Executive summary

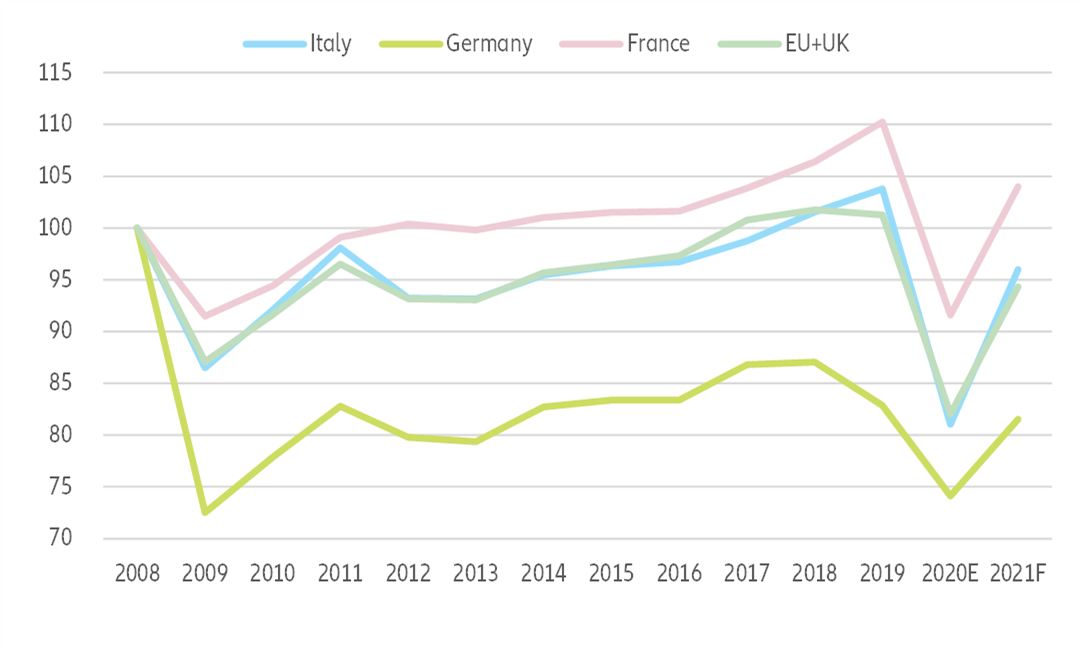

- An unprecedented disruption in trade, manufacturing and retail activities, followed by a major economic crisis, will send the turnover of the European textile and apparel industry down by -19% in 2020, amid a -9% slump in GDP for Eurozone countries. We expect turnover to bounce back by about +15% in 2021 and return to pre-crisis levels only in 2023, assuming a progressive easing of the global sanitary emergency and substantial fiscal and monetary support to the economy.

- Despite the major relief provided by the various job-retention schemes and abundant funding, we believe that up to 8% of total industry employment (about 158,000 jobs) and 6% of companies (about 13,000) could disappear by the end of 2021. The share of SMEs in the textile industry’s total turnover is twice as high as the manufacturing sector average, making it more vulnerable.

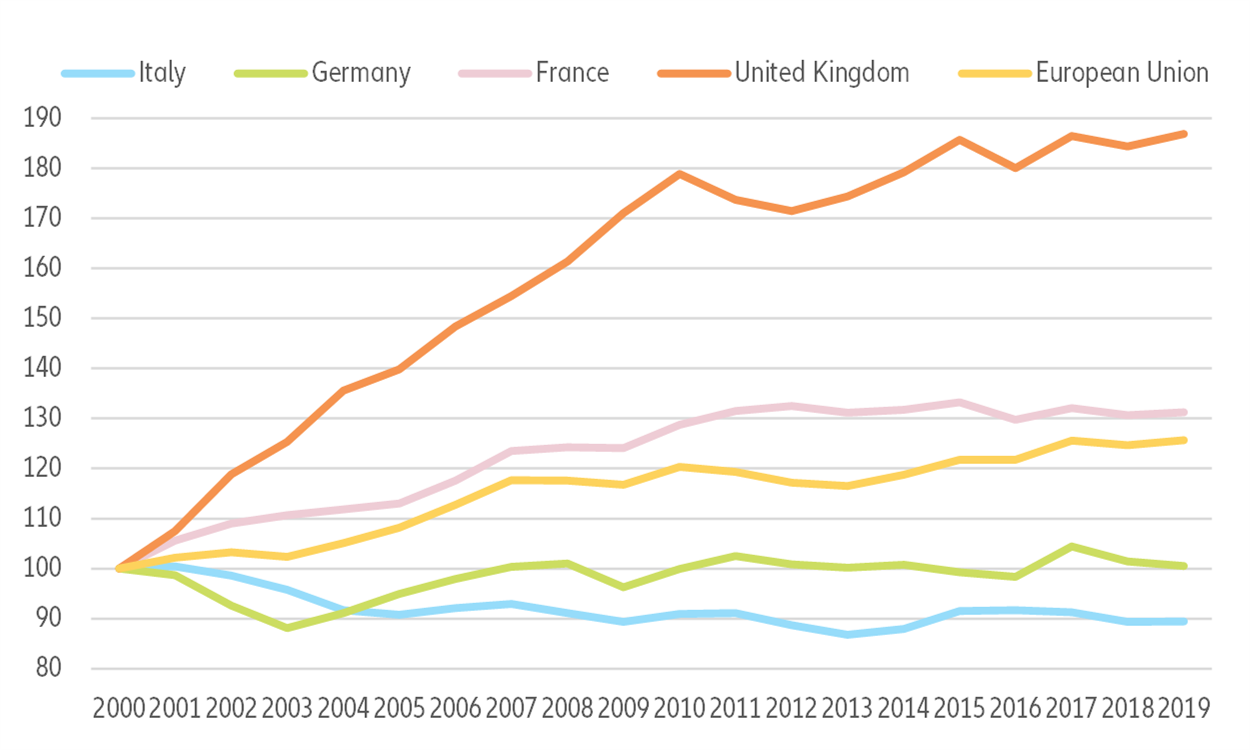

- However, three factors suggest the industry is far more resilient and competitive than it was in 2009, making it better placed for a recovery: 1) The stabilization of the European textile and apparel trade balance, 2) dynamic growth across segments where European manufacturers are the most competitive and 3) progress in productivity. Public support to the industry could not only allow a speedier rebound and help manufacturers return to their pre-crisis growth track, but also align with calls for a greener and more digital economy.

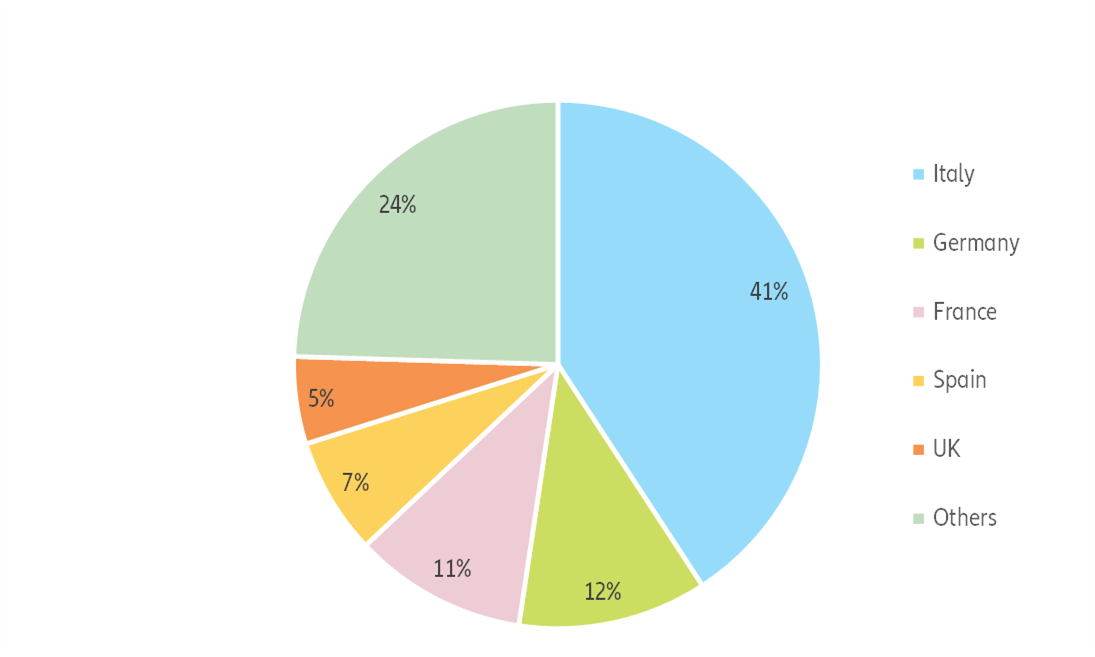

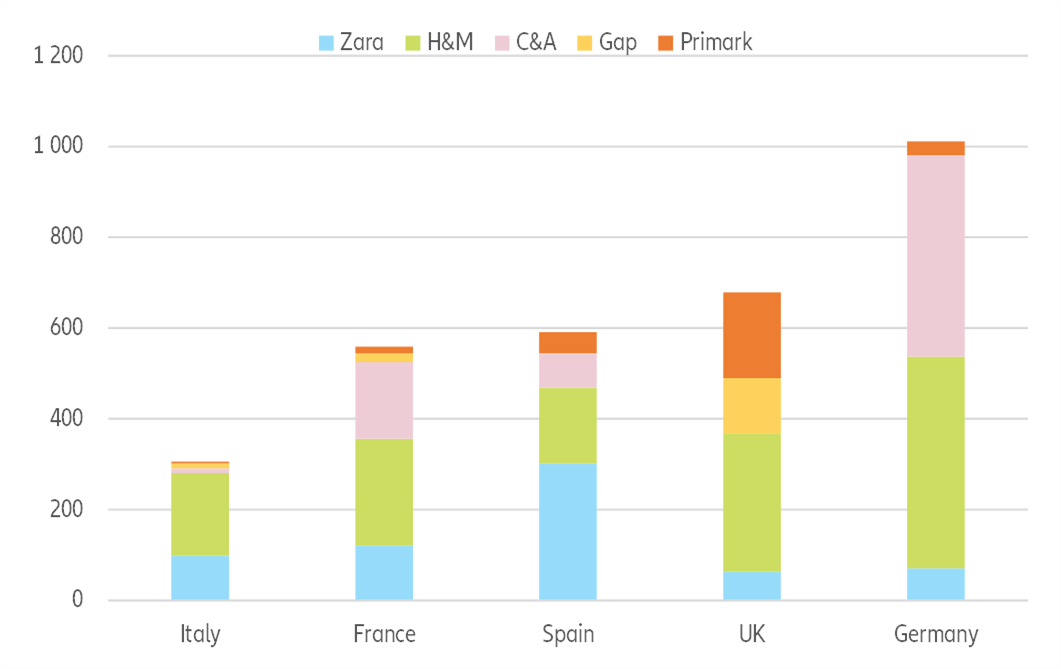

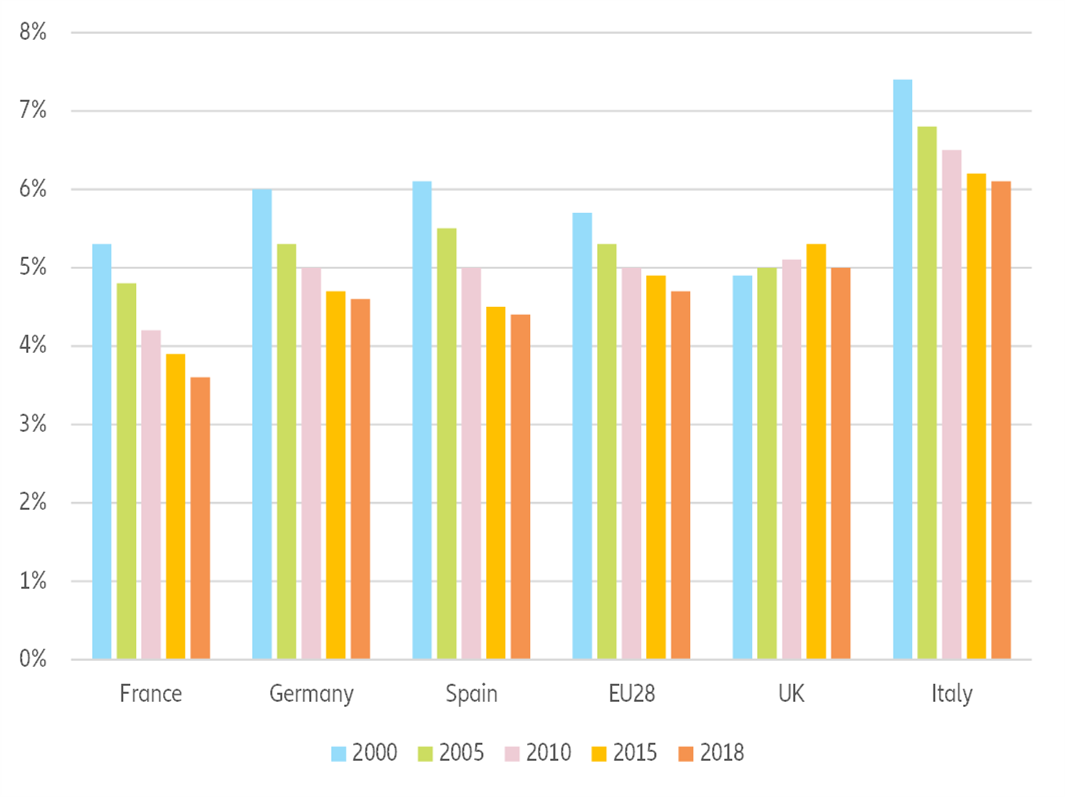

- A greener textile industry would place greater emphasis on quality rather than quantity, a U-turn from the fast-fashion paradigm that has worked against the best interests of Europe’s manufacturing industry. Booming per capita apparel consumption comes with a cost: the industry globally generates about 10% of all greenhouse gas emissions. The case of Italy, where the aligned interests of consumers, retailers and manufacturers have allowed the country to keep a preference for more expensive, yet higher quality and locally made apparel, sets the example for the rest of the region. The benefits of import substitution would be very tangible: A 10% decrease in French and German imports of apparel would represent the equivalent of an 8% boost in European apparel manufacturing turnover. Efforts to encourage a transition from linear to circular manufacturing practices could also yield substantial opportunities for the local manufacturing base.

- Encouraging the adoption of state-of-the-art technologies would also be beneficial to an industry where SMEs dominate and do not necessarily have the clout to engage in expensive R&D programs. Learning from the lessons of the past retail lockdown and the slow recovery in international travel, support for the development of e-commerce capabilities would help manufacturers increase their reach and mitigate their risks.

European manufacturers hit hard by a unique trade, manufacturing and retail standstill

- The impact was first felt in trade activities as China entered a prolonged and severe lockdown period starting in February — the country is a major exporter of fibers and fabric used by European manufacturers and a major destination for European apparel exporters.

- European production was, in turn, hit by regional lockdown measures, which began in the major manufacturing districts of Brescia and Bergamo (Lombardy). Manufacturing hit a low in April, with year-on-year slumps ranging between -35% (Germany) and -78% (Italy).

- The region also witnessed a collapse in demand, with its three client industries (export markets, local industries, local apparel retailers) running at low capacity to avoid an inventory build and preserve their cash positions. The low point in specialized retail also occurred in April, with year-on-year declines oscillating between -65% for the UK and -90% for Spain.

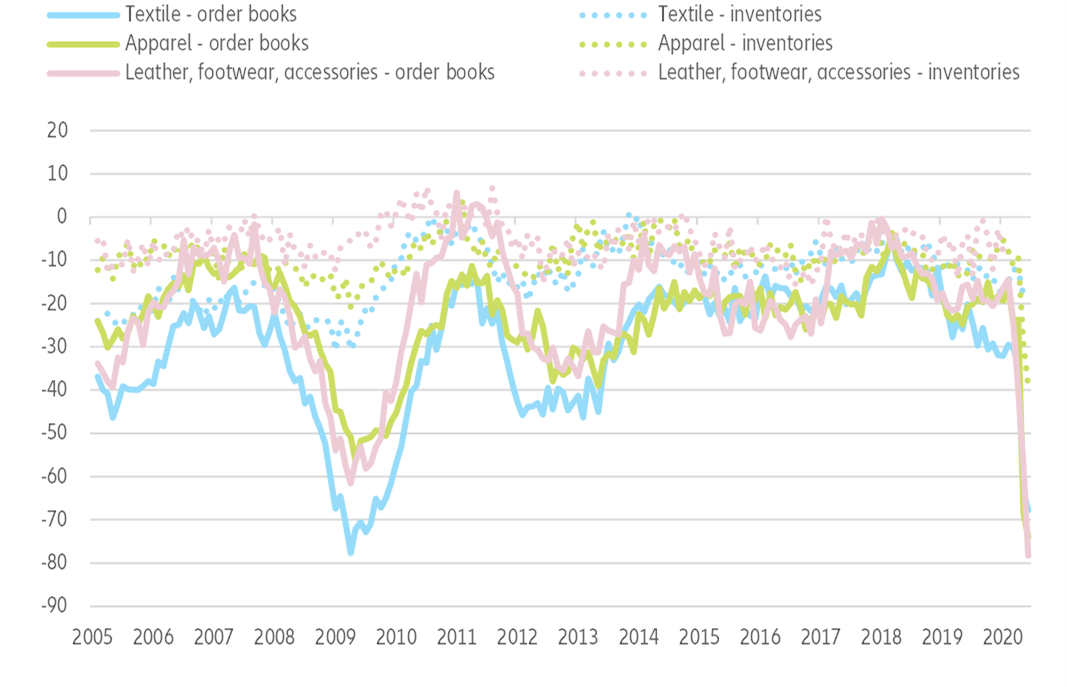

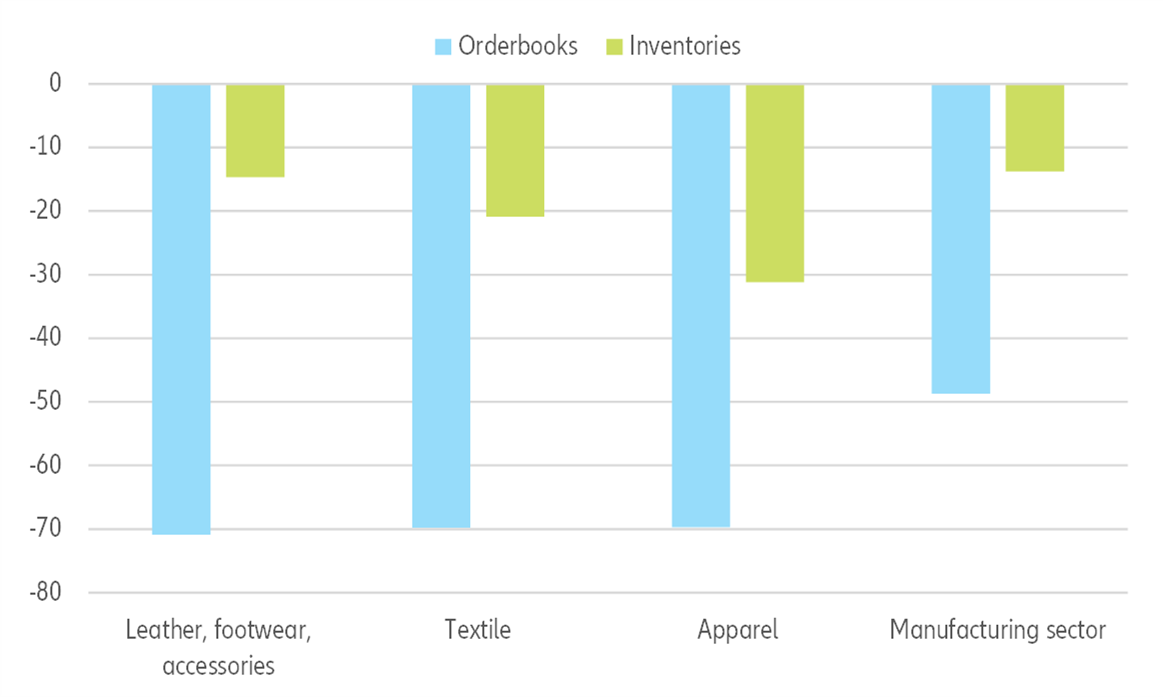

Looking at year-to-date data on manufacturing and retail activity (Figure 1), we find strong evidence of both T&A manufacturing and retail falling much harder than other manufacturing activities. Because industrial textiles are intermediate goods and consumer textile goods come under discretionary expenditure, the T&A industry tends to be hit harder during economic downturns.

Figure 1: Year-to-date change in T&A manufacturing turnover and retail sales in specialized stores vs other manufacturing sectors (%)