A dual-pricing scheme could address the shortcomings of the counter-measures implemented so far.

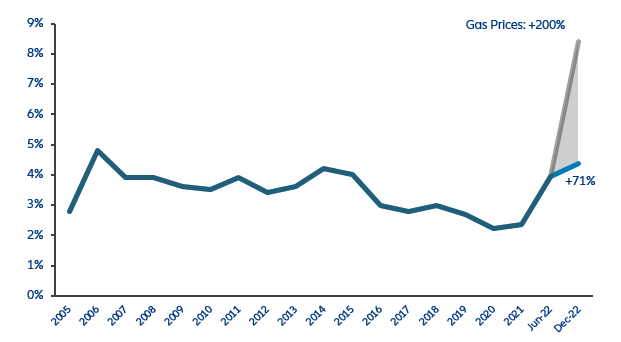

The counter-measures implemented by governments so far, such as tax cuts and price caps, have serious shortcomings, not least in curtailing incentives to save energy. A dual-pricing scheme might be worth considering. Many EU member states have already passed legislation to shield consumers from high energy prices, implementing subsidies or price caps (see appendix). Most measures, however, have serious shortcomings. Many of them are not targeted but let all households benefit, regardless of their income levels — (temporary) tax cuts or the 9-Euro-Ticket in Germany are prominent examples. Other measures such as price cuts distort the market mechanism; price signals no longer work. While others might be targeted (e.g. grants to low-income households), they are perceived as rather arbitrary and/or insufficient. And all measures suffer from a fundamental weakness: They undermine incentives to save energy, which should be the order of the day. A dual-pricing scheme, as advocated by economist Jean Pisani-Ferry , could address these shortcomings. The idea is quite intriguing: every household would have the right to buy a certain needs-based quantity of energy to power its home at an administered price; all further energy needs would have to be bought at market price. The simplest approach to define the allotted quantity would be a “grandfathering” one, i.e. basing it on the previous years’ energy consumption but with a deduction of, say, 25% to incentivize energy savings. This would give all households an incentive to reduce their energy consumption, but provide large transfers to richer households that are not at risk of energy poverty. Therefore, it should be combined with limiting the upper “ceiling” amount of the grandfathered energy by the median consumption. This would ensure incentives for all consumers while accounting for their capacity to cope with the burden.

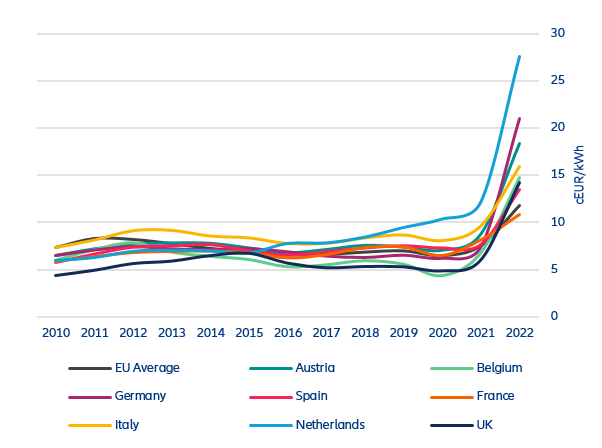

For the administered price, the prevailing levels before the crisis could act as a guide. Such a scheme has two advantages: it’s flexible and redistributive.

• Flexibility: The administered price as well as the allotted energy can be set in accordance with the desired level of protection (itself a compromise between the need to help and available fiscal space). For example, the allotted quantity can be set at more than 25% below past consumption and the quantity ceiling can be lowered below the median in order to increase saving incentives and reduce the number of protected households (and the costs of the scheme). Moreover, the administered price and the allotted quantity should be dynamically adjusted annually to keep incentives to save energy intact; ultimately, the administered price should converge with the market price.

• Redistribution: As high-income households tend to live in bigger homes (and have more electrical gadgets), they are forced to buy more energy at market price; relatively, the support for low-income households will be (much) higher . To strengthen the redistributive character of the scheme, an income threshold (e.g. the level of the so-called “rich tax” in Germany) could be introduced, beyondd which households are no longer entitled to buy energy at administered prices at all. This would, however, complicate things a bit as the scheme could no longer be administered by the utility companies only; the “excess” subsidy would need to be collected by tax authorities later on.

A back of the envelope calculation gives a price tag of around EUR22bn (0.6% of German GDP) for gas consumption. However, this assumes that the administered price equals the pre-crisis average. By setting the administered price differently, costs can be reduced variably. If, for example, the administered price is set at twice the pre-crisis level, costs would fall to EUR8.4bn.

A new social contract is needed to safeguard the green transformation.

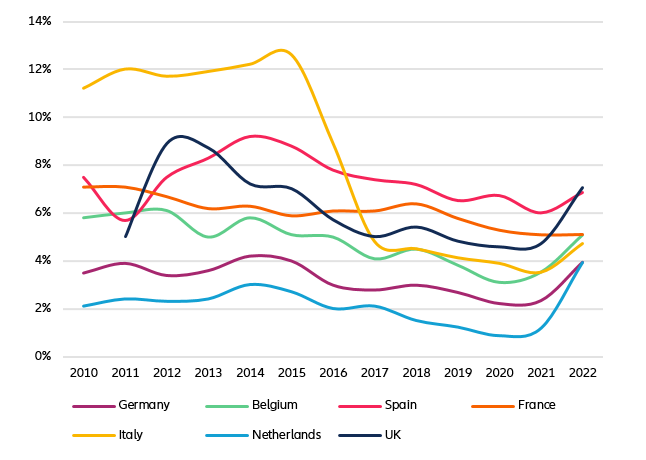

Beyond this first layer of ad-hoc crisis measures to avert gasmageddon, a new social contract is needed to address the long-term challenges of the higher energy prices likely during the green transformation. High energy prices and hence energy poverty are here to stay, given the changed geopolitical landscape and the need for more aggressive measures to tackle the climate crisis. In particular, climate policy is inherently regressive. There are two channels of impact: via the generation of income (labor) and the use (consumption). Overall, the employment effects of the green transformation are likely to be small, at least in net terms. In fact, there is likely to be a massive shift in jobs across sectors and regions. “Green” jobs will require different and higher skills, so lower-skilled workers are likely to be hit hardest by these upheavals in the labor market. In the course of the green transformation, relative prices will also change: Carbon prices make energy consumption more expensive, and regulations and standards will drive up the prices of housing and food, for example. This will affect different income groups differently. Even if their energy consumption is generally lower, lower income groups will suffer particularly from rising prices. Therefore, more needs to be done over the long-term to protect the most vulnerable households. Social justice demands that corrective action be taken here to ensure an equal distribution of the costs and benefits of the green transition. An unequal distribution could result in significant delays in the transformation of economies, whether through protests against necessary closures of factories and mines or through overly timid measures in the pricing of emissions. The mistakes made in globalization in the past should not be repeated: although the internationalization of value chains has significantly increased global prosperity and produced many winners (in all countries), there have also been many losers, whose welfare losses and difficulties to adjust have been inadequately addressed by policymakers.

Climate-proof social policy should include permanent subsidies to low-income households (so-called “energy money”). With regard to labor markets, new instruments are not necessary but the consistent use of active labor market programs (e.g. job brokerage services, support to start-ups) is. In addition, targeted training and skill development programs are needed in order to reskill and upskill workers, and support their transitions to new jobs, potentially in new occupations or sectors. To support consumption during the green transformation, there are two options available in principle:

• First, integrating the social measures accompanying climate policy into the existing system of social benefits. The advantage of this is that implementation and administration should be relatively simple. The disadvantages, however, are more serious. First, the measures lack visibility and are likely to be understood by those affected as “business as usual”; from the point of view of political economy, this is problematic as it is unlikely to help increase the acceptance of climate policy. In addition, there are two “technical” problems: the adjustment of social benefits to changed prices generally takes place “after the facts”, meaning that support reaches those in need only after a certain time delay. And the accuracy of the measures must also be viewed critically, since only those already in need, i.e. households already receiving social benefits, are covered. The group of those whose livelihoods are threatened by rising energy costs is likely to be larger and extend into the (lower) middle class – which is why many climate measures have been so unpopular in the first place. The Yellow Vests movement in France has made this all too clear.

• Second, the introduction of a new benefit in the form of a direct energy subsidy, so-called “energy money”. This involves fixed cash transfers to all those affected depending on their income and social status (e.g. children). This form of social protection in the transition phase would solve the problems of the first approach (integration). However, political decisions on the amount of “energy money” as well as its scaling depending on income are likely to be hard-fought. A pragmatic approach here would be to link the total payment amount to climate policy revenues (e.g. carbon-tax, CBAM, ETS). In this way, the state would signal that all revenues from the necessary measures to make fossil energy more expensive will ultimately be returned to those affected. However, this does not solve the specific distribution of funds.

The biggest advantage of “energy money” lies in its combination with incentives to change behavior and build long-term savings. This is often the blind spot of climate policy: that it might be possible to stop the climate crisis with just the right toolbox of prices and regulations to guide the necessary technological transformation. In fact, however, achieving the 1.5°C target requires far-reaching behavioral changes, vulgo energy savings. This also describes the inherent dilemma of social compensation for climate policy: If it goes too far, the desired price signals can be thwarted and there is no – or only insufficient – reduction in fossil energy consumption (the so-called rebound effect). “Energy money” could be designed to minimize this risk. The simple trick: the energy money is either paid out to a current account, i.e. it flows fully into consumption, or the payment (full or smaller amounts) is made to a so-called “energy savings account”, i.e. the amounts are not consumed but saved. (The savings vehicle – be it a simple bank account, an investment fund or an insurance policy – can be chosen by the households themselves.) The central idea is that the amount of energy money that households save is doubled by the state. It is therefore – similar to Riester – a form of savings subsidized by the state. This creates a great incentive not to spend the energy money immediately. In this way, two goals can be achieved at the same time. On the one hand, households that save their “energy money” have to adjust their consumption and use less energy in order to be able to continue making a living, i.e. pay their energy bills. Second, it also enables poorer households to build up reserves, whether for the purchase of residential property or for retirement. However, there should be some flexibility in the disbursement of savings; for example, it would be conceivable to allow withdrawals of up to half of the accumulated savings after every five (ten) years, with exceptions for home purchase and retirement. In this way, the “energy money” could be expanded into an innovative social benefit that kills two birds with one stone: safeguarding the green transformation and alleviating social inequality.