EXECUTIVE SUMMARY

- Inflation is back with a vengeance in the Eurozone, sending the cost of living to record highs. Aside from pandemic-related base and one-off effects, snarled-up global supply chains have failed to keep up with post-pandemic demand. To add to this, the war in Ukraine and sweeping lockdowns due to China’s zero-Covid policy have further disrupted trade flows and contributed to exploding commodity prices – notably for energy. Europe has been particularly affected, given its stronger reliance on energy imports and the recent depreciation of the euro to a five-year low against the US dollar.

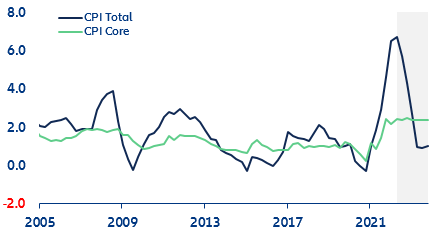

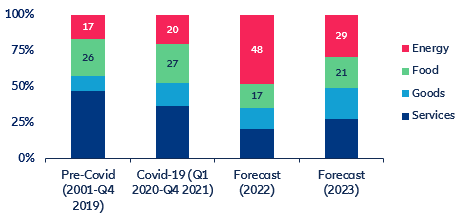

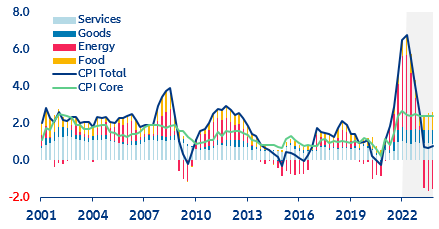

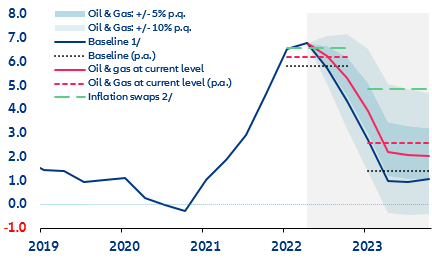

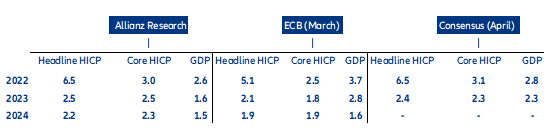

- Is the worst yet to come? Without an EU embargo on oil and gas imports from Russia, headline inflation is very likely to peak in the second quarter of 2022. Inflation dynamics will hinge on energy and food price developments, which explain around two-thirds of the current surge. As negative base effects phase in over time, still-elevated core inflation will become the driver of consumer price pressures next year. We expect Eurozone inflation to register at 6.5% y/y this year and 2.5% y/y next year. Core inflation will remain unusually high during our forecast period, settling at 3.0% y/y and 2.5% y/y on average – more than twice the rate observed during the decade running up to the Covid-19 shock.

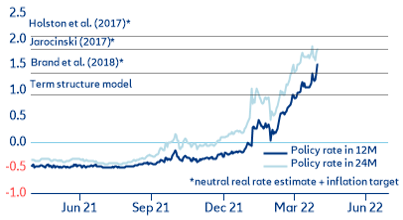

- Rising stagflation risks put the ECB in a dilemma—a first rate hike in September seems probable. Higher inflation and lower growth impose hard policy trade-offs in a world where classic aggregate demand support has little impact in the face of strong cost-push pressures causing negative supply shocks. The disappointing Q1 GDP performance across the Eurozone underlines the economic costs of the war in Ukraine as well as the heightened risk of a stagflation scenario. We expect economic growth to evolve below consensus over the near term, which should also put a dampener on wage pressures and support a more dovish stance. However, clearer signs of second-round effects in wage growth and inflation expectations could require an earlier tightening.

How high could inflation go in the Eurozone?

The Eurozone is facing the highest price pressures since the 1970s. Headline inflation reached 7.5% y/y in April (up from 7.4% y/y in March), with almost 60% explained by energy inflation. Europe has been hit particularly hard, given its stronger reliance on energy imports and the recent depreciation of the euro to a five-year low against the US dollar.

What is driving current inflation pressures? Aside from pandemic-related base and one-off effects, the surge is largely due to the combination of a strong re-opening momentum and snarled-up supply chains as the fragile global production and distribution system failed to keep up with post-pandemic demand, especially for goods. Russia’s war with Ukraine has further exacerbated inflation dynamics, driven above all by a sharp increase in commodity prices – notably for energy. More recently, China’s zero-Covid policy and the related lockdowns of important industrial centers have put additional strain on supply chains, which threatens to keep shipping costs and producer prices higher for longer. As the war in Ukraine drags on and eradicating the Covid-19 virus becomes an ever more elusive goal, the implications of the rising cost of living are far-reaching and raise hard questions about the adequacy of commonly used inflation models and in turn policy choices derived from these.

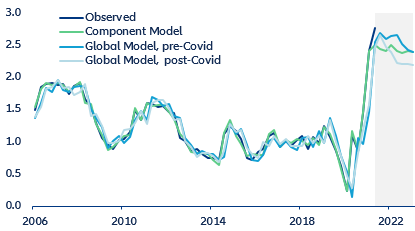

Figure 1: Evolution of headline and core inflation (y/y, %)