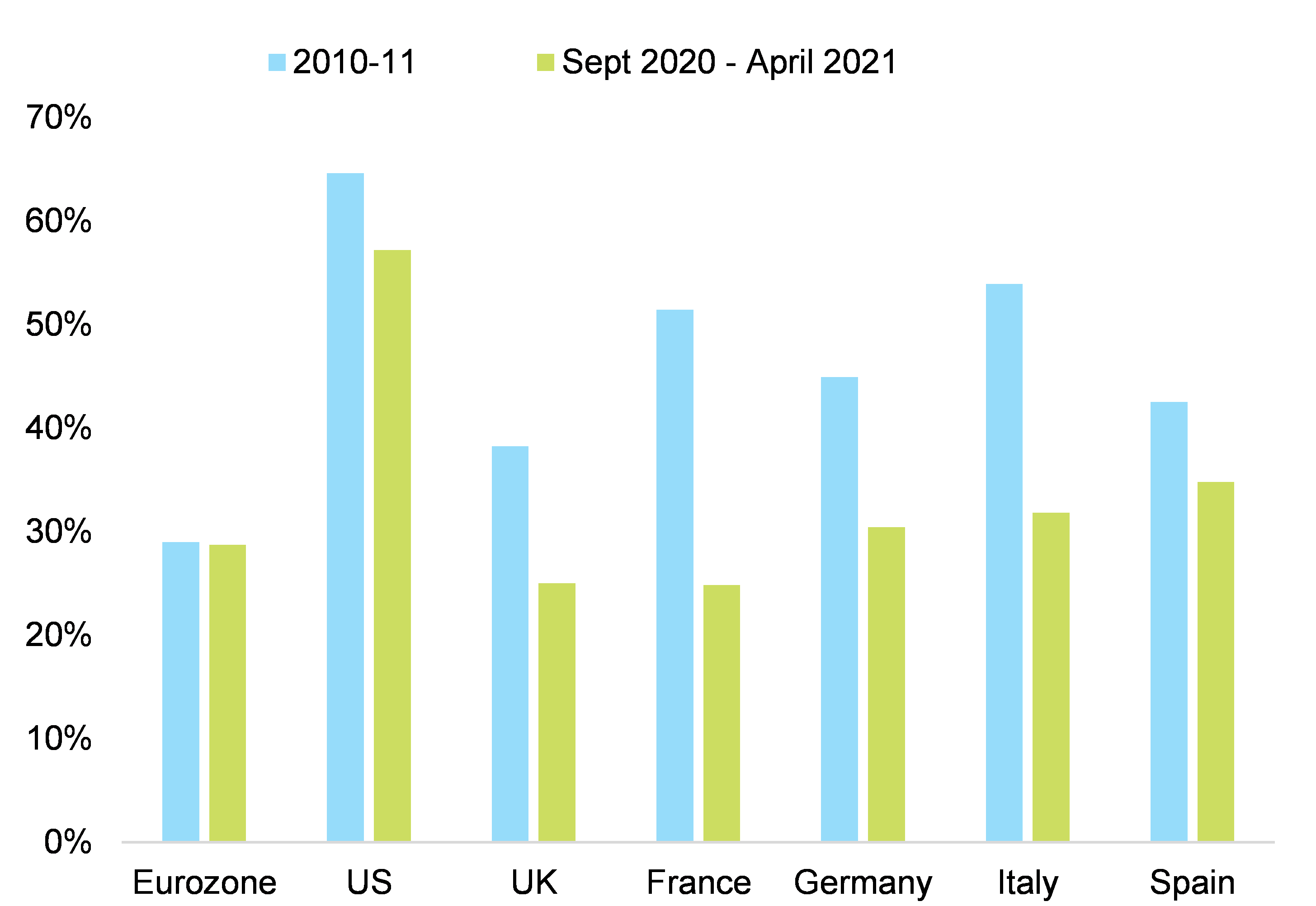

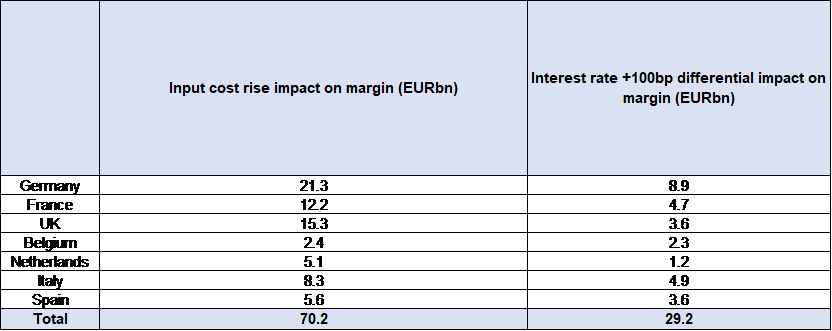

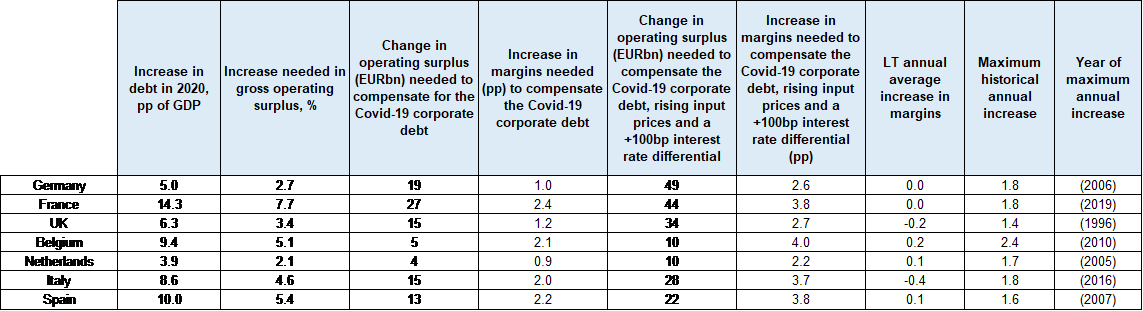

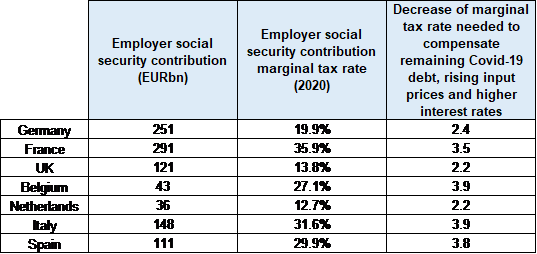

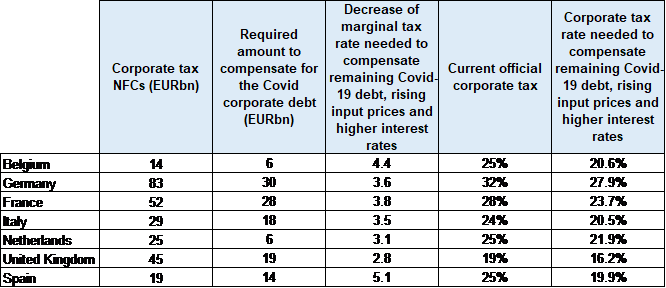

As global trade recovers, accelerating input prices will increase European corporates’ financing needs by EUR70bn in 2021, the equivalent of a -3pp loss in margins. Suppliers’ delivery times in the manufacturing sector are back to levels last seen during the peak of the Covid-19 pandemic in 2020, while container prices have stood at a five-year high for two months. This coupled with the rise in commodity prices has brought input prices to highs similar to those seen in 2011. In this context, the key question remains the pricing power of European corporates to absorb increasing production costs. In our recent report, we showed that most sectors have limited pricing power, with the exception of consumer electronics, pharmaceuticals and airlines. This is also visible in the share of the rise in input prices absorbed by selling prices in the manufacturing sector since last fall (25% in the Eurozone against close to 60% in the US, see Figure 1). Hence, we estimate the cost of the rise in input prices at around EUR70bn for the main European countries (see Figure 2). Part of the rise can be compensated for by the excess cash that non-financial corporates have on their balance sheets thanks to generous state-support schemes. However, it could still be equivalent to a loss of -3pp of margins.

Figure 1 - Share of y/y increase in input prices covered by selling price increases in the manufacturing sector

Figure 1 - Share of y/y increase in input prices covered by selling price increases in the manufacturing sector