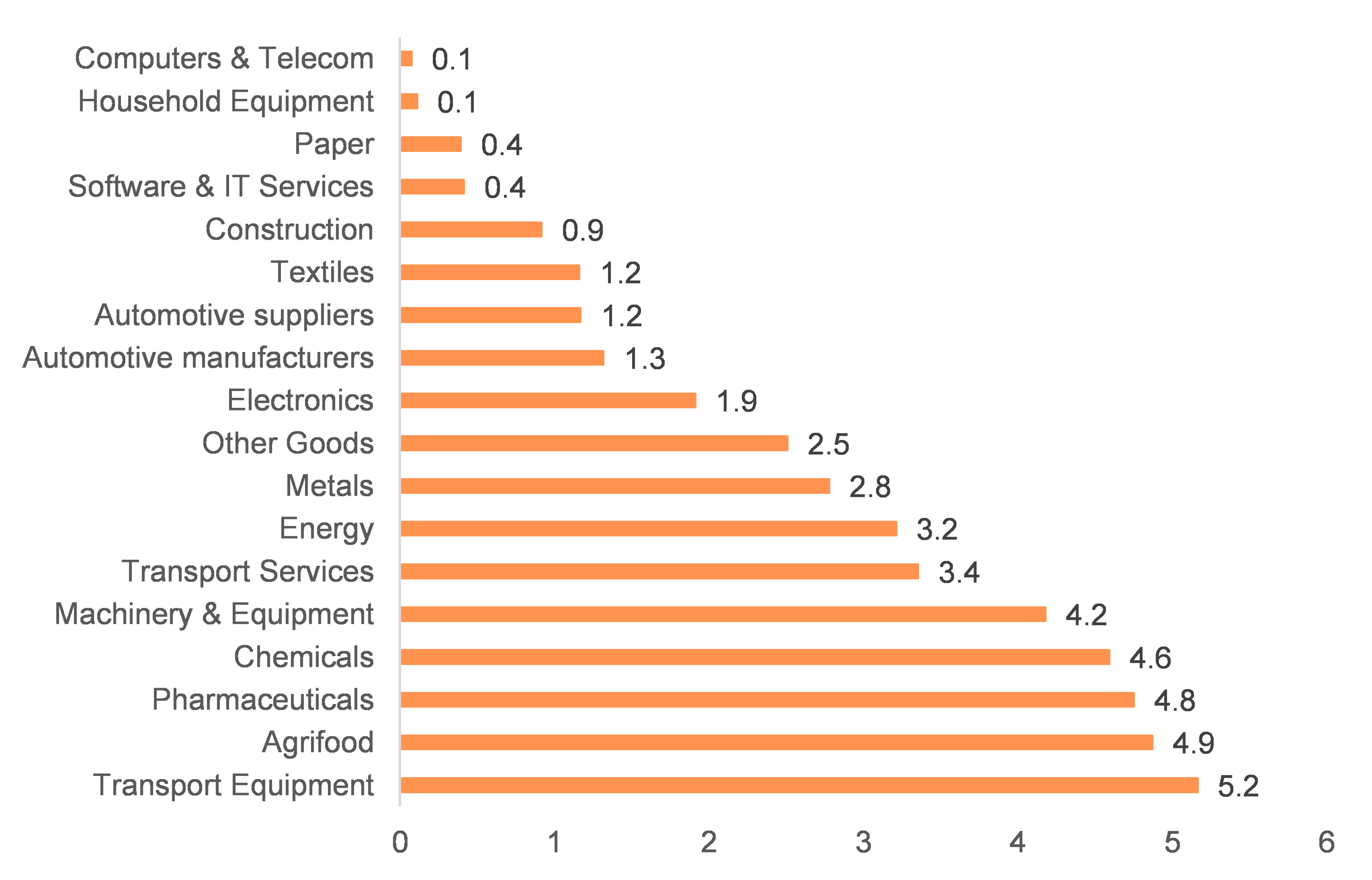

Demand from Germany and the US will drive export gains in France, with the transport equipment, agrifood and pharmaceuticals sectors standing out as the most dynamic. In 2021, additional export outlets for French companies will be located mainly in Europe, with EUR7.2bn to be seized in Germany in 2021, EUR4.5bn in Belgium and EUR4.3bn in Spain (Figure 1). But international markets will also offer key opportunities to French exporters, with EUR6.6bn to be seize in the US and EUR2.3bn in China. The UK will be among the top five export destinations for French companies as a consequence of the grand reopening of the economy and the induced strong catch-up effects in terms of consumption. In addition, the normalization of trade procedures post Brexit will also help boost demand from the UK to French exporters, while the government’s hyper-amortization scheme will allow for double-digit growth in UK business investment. Flagship export industries, such as transport equipment (EUR5.2bn), the food industry (EUR4.9bn) and the pharmaceutical sector (EUR4.8bn), will capture the bulk of this excess external demand addressed to France (Figure 2).

Figure 1 – 2021 export gains in France by destination, EURbn (nominal)