Where we come from

Brexit is proving much harder to tame than a Shakespearian shrew. As expected, on January 15th, the UK House of Commons rejected Theresa May’s Brexit deal. Only 202 out of 650 votes of MPs were favourable (31%).

No less than 118 Conservatives and 10 MPs from the Northern Irish DUP (Democratic Unionist Party) from May’s caucus voted against the deal. However, this was not a real surprise as already in the no-confidence vote in December 2018, 117 Tories had voted against the Prime Minister (PM ). Following the defeat, Theresa May presented her plan B to the Parliament, i.e. to renegotiate with Brussels the Irish backstop solution which is the main source of disagreement among the hard Brexiteers. After several days of debate, the Parliament voted on proposed amendments to the EU Withdrawal Bill. Two of them got approved on January 29.

The first amendment, known as the Brady amendment, was approved by 317 to 301 MPs, and officially requires PM Theresa May to renegotiate the deal with the EU, possibly by introducing an-end date to the Irish backstop, after which the UK can leave the customs union without an agreement with the EU on the solution to avoid a hard border on the Irish island – the so called ‘Malthouse compromise’. Theresa May had been supporting such a modification of the exit deal and she now has Parliament’s official backing.

The second amendment, known as Spelman amendment, was approved by 318 to 310 MPs and also got the vote of a Tory MP. It states that the Parliament can reject a “no Brexit deal”. However this amendment is non-binding and the government can choose to overrule it.

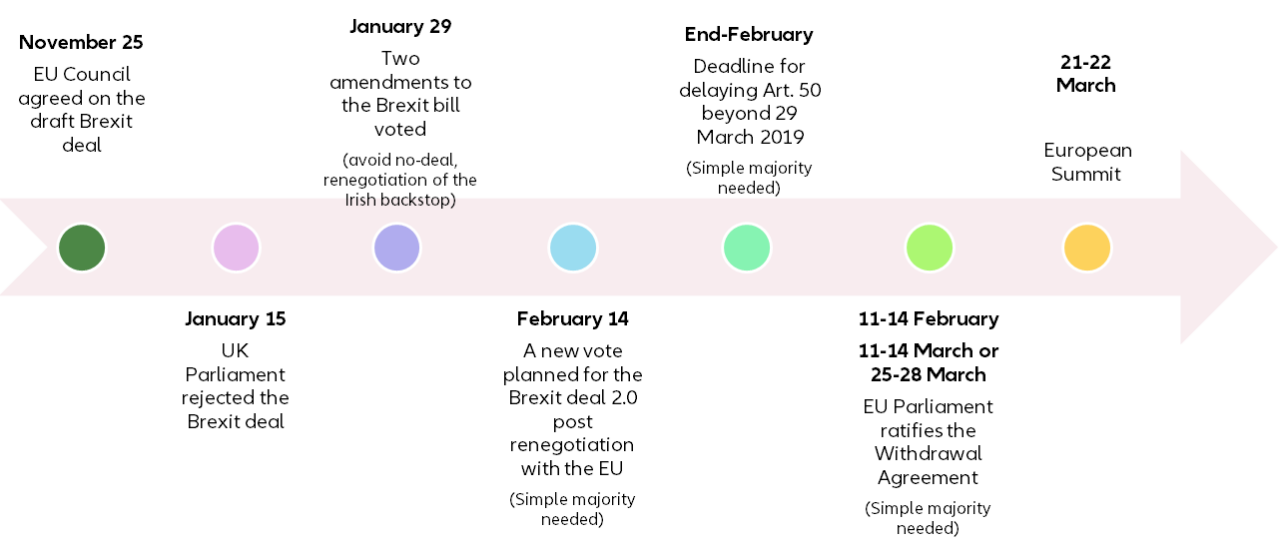

As we argued in our recent Brexit update, the true deadline for a last-minute agreement is mid-February in order to allow enough time for ratification by the EU Parliament (see timeline below). A last-minute agreement, our baseline scenario, could either be (i) a ratification of the present Brexit deal or a slightly modified one through EU concessions by the UK House of Co mons or (ii) a delayed Brexit through an Article 50 extension until July or December 2019. Theresa May has until February 13th to renegotiate the Irish backstop with the EU and submit the potentially modified deal to a new vote in Parliament. As the EU has emphasized that the Withdrawal Agreement already approved by the European Council is not for open for renegotiation, this scenario seems rather unlikely. More time will be needed. The EU has confirmed it is open to extending Article 50 if the UK requests it.

Figure 1 Brexit short-term timeline